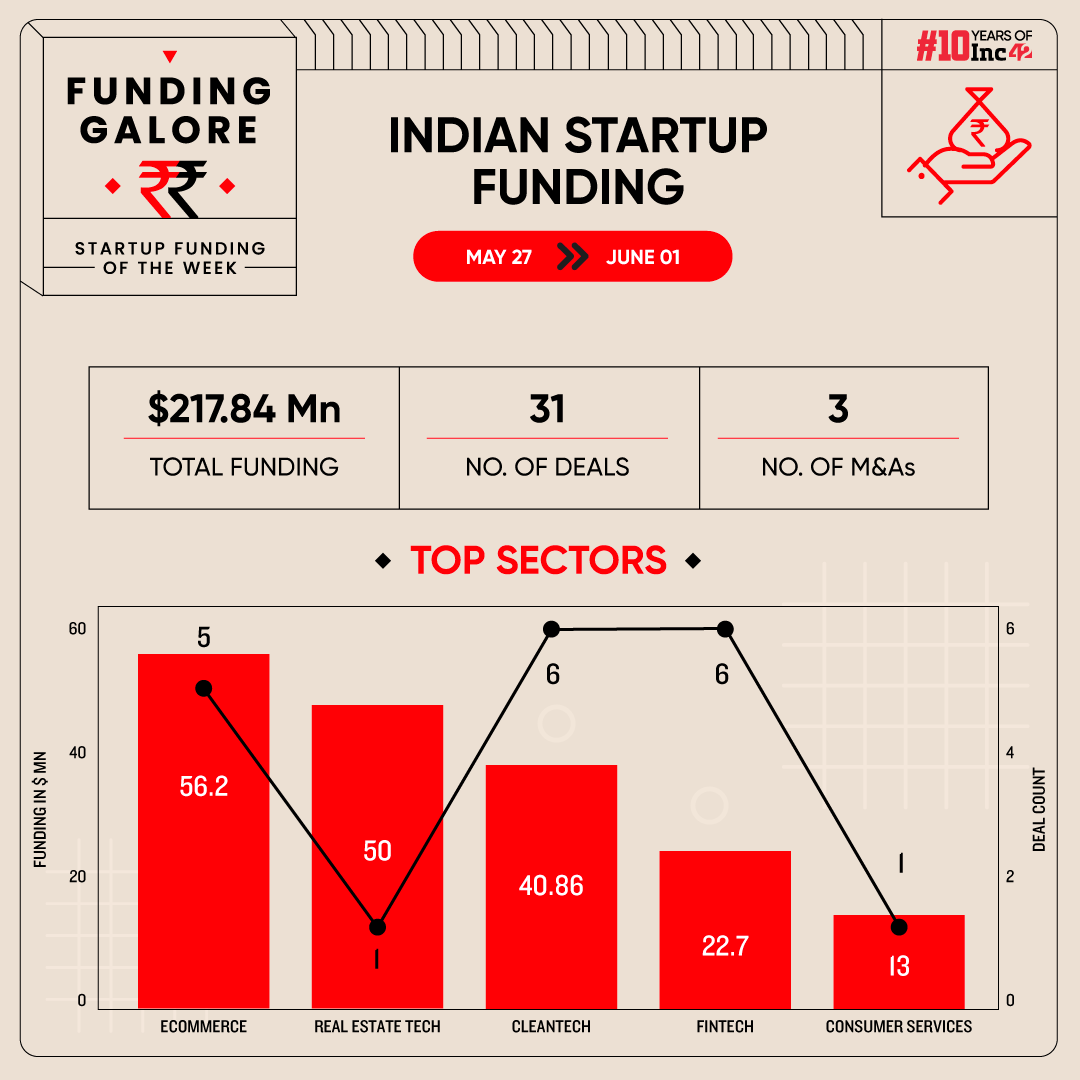

Indian startups cumulatively raised $217.84 Mn via 31 deals, a 273% increase from last week’s $58.36 Mn raised across 16 deals

The ecommerce sector emerged to be the investor favourite this week, with startups in the space bagging $56.2 Mn across five deals

Venture Catalysts was the most active investor this week, backing four startups

After muted funding trends over the past two weeks, investment activity in the Indian startup ecosystem picked up pace during the final week of May. Between May 27 and June 1, startups raised $217.84 Mn across 31 deals, a 273% increase from last week’s $58.36 Mn bagged across 16 deals.

