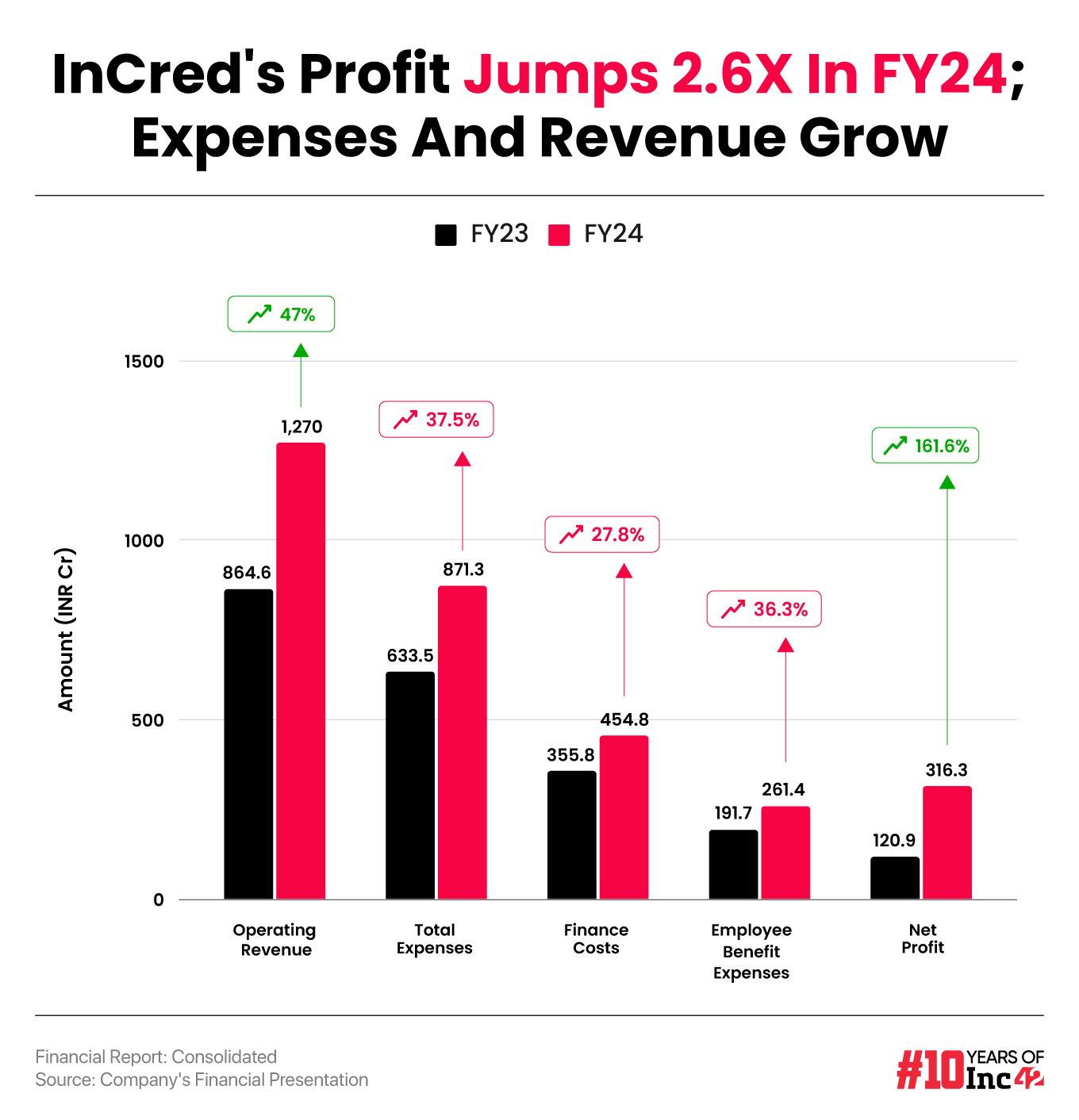

Growing almost 47% YoY, InCred reported an operating revenue of INR 1,270 Cr in FY24 as against INR 864.6 Cr in FY23

Interest income continued to contribute the biggest chunk to the revenue, rising 45% YoY to INR 1,193.5 Cr during the year under review

InCred turned unicorn in 2023 after raising $60 Mn in its Series D funding round, led by Manipal Education and Medical Group’s Ranjan Pai

Fintech unicorn InCred

Its operating revenue also crossed the INR 1,000 Cr mark during the last fiscal, as per the unicorn’s financial statement accessed by Inc42. Growing almost 47% year-on-year (YoY), InCred reported an operating revenue of INR 1,270 Cr in FY24 as against INR 864.6 Cr in FY23.

Founded in 2016 by Bhupinder Singh, InCred operates in the BFSI sector through three separate entities – lending vertical InCred Finance, wealth and asset management vertical InCred Capital, and retail bonds and alternative investments platform InCred Money.

The unicorn classifies its operating income under various heads, including interest income, dividend income, fees and commission income, and net gain on derecognition of financial instruments under the amortised cost category.

Interest income continued to contribute the biggest chunk to the revenue, rising 45% YoY to INR 1,193.5 Cr during the year under review. On the other hand, fees and commission income grew over 58% YoY to INR 33.1 Cr.

Overall, InCred’s total revenue stood at INR 1,293.1 Cr in FY24 versus INR 877.4 Cr in the previous fiscal year.

In 2022, InCred Financial merged with KKR’s non-banking financial company, KKR India Financial Services, and the current consolidated figures are that of the merged entity.

Recently, reports said that global investment firm KKR was looking to divest around 10% of its stake in InCred Finance, which Japan’s Mizuho Financial Group might acquire.

As per InCred Financial Services’ FY24 investor presentation, its total asset under management (AUM) grew to INR 9,039 Cr by the end of the year from INR 6,062 Cr in FY23.

Where Did InCred Spend?

InCred’s total expenses rose 37.5% to INR 871.3 Cr during the reported fiscal year from INR 633.5 Cr in FY23, with finance costs continuing to contribute the biggest portion to it.

The startup’s finance costs surged 27.8% to INR 454.8 Cr in FY24 from INR 355.8 Cr the year before.

Employee benefit expenses also increased 36.3% to INR 261.4 Cr in FY24 from INR 191.7 Cr in the previous fiscal year.

InCred also spent INR 118.2 Cr as other expenses, which grew over 39% YoY. The company did not provide any breakup of these expenses.

InCred turned unicorn in 2023 after raising $60 Mn (INR 500 Cr) in its Series D funding round, led by Manipal Education and Medical Group’s Ranjan Pai.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)