Awfis emerged as the biggest gainer, with its shares zooming over 12% this week

Paytm, Zomato, Nykaa, PB Fintech, and ixigo were among the 10 new-age tech stocks which gained this week

Yudiz emerged as the biggest loser this week. Mamaearth parent Honasa, MapmyIndia, Go Digit, and TBO Tek were among the other losers

Indian new-age tech stocks experienced a mixed week as investors await the upcoming Union Budget and earnings for the first quarter of the ongoing fiscal year 2024-25 (Q1 FY25).

Analysts expect stock-specific actions in the coming week amid the ongoing earnings season.

Ten out of the 24 new-age tech stocks under Inc42’s coverage gained this week in a range of 1% to a little over 12%. Recently-listed coworking startup Awfis emerged as the biggest gainer, with its shares zooming over 12%.

Earlier in the week, shares of Awfis touched a record high of INR 635 during intraday trading on July 11. TAC Infosec trailed Awfis, with its shares rising 8.78% this week.

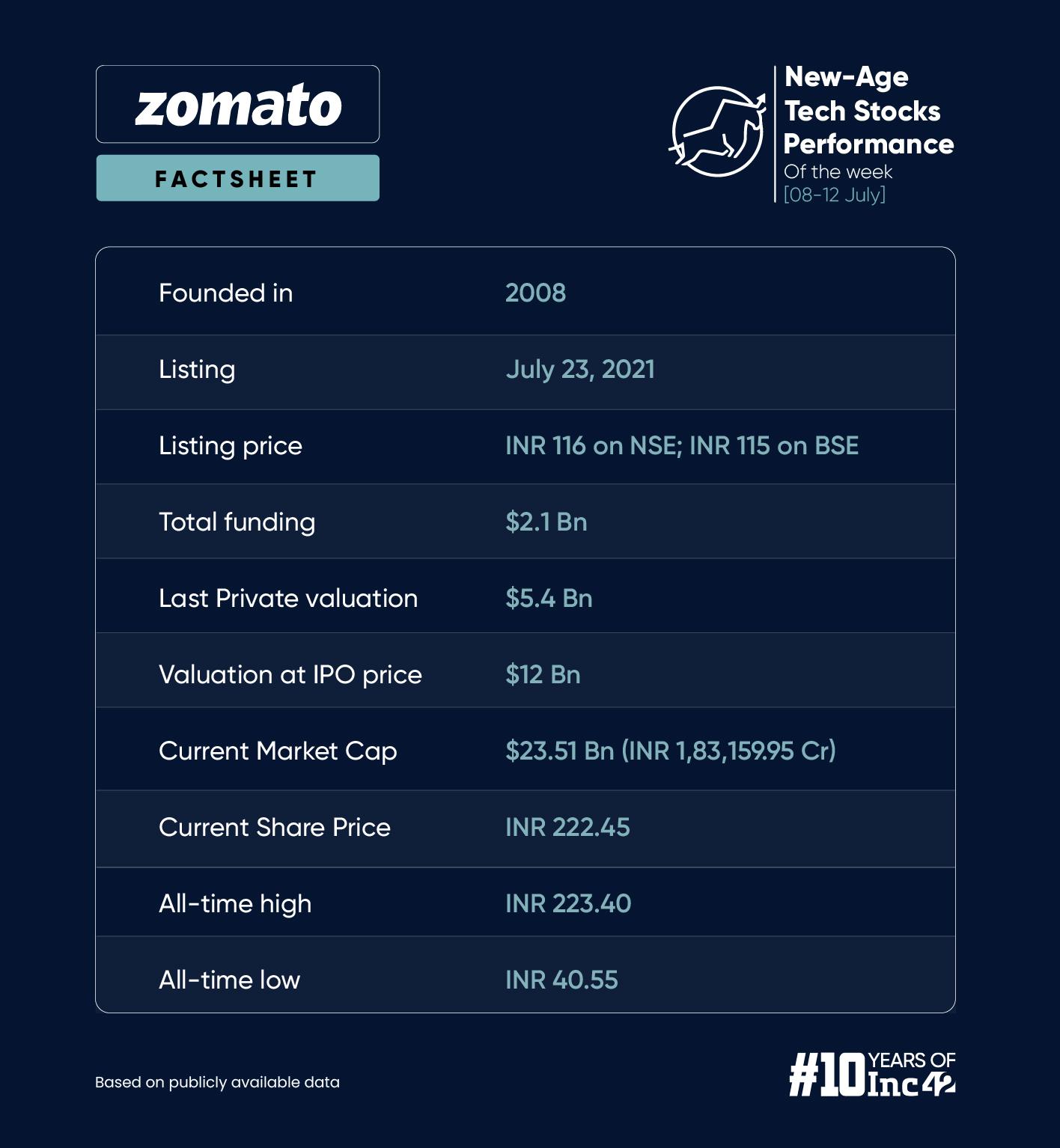

Paytm and Zomato also saw a healthy uptrend this week, with shares of both the companies gaining over 7% each. Paytm is scheduled to declare its financial results for Q1 FY25 on July 19. Nykaa, PB Fintech, and ixigo were among the other gainers this week.

On the other hand, 14 startups, including last week’s top gainer Honasa, MapmyIndia, Go Digit, and TBO Tek, were among the losers this week. Their shares fell in the range of 0.02% to over 8%. Blockchain and IT development startup Yudiz emerged as the biggest loser this week.

