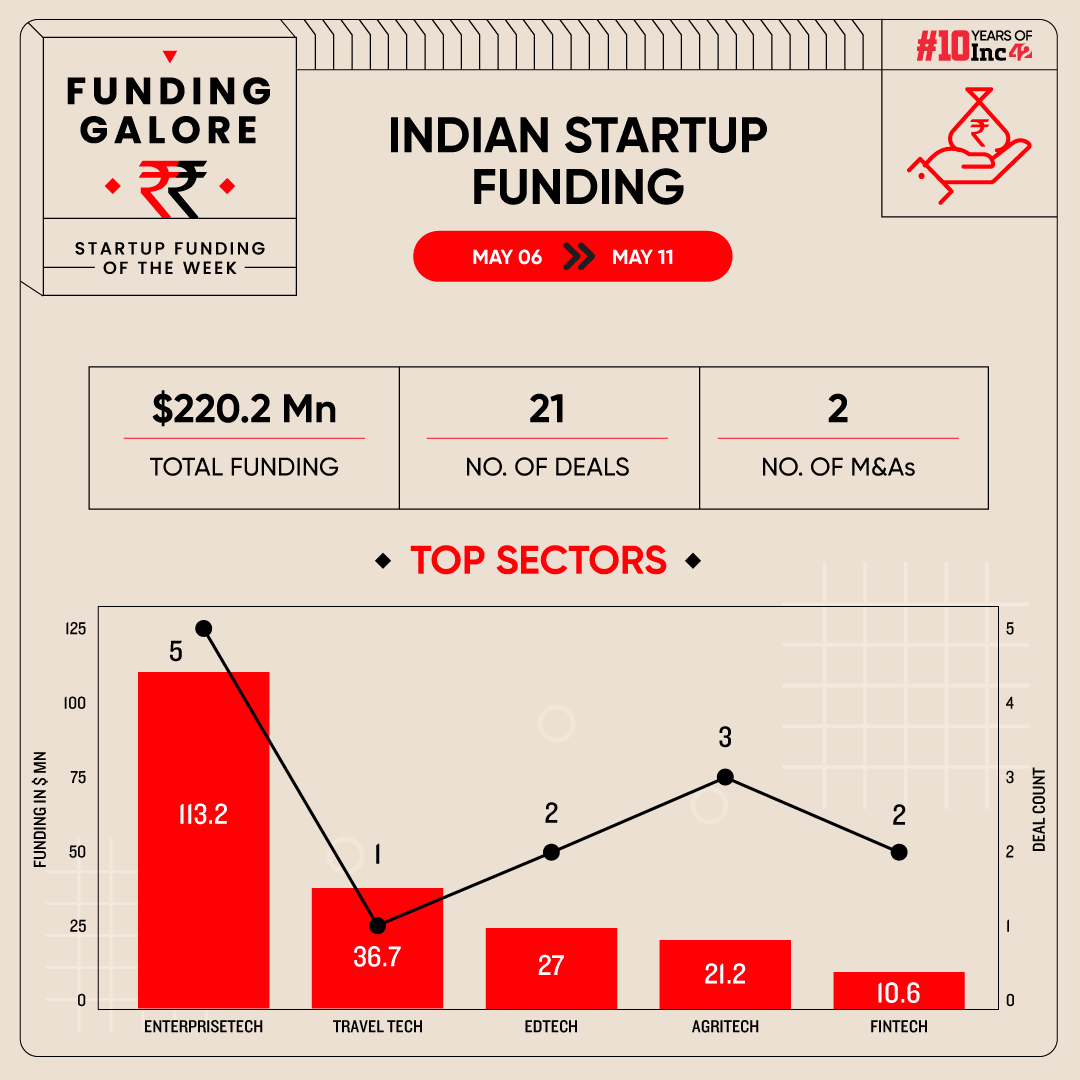

Indian startups cumulatively raised $220.2 Mn across 21 deals between May 6 and 11

Atlan $105 Mn funding was the lone mega funding round of the week

Seed funding continued to maintain to tumble down this week, with startups at this stage securing $8.4 Mn this week

Investment activity in the Indian startup ecosystem was a low-key affair this week as compared to the previous six-day period. Between May 6 and 11, startups cumulatively raised $220.2 Mn across 21 deals, a 30% decline from last week’s $316.4 Mn secured in 23 deals.

Funding Galore: Indian Startup Funding Of The Week [May 6 – May 11]

| Travel Tech | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 8 May 2024 | Atlan | Enterprisetech | Horizontal SaaS | B2B | $105 Mn | Series C | GIC, Meritech Capital, Salesforce Ventures, Peak XV Partners | GIC, Meritech Capital |

| 7 May 2024 | GreenCell Mobility | Travel Tech | Transport Tech | B2B | $36.7 Mn | Credit | Sumitomo Mitsui Banking Corporation | Sumitomo Mitsui Banking Corporation |

| 9 May 2024 | K12 Techno Services | Edtech | Edtech Saas | B2B-B2C | $27 Mn | – | Venturi Partners | Venturi Partners |

| 6 May 2024 | Superplum | Agritech | Precision Agriculture | B2B | $15 Mn | Series A | Erik Ragatz | Erik Ragatz |

| 7 May 2024 | Lendingkart | Fintech | Lendingtech | B2B | $10 Mn | Debt | BlueOrchard | BlueOrchard |

| 6 May 2024 | Poshn | Agritech | Market Linkage | B2B-B2C | $4 Mn | pre-Series A | Prime Venture Partners, Zephyr Peacock India | Prime Venture Partners, Zephyr Peacock India |

