New-age tech stocks gained this week on a rally in the broader market due to positive global cues. Eighteen of the 28 new-age companies under Inc42’s coverage rose in a range of 0.38% to just a little under 35% this week.

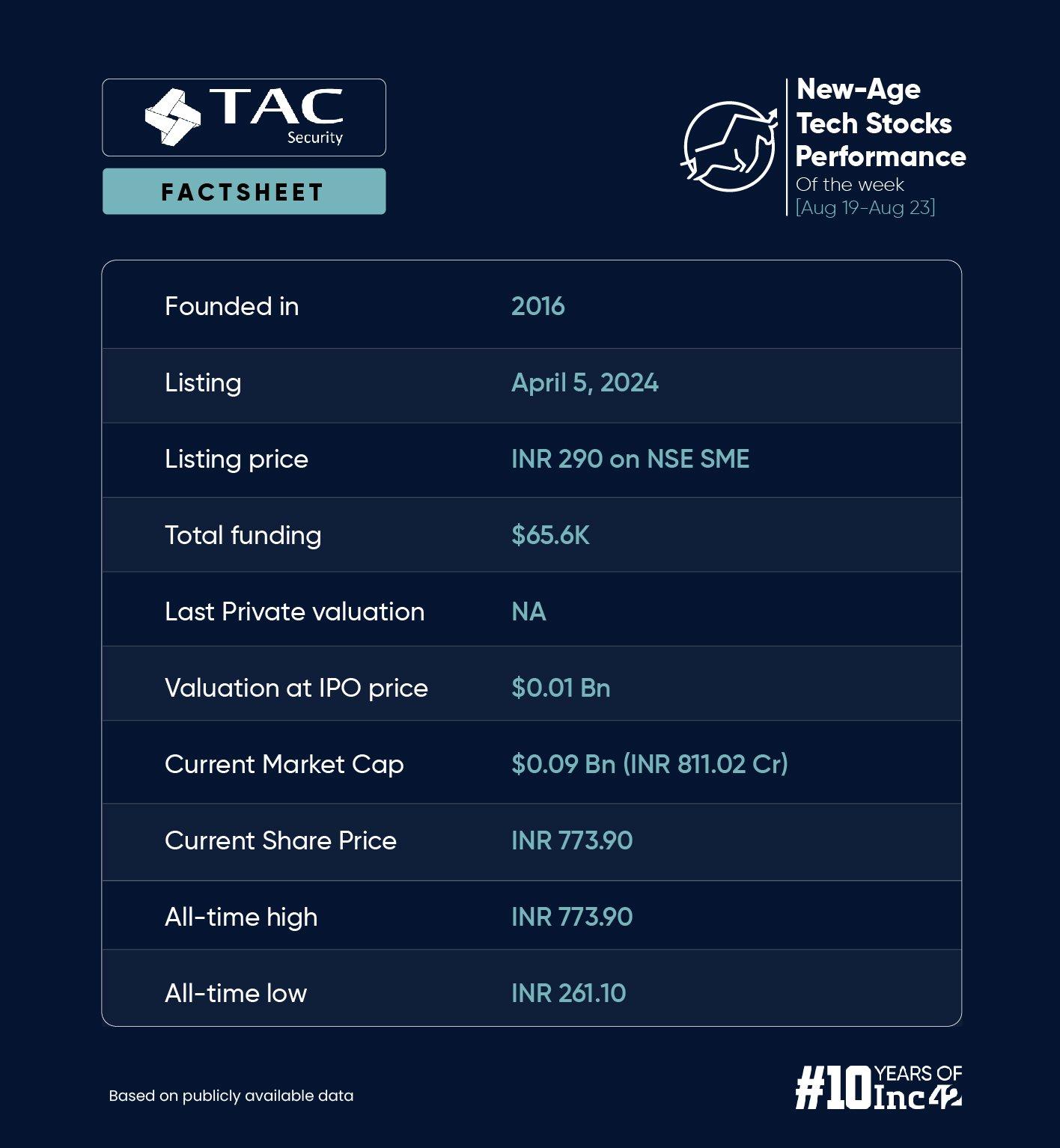

Cybersecurity startup TAC Infosec, which is listed on NSE Emerge, was the biggest gainer this week. Its shares surged 34.42% to end the week at an all time high of INR 773.90.

Other top gainers of the week included recently listed SaaS startup Unicommerce, coworking startup Awfis, last week’s top loser TBO Tek, and Mamaearth parent Honasa Consumer.

