SUMMARY

Tiwari told Inc42 that with the market regulator’s green light, Angel One will be locking horns with Zerodha and Groww in the highly underpenetrated passive mutual funds space in India

The stockbroking firm aims to reach out to at least 500 Mn Indians through on-ground advertisements as well as digital and print channels as IPL’s official partner

Besides the mutual funds business, Angel One is also conducting beta testing for a lending business and exploring insurance distribution

Listed stockbroking firm Angel One is currently in the final leg of setting up an asset management company (AMC), following which the company will launch a passive mutual fund.

Chief growth officer of Angel One, Prabhakar Tiwari, told Inc42 that with the market regulator’s (SEBI) green light, Angel One will be locking horns with Zerodha and Groww in the highly underpenetrated passive mutual funds space in India. Notable, Angel One rivals, Zerodha and Groww, forayed into the market last year.

It is imperative to mention here that the share of exchange-traded funds (ETFs) or passive mutual funds in overall retail assets under management (AUM) is currently at a mere 2%.

However, the silver lining is that the same is on the rise. According to Motilal Oswal Financial Services, the share of exchange-traded funds stood at INR 9,700 Cr in FY23, growing at a CAGR of 56% since FY19, largely driven by online distributors.

In addition to venturing into the passive mutual funds space, Angel One has also clinched a five-year deal as one of the official partners for the Indian Premier League.

Reportedly, Angel One outbid rival Groww by paying INR 380 Cr to the BCCI in the online stockbroking category for the IPL’s sponsorship.

Without divulging the price details of the IPL deal, Tiwari stated that the stockbroking firm aims to reach out to at least 500 Mn Indians through on-ground advertisements as well as digital and print channels as IPL’s official partner.

While Groww and Zerodha have been making headlines with their monthly active user bases, Angel One has secured the third spot, according to the NSE data.

