As the Indian government pursues its vision of Viksit Bharat@2047, the focus is on nurturing a low-carbon economy. The high cost of gasoline and its growing shortage are pushing developed nations towards electric alternatives. And India, too, is looking forward to a decarbonised ecosystem, be it shifting freight from road to railways or the robust growth of electric vehicles (EVs) by 2030.

On the back of growing EV demand, the Indian government approved Phase II of the FAME (Faster Adoption and Manufacturing of Electric Vehicles) scheme with an outlay of INR 10K Cr for three years, starting from April 1, 2019. The aim was to incentivise EV makers to promote domestic manufacturing of electric vehicles. The scheme was extended until March 31, 2024, and a four-month programme called the Electric Mobility Promotion Scheme (EMPS) was introduced in April this year to service OEMs during general elections.

However, all’s not well in a country that has never considered electric vehicles a passim fancy. In May 2023, the ministry of heavy industries (MHI), in charge of FAME II, issued show-cause notices to leading electric two-wheeler (E2W) players, including Hero Electric, Okinawa Autotech, Ampere Vehicles (Greaves Cotton), Benling India, Revolt Intellicorp and Amo Mobility.

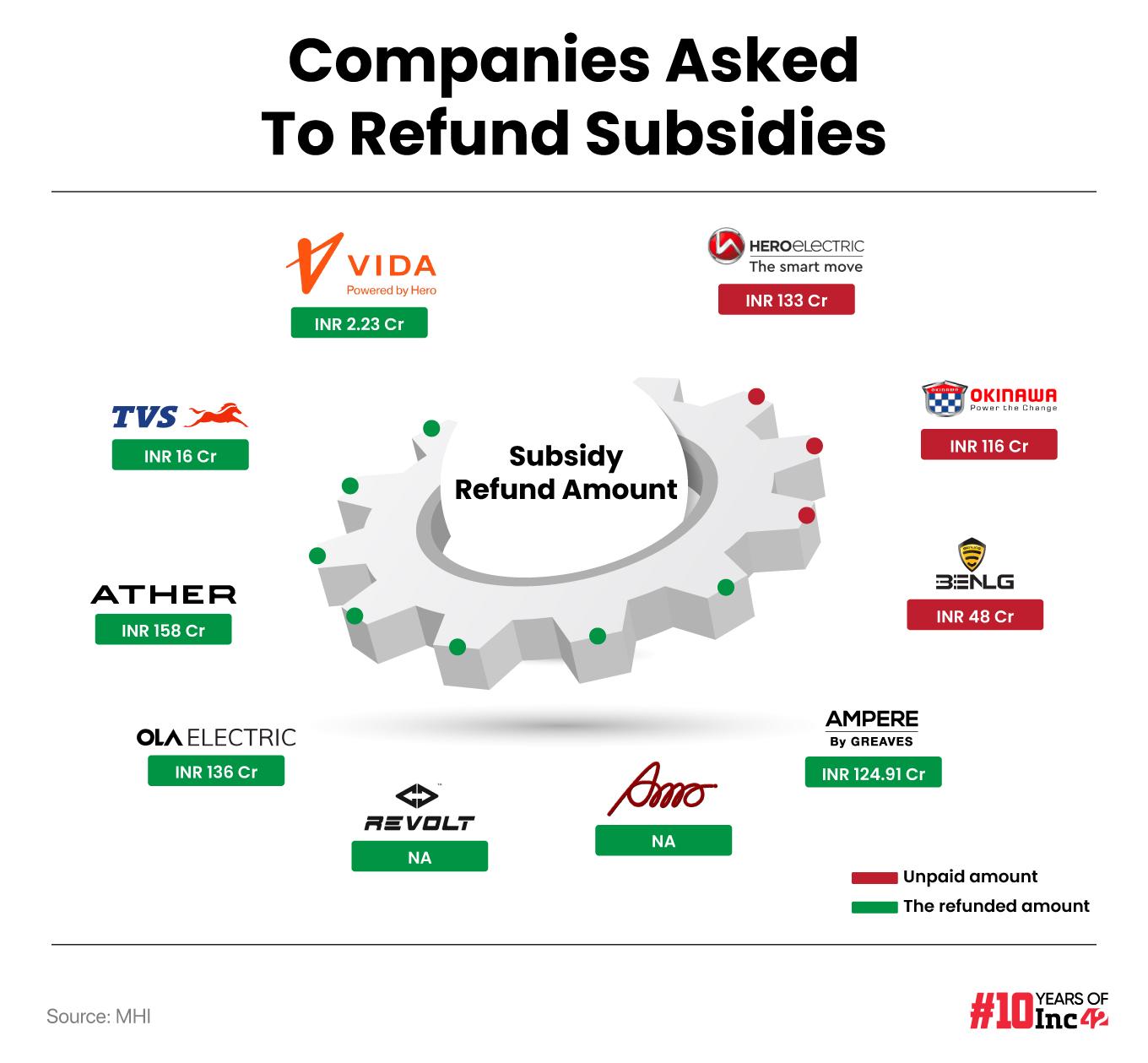

The allegation: Violation of FAME II manufacturing norms (more on that later) that may result in certain 2W models getting deregistered. The MHI also asked these companies to refund the entire subsidy amount worth INR 469 Cr spent on their models.

On March 27, 2024, debarment orders were issued to Hero Electric and Benling India, which means these companies cannot leverage the government’s schemes in the future. Okinawa received interim relief as its case was pending in the Delhi High Court.

