As Bitcoin block no. 839729 is currently being mined at the time of writing this article, we’re just a day away from reaching block number 840,000. This milestone will automatically reduce the mining reward by 50%, decreasing from the current 6.25 to 3.125 Bitcoins.

For those new to the concept, this event is known as Bitcoin halving, a pre-programmed occurrence after every 210,000 blocks, cutting the Bitcoin mining reward in half.

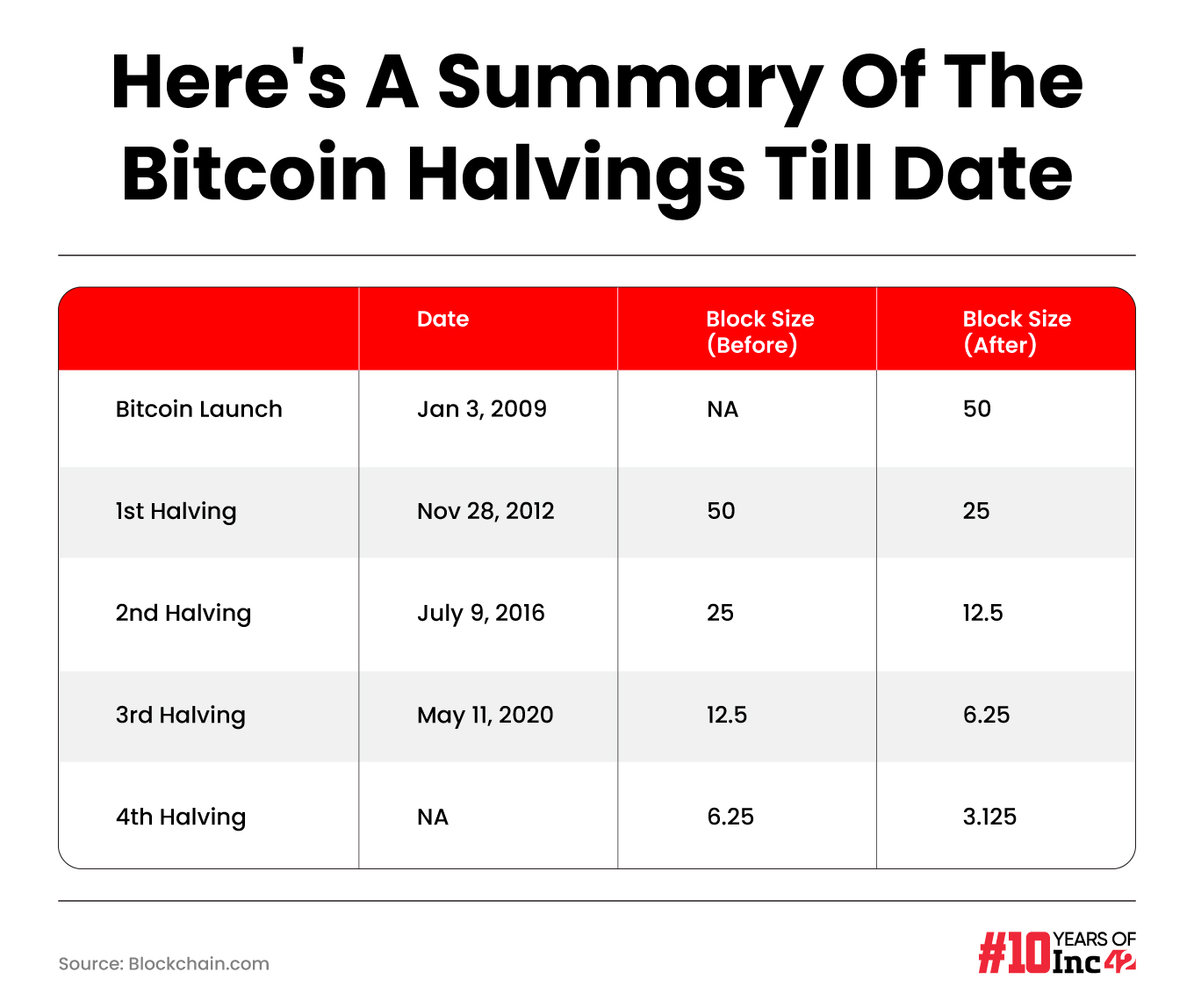

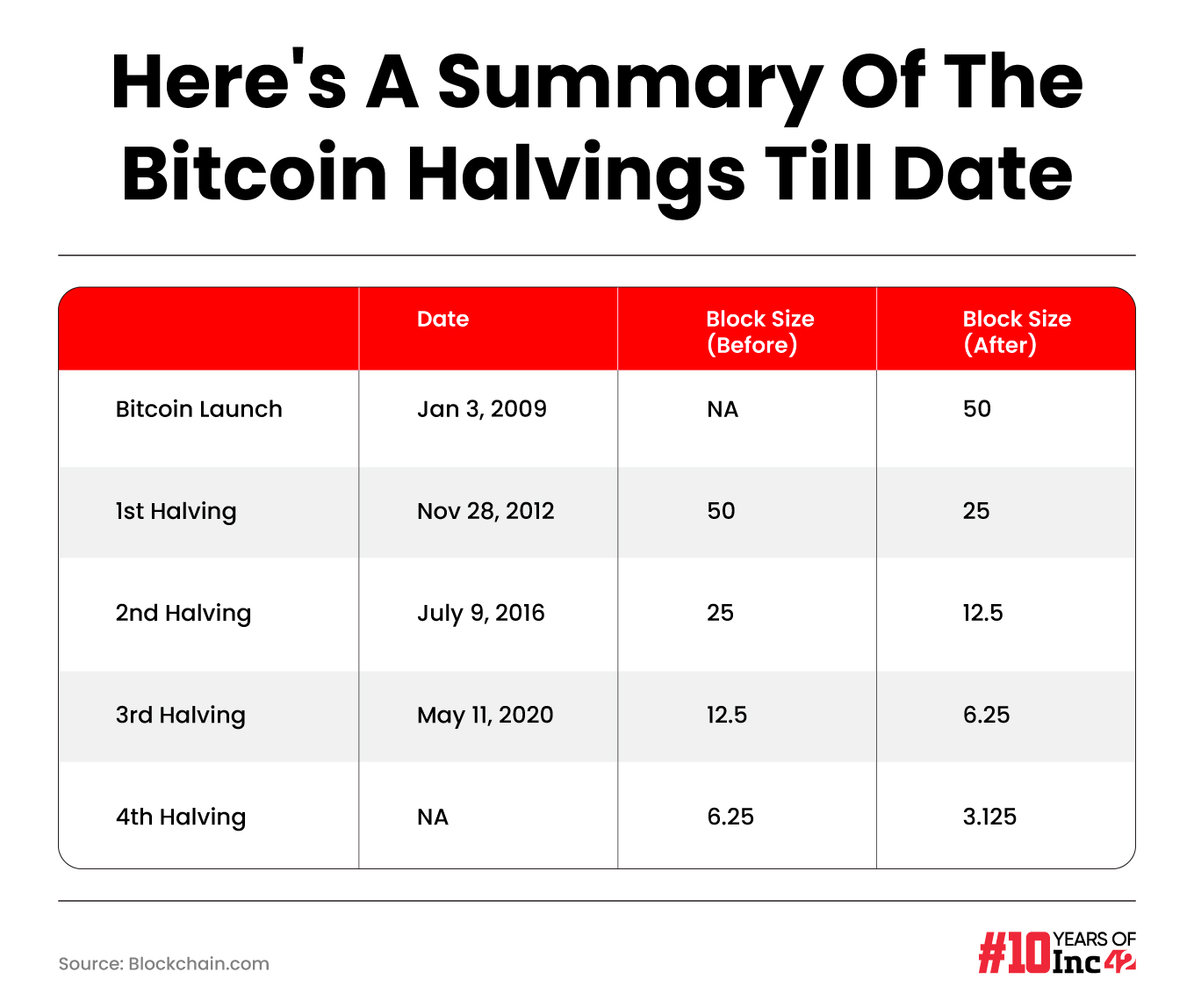

Since the genesis of the first Bitcoin block on January 3, 2009, we’ve experienced three halving events so far. The initial reward of 50 Bitcoins per block has gradually decreased, and post the next halving, it will further reduce to 3.125 Bitcoins per block.

But this time around, leading up to the fourth halving in April 2024, the crypto landscape is unique.

For instance, Parth Chaturvedi, investments lead at CoinSwitch Ventures, noted that prices surged to unprecedented levels just before the event, adding an intriguing dimension to post-halving market dynamics. The introduction of spot Bitcoin ETFs in the US has attracted institutional players to the crypto ecosystem, enhancing market credibility and stability.

Besides this, unlike previous halvings, the current ecosystem is more mature, with increased nuances and complexities.

Siddarth Sogani, founder and CEO of blockchain analytics firm CREBACO, believes that geopolitical events like the Iran-Israel conflict could destabilise matters. He suggested that while the halving was expected to occur earlier, recent geopolitical tensions have caused a delay. Sogani expects the full impact to reveal itself by the end of May 2024.