Funding Galore: Indian Startup Funding Of The Week [May 27 – Jun 1]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 28 May 2024 | Infra.Market | Real Estate Tech | Real Estate SaaS | B2B-B2C | $50 Mn | – | MARS Unicorn Fund | MARS Unicorn Fund |

| 31 May 2024 | TechnoSport | Ecommerce | D2C | B2C | $25 Mn | – | A91 Partners | A91 Partners |

| 29 May 2024 | Euler Motors | Cleantech | Electric Vehicles | B2B | $24 Mn | Series C | Blume Venture, British International Investment, Piramal Alternatives India Access Fund | – |

| 30 May 2024 | Libas | Ecommerce | D2C | B2C | $18 Mn | – | ICICI Ventures | ICICI Ventures |

| 25 May 2024 | Zypp Electric | Cleantech | Electric Vehicles | B2B | $14 Mn | – | ENEOS Oil & Energy Pte Ltd | ENEOS Oil & Energy Pte Ltd |

| 30 May 2024 | Rebel Foods | Consumer Services | Hyperlocal Delivery | B2C | $13 Mn | Debt | Alteria Capital, InnoVen Capital | – |

| 25 May 2024 | Dvara | Fintech | Lendingtech | B2B-B2C | $10 Mn | Debt | BlueOrchard Microfinance Fund | BlueOrchard Microfinance Fund |

| 31 May 2024 | SEDEMAC Mechatronics | Deeptech | Hardware & IoT | B2B | $9 Mn* | – | Xponentia Capital Partners, A91 Partners, and 360 ONE Asset | – |

| 30 May 2024 | MediBuddy | Healthtech | Telemedicine | B2C | $8.4 Mn | Debt | Innoven Capital, Alteria Capital | – |

| 27 May 2024 | High Street | Ecommerce | Roll Ups | B2C | $6 Mn | Equity, Debt | Sangita Jindal, SRF Group Family Offices, MD Krishna Bodanapu, Timmy Sarna | Sangita Jindal |

| 27 May 2024 | Turno | Ecommerce | B2C Ecommerce | B2C | $6 Mn | Series A | British International Investment, Stellaris Venture Partners, B Capital, Quona Capital, Accion Venture Lab | British International Investment |

| 30 May 2024 | Vegapay | Fintech | Lendingtech | B2B | $5.5 Mn | Seed | Elevation Capital, Eximus Ventures | Elevation Capital |

| 29 May 2024 | Difacto | Deeptech | Robotics Process Automation | B2B | $4.8 Mn | – | Stakeboat Capital | Stakeboat Capital |

| 28 May 2024 | Flam | Media & Entainment | Social Media & Chat | B2B-B2C | $4.5 Mn | pre-Series A | Turbostart, Twin Ventures, Alphatron Capital | – |

| 30 May 2024 | Fyllo | Agritech | Precision Agriculture | B2C | $4 Mn | – | IndiaQuotient, SIDBI Venture Capital, Triveni Trusts, Indian Angel Network, KiaOra Ventures | IndiaQuotient |

| 27 May 2024 | CoverSure | Fintech | Fintech SaaS | B2C | $4 Mn | pre-Series A | Enam Holdings | Enam Holdings |

| 29 May 2024 | FarMart | Agritech | Market Linkage | B2B-B2C | $2.8 Mn | – | ResponsAbility Investments | ResponsAbility Investments |

| 28 May 2024 | Maxvolt Energy | Cleantech | Electric Vehicles | B2B-B2C | $1.5 Mn | – | – | – |