An MHI official told Inc42 on condition of anonymity. “Non-compliance was established on various occasions. For instance, we tested a Benling India scooter and found almost all components were imported [as per FAME II, at least 50% should be locally manufactured]. Okinawa will also get the debarment order after the Delhi High Court disposes of the case.”

This may well be routine proceedings for the Ministry of Heavy Industries, but the issue may escalate into something more worrying.

“At least three to five OEMs may shut down in the following months, affecting 1K dealerships and more than 5K jobs,” an industry insider closely following the developments said when asked about the potential impact.

lockquote>

According to a report published in August 2023 by the Society of Manufacturers of Electric Vehicles (SMEV), with government subsidies on hold for 22 months, EV OEMs have suffered losses above INR 9,075 Cr.

Again, many dealers had no choice but to opt for legal proceedings against these companies for not meeting the demand as per the dealership agreements.

Speaking to Inc42, Vinkesh Gulati, chairman (Research & Academy) at the Federation of Automobile Dealers Association, revealed an intriguing scenario. According to him, some manufacturers initially fulfilled the PMP norms by purchasing imported components from local vendors. It was an ingenious supply chain where Vendor A imported the components and sold them to Vendor B. Next, Vendor B sold those to Vendor C, and finally, the OEMs purchased those components from Vendor C.

However, it would be unfair to blame the OEMs alone, given the inadequate manufacturing infrastructure that led to the component crunch at home, said Gulati.