The recent influx in its price underscores Bitcoin’s evolving role in the global economy, paving the way for increased demand and utility. With Hong Kong’s recent approval of spot Bitcoin ETFs, analysts anticipate a rise in global wealth managers’ exposure to Bitcoin as an asset class, particularly as investment managers look for an edge within their clients’ portfolios.

Where Will Bitcoin Price Go Next?

In a conversation with Inc42, Sumit Gupta, cofounder of CoinDCX, said that historically Bitcoin halvings have correlated with price surges. These increases are driven by a reduction in the supply issuance rate, emphasising Bitcoin’s scarcity, which in turn could drive up demand, prices, and trading activity.

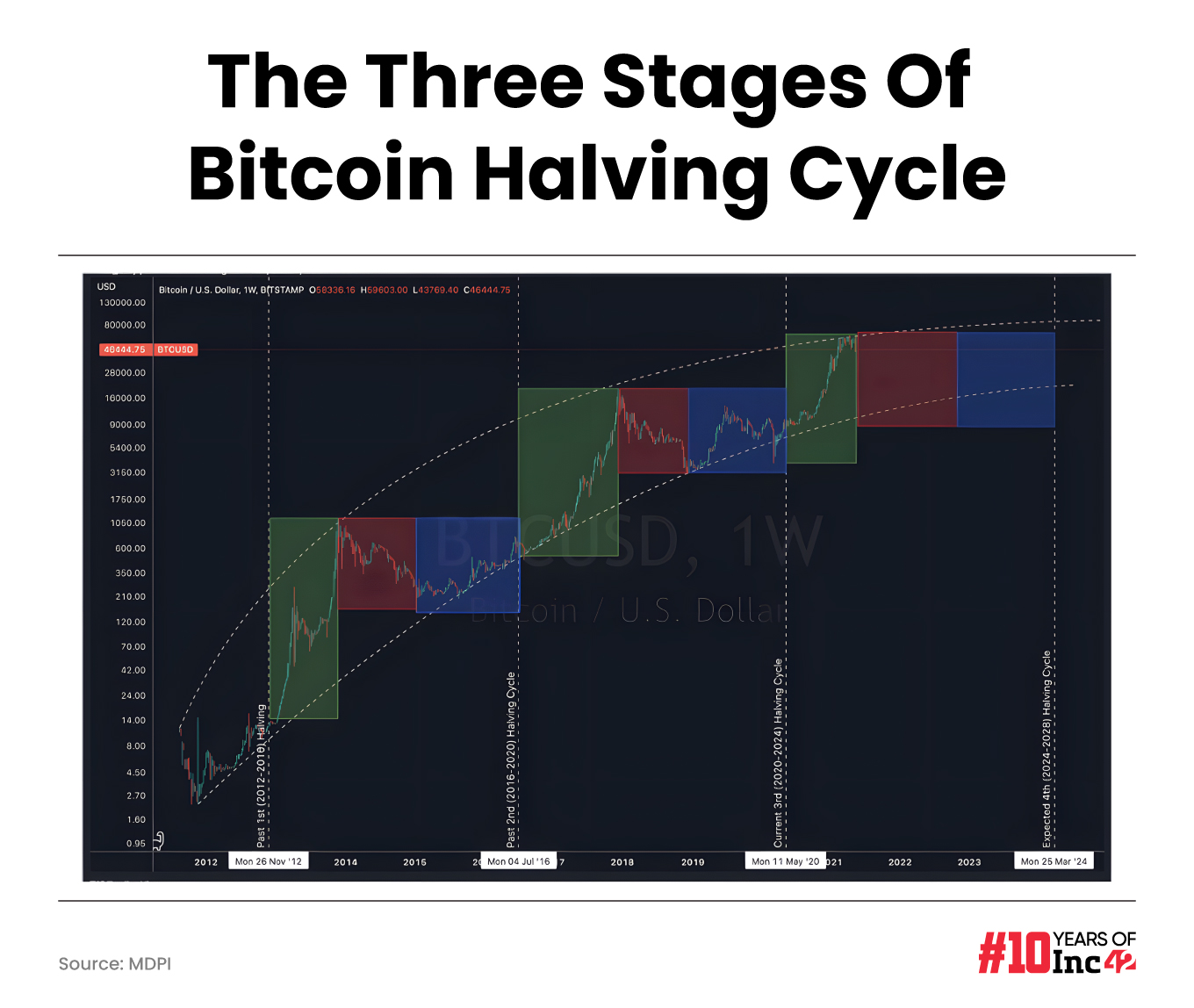