Amid all these, the ongoing IPO boom continued. On July 7, logistics unicorn BlackBuck filed its IPO papers with the Securities and Exchange Board of India (SEBI). The startup is looking to raise INR 550 Cr via fresh issue of shares. Besides, the IPO of D2C men’s grooming brand Menhood is scheduled to open on July 16. The startup’s IPO will comprise a fresh issue of 25,95,200 equity shares of face value of INR 10 each. It is expected to raise INR 19.5 Cr via its IPO.

Meanwhile, the broader market maintained its bullish momentum this week. Sensex gained 0.6% to end the week at 80,519.34, while Nifty50 rose 0.7% this week to end Friday’s session at 24,502.15.

Commenting on the market’s performance this week, Geojit Financial Services’ head of research Vinod Nair said that while investors are cautious about the earnings session, there are also expectations of the government presenting a growth-oriented Budget.

Meanwhile, Emkay Wealth Management’s head of research Dr Joseph Thomas said, “Markets trended higher towards the close of the week as the earnings season kicked off on a positive note and inflation numbers in the US were better than expected. The current phase of volatility cannot be ruled out as profit booking may continue ahead of the Budget, which will provide more clarity on policy continuity.”

Finance minister Nirmala Sitharaman is scheduled to present the Union Budget 2024-25 on July 23.

Now, let’s take a deeper look at the performance of some of the new-age tech stocks this week.