How Hero Electric & Okinawa Pioneered EVs

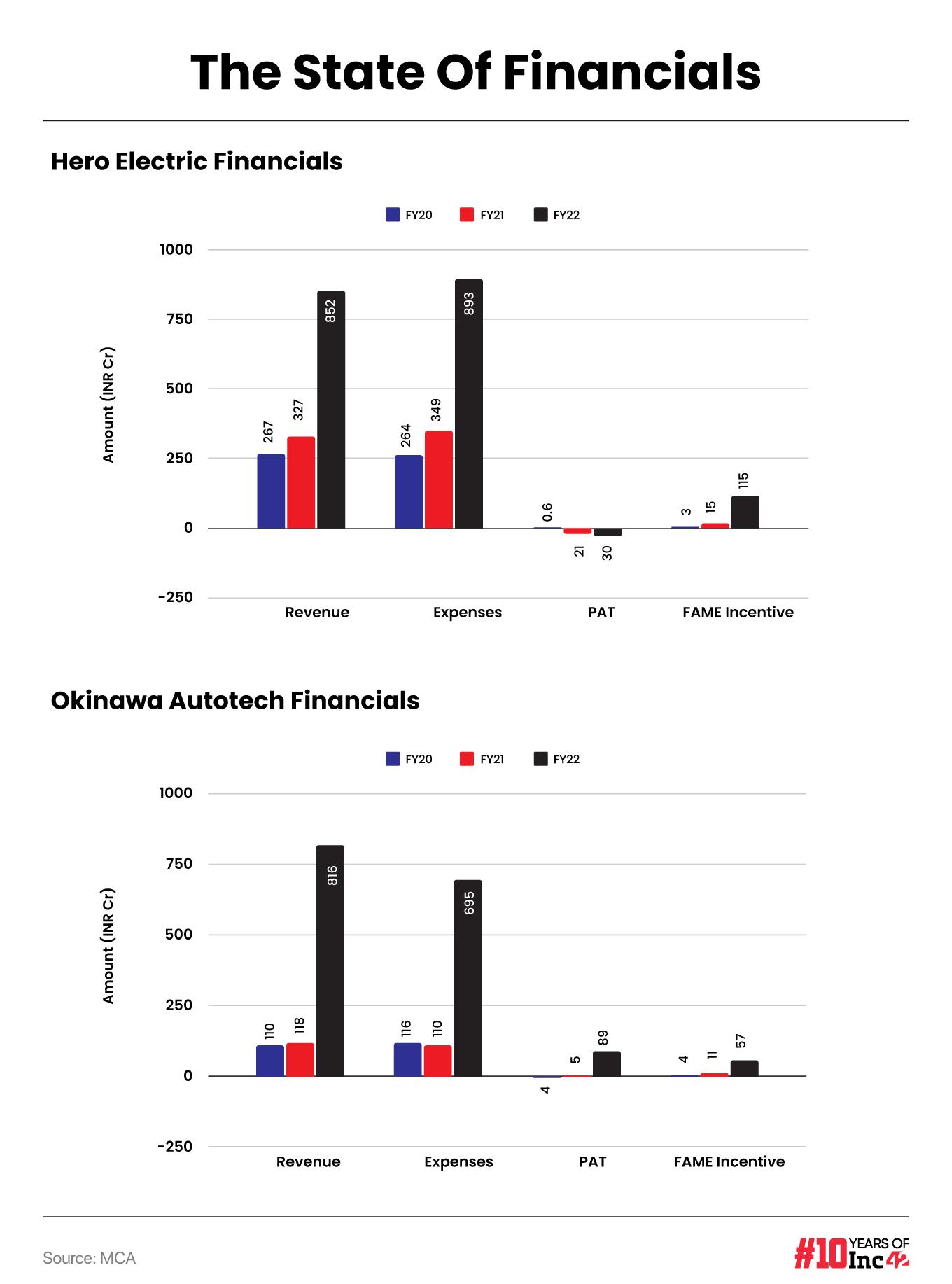

Once the commanding force of the Indian E2W space with a combined market share of 70%, Okinawa and Hero Electric’s contributions have now shrunk to less than 1%. Their manufacturing units have been shut down for more than a year, although Okinawa and Benling India are reportedly rolling out a few batches now and then.

Hero Electric and Okinawa were long lauded for bringing electric two-wheelers to the mainstream by lowering sticker prices. These companies started with lead-acid batteries to keep costs low and consistently commanded more than 50% of the market share in FY20 and FY21. But it dropped to 46% in FY22.

Okinawa’s founder, Jeetender Sharma, claimed several nifty innovations and was confident about the company’s future. “We were among the first ventures in India to mass manufacture high-speed electric scooters. With a top speed of 55 kmph, a loading capacity of 150 kg, a battery range of 88-90 km per charge and enough power in its motor to climb flyovers, the Okinawa Ridge was our breakthrough EV. The Ridge was greatly appreciated in the nascent Indian market, with more than 10K units sold in the first year. Naysayers said I would not even cross 500 units in the first year, but they were wrong,” he told the media a few years ago.

