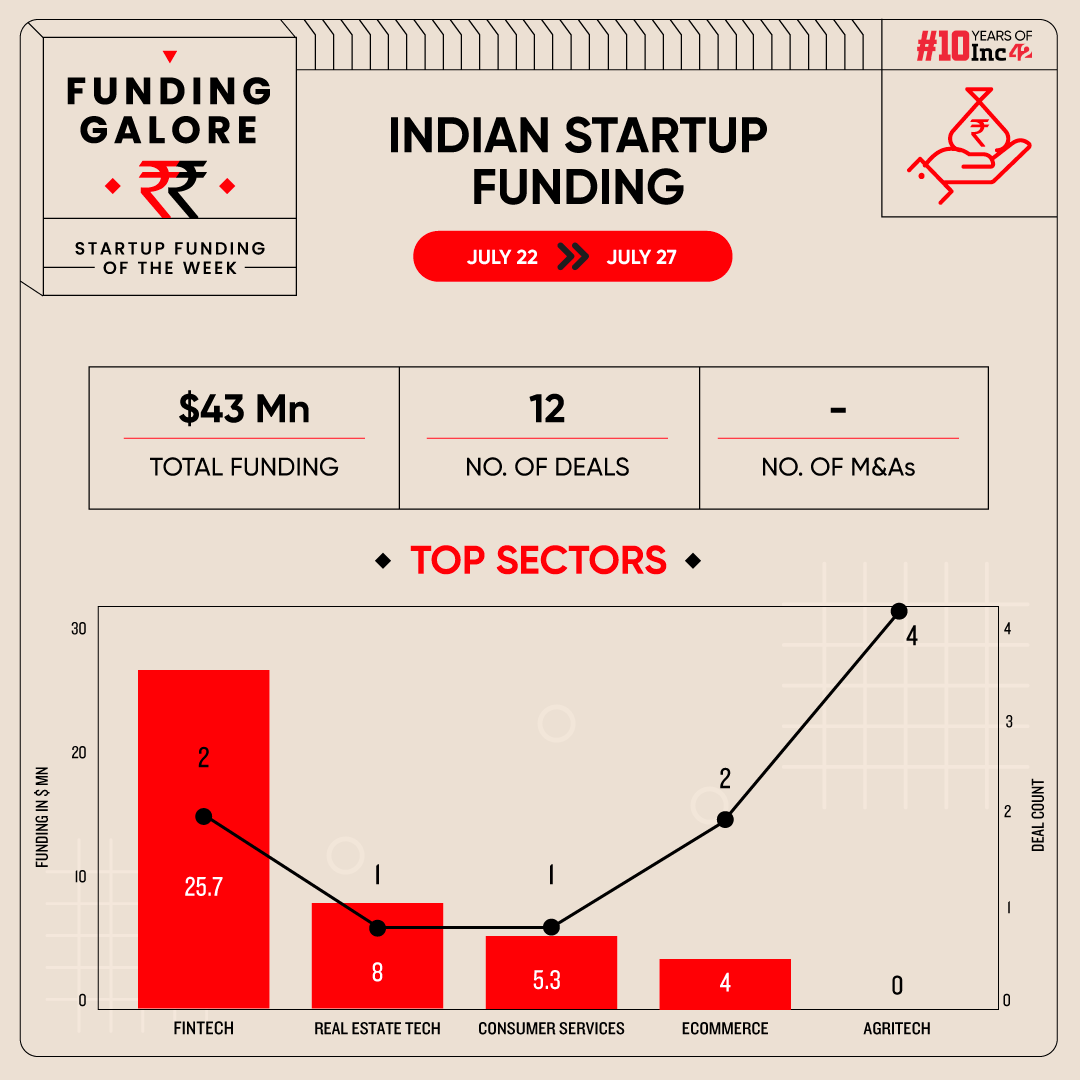

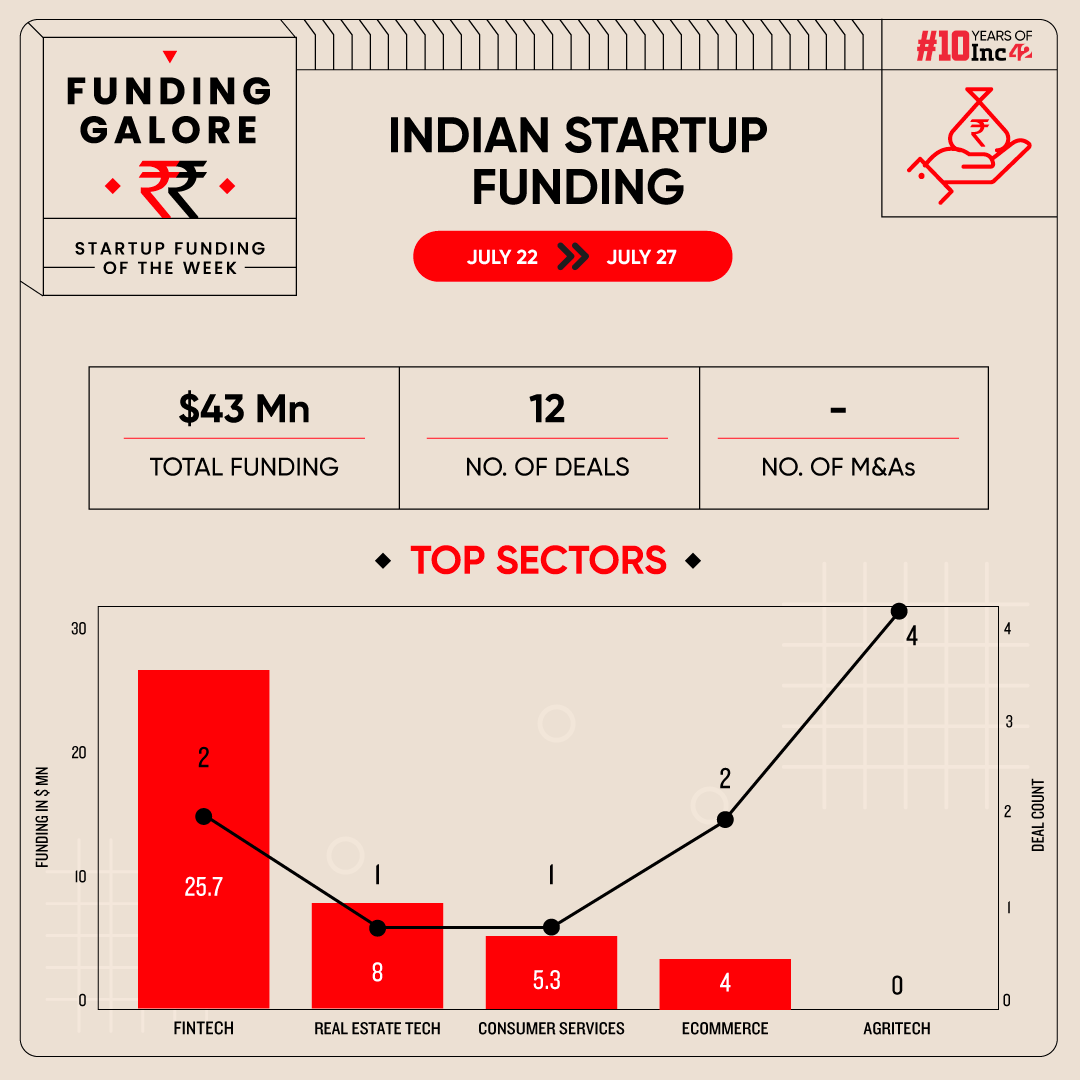

Between July 22 and July 27, Indian startups managed to cumulatively raise a meagre $43.1 Mn this week via 12 deals, marking a 365% decline from last week’s $200 Mn raised across 25 deals

The past week saw funding trends redact to an all year low

FAAD Capital emerged as the most active investor this week, backing four agritech startups with an infusion of over $121K

Investment activity across the Indian startup ecosystem redacted to an all year low in the budget week. Between July 22 and July 27 startups managed to cumulatively raise a meagre $43.1 Mn this week via 12 deals, down 365% from last week’s $200 Mn raised across 25 deals.

It is pertinent to note that seven of the deals materialised this week didn’t disclose the financial terms of their transactions.