Beauty and fashion ecommerce major Nykaa touched a fresh 52-week high twice during the week. The stock surged more than 9% to hit a fresh 52-week high of INR 229.9 apiece on the BSE during the intraday trading on August 23. Amid the bull run, its early investor Harindarpal Singh Banga offloaded around 4.1 Cr shares worth INR 851.5 Cr in a bulk deal on Friday. Overall, shares of Nykaa ended the week 16.99% higher/lower at INR 226.90on the BSE.

Meanwhile, 10 new-age tech stocks fell in a range of 0.20% to just under 5% this week. Last week’s top gainer Ola Electric emerged as the biggest loser, falling 4.93% to end the week at INR 126.21.

In the broader market, Sensex grew 0.8% to end the week at 81,086.21 and Nifty 50 jumped 1.1% to end at 24,823.15.

Vinod Nair, head of research at Geojit Financial Services, said multiple global factors, including diminished likelihood of a recession in the US, ceasefire talks between Israel and Hamas, and decline in crude oil price, led to the rise in the benchmark indices.

“However, inflationary pressure in Japan and the appreciation of the yen tempered the market’s gains at the end,” he added.

Among the recently listed new-age tech companies, Unicommerce ended the week with 19.09% gains. Meanwhile, FirstCry ended in the red.

It is pertinent to mention that startups like Swiggy, BlackBuck, Avanse Financial Services, Ecom Express, ArisInfra, among others, are awaiting the market regulator’s nod to make their public market debut.

Commenting on the surge in IPOs, Pantomath Capital Advisors said, “A confluence of factors has boosted India’s primary market. The biggest reason is India’s strong macro environment, which has raised investor confidence. The healthy performance of several new stocks in the last couple of years has also lured investors into investing in new IPOs.”

Overall, the total market capitalisation of 28 new-age tech stocks under Inc42’s coverage stood at $81.39 Bn at the end of this week as against $77.52 Bn last week.

Now, let’s take a deeper look at the performance of some of the new-age tech stocks this week.