| 8 May 2024 | Myelin | Enterprisetech | Horizontal SaaS | B2B | $4 Mn | Equity | SIDBI Venture Capital, Endiya Partners, Pratithi Investment Trust, Subh Labh | SIDBI Venture Capital |

| 6 May 2024 | Ecozen | Cleantech | Solar Tech | B2B | $2.9 Mn | – | Coromandel International | Coromandel International |

| 7 May 2024 | Parseable | Enterprisetech | Horizontal SaaS | B2B | $2.75 Mn | Seed | Peak XV, NP-Hard Ventures | Peak XV, NP-Hard Ventures |

| 7 May 2024 | BharatRohan | Deeptech | Dronetech | B2B | $2.3 Mn | pre-IPO | Villgro Innovation Foundation, Caspian, RevX, Venture Garage | – |

| 7 May 2024 | Cornext | Agritech | Farm Inputs | B2B | $2.2 Mn | Seed | Omnivore | Omnivore |

| 7 May 2024 | REGRIP | Cleantech | Waste Management | B2B-B2C | $2 Mn | SiriusOne Capital, Inflection Point Ventures, LetsVenture, Rikant Pitti, Mahavir Pratap Sharma, Aparna Thyagarajan | SiriusOne Capital, Inflection Point Ventures, LetsVenture | |

| 7 May 2024 | ICON | Ecommerce | D2C | B2C | $1.2 Mn | Seed | DSG Consumer Partners | DSG Consumer Partners |

| 8 May 2024 | Atomgrid | Ecommerce | B2B Ecommerce | B2B | $1.2 Mn | Seed | Merak Ventures, Dexter Ventures, Upsparks, Point One Capital, Nitin Gupta, Prateek Jindal | Merak Ventures |

| 7 May 2024 | Eternz | Ecommerce | D2C | B2C | $1.15 Mn | Pre-seed | Kae Capital, Gemba Capital, IIMA Ventures, TDV Partners, Venture Lab | Kae Capital |

| 7 May 2024 | Knit | Enterprisetech | Horizontal SaaS | B2B | $1 Mn | Seed | Endiya Partners, Axilor Ventures | Endiya Partners |

| 8 May 2024 | Centriti | Logistics | Supply Chain | B2B | $719K | pre-Series A | Ev2 Ventures, Atrium Angels, Alluviam Capital, Brigade REAP, HOF Profectus & CoralBay Ventures | Ev2 Ventures |

| 6 May 2024 | 50Fin | Fintech | Leadingtech | B2C | $550K | – | Arali Ventures, Nitin Gupta | Arali Ventures, Nitin Gupta |

| 9 May 2024 | Treacle | Enterprisetech | Horizontal SaaS | B2B | $479K | pre-Seed | Inflection Point Ventures | Inflection Point Ventures |

| 6 May 2024 | GyanLive | Edtech | Test Preparation | B2C | – | – | Classplus | Classplus |

| 6 May 2024 | QUE | Ecommerce | D2C | B2C | – | – | Shikhar Dhawan | Shikhar Dhawan |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Despite the muted funding trends in the week, one mega deal materialised in the week for SaaS startup Atlan. The data collaboration software provider bagged $105 Mn in its Series C funding round, co-led by GIC and Meritech Capital. The round also saw Atlan’s post-money valuation climbing to $750 Mn.

- Buoyed by Atlan’s mega funding, enterprisetech rose to dominate funding trends at a sectoral level. Startups in the space raised $113.2 Mn across 5 deals, the greatest number of deals secured at a sectoral level.

- Peak XV Partners, Endiya Partners, Nitin Gupta, and Inflection Point Ventures were the most active investors this week, backing 2 startups a piece.

- Seed funding continued to tumble down this week, with startups at this stage securing $8.4 Mn this week. This is a 32% decline from last week’s $12.3 Mn.

Updates On Indian Startup IPOs

Startup Acquisitions This Week

Other Other Major Developments Of The Week

- Lending tech startup Niro is eyeing $4.3 Mn in a pre-Series B funding round. It is looking to raise the funds from Marui Group, along with existing investors like Elevar Equity, GMO Venture Partners, Rebright Partners, among others, at a valuation of $55 Mn.

- InCred Capital’s Incred Alternative Investments marked the first close of its maiden private equity fund with capital commitments of over INR 330 Cr. The Vivek Singla-led venture capitalist (VC) firm is targeting to close the fund at INR 500 Cr.

- Wealth management firm Client Associates announced the first close of its maiden Category II alternative investment fund (AIF) at INR 300 Cr. It will look to back 12-15 consumer tech startups at the Pre-Series A to Series B stages with cheque sizes in the range of INR 10 Cr – INR 50 Cr per deal.

- Murugappa Group’s EV arm TI Clean Mobility (TICMPL) will be raising INR 580 Cr in a mix of equity and compulsorily convertible preference shares (CCPS). PE firm GEF Capital will back the company via its two funds, GEF South Asia Growth Invest III and GEF South Asia EBT Trust III.

- Among CarTrade’s bull run on the bourses, Goldman Sachs Asset Management has increased its stake in the startup to 5.15%, becoming a substantial shareholder. It now possesses 2.4 Mn shares in the company, up 4% from the erstwhile 2.3 Mn.

- Ex-BharatPe CBO Pratekk Agarwaal-led VC firm GrowthCap is looking to close its maiden fund at INR 50 Cr in the next two months. It will be investing in fintech, SaaS, and deeptech startups.

- Pune-based software company Icertis is looking to raise $150 Mn via a secondary share sale, a deal that could see an increased investment from SoftBank.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)