| 28 May 2024 | Skippi | Ecommerce | D2C | B2C | $1.2 Mn | pre-Series A | Hyderabad Angel Network, Venture Catalysts, Soonicorn Ventures, HEM Securities | Hyderabad Angel Network, Venture Catalysts |

| 28 May 2024 | AbleCredit | Fintech | Fintech SaaS | B2B | $1.2 Mn | Seed | Merak Ventures, Venture Catalysts, Helios Holdings | Merak Ventures |

| 28 May 2024 | Inspeq AI | Enterprisetech | Horizontal SaaS | B2B | $1.1 Mn | pre-Series-A | Sure Valley Ventures, Delta Partners, Gaurav Singh Kushwaha, Prateek Dixit, Rick Kelly, Cyril Treacy | Sure Valley Ventures |

| 28 May 2024 | Gravity | Fintech | Banking | B2B | $1 Mn | – | Kettleborough VC | Kettleborough VC |

| 27 May 2024 | EcoRating | Cleantech | Climate Tech | B2B | $1 Mn | Seed | We Founder Circle, 888 VC, Vinners, Indigram Labs Foundation, Google | – |

| 27 May 2024 | CirclePe | Fintech | Lendingtech | B2B-B2C | $1 Mn | pre-Seed | OTP Ventures, 1947 Rise, iSeed, IIT Delhi, Venture Catalyst | OTP Ventures |

| 29 May 2024 | Nanosafe | Cleantech | Climate Tech | B2C | $360K | – | IIML EIC, Uday Chatterjee, Sandhya Vasudevan, Tejinderpal Singh Miglani, Romesh Sobti | IIML EIC |

| 30 May 2024 | Logistiex | Logistics | Ecommerce Logistics | B2B | $250K | – | PACE Family Office, Siddhant Khemka | PACE Family Office |

| 27 May 2024 | Hyperleap AI | Enterprisetech | Horizontal SaaS | B2B | $225K | pre-Seed | Anil Kommineni | Anil Kommineni |

| 28 May 2024 | Yali Aerospace | Deeptech | Dronetech | B2B | – | – | Zoho | Zoho |

| 30 May 2024 | TechEagle | Deeptech | Dronetech | B2B | – | – | Navam Capital, Inflection Point Ventures, Vijay Shekhar Sharma, Venture Catalysts | Navam Capital, Inflection Point Ventures |

| 28 May 2024 | Solinas | Cleantech | Climate Tech | B2B | – | – | Neev Fund II, Rainmatter Capital | – |

| 31 May 2024 | Aprecomm | Enterprisetech | Horizontal SaaS | B2B | – | – | ACT Fibernet | ACT Fibernet |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

[Note: This week’s funding galore also includes deals from last Saturday (May 25).]

Key Startup Funding Highlights Of The Week

- With startups like TechnoSport and Libas bagging funds to the tune of $25 Mn and $18 Mn respectively, the ecommerce sector emerged to be the investor favourite this week. Startups in the space netted $56.2 Mn across five deals.

- Real Estate Tech unicorn Infra.Market raised $50 Mn in an additional funding round from Liquidity Group and Mitsubishi UFJ Financial Group’s MARS Unicorn Fund. The funding round drove real estate tech to become the second most funded sector this week.

- Further, the cleantech and fintech sectors, each saw the highest six deals materialise this week. Startups in the sector bagged $40.8 Mn and $22.7 Mn, respectively.

- Venture Catalysts was the most active investor this week, backing four startups.

- Seed funding tumbled down this week, with startups at this stage securing $7.7 Mn. This was a 41% decline from last week’s $13.12 Mn.

Startup Fund Launches Of This Week

- Venture Capitalist (VC) firm Sauce.vc Floats has floated an $30Mn (INR 250 Cr) fund, its third largest till date. With this, the investment firm will back 15-16 early stage consumer brands.

- Homegrown financial services firm Avendus launched its late-stage ‘Future Leaders Fund (FLF) III’ with a total corpus of $350 Mn (INR 3,000 Cr), along with a green shoe option of up to INR 1,500 Cr. It will look to make 10-12 investments with an average ticket size of $25 Mn to $35 Mn.