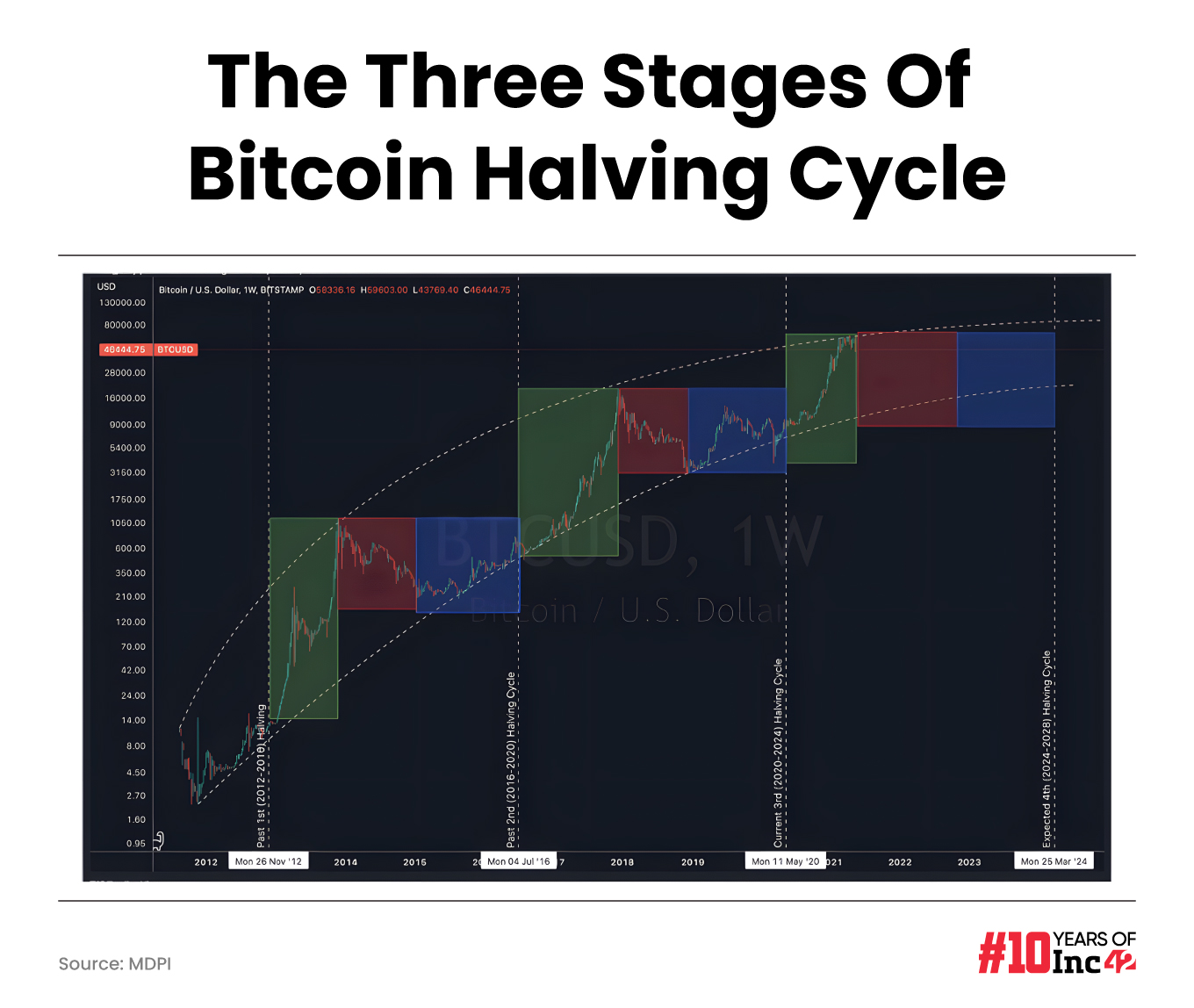

The first halving in November 2012 saw the block reward decrease from 50 BTC to 25 BTC. In the year following this event, Bitcoin’s price soared from around $12 to over $1,000, marking an approximate 83x increase. Similar trends were observed after subsequent halvings.

Following the July 2016 halving, where the reward was slashed from 25 BTC to 12.5 BTC, Bitcoin’s price surged from approximately $650 to a peak of around $20,000 in just 18 months, a nearly 30x increase, Gupta noted.

Defining the short-term impact, Jyotsna Hirdyani, South Asia head at Bitget, also pointed out that typically six to 12 months after a halving, there’s a surge in price, leading the crypto market out of the medium and long-term bull market.

