Twenty one out of the 24 new-age tech stocks under Inc42’s coverage fell this week, with TAC Infosec emerging as the biggest loser

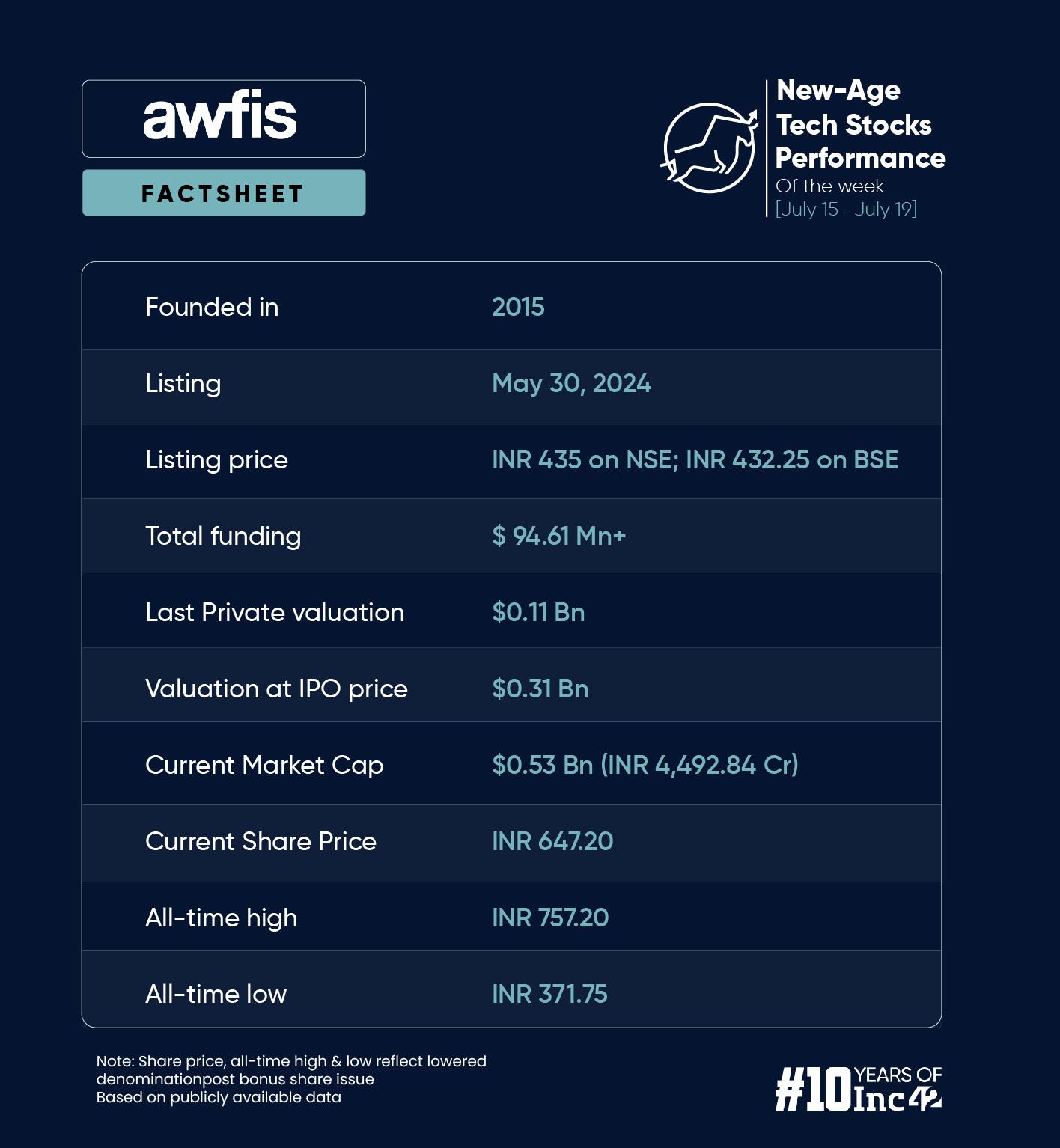

Continuing its bull run from last week, coworking startup Awfis emerged as the biggest gainer (up 4.52%) this week

Next week, all eyes will be on the Union Budget, which would decide the directions for the market in the coming weeks

Most of the Indian new-age tech stocks declined this week amid the ongoing earnings season and a global IT outage, despite the broader market seeing a slight uptick.