Funding Galore: Indian Startup Funding Of The Week [ July 22- July 27]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 22 Jul 2024 | Stable Money | Fintech | Investment Tech | B2C | $14.7 Mn | Series A | RTP Capital, Matrix Partner, Lightspeed Ventures | RTP Capital |

| 22 Jul 2024 | NeoGrowth | Fintech | Lending Tech | B2B | $11 Mn | Debt | Symbiotics Group | Symbiotics Group |

| 22 Jul 2024 | Incuspaze | Real Estate Tech | Shared Spaces | B2B | $8 Mn | – | India Inflection Opportunity Fund | India Inflection Opportunity Fund |

| 25 Jul 2024 | Charcoal Eats | Consumer Services | Hyperlocal Delivery | B2C | $5.3 Mn | – | Girish Patel, Anil Singhvi, Ajinkya Firodia, Rajiv Jain | Girish Patel |

| 25 Jul 2024 | Nasher Miles | Ecommerce | D2C | B2C | $4 Mn | – | Narendra Rathi, Sulabh Arya, Mohit Goyal | – |

| 25 Jul 2024 | Devnagri | Enterprise Tech | Horizontal SaaS | B2B | – | pre-Series A | Inflection Point Ventures, Software Technology Parks of India | Inflection Point Ventures |

| 24 Jul 2024 | Pneucons | Ecommerce | B2B Ecommerce | B2B | – | – | Tarun Mehta | Tarun Mehta |

| 24 Jul 2024 | Godaam Innovations | Agritech | Market Linkage | B2B | – | – | FAAD Capital | FAAD Capital |

| 24 Jul 2024 | VedaFit Foods | Agritech | Market Linkage | B2B-B2C | – | – | FAAD Capital | FAAD Capital |

| 24 Jul 2024 | Aqin Biotech | Agritech | Farm Inputs | B2B | – | – | FAAD Capital | FAAD Capital |

| 24 Jul 2024 | Mkelly Biotech | Agritech | Market Linkage | B2B-B2C | – | – | FAAD Capital | FAAD Capital |

| 26 Jul 2024 | Mayhem Studios | Media & Entertainment | Gaming | B2C | – | – | Lumikai | Lumikai |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Despite the plunge in overall funding aggregated, fintech emerged as an investor favourite in the week. The week’s top two fund rounds, Stable Money’s $14.7 Mn Series A round and NeoGrowth’s $11 Mn debt, took fintech to the top spot at a sectoral level.

- The week saw FAAD Capital backing four agritech startups with an infusion of over $121K. The firm’s investment turned agritech as the sector with the maximum number of deals and FAAD as the most active investor in the startup ecosystem.

- The week saw no seed funding deal materialise.

Other Major Developments Of The Week

- During the budget speech, finance minister Nirmala Sitharaman announced the setting up of an INR 1,000 Cr venture capital (VC) fund. She said that the government has increased its focus on the space economy and private sector-driven research and innovation at the commercial scale.

- Packaged food startup Wingreens Farms is eyeing the raise of $4.3 Mn debt from investors including S Gupta Family Investments, Saket Agarwal, Reena Singhal, Sanjeev Agarwal, among others

- In an exchange filing, beauty ecommerce major Nykaa said that it is looking to raise INR 125 Cr (about $15 Mn) via non-convertible debentures (NCDs) from an undisclosed foreign portfolio investor. Its board has approved and authorised the issuance of up to 12,500 NCDs at a face value of INR 1 Lakh each to raise the amount.

- Adtech unicorn InMobi-owned mobile content provider Glance is in advanced talks with existing investors, including Google, to raise $250 Mn. The talks are expected to materialise in the coming weeks.

- Former defence secretary Ajay Kumar led venture capitalist firm MountTech Growth Fund has marked the first close of its fund Kavach at INR 250 Cr (around $29.9 Mn). The VC is targeting a total corpus of INR 500 Cr for Kavach.

- Electric mobility startup Kazam is raising $5 Mn in a funding round led by Licious and Vertex Ventures. It plans to use the capital to fuel its growth and expansion plans.

- PharmEasy-owned diagnostics platform Thyrocare Technologies is acquiring the Punjab-based pathology diagnostic business of Polo Labs to expand its presence in northern India.

- EV major Ola Electric is looking at a public listing as early as in the first fortnight of August. It plans to raise around $740 Mn via a combination of a fresh issue and an offer for sale.

- Captain Fresh is looking to acquire Poland-based food and beverage manufacturing company Koral to expand its footprint in the European market.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)