- 360 ONE Asset announced the launch of its late stage secondaries fund,‘Special Opportunities Fund-12’, with a target base corpus of $480 Mn (INR 4,000 Cr). The private equity (PE) firm has already made six investments from the new fund with an average ticket size of $18- $30 Mn (INR 150-250 Cr).

- Early stage consumer VC fund RPSG Capital Ventures has marked the final close of its second fund, Fund II at INR 550 Cr. Through the fund, it claims to have already invested in four direct-to-consumer (D2C) startups Supertails, Perfora, Rabitat and Headway.

- Former KKR India head Sanjay Nayar’s VC firm Sorin Investments marked the final close of its maiden fund at INR 1350 Cr. Under the fund, it has made 5 investments till date in Uniqus Consultech, Venwiz, Litestore, Freed and Shivalik SFB with a few more nearing closure.

Startup Acquisitions This Week

- Broadcasting giant Times Network bought technology media portal Digit.in from 9.9 Group via an undisclosed deal. The company will look to leverage its digital publishing capabilities to expand its footprint in the technology and gaming sectors.

- Fintech startup BharatX has forayed into the healthcare lending space with the acquisition of the healthcare startup Zenifi. As part of the deal, Zenifi’s cofounder Padam Kataria will join BharatX to spearhead its healthcare vertical.

- Parent of D2C unicorn Mamaearth, Honasa Consumer Ltd, has acquired the assets of Thane-based skincare company CosmoGenesis Labs for $480K (INR 4 Cr). With the buyout, it seeks to strengthen its research and development and manufacturing capabilities.

- Zerodha cofounder Nikhil Kamath, Capri Global Family Office, Sumeet Kanwar from Verity and Abhijeet Pai-led Wear Steels, have bought 10% stake in Infra.Market’s subsidiary RDC Concrete for $20 Mn.

- B2B marketplace IndiaMART InterMESH has acquired a 10% stake in fraud detection startup Baldor Technologies for INR 89.7 Cr (about $10.7 Mn) via a secondary transaction. The investment aligns with its long-term objective of providing various software-as-a-service (SaaS) solutions for businesses.

- US-based ecommerce giant Amazon is in the final stages of acquiring Times Internet-owned video streaming platform MX Player. Sources told Inc42 that the ecommerce major is acquiring MX Player in an all-cash deal for a little over $100 Mn.

Other Major Developments Of The Week

- Shares of the coworking space provider Awfis were listed at INR 432.25 on the BSE, a premium of 12.8% from its issue price of INR 383. On the NSE, its shares were listed at INR 435 apiece, 13.5% higher than the issue price.

- Travel tech startup Atlys is in talks with existing investor Peak XV Partners and others to raise $15-18 Mn in its Series B round. It is said to be eyeing the fresh infusion at a valuation of $70 Mn.

- Electric two wheeler maker Ather is looking to raise $34 Mn (INR 286.5 Cr) in a mix of equity and debt as part of its latest funding round. It plans to raise INR 200 Cr in debt from Stride Ventures while the founders Tarun Mehta and Swapnil Jain are looking to infuse the rest of the capital.

- VC firms Xponentia Capital Partners, A91 Partners, and 360 ONE Asset have acquired stakes in deeptech startup SEDEMAC Mechatronics through a secondary transaction , giving full exit to the company’s early investors, Nexus Venture Partners, TR Capital and Montane Ventures. While the size of the round was $100 Mn, it included a primary infusion of around $9 Mn into the startup at a valuation of $260 Mn.

- Ratan Tata-backed omnichannel jewellery startup BlueStone is in discussions to secure close to $100 Mn in a pre-IPO funding round at a unicorn valuation. This would translate to a more than 2X jump from its erstwhile valuation of $450 Mn.

- As part of its ongoing Series A round, D2C kidswear brand Kidbea has seen Innov8 founder and angel investor Ritesh Malik, Nazara Technology founder Nitish Mittersain, and cardiovascular surgeon Dr Shriram Nene join its captable.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)