SUMMARY

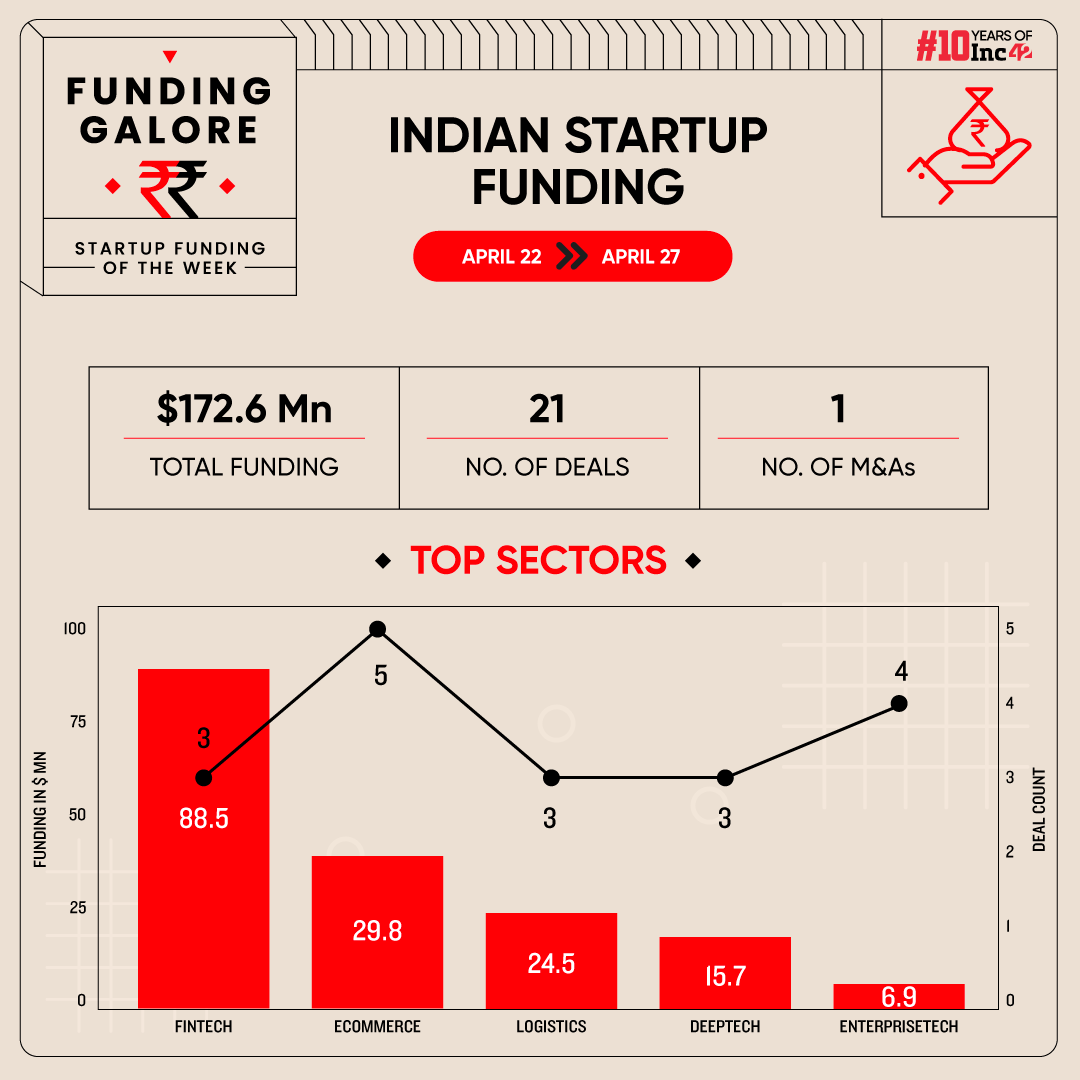

Indian startups cumulatively raised $172.6 Mn across 21 deals between April 22-27

Fintech took the leader spot this week with startups in the sector cumulatively raising $88.5 Mn via 3 deals

Seed funding picked up this week to $33.9 Mn, a 29% increase from last week’s $26.2 Mn

After two weeks of decent investment activity across the Indian startup ecosystem, funding remained muted between April 22 and 27. During the week, startups cumulatively raised $172.6 Mn across 21 deals, down 33% from last week’s $260.1 Mn secured across 31 deals.