Just before the lockdown, Okinawa used to sell more than 4.5K units a month, but Hero Electric soon surpassed it, reaching monthly sales of 6K+ EV two-wheelers. But in spite of creating an all-new E2W market in India, early entrants like Hero Electric, Okinawa, Benling India and Ampere heavily depended on imports for the supply of components, according to EV experts. Had India established a robust supply chain in early days, the subsidy misappropriation by wrongfully declaring imported components as locally produced could have been prevented, bringing EVs within striking distance of ICE-powered vehicles by now.

The Anatomy Of A ‘Faulty’ Business Model

Commenting on the latest developments, Deb Mukherji, CEO of Clean Mobility Solution India, said, “Credit must be given where it is due. Both Hero Electric and Okinawa ushered in the E2W era here. But their dependency on imports cannot be overlooked. They used to purchase all their kits and components from China.”

No doubt assembly and incremental value-additions (if any) came later. But what happened then could be likened to a trading model, according to Mukherji.

“Such a model is adopted for two reasons. One may go for it if the business deals in low-value commodities such as toys and candles, which are cheaper to import and have no quality concerns involved. Or you may go for it if there is a strict cost advantage and competition is based solely on price,” he added.

lockquote>

However, the second option is always risky and short-term. If one is selling at INR 100 today, someone may offer it at INR 90 tomorrow, forcing others to lower their prices. Competing purely on cost is unsustainable because someone can always undercut the price.

As the market developed and demand grew, these companies were under significant pressure. They tried to shift to the next level of manufacturing but manufacturing prowess was not their strength.

According to an analyst who did not want to be named, a close look at the companies’ financials would reveal how their dependency on FAME II incentives increased annually, rising from 1% to 20% of the operational revenue. It was understandable in the beginning when they had to import all components. But unlike other players, they maintained the same approach even when local component manufacturers were around. Their expenses also reveal little or no allocation for R&D, indicating a lack of long-term focus.

Randheer Singh, CEO of the EV value chain consulting ForeSee Advisors and former director of NITI Aayog, concurred saying that Hero Electric’s and Okinawa’s decline in market share could be attributed to intense competition from brands like Ola and TVS, which excel in affordability and extensive service networks. Product quality and the recent subsidy withdrawal for non-compliance have also impacted their market positioning.

Singh believes enhancing product reliability and leveraging government incentives will be crucial for their comeback.

FAME II Violation Hurts EV Ecosystem

The Indian government’s ambitious subsidy scheme to promote EVs was marred by alleged norms violations after whistleblowers started complaining in 2022. But before we enter the contentious ground, a quick look at the backstory will not be out of context.

The government launched the National Electric Mobility Mission Plan (NEMMP) in 2013 to promote hybrid and electric vehicles, aiming to hit 6-7 Mn sales by 2020 and enhance fuel security. Since EVs cost 30-40% more than their ICE counterparts, the FAME programme was introduced under NEMMP in March 2015 to make these ‘green’ vehicles more affordable through subsidies.

The first phase of FAME continued until March 31, 2019, with an allocation of INR 895 Cr, out of which INR 529 Cr was released. The remaining amount was reallocated to the FAME II scheme.

FAME I focussed on early market creation through demand incentives, in-house technology development and domestic production to help the industry reach self-sufficient economies of scale. It provided demand incentives for the adoption of 2.8 Lakh EVs (2Ws, 3Ws and 4Ws) and 425 electric and hybrid buses, besides the development of 520 charging stations.