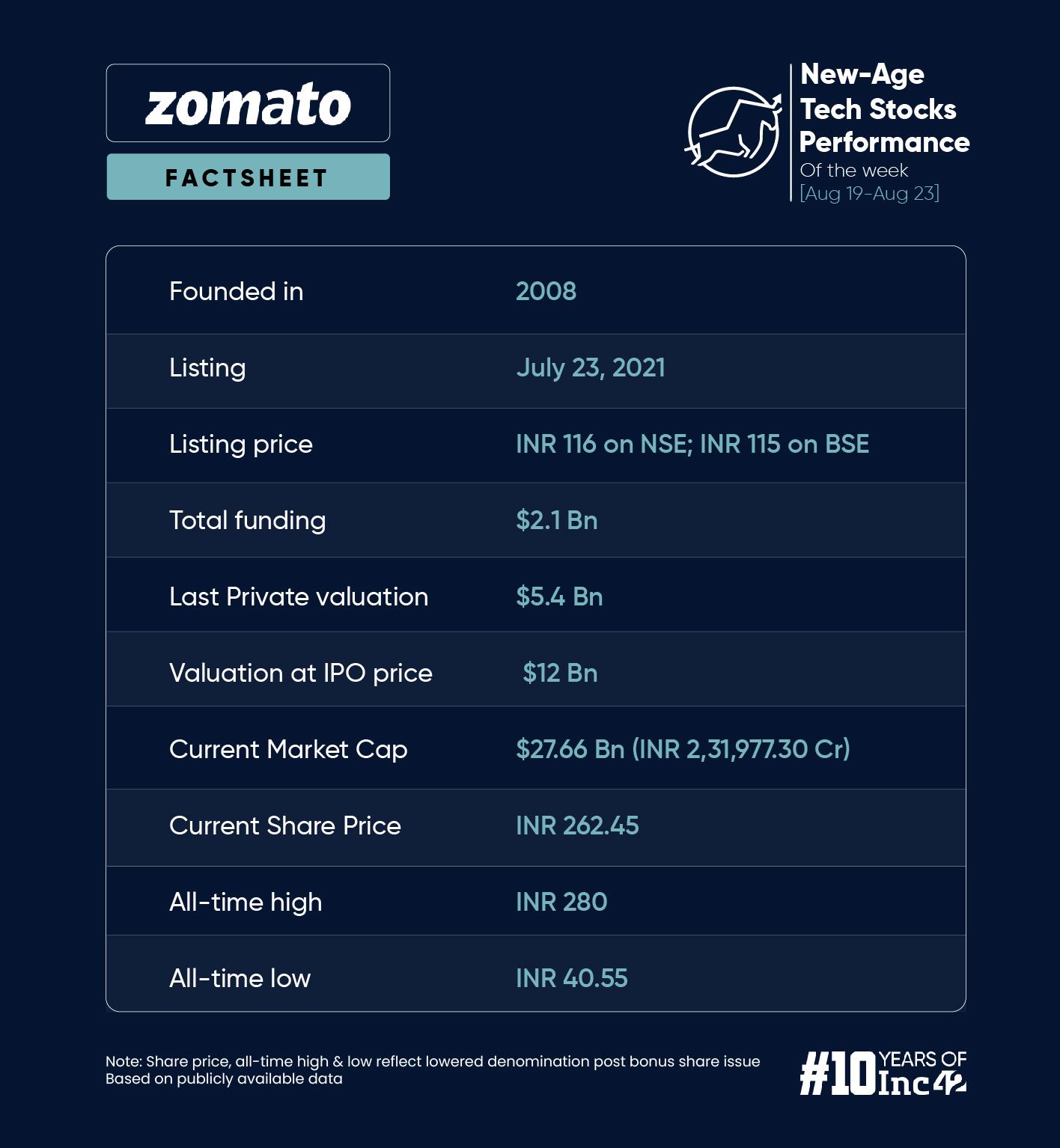

Zomato, Paytm End In The Red After Ticketing Deal

Following months of speculation, foodtech major Zomato announced the acquisition of the entertainment ticketing business of Paytm for INR 2,048 Cr in an all-cash deal this week.

With the acquisition, Zomato is looking to scale up its third B2C business, going out, with the launch of its new app ‘District’.

On the other hand, Paytm said that the move to sell the ticketing business will help it focus on its core payments and financial services distribution business.

However, the deal seemed to have failed to enthuse the investors, as shares of both Zomato and Paytm ended in the red this week.

Zomato ended the week at INR 262.70, down 0.68% week-on-week. This was despite the startup touching a fresh 52-week high of INR 280 at the beginning of the week.

Antfin Singapore Holding Pte Ltd, an investor in Zomato, also offloaded nearly half of its stake in the foodtech major in two block deals worth INR 4,771 Cr on August 20.

Brokerages’ response for Zomato’s acquisition of Paytm’s ticketing vertical were largely positive. Emkay gave Zomato a price target of INR 270 by June 2025. Motilal Oswal maintained its ‘BUY’ rating for Zomato, with a target of INR 300.

“District app could be a small part of Zomato’s business, but if executed correctly, it could give Zomato a strong mind share in the spending patterns of urban consumers across key forms of recreational or staple spending: groceries, food, and recreational “Going out” activities spanning dining, movies, sports, and music,” Motilal Oswal said.

Meanwhile, Paytm declined 1.67% this week to end at INR 554.50. Post the announcement, Emkay gave Paytm parent One97 Communications a ‘Reduce’ rating and a price target of INR 375. Motilal Oswal gave a neutral rating with a target of INR 550.