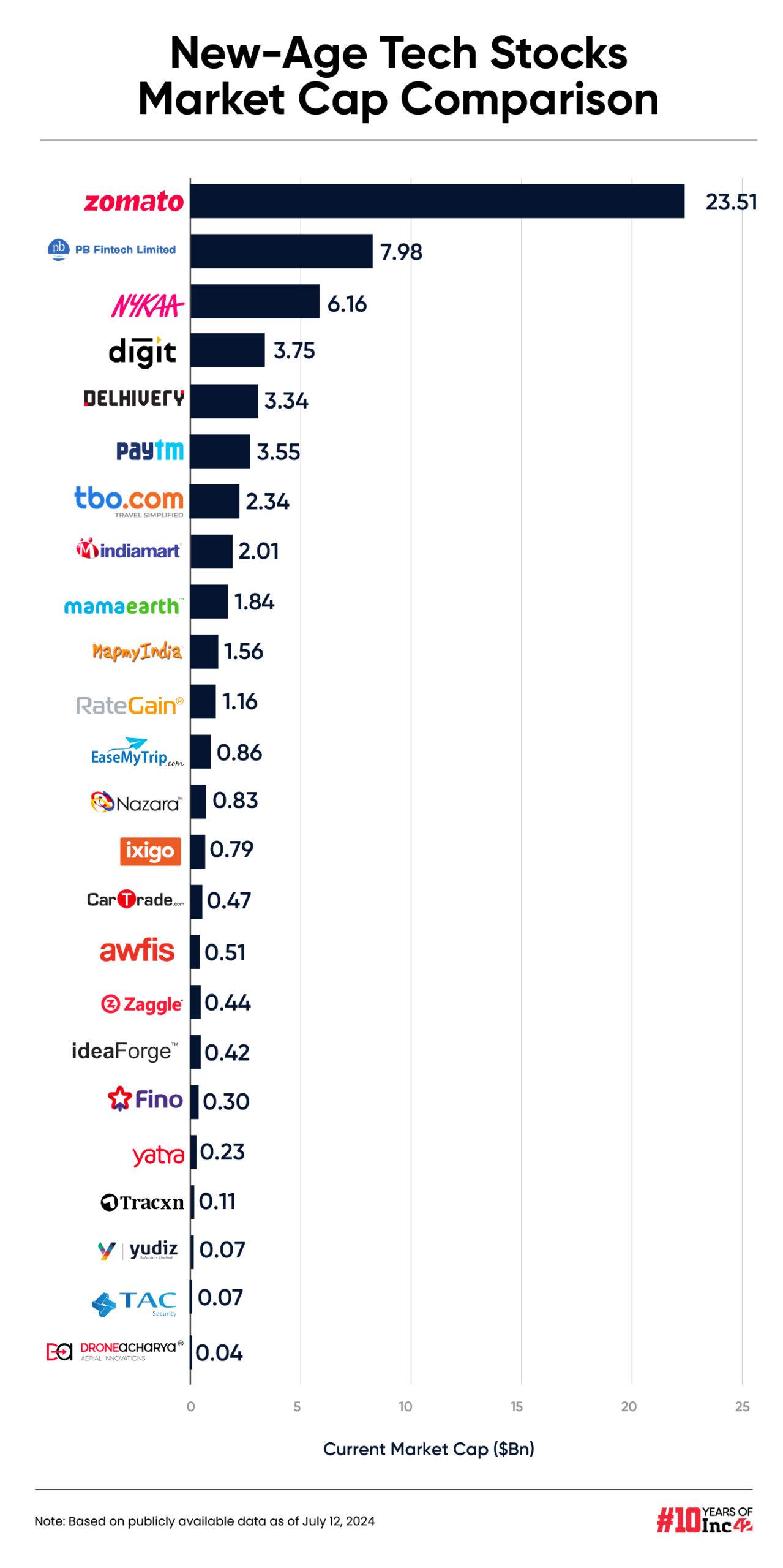

Overall, the total market capitalisation of the 24 new-age tech stocks under Inc42’s coverage stood at $63.02 Bn at the end of this week.