FAME II came into force in April 2019 (FY20) for a three-year span, with an allocation of INR 10K Cr (including the remaining INR 366 Cr from FAME I). However, with the onset of the Covid-19 pandemic in 2020 and the following socio-economic setbacks, its subsidy period was extended to March 2024. Its focus areas included financial incentives for EV purchase, charging infrastructure development and all other related activities.

But the flagship scheme’s timeline got disrupted again. Based on the feedback from industry stakeholders, FAME II was overhauled in June 2021 and upfront costs were lowered to ensure faster EV adoption. Earlier, the government used to offer an incentive of INR 10K per kilowatt-hour (kWh indicates energy consumed per hour) for two-wheelers, but this was revised to INR 15K per kWh, with the maximum cap rising from 20% to 40% of the vehicle cost.

Maximum ex-factory prices for 2Ws, 3Ws and 4Ws remained unchanged at INR 1.5 Lakh, INR 5 Lakh and INR 15 Lakh, respectively, for manufacturers to avail of FAME II incentives.

EV makers were mandated to use locally produced components such as battery packs, traction motors, controllers, vehicle control units, onboard chargers and instrument panels in a phased manner. All other components must be sourced locally to meet FAME II compliance and obtain subsidies under the scheme. Subsequently, OEMs had to declare domestic value addition (DVA), a metric indicating how much value an EV manufacturer has created locally for every EV unit. At least 50% of vehicle components should be sourced from India to qualify for the FAME II incentive scheme.

Things took a bad turn when the MHI received several letters from whistleblowers between April and September 2022. They claimed that EV manufacturers such as Okinawa, Hero Electric, Ampere and Benling India had flouted FAME II procurement norms and imported components, which were supposed to be manufactured or assembled in India.

According to these letters, some of the components such as DC-DC converter, electronic throttle, vehicle control unit, onboard charger, traction motor and traction motor controller were supposed to be sourced locally from April 1, 2020. But a few E2W OEMs continued to use imported parts even after the deadline.

This violates the PMP framework of the FAME II scheme.

The MHI probed as many as 13 EV companies. Among these, six E2W players, including Hero Electric, Okinawa, Ampere Vehicles (Greaves Cotton), Benling India, Revolt Intellicorp and Amo Mobility, allegedly violated PMP/DVA norms. Others, such as Ather Energy, Ola Electric, TVS and Vida (from Hero MotoCorp), were accused of violating pricing norms.

An MHI official told Inc42 that Hero Electric, Okinawa, Benling India and others had confessed during the probe that most of their components were imported. Among these were chassis, wheel rims, electric switches, steering locks, braking systems, suspensions, light sets and even body panels.

lockquote>

The tests were carried out by the International Centre for Automotive Technology (ICAT). In its strip-down analysis report, ICAT said both Hero Electric and Okinawa imported DC-DC converters, traction motors, onboard chargers, wheel rims and buzzers in FY22 and FY23.

“We are not even talking about controllers and motors,” the MHI official said. “In the case of Okinawa, we found even the tyres, horns and seats were imported. Literally, the entire scooter. How could we pass it off?”

lockquote>

After receiving the show-cause notice last year, Hero MotoCorp, TVS Motor Company, Ather Energy and Ola Electric deposited around INR 300 Cr as a penalty for violating the guidelines under the FAME scheme.

A source close to the development made another point. “The certification process of the testing agencies had their interpretational issues at the time. Also, some OEMs used to send one model for certification and sold another variant post-certification. Even if they incorporated locally made components for testing purposes, the rest of the models featured imported parts.”

Rebuttal From The OEMs: What Hero Electric And Others Have To Say

Although most EV players have refunded past subsidies and publicly admitted wrongdoing, Hero Electric, Okinawa and Benling India have approached the court for a resolution.

According to a press statement by the industry body SMEV, the MHI owes the OEMs INR 1,200 Cr [unpaid earlier subsidies for which invoices were submitted]. If the ministry’s demand for a subsidy refund of INR 469 Cr under FAME II is actualised, it will have INR 1,669 Cr in all. This means the INR 2K Cr budget for the E2W sector will remain largely non-disbursed. In that case, the non-compliance becomes a non-issue, although the FAME II scheme would have become a complete non-starter [minus the subsidies].