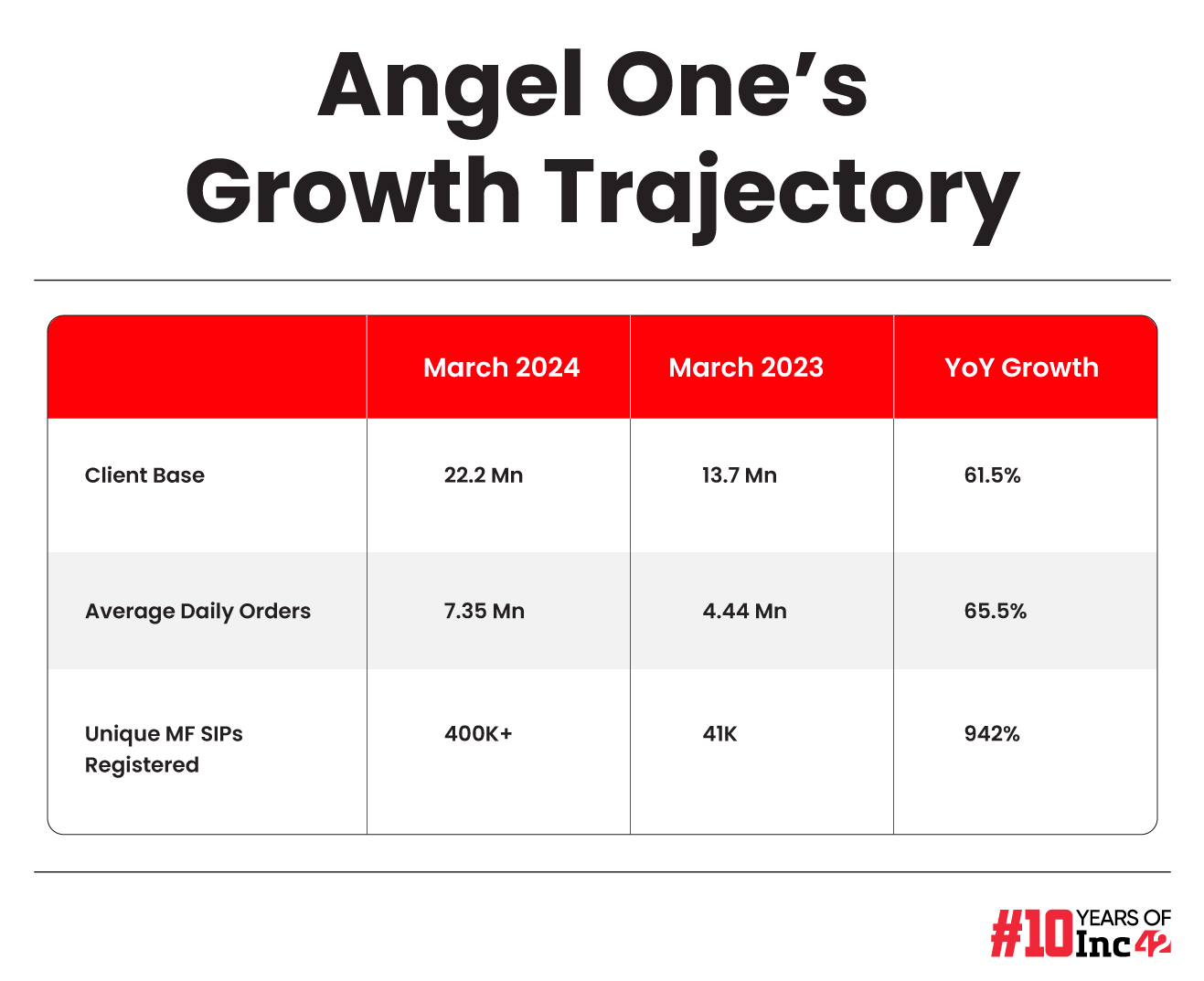

Tiwari mentioned that crucial revenue metrics such as average daily orders placed on the platform, new account openings, and SIPs in mutual funds have witnessed substantial growth for the company. Meanwhile, the company is also planning to enter the lending and insurance space soon.

Here are the edited excerpts:

Inc42: Congratulations on securing the IPL sponsorship in the stockbroking category. Sports tournament deals seem to be a huge draw for many digital-first platforms. How important will this deal prove for Angel One?

Prabhakar Tiwari: Thank you! We have been able to secure the official IPL sponsorship title in the stock broking/fintech category. With this sponsorship, we aim to get several advantages like on-ground visibility, boundary rope branding, digital parameter branding, and screen branding, among others. Seventy-four matches are being played in the IPL this year, and the number of matches may increase in the next few years.

We hope to reach out to the stadium audience, broadcast viewers and the viewers who watch the matches on digital devices. That is the kind of visibility our brand will have through this sponsorship.

We are aligning our business growth goals with the marketing campaigns we will launch through IPL and other activities. We aim to reach out to at least 500 Mn potential customers through this deal.

Our three decades of existence (Angel One was incorporated as Angel Broking in 1996), combined with the adoption of technology, makes us a trusted brand for customers. We are hoping the IPL sponsorship will have an impact on our revenue funnels, acquisition channels, and reactivation of inactive users.

The IPL sponsorship will be a yearly payout, which will be in addition to other print/TV/ digital ad spends. However, this does not mean that we will compromise on profitability like some venture capital-funded businesses. Depending on our requirements, we will keep scaling (up or down) our marketing expenses.

Inc42: Your closest competitors, Zerodha and Groww, have captured the limelight because of the active user base debate. How is Angel One positioned in the stockbroking industry?

Prabhakar Tiwari: We are an important contributor to the overall stock broking industry on various metrics. In terms of userbase, we have 21 Mn users, and we keep adding 2 Mn users every quarter. In the March quarter, we have added 1 Mn users every month.

Further, we also gauge our performance on other important monetisable revenue metrics. For instance, the daily average orders (DAO) placed in March was 7.3 Mn, up 65.5% YoY. Similarly, our unique Mutual Fund SIPs stood at 4.2 Lakh in February 2024, up 942.3% YoY.

Being a listed company, we do release monthly and quarterly data on all such important metrics, also highlighting how the company’s revenue channels have strengthened.

We also take pride in the fact that we are counted among the top three players with the largest monthly active user base.

Inc42: From an offline broker to embracing a digital avatar, what kind of growth you have witnessed?

Prabhakar Tiwari: The confidence mature retail investors and young users have shown in us is because of the brand value that we have created in the last 30 years. Through our digital transformation, we have only made sure that we become more accessible and convenient for our customers.

The digital embrace has helped us reduce downtimes, enhance the speed of operations and increase security to protect user interests.

In any financial services category, the power of brand holds much value, and we have very well leveraged the brand that we have created over the years.

Inc42: Two of your competitors have already announced their foray into the passive mutual fund space. Are you planning a similar move?

Prabhakar Tiwari: Passive investments are a worldwide trend and have picked pace in developed economies more than in India. I think India is not yet where countries like the US and China are when it comes to passive funds. We are in the final leg of fetching an AMC license from market regulator SEBI.

Inc42: What are some of the other wealth tech opportunities that Angel One is looking at?

Prabhakar Tiwari: Besides the mutual funds business, we are also conducting beta testing for a lending business and exploring insurance distribution.

[Edited by Shishir Parasher]

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)