Twenty one out of the 24 new-age tech stocks under Inc42’s coverage fell this week in a range of 0.28% to just under 12%. Cybersecurity startup TAC infosec emerged as the biggest loser, with its shares dropping 11.99% to end the week at INR 527.95.

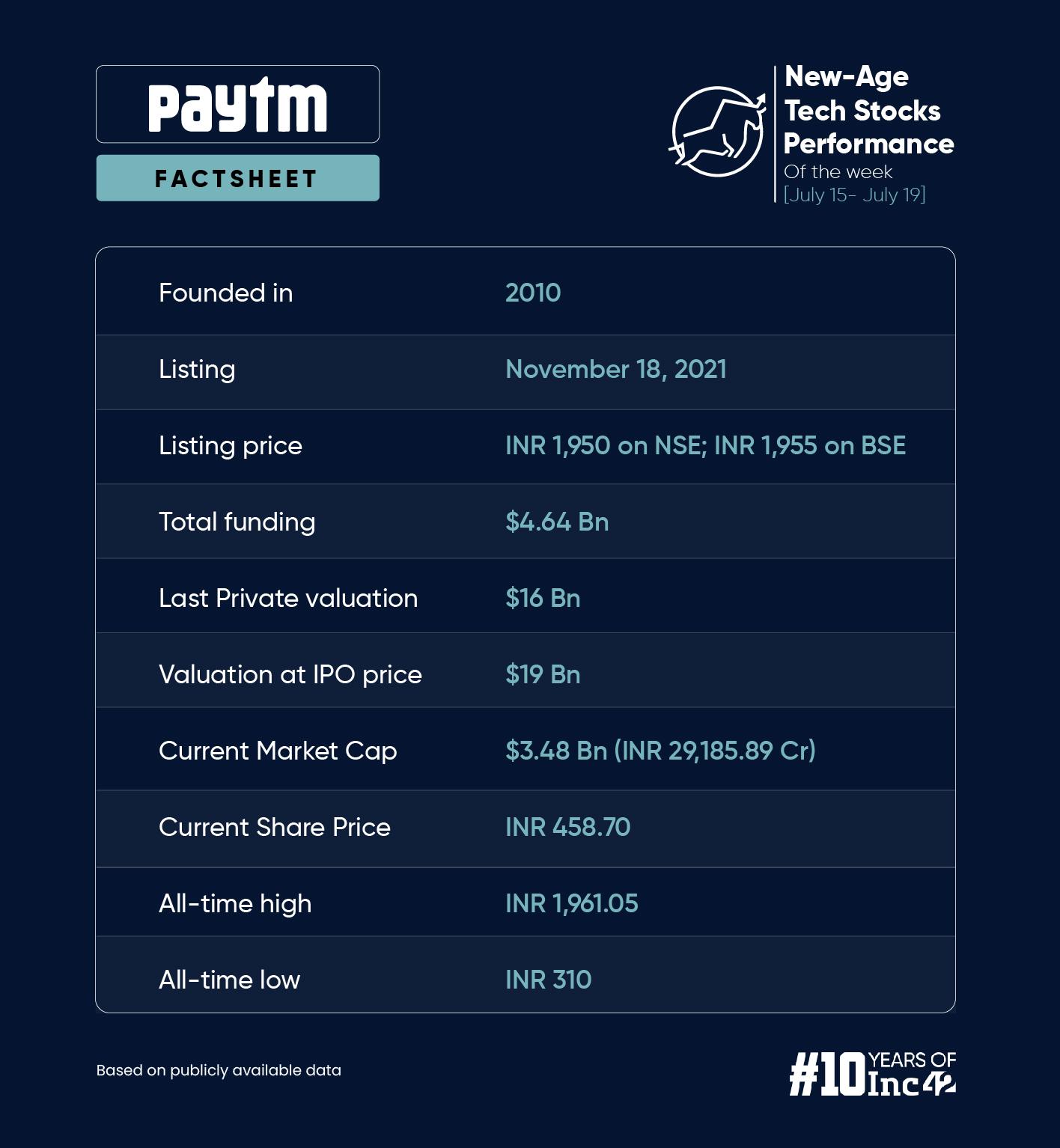

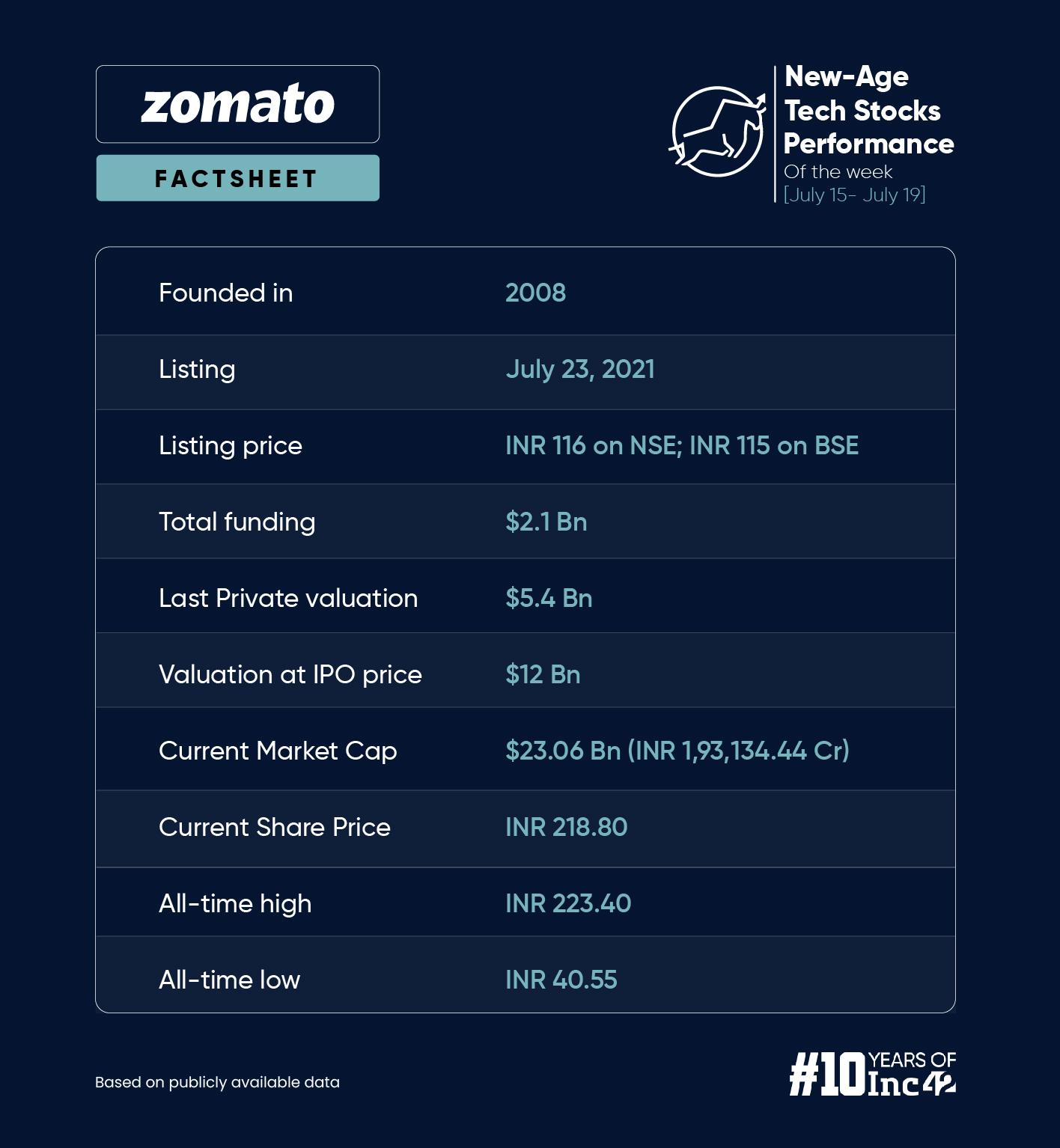

Nazara, Paytm, Zomato, and Nykaa were among the losers this week.

Meanwhile, only three stocks – Awfis, Yudiz and Go Digit – gained this week. Continuing its bull run from last week, coworking startup Awfis emerged as the biggest gainer (up 452%) this week.

It is pertinent to note that markets remained closed on Wednesday (July 17).

Meanwhile the broader market maintained its upward momentum this week. However, Nifty 50 and Sensex fell nearly 1% each after a global IT outage created by a cybersecurity-related mishap at big tech Microsoft. Overall, Sensex and Nifty 50 gained 0.1% this week to end at 80,604.65 and 24,530.90, respectively.

The IT outage barred users from accessing various Microsoft 365 apps and services, impacting businesses across industries globally. In India, airtravel, brokerages and some financial institutions were impacted.

