More than five decades ago, India desired to become a self-dependent nation in milk production. Consequently, the country launched Operation Flood, a dairy development programme, on January 13, 1970. Today, India is the number one milk-producing nation in the world. The country also produces 24% of the world’s milk and has witnessed a 51% increase in milk production between 2014 and 2022.

However, despite this significant achievement, the country has been a laggard in terms of sourcing, storage, supply, and distribution of dairy products. Fortunately, fixing these critical gaps are the homegrown dairytech startups. Adept at using state-of-the-art tech solutions, these ventures are spearheading the country’s White Revolution 2.0.

Ranging from using IoT (Internet of Things) devices to leveraging AI and ML, these startups have left no stone unturned to revolutionise the Indian dairy sector in recent times. As a result, farmers are today in a better position to monitor the health of cattle, leading to improved yields, higher-quality dairy products, and enhanced milk quality.

Besides, Indian dairytech startups are combating age-old issues plaguing the sector. Some of the top problems include poor quality feed, substandard animal healthcare, and poor disease management.

According to Ragavan Venkatesan, the founder & CEO of DGV, new-age milk sourcing, production, and delivery players have successfully established a product market fit for themselves amidst competition from established legacy players, all while ensuring proper bovine nutrition and free-range grazing.

All in all, the Indian dairy sector opportunity appears promising. Giving heft to this are projections that the Indian dairy industry would become an INR 49.95 Lakh Cr opportunity by 2032, growing at a CAGR of 13% from 2023.

Startups Transforming The Indian Dairy Landscape

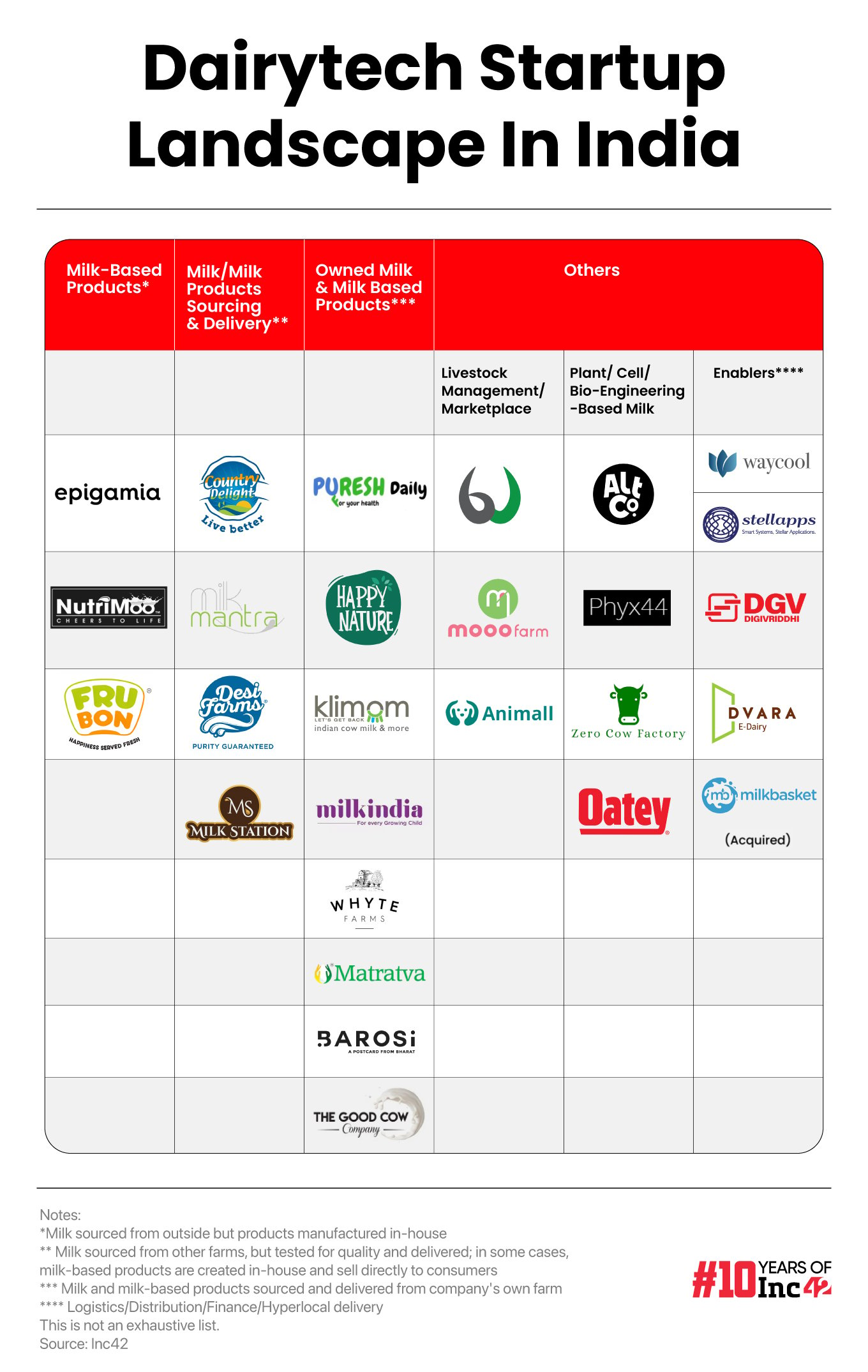

The Indian dairy startup landscape has evolved on the back of new-age hyperlocal delivery platforms like MilkBasket, DailyNinja, and Supr Daily (now InsanelyGood), to name a few, taking over legacy brands like Amul, Mother Dairy and others through retail channels. Later, companies like Country Delight, Milk Mantra and others emerged to address quality and timely delivery concerns.