“The most recent halving occurred in May 2020, reducing the reward from 12.5 BTC to 6.25 BTC. Although the immediate impact on price was less pronounced compared to previous halvings, we saw a steady upward trajectory in the following months. By early 2021, Bitcoin had reached new all-time highs, surpassing $60,000 per coin, marking a 5x increase from the pre-halving price around $12,000,” CoinDCX cofounder Gupta added.

However, this time, opinions diverged among over a dozen crypto founders and experts Inc42 spoke to, with some highlighting different trajectories this time, attributing significance to other factors.

According to Shivam Thakral, founder and CEO of BuyUcoin, the upcoming halving could have dual effects on the Indian market: a surge in prices due to decreased supply as coins become scarcer for mining, and short-term volatility due to anticipation and excitement surrounding the event. Traders could potentially buy in anticipation of price increases.

Thakral also noted that the predicted price increase of Bitcoin may entice new investors, consequently increasing the daily transaction volume. Thakral also highlighted the potential for increased adoption by Indian enterprises to drive up daily transactions.

According to various research reports, each of the Bitcoin halvings in the past was followed by three stages — a one-year bull market, a one-year bear market, followed by a two-year stagnation.

However, the stance of the Indian government on cryptocurrencies could potentially temper investor enthusiasm, thereby affecting both price and transaction volume.

Will The Halving Boost Altcoins?

Bitcoin, as the foundational cryptocurrency, has been instrumental in shaping the entire crypto ecosystem. Hence, the impact of halving won’t be confined solely to Bitcoin but will extend to altcoins and other products like future ETFs and spot ETFs.

Sogani believes that the altcoin markets will also experience an upsurge post-halving, given that Bitcoin’s dominance stands at around 53% of the total market cap.

When Bitcoin prices rise, investor attention is solely on Bitcoin, causing its dominance to climb to 56% to 70%. However, this dominance eventually stabilises as traders start capitalising on their Bitcoin gains, divesting some profits into altcoins.

This shift usually occurs after Bitcoin hits an all-time high. As the market has matured, this transition to altcoins can occur concurrently to a certain extent. Moreover, this trend could gain further momentum with the introduction of Ethereum ETFs, followed by potential offerings for other cryptocurrencies like Solana.

In addition to the potential impacts on altcoins, Bitcoin futures, and related products, new financial products are likely emerging in response to the dynamics surrounding the Bitcoin halving.

Dhruvil Shah, SVP of technology at Liminal Custody Solutions, believes that just as spot ETFs launch globally, innovative financial instruments may emerge, providing investors with alternative pathways to access digital assets.

Crypto Spring In India?

Gupta of CoinDCX asserts that India is leading the charge in crypto adoption. The upcoming halving event has ignited excitement within the crypto community, prompting us to closely monitor market movements. The impact of the halving on Bitcoin’s price and daily transaction volume in the Indian market hinges on various factors, including regulatory developments and investor sentiment.

The Bitcoin halving in April 2024 will slash block rewards from 6.25 BTC to 3.125 BTC, reducing daily new Bitcoins from 900 BTC/day to 450 BTC/day. Gupta notes that this reduction may intensify competition among miners, potentially leading to consolidation as rewards decrease while operational costs remain high.

Echoing Gupta’s sentiments, Hirdyani of Bitget anticipates a surge in trading volume fueled by positive sentiment towards crypto. “With the growing interest in cryptocurrencies in the country, we may witness increased trading activity and price appreciation, especially if Bitcoin continues its global trend of reaching new all-time highs,” she stated.

In contrast to previous instances, exchanges are refraining from aggressive advertising during the IPL season. This suggests that the observed growth is genuine and organic, albeit modest. CREBACO’s Sogani added, “While we lack concrete data for India, it’s apparent that exchanges aren’t as aggressively promoting during the IPL or through traditional media channels compared to the previous cycle in 2021. Hence, while growth is expected, it may not match the levels seen in the past.”

The total Bitcoin supply is capped at 21 Mn, and it’s estimated that there will be around 33 halving events in total. The idea behind halving was to limit the supply and keep pushing the value of Bitcoin. Out of 21 Mn, 19.685 Mn Bitcoins have already been mined.

It’s no surprise, then, that halving events has a knock-on effect on Bitcoin’s price. While the miners will have lower profitability due to fewer blocks, increased competition, and transition to renewable energy and may have to bear an estimated loss of $ 10 Bn, the current Indian crypto community is battle hardened and remains vigilant.

Whether it’s the surge in altcoin interest, the emergence of innovative financial products, or the evolving trading landscape in India, one thing is certain: the halving’s ripple effects will continue to shape the future of digital finance.

The RBI’s CBDC is just one example for now, believes the industry.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)