A former SMEV official further argued if the certified models breached the FAME II framework, the responsibility should first fall on the testing agencies, not the OEMs.

The testing agencies in question include the Automotive Research Association of India (ARAI) in Pune, Maharashtra; the International Centre for Automotive Technology (ICAT) at Manesar, Haryana; the Global Automotive Research Centre at Oragadam, Tamil Nadu, and the National Automotive Test Tracks at Pithampur, Madhya Pradesh.

“Has the MHI punished any of these testing agencies? No. But they are punishing the OEMs who sold the models certified by these agencies,” a senior official working for Hero Electric said, requesting anonymity. “The MHI is asking for refunds at a time when these subsidies have already been paid to end users. We wanted to recall buyers’ subsidies and deposit them back to the ministry, but didn’t get approval for the same,” he added.

lockquote>

“Although Ampere, Amo and Revolt paid their dues, their models have still not been approved by the MHI. So, paying the subsidy back does not offer them any lifeline. As we no longer have financial backing, we won’t be able to compete with other players loaded with subsidies,” the employee observed.

He also brought forward another anomaly. “Govt officials have alleged that we bought components from a vendor whose certification had already expired. Four-wheeler OEMs did it but the exception was extended to them for another year. We didn’t have that advantage, but rules must be the same for everyone. Approval for a new vendor would have taken months and we had no choice but to purchase components from the same company.”

The MHI official mentioned above called it a feeble excuse. “Per the PMP framework, different deadlines were set for component imports. After consultations with industry representatives, those timelines were specifically tailored for two-wheelers, three-wheelers and four-wheelers. So there should have been no bottlenecks regarding procurement.”

lockquote>

While Hero Electric officially declined to comment on these allegations and counter-allegations, Okinawa Autotech did not respond to Inc42 queries till the time of publishing this article.

How The Legal Spat Panned Out

In September 2022, the customs commissioner in Ludhiana (the jurisdiction covers Punjab, Himachal Pradesh, and Chandigarh) issued a show-cause notice to Hero Electric under Section 28(9)(b) of the Customs Act, 1962. The notice alleged that the company imported whole e-scooters instead of their components.

In its response on February 14, 2023, Hero Electric claimed to have sufficient evidence to prove that only parts, not entire scooters, were imported.

In July 2023, after Hero Electric models were deregistered from the FAME subsidy portal, the company filed a petition in the Punjab and Haryana High Court. The petition argued that despite the company’s response, the Customs did not follow any procedures or take steps to finalise the proceedings on the show-cause notice.

On July 27, the HC directed the Indian government to complete the proceedings by issuing a final order on the show-cause notice by November 27, 2023.

In April 2024, the company filed another petition against the Indian government’s deregistration and debarment order. This will be heard on July 30, 2024.

In November 2023, Okinawa Autotech approached the Delhi High Court challenging the MHI order dated October 9, 2023, which deregistered Okinawa scooters from the FAME II portal and demanded a refund of the entire subsidy amount of INR 116.85 Cr.

Benling India also approached the Delhi High Court in May 2024, challenging the show-cause notice issued on May 25, 2023, and the debarment order dated March 7, 2023. The company argued that the scooter in question was obtained from a third party and, therefore, the company was not liable for any foreign components fitted in the vehicle.

Meanwhile, Hero Electric was taken to the Delhi High Court for non-payment of rent. The owner of the premise alleged that rent worth INR 68 Lakh had not been paid and requested arbitration. These matters, too, will be heard on July 23, 2024.

Kaybee Overseas, a vendor of Hero Electric, filed a petition regarding non-payment. Another dealer, Aurum Automobile, also approached the Delhi High Court Mediation and Conciliation Centre for a settlement with the company.