However, despite an explosion of startups in this space, several challenges remain unresolved. For one, sourcing milk from various dairy farms is a massive pain point. This directly impacts the quality of milk.

To address this, Indian startups have started setting up their own farms and adopted a direct-to-consumer (D2C) model. Some names include Barosi, Happy Milk, Doozy Happy Nature, The Milk India Company, and The Good Cow Company.

Meanwhile, many Indian founders have emerged to serve a section of individuals who are lactose intolerant or follow a vegan lifestyle. Alt Co, Zero Cow Factory, Oatey and Phyx44 Labs are some startups that serve this section of consumers.

Concurrently, the Indian dairytech ecosystem witnessed the arrival of players to tackle logistics, distribution, and financing for dairy farmers.

Innovators such as DVG, Dvara E-Dairy (a dairy fintech), WayCool, Ninjacart, DeHaat (focused on logistics & supply chain distribution), and Stellapps (digitising supply chain through AI/ML/IoT) have also made significant strides in the last few years.

Fintech startups are particularly optimistic about the rising opportunities in the sector.

According to Venkatesan, the key challenge for farmers engaged in dairy activities lie in meeting monetary needs.

lockquote>

Typically, farmers rely on traditional financial entities such as cooperative societies, banks, and money lenders. However, the rural financial framework is intricate and paper-heavy, causing confusion and reluctance among farmers.

“This has spurred the need for simpler, more modern financial solutions,” he added.

But Speedbumps Run Galore

While the dairy industry has evolved significantly, it faces numerous challenges. Startups like Mooofarm and Animall attempted to address various industry aspects but encountered difficulties.

Animall transitioned to a marketplace model due to challenges in cattle management, while Mooofarm faced allegations of financial misconduct, raising concerns about its future and among investors.

While methane emissions, developing nutrition products, improving cattle management, optimising the supply chain, and implementing effective livestock monitoring systems are top issues, quality of milk is the industry’s biggest headache.

According to eFeed’s cofounder Kumar Ranjan, India has the poorest milk quality due to Aflatoxins, which is a harmful cancer-causing fungus.

lockquote>

Further, despite available technologies like lactometers and hands-free milking machines, many dairy farmers struggle to adopt them due to financial constraints and limited access to institutional credit.

“Technology is accessible but not widely adopted in the country. While the feasibility of robotic milking machines can be appealing, but it is questioned due to affordability concerns. Any good robotic machine will cost a minimum of INR 3 lakhs and farmers earn around INR 1-1.5 lakhs annually, the affordability of such technology is in doubt, for a country like India,” added Ranjan.

lockquote>

The Way Ahead

As stated above, India is the largest milk-producing nation in the world. It is on the back of its 300 Mn cattle and 80 Mn dairy farmers that the Indian dairy sector accounts for 3-4% of the country’s GDP.

“Dairytech startups are capitalising on this vast market opportunity by addressing challenges in on-farm production, milk collection, dairy processing, and sales/distribution,” Mark Kahn, managing partner at OmnivoreFund, said.

lockquote>

It is imperative to highlight that despite India’s major role as a milk producer, its yield per animal lags behind other countries. To address this, the country needs to improve cow breeding and feeding practices. While selective breeding can help in higher milk production and improved cattle health, optimising feeding practices will ensure that cows receive a balanced diet, further enhancing milk production.

Lastly, the dairy industry in the country is largely unorganised and lacks technical support. Despite the emergence of many tech startups addressing various issues, industry leaders Inc42 spoke with suggest that a specialised organisation assisting those in livestock management, milk production, and delivery could further enhance opportunities and unite stakeholders.

While traditionally seen as part of agriculture, the sector is evolving, with private players dedicating resources to build a structured dairy ecosystem.

Additionally, creating accessible financial products and increasing awareness in rural areas is essential. Further, by focussing on farmers’ needs and considering initiatives like carbon credits, the Indian dairy industry shows great growth potential.

According to a market study, the Indian dairy market generated revenue exceeding $71 Bn in 2024 and is expected to grow at a CAGR of 6.77% by 2028.

With India’s GDP experiencing incremental growth and an increasing number of tech startups entering the scene, there’s a significant opportunity to capitalise on this growth and assist manufacturers and enablers in India’s dairy industry in exploring new revenue streams.

For now, it will be intriguing to see if Indian dairytech startups can disrupt the legacy sector and elevate India’s quality and supply index on a global scale.

[Edited by Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)