Funding Galore: Indian Startup Funding Of The Week [April 22 – April 27]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 25 Apr 2024 | Northern Arc | Fintech | Lendingtech | B2B | $80 Mn | Equity and Debt | International Finance Corporatio | International Finance Corporatio |

| 26 Apr 2024 | Lyskraft | Ecommerce | B2C Ecommerce | B2C | $26 Mn | Seed | Peak XV Partners | Peak XV Partners |

| 24 Apr 2024 | LetsTransport | Logistics | Ecommerce Logistics | B2B | $22 Mn | Series E | Bertelsmann India Investments, Rebright Partners, NB Ventures, ALES Global, Stride Ventures and CAC Capital | Bertelsmann India Investments |

| 22 Apr 2024 | Dhruva Space | Deeptech | Spacetech | B2B | $15 Mn | Series A | Indian Angel Network Alpha Fund, Blue Ashva Capital, Silverneedle Ventures, BIG Global Investment JSC, IvyCap Ventures, Mumbai Angels, Blume Founders Fund, Small Industries Development Bank of India, Technology Development Board | – |

| 22 Apr 2024 | Accacia | Cleantech | Climate Tech | B2B | $6.5 Mn | Series A | Illuminate Financial, Accel, B Capital | Illuminate Financial |

| 25 Apr 2024 | Clix Capital | Fintech | Lendingtech | B2B | $6 Mn | Debt | DCB Bank | DCB Bank |

| 22 Apr 2024 | Smartworks | Real Estate Tech | Shared Spaces | B2B | $4 Mn | – | Keppel Land | Keppel Land |

| 24 Apr 2024 | Plane | Enterprisetech | Horizontal SaaS | B2B | $4 Mn | Seed | OSS Capital | OSS Capital |

| 25 Apr 2024 | Flashaid | Fintech | Insurtech | B2C | $2.5 Mn | pre-Series A | Piper Serica Angel Fund, SOSV, Z21 Ventures Fund, ZNLGrowth Fund | Piper Serica Angel Fund, SOSV |

| 22 Apr 2024 | Runo | Enterprisetech | Horizontal SaaS | B2B | $1.5 Mn | Pre-Series A | Unicorn India Ventures, Callapina Capital | – |

| 26 Apr 2024 | Matchlog | logistics | Logistics SaaS | B2B | $1.5 Mn | pre-Series A | Motion Ventures, July Ventures, Venture Catalysts, Blue Ashva Capital, Capital | Motion Ventures, July Ventures |

| 24 Apr 2024 | Boba Bhai | Ecommerce | D2C | B2C | $1.5 Mn | Seed | Titan Capital, Global Growth Capital UK, Arjun Vaidya, Marsshot VC, DeVC, Warm Up Ventures, Varun Alagh, Peercheque | Titan Capital, Global Growth Capital UK |

| 24 Apr 2024 | Clueso | Enterprisetech | Horizontal SaaS | B2B | $1.4 Mn | Seed | f7 Ventures, Y Combinator | f7 Ventures |

| 24 Apr 2024 | Adukale | Ecommerce | D2C | B2C | $1.3 Mn | pre-Series A | Force Ventures, Aanya Ventures, Subrata Mitra, Radhika Pandit | Force Ventures |

| 24 Apr 2024 | KARBAN Envirotech | Ecommerce | D2C | B2B-B2C | $1.07 Mn | Seed | All in Capitals, Titan Capital, Rainmatter, Urban Company, JK family office, Anupam Mittal, Kunal Shah, Natasha Malpani Oswa | All in Capitals, Titan Capital, Rainmatter |

| 22 Apr 2024 | BluWheelz | Logistics | Last Mile Delivery | B2C | $1 Mn | – | Venture Catalysts, FAAD, LetsVenture, Chakra Growth Fund | – |

