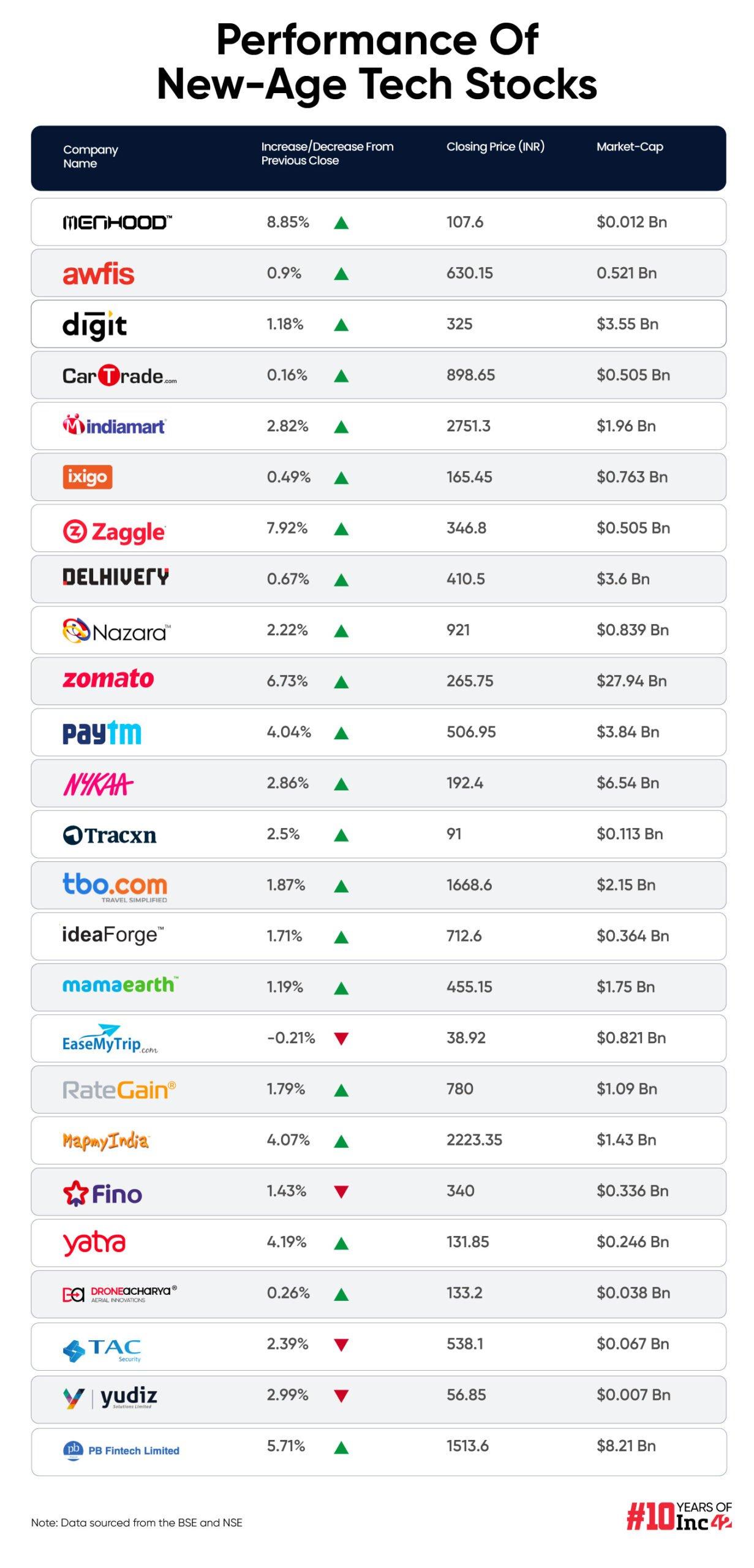

Twenty one out of the 25 new-age tech stocks under Inc42’s coverage gained in a range of 0.16% to 8.85% in Wednesday’s trade

Menhood emerged as the biggest gainer, with its shares surging almost 9%. It was followed by Zaggle, which jumped nearly 8%

Yudiz emerged as the biggest loser, with its shares ending the day almost 3% lower at INR 56.85 apiece on the NSE

New-age tech stocks surged on Wednesday (August 7) amid a rally in the broader equities market on positive global cues.

In line with the broader market gains, 21 out of the 25 new-age tech stocks under Inc42’s coverage gained in the range of 0.16% to 8.85% in today’s trade .

Menhood emerged as the biggest gainer, with its shares surging almost 9% to close the day at INR 107.6 apiece on NSE Emerge. Menhood made its stock market debut on July 24, with its shares listing at INR 96 apiece, a 28% premium over the issue price of INR 75 per share.

Menhood was followed by Zaggle, with the enterprise tech startup’s shares zooming 7.92% to close at INR 346.80 on the BSE.

Zomato, PB Fintech, MapmyIndia, Paytm and Yatra were among the other major gainers today.

It is pertinent to mention that PB Fintech shares opened at an all-time high of INR 1,664.35 on the BSE today after the parent entity of insurtech major Policybazaar posted a consolidated net profit of INR 60 Cr in the April-June quarter (Q1 FY25).

Amid these, only four new-age tech stocks ended in the red today, falling in a range of 0.21% to 2.99%. Yudiz emerged as the biggest loser, with its shares ending the day almost 3% lower at INR 56.85 apiece on the NSE.

TAC Infosec, Fino Payments Bank and EaseMyTrip were the other losers today.

The broader Indian stock market recovered all losses after crashing in the previous trading session, with domestic benchmark indices Sensex and Nifty50 ending the day in the green.

While the 30-share BSE Sensex rose 1.11% to end the day at 79,468.01, Nifty50 climbed 1.27% to close at 24,297.5.

Commenting on the market trend, Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Interrmediates, said, “Domestic benchmark indices began higher on Wednesday, driven by strong global sentiment. Nifty opened with a gap up and remained strong throughout the day. As a result, the Nifty concluded the day higher at 24,298. The volatility index, INDIA VIX, fell 14% to around 16.17, indicating drop in volatility.”

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)