In April 2024, the Delhi HC appointed a sole arbitrator to adjudicate the dispute between Okinawa and Goyal Ebike, one of Okinawa’s dealers. Goyal Ebike alleged that Okinawa failed to supply its e-scooters despite multiple calls and email messages. The case will be heard on July 15, 2024.

EV Majors In A Deep Hole

The legal storm overtook the EV companies when Hero Electric was looking for strategic partners to raise $250 Mn and Okinawa was aiming to bag $100 Mn. They raised part of the capital through compulsorily convertible preference shares (CCPS) and compulsory convertible debentures (CCD), but the plan went south as the news of model deregistration and subsidy refund hit the headlines.

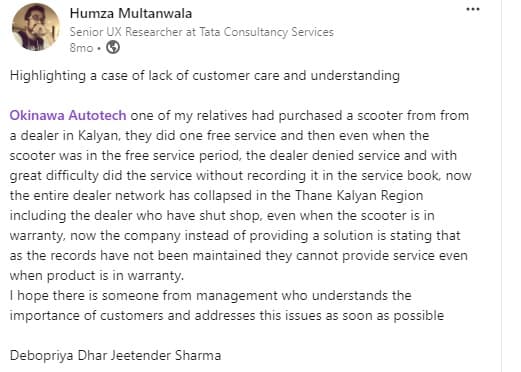

The current turmoil has brought the three companies to the brink of closure. Hero Electric’s plant has reportedly remained idle for the past 15 months, while the Benling India unit in Manesar has been non-operational for more than a year. Okinawa, too, is facing similar challenges, as it has invested substantially to set up a second unit in Karoli, Rajasthan (the first one is in Alwar). To fulfil some outstanding orders and thus avoid legal conflicts with their dealers, Okinawa and Benling have intermittently resumed operations and paid their workers daily wages, sources from these companies told Inc42.

More stories of suffering follow. More than 80% of permanent employees in Hero Electric and Benling have been laid off since May 2023. At Benling India, nearly all employees have been dismissed, barring four or five, said a former senior employee.

A host of component suppliers have not been paid yet and 1K+ dealers have run out of supplies after regular production has gone on hold. Assuming each dealership employed around five people, each supporting a family of four, nearly 20K lives have been impacted.

The MHI decision has impacted thousands of people. Vendors have not received payments for component supplies, and dealers face supply shortages after regular production is put on hold. This has affected 1K+ dealerships nationwide, affecting nearly 20,000 lives (assuming each dealership employed around five people and each supported a family of four).

lockquote>

Numerous dealerships listed on these companies’ websites have shut down, with some switching to other brands. When queried, sales staff cite a lack of support from these brands as the reason for the shift.

How the dealers are trying to sell these e-scooters now can be gleaned from a recent interaction. When we called a Benling India dealer regarding the availability of those E2Ws, he said, “We currently have two scooters in stock, but could not communicate with the company for the past few months. If you want to buy, I can offer some parts and provide a personal guarantee. But I cannot extend that assurance on behalf of the brand.”

This has impacted the owners as well. A significant number of users have not been getting after-sales services and support from these brands.

Summing up the situation, one of the E2W founders said, “Although this may not have been the MHI’s intention, it has overlooked the humane angle here when it implemented the decision. The MHI is primarily at fault in this scenario. The goal should have been to enforce the law in real-time, but the ministry failed miserably. After identifying the FAME II violation, it should have issued a warning and extended the deadline by a few months. Such extreme punishments are typically reserved for repeat violations, not for the first-time offenders, especially in a nascent market.”

Driving the adoption of EVs in India is not just about nurturing a new industry and market but is also critical for India’s sustainable development goals. The hurdles such as the FAME-II violation severely dent the confidence of the EV ecosystem, but execution and implementation gaps from the government side have also resulted in value erosion for the companies. For the sake of India’s EV future, many in the industry hope this is the last such fracas between EV makers and policymakers.

[Edited by Sanghamitra Mandal]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)