| 25 Apr 2024 | Endimension Technology | Healthtech | Healthcare SaaS | B2B | $720K | pre-Series A | Inflection Point Ventures, Sucseed Indovation, SINE IIT Bombay | – |

| 23 Apr 2024 | Nabhdrishti Aerospace | Deeptech | Spacetech | B2C | $360K | pre-Seed | IIMA Ventures | IIMA Ventures |

| 25 Apr 2024 | Control One AI | Deeptech | Robotics Process Automation (RPA) | B2B | $350K | pre-Seed | Kunal Shah, Chaitanya Ramalingegowda, Amit Singh | – |

| 25 Apr 2024 | FlexiCloud Internet | Enterprisetech | Horizontal SaaS | B2B | – | – | Raoji Group | Raoji Group |

| 23 Apr 2024 | Rentomojo | Ecommerce | B2C Ecommerce | B2C | – | Series D | ValueQuest | ValueQuest |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- IPO-bound non-banking lender Northern Arc secured $80 Mn from International Finance Corporation (IFC) in equal halves of equity and debt components on April 25, marking the largest fundraise of the week.

- Buoyed by Northern Arc’s funding, the fintech sector maintained its dominance over funding trends at a sectoral level. Startups in the space snagged $88.5 Mn via 3 deals, up 18% from last week’s $74.8 Mn secured across 5 deals.

- Ecommerce topped the highest deal chart this week, with startups in the sector raising $29.8 Mn across 5 deals.

- The week also saw Blue Ashva Capital, Titan Capital, Venture Catalysts, and Cred’s Kunal Shah clinching the active investors tag with each backing two startups.

- Seed funding continued its ascent with early stage startups securing $33.9 Mn this week. This is a 29% surge from last week’s $26.2 Mn.

IPO Updates From The Week

Other Major Developments Of The Week

- Capria Ventures announced the final close of its India Opportunity Fund at INR 153 Cr. This follows Capria’s full-cash exit from HR tech platform Awign, with a return of more than 50%. With this, Japanese Mynavi Corporation has picked up a majority stake in Awign.

- Global investment firm Lighthouse Canton launched a new fund, LC GenInnov Global Innovation Fund, to focus on investments in global GenAI companies.

- After a six-year-long stint, Peak XV Partner’s managing director Piyush Gupta is set to part ways with the VC by the end of April. Moving further, he is in the process of setting up a secondary-focused fund.

- Australia’s Macquarie Group’s investment arm, Macquarie Asset Management, is looking to invest $1.5 Bn into India’s EV space via its recently unveiled platform Vertelo.

- EV maker Ather Energy is eyeing a $90 Mn funding round via a combination of primary and secondary share sales at a unicorn valuation. Meanwhile, existing investor Flipkart’s Sachin Bansal has divested some of his stake to Zerodha’s Nikhil Kamath.

- Saudi Aramco’s venture capital arm is building a team in India to back early-stage startups in the country. Further, Aramco’s subsidiary Prosperity7 Ventures is in discussions to rope in a leader for its India operations.

- Investment firm Kedaara Capital has marked the final close of its fourth fund, Kedaara IV, at $1.7 Bn. With this, it has raised the country’s largest PE Fund, surpassing Chrys Cap’s $1.3 Bn Fund IX raised in 2023.

- Singapore-based investment firm Temasek and US-based Fidelity are in final discussions to invest around $200 Mn in Lenskart through a secondary share sale at a valuation of $5 Bn.

- Former BharatPe CEO Suhail Sameer-backed OTP Ventures is planning to mark the first close of its debut fund at INR 400 Cr by June. The fund will be investing in consumer, consumer tech and fintech startups.

- VC fund Norwest Venture Partners announced the close of its 17th fund, NVP 17, at $3 Bn. With the fund, it will invest in enterprise tech, consumer and healthcare startups in three focus markets – India, Israel, and the US.

- Coworking space provider WeWork Inc is in talks to sell its remaining 27% stake in its Indian unit, WeWork India, via an INR 1,200 Cr secondary transaction to Enam group’s family office, investment fund A91 Partners, and CaratLane founder Mithun Sacheti.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)