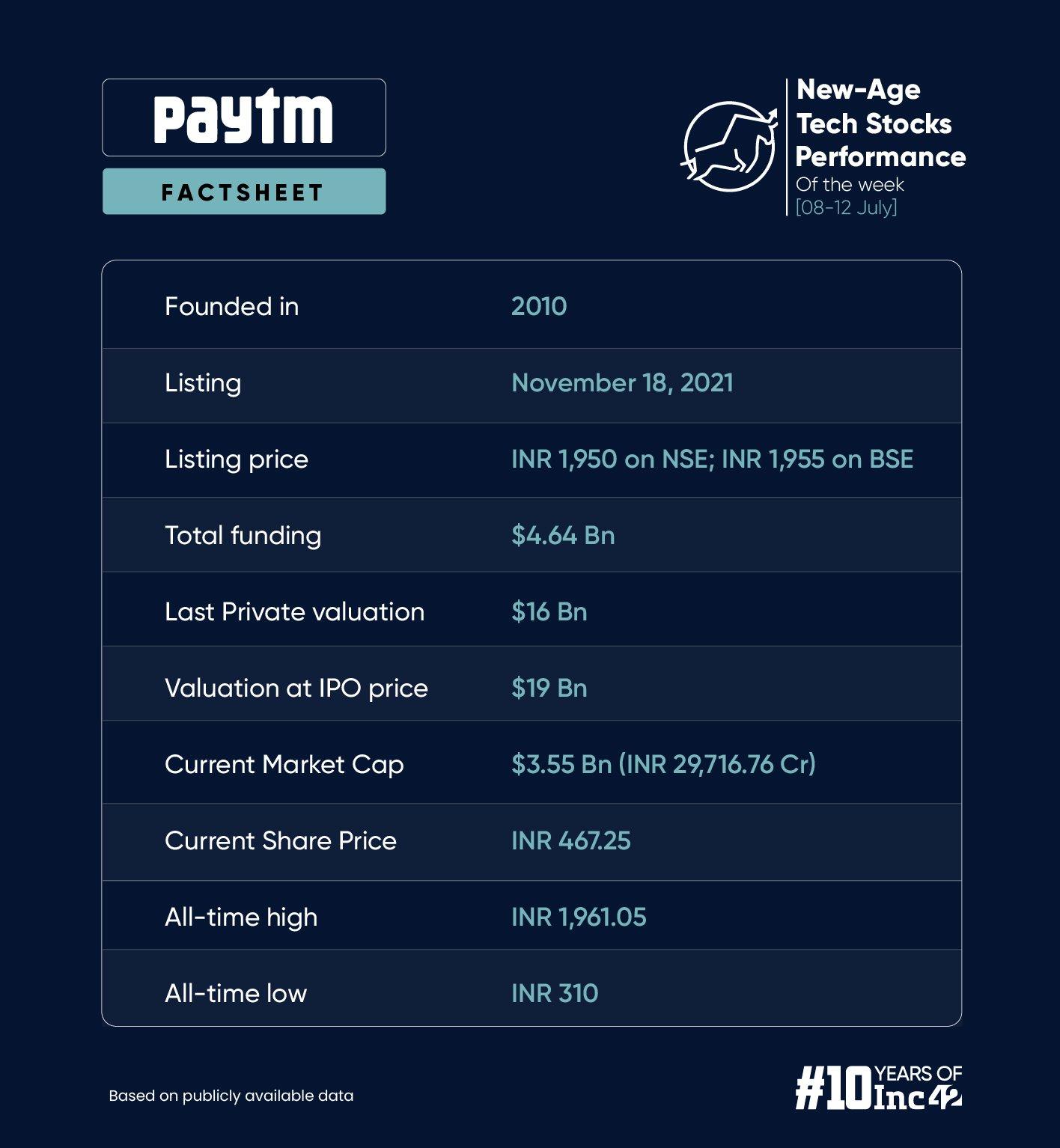

Paytm Shows Signs Of Recovery

Shares of Paytm ended the week, which was filled with multiple developments for the company, 7.2% higher at INR 467.25.

While shares of Paytm have been under pressure since February this year, following the Reserve Bank of India’s (RBI) curbs on Paytm Payments Bank Ltd (PPBL), the stock has been seeing an uptrend since last month.

The company was also in the news for multiple reasons this week. Let’s take a look:

All eyes will now be on Paytm’s Q1 numbers, scheduled to be declared on Friday (July 19). In its last disclosed financial results for Q4 FY24, Paytm’s loss more than tripled to INR 550.5 Cr from INR 167.5 Cr in the year-ago period. Revenue from operations also declined 2.9% to INR 2,267.10 Cr during the quarter from INR 2,334 Cr in Q4 FY23.

However, CEO and founder Vijay Shekhar Sharma recently reiterated his optimism about the company’s future and said his vision is to turn Paytm into a $100 Bn company.

Zomato Extends Its Bull Run

Continuing its bull run, the foodtech major’s shares touched a fresh all-time high of INR 223.40 during the intraday trading on July 12. The stock has jumped nearly 170% in the last one year.

Recently, Zomato received its shareholders’ approval to create a new employee stock option pool of 18.26 Cr shares.

However, earlier this week, JM Financial cut Zomato’s price target to INR 230 from INR 250 previously. Giving its reasoning, the brokerage said that ESOP grants should be linked to measurable performance-based outcomes, which is not the case with Zomato’s newly laid-out policy.

“There is a risk of the new ESOP policy being considered unfair by some shareholders as they would be the ones taking a meaningful hit on their earnings in the medium term”, said JM Financial analysts.

Awfis Soars To An All-Time High

While investor interest has been bullish on the coworking space provider startup since its listing on the bourses in May, the company’s shares touched an all-time high of INR 635 during the intraday trading on July 11.

The stock has gained 43% on the BSE since its listing on May 30.

Recently, Awfis managing director and chairman Amit Ramani told Inc42 that the startup’s top line is expected to breach the INR 1,100 Cr mark in FY25. The company is also looking to expand its portfolio by about 50%, reaching a total of 1,35,000 operational seats by the end of the year.

Awfis turned profitable in Q4 FY24, posting a profit after tax (PAT) of INR 1.4 Cr on an operating revenue of INR 232.3 Cr.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)