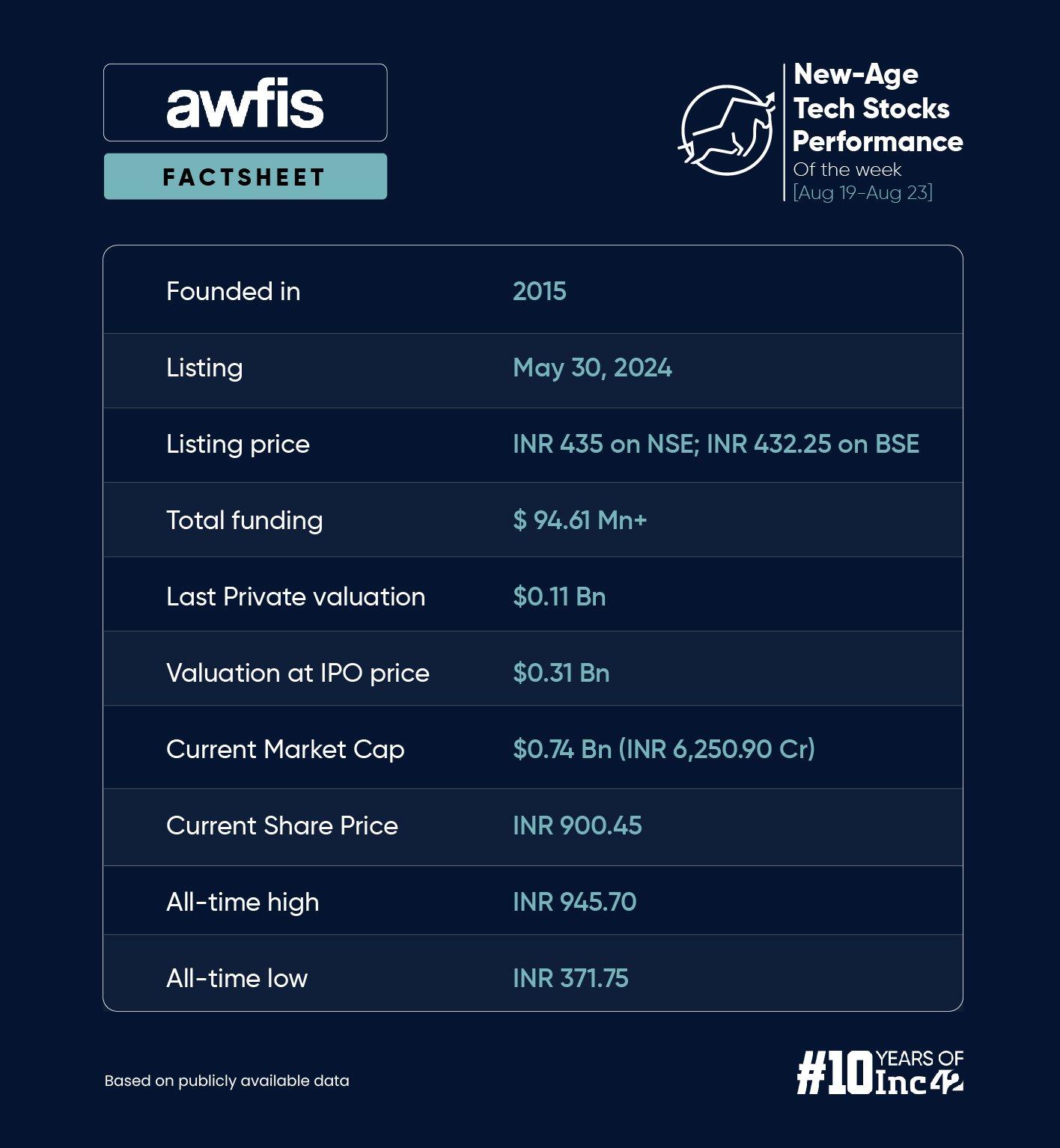

Awfis Zooms On Expansion Announcement

On a bull run since its listing in May, shares of Awfis zoomed this week and reached an all-time high of INR 909.75 apiece on August 22. This marked a 110% increase from its listing price of INR 435. The shares of the startup ended the week with a gain of 25.18% at INR 900.45.

This surge came after the startup announced the launch of two new centres at Mantri Commerce and Vista Pixel in Bengaluru.

“We are confident that the demand for high-end workspaces will continue to surge in the years to come. Our new centres are strategically located to cater to this growing need, offering unparalleled amenities, cutting edge infrastructure, and a vibrant community that nurtures innovation and collaboration,” Awfis chairman and MD Amit Ramani said.

Awfis operates 1,12,038 seats across 185 centres in 17 cities currently. Moving ahead, it plans to further expand across India by adding 40,000 new seats in FY25, taking the total seat count to 1,35,000.

TAC Infosec Touches Fresh All-Time High

Shares of cybersecurity startup TAC Infosec zoomed 34.42% this week to end at INR 773.90. The jump came after the company’s update on new customer additions on August 19.

TAC Infosec said it acquired 250 new customers in July and 590 in the first quarter of financial year 2024-25 (Q1 FY25).

While 149 of the new clients came from the US, the company also onboarded 20 new clients from India, including Cars24. Moving forward, TAC Security is looking to build on this momentum by upselling additional products and services to its newly acquired clients.

The startup’s clients include Salesforce, MPL Gaming, Zepto, Juspay, Reliance ADA Group, among others. It has set a target to have 10,000 customers globally by March 2026 and 3,000 by March 2025.

In a bid to bolster its global expansion bid, the startup also informed the bourses of its intent to acquire US-based cybersecurity firm Cyber Sandia.

“Cyber Sandia holds a critical State-Wide Agreement with the State of New Mexico for IT Professional Services, which makes this strategic acquisition a key opportunity for TAC Security to significantly bolster its presence in the U.S. public sector. This will also enable the company to expand its cybersecurity services nationwide across the US—the largest market in the world,” the company said in a release.

TAC Infosec reported a net profit of INR 6.33 Cr in FY24, a jump of 23% from INR 5.12 Cr in FY23.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)