Commenting on the market performance this week, Mehta Equities’ senior VP (research) Prashanth Tapse said investors began profit booking on Friday amid the news of disruptions across industries.

“IT stocks, which held ground in early trades, too gave up their gains, while other sectoral and broader indices incurred substantial losses after sentiment turned extremely bearish on weak global cues and reports of online businesses in several countries, including in India, hit by cyber outages,” Tapse said.

Analysts expect stock-specific actions in the coming weeks as the earning season picks up pace.

Reliance Industries, Paytm, and Justdial were among the companies which reported their Q1 FY25 numbers this week. Shares of Justdial surged nearly 24% this week after the company posted a 69% year-on-year increase in net profit to INR 141.22 Cr in the quarter ended June 30, 2024.

Next week, all eyes will be on finance minister Nirmala Sitharaman as she presents the Union Budget on July 23. Motilal Oswal Financial Services’ retail research head Siddhartha Khemka said that the Budget announcements will set the direction for the market for the coming weeks.

“Investors are anticipating pro-industry and populist measures with prudence on fiscal matters. If the Budget meets the expectations, it will provide more stability in the market,” he added.

Overall, the total market capitalisation of the 24 new-age tech stocks under Inc42’s coverage stood at $60.69 Bn at the end of this week as against $63.02 Bn last week.

Now, let’s take a deeper look at the performance of some of the new-age tech stocks.

Paytm’s Promising Commentary

Hit by the Reserve Bank of India’s (RBI’s) regulatory action, fintech major Paytm reported another quarter of weak earnings. Its net loss stood at INR 840.1 Cr in the June quarter, a 134% jump from INR 358.4 Cr in the year-ago period. Operating revenue also declined 36% to INR 1,502 Cr.

However, the Vijay Shekhar Sharma-led startup said it anticipates enhanced revenue and profitability in the future. The company cited the revival of its merchant payment business, expansion of its loan cross-selling vertical, and robust product-market fit in its shop insurance vertical as key drivers for this growth.

These projections were well received by the bourses as the company’s shares surged 6% to INR 472.15 during the intraday trading session on the BSE on Friday. Despite this, the stock ended the week 1.83% lower, breaking the upward momentum of two weeks.

Paytm also informed that it received a show cause notice from market regulator SEBI in relation to a grant of 2.1 Cr employee stock options (ESOP) to CEO Sharma.

The company also received an administrative warning letter from SEBI over related party transactions conducted by the company with Paytm Payments Bank in FY22.

Mixed Week For Zomato

Continuing last week’s bull run, foodtech major Zomato’s shares surged as high as INR 232 during the intraday trading on Monday. However, the stock lost steam later to end the week 1.64% lower at INR 218.80 on the BSE.

Zomato was in the news for multiple new developments this week:

All eyes will now be on Zomato’s Q1 FY25 numbers. The company is yet to declare the date for the results announcement.

Kotak Institutional Equities anticipates that Zomato will reveal robust results for Q1 FY25, driven by a 23% YoY growth in food delivery gross merchandise value (GMV) and an impressive 113% YoY growth in Blinkit’s GMV.

Nuvama projects Zomato’s revenue to increase 11.5% quarter-on-quarter (QoQ) and an impressive 64.4% YoY. Adjusted revenue from the food delivery segment is anticipated to grow 5.3% QoQ and 23.9% YoY, while Blinkit is forecasted to grow 29% QoQ.

JM Financial, also said in a recent research note, that it expects Zomato to report a very strong quarter sequentially for its food delivery and quick commerce businesses in Q1 FY25.

Awfis Continues Its Bull Run

Despite the broader bearish trend in new-age tech stocks, Awfis continued its winning run this week. The stock hit the 20% upper circuit on Thursday during the intraday trading on the BSE, reaching a new 52-week high of INR 757.20.

While the stock plunged 7.63% on Friday, Awfis ended the week 4.52% higher at INR 647.20.

The startup’s shares have gained about 50% since its listing in May.

Recently, Awfis managing director and chairman Amit Ramani told Inc42 that the startup is expected to surpass the INR 1,100 Cr revenue mark in FY25. Additionally, it aims to expand its operational seats by approximately 50%, reaching a total of 1,35,000 seats by the end of the year.

Awfis achieved profitability in Q4 FY24, reporting a profit after tax (PAT) of INR 1.4 Cr on an operating revenue of INR 232.3 Cr.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)