The shares of Ola Electric were trading at INR 129.03 at 12:07 PM

On Thursday, Ola Electric unveiled its electric motorcycle portfolio, ‘The Roadster Series’, during its annual event

This move comes as several new-age mobility companies, including Ultraviolette, EMotorad, Motovolt, and Toutche Electric, enter the electric bike market

Shares of EV major Ola Electric

The shares of Ola Electric were trading at INR 129.03 at 12:07 PM.

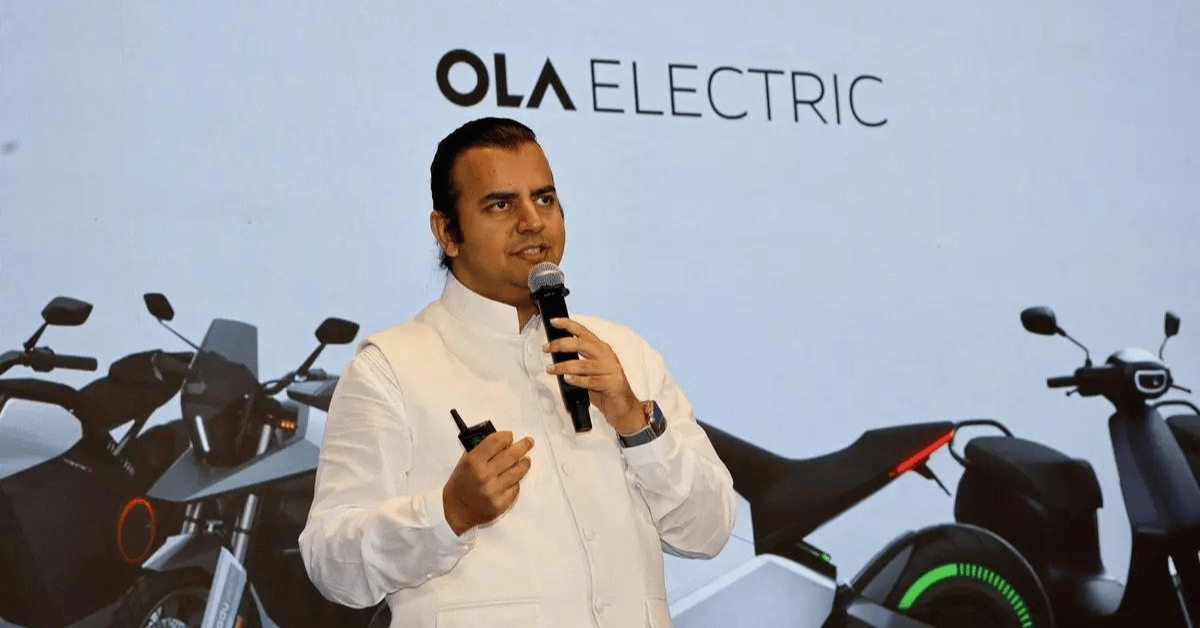

On Thursday (August 15), Ola Electric unveiled its electric motorcycle portfolio, ‘The Roadster Series’, during its annual event. The Bhavish Aggarwal-led startup unveiled three motorcycles under this portfolio – Roadster X, Roadster, and Roadster Pro.

Roadster will have a peak motor output of 13 kW and will come in 3.5 kWh, 4.5 kWh and 6 kWh battery variants. Its variants are priced between INR 1,04,999 and INR 1,39,999. It will have a top speed of 126 km/hour and a range of 248 kms.

Meanwhile, Roadster Pro will have a peak power output of 52 kW and 105 Nm torque, delivering a top speed of 194 km/hour and a range of 579 kms (for the 16 kWh variant). It will be available in two variants of 8kWh and 16 kWh, priced at INR 1,99,999 and INR 2,49,999, respectively.

Bookings have opened for all three models and their variants, but the Roadster X and Roadster will be the first to reach customers, with deliveries set to begin in Q4 FY25, according to Ola Electric. The Roadster Pro, however, will not be delivered until Q4 FY26.

Ola Electric has been developing a prototype electric bike and last August unveiled concept models for four electric motorcycles: Diamondhead, Adventure, Roadster, and Cruiser.

This move comes as several new-age mobility companies, including Ultraviolette, EMotorad, Motovolt and Toutche Electric, entered the electric bike market.

Ola’s entry into the electric motorbike segment comes a week after the company listed on the bourses in a muted market debut. The stock opened at a flat INR 75.99 apiece on the BSE as against its IPO issue price of INR 76.

In the first quarter (Q1) of the financial year 2024-25 (FY25), the startup’s net loss rose 30% to INR 347 Cr from INR 267 Cr in the year-ago quarter.

Meanwhile, operating revenue grew 32% year-on-year (YoY) to INR 1,644 Cr during the quarter under review.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)