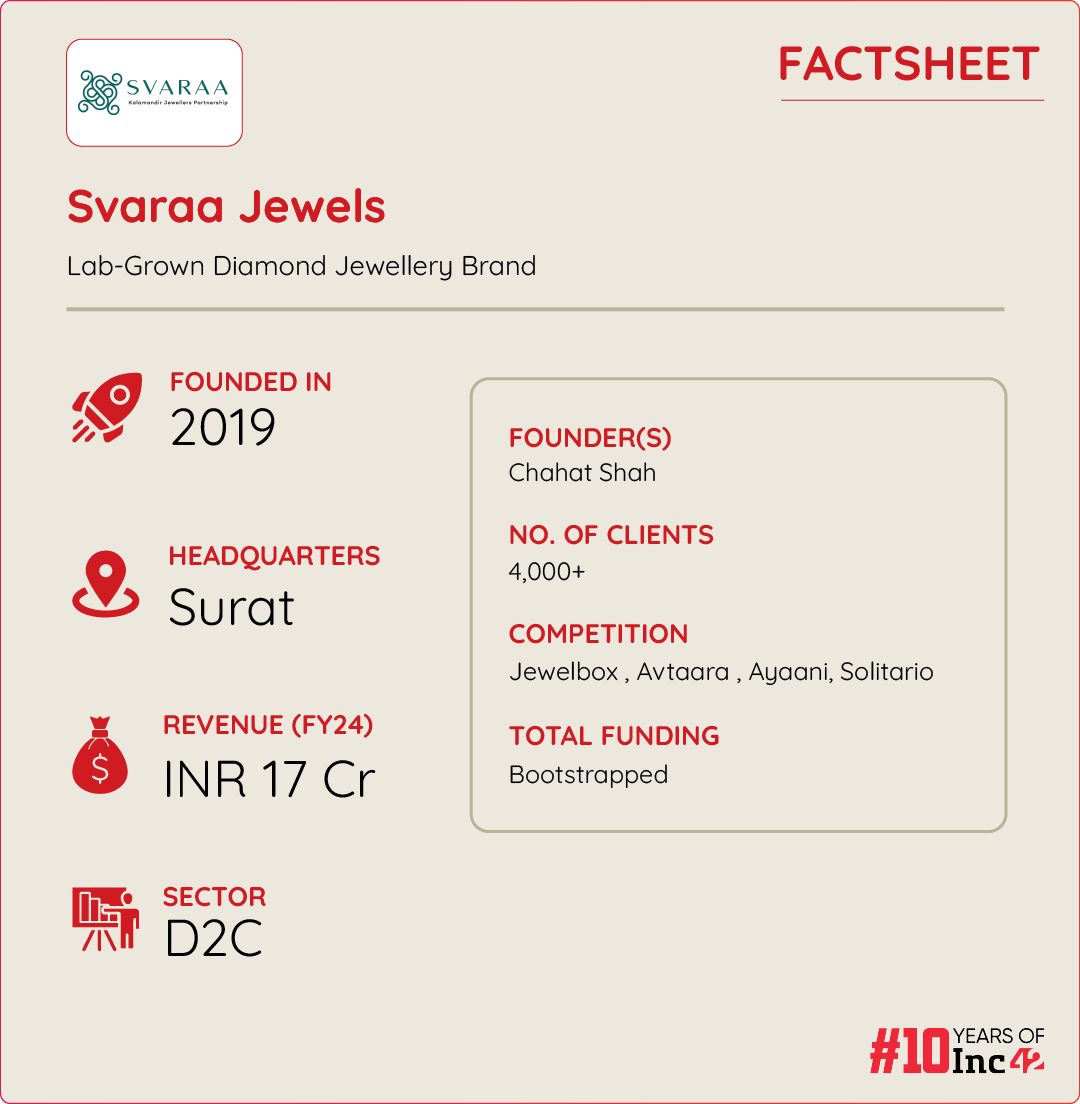

Founded in 2019, Svaraa Jewels provides IGI and GIA-certified lab-grown diamonds. In a bid to tap into the Indian daily wear jewellery market, estimated to reach $60 Bn by FY28, the startup has relied on the omnichannel approach since its inception

The founder of the bootstrapped startup claims to have registered 5X YoY revenue growth in FY24 to INR 16.5 Cr. He has set his eyes on garnering INR 25 Cr in revenues in FY25

Svaraa faces stiff competition from VC-funded players like Fionaa Diamonds, Aukera, Giva, and Bluestone in the Indian lab-grown diamonds space

Once seen as a niche market accessible only to the affluent, diamond jewellery has now become more mainstream, with brands offering options to suit a wider range of budgets. Not just this, as consumer preferences shift towards sustainability, lab-grown diamonds (LGDs) have arrived to change the rules of the game. With this, it is imperative to mention that the total size of the Indian lab-grown diamond jewellery market is set to spiral upward — from $ 299.9 Mn in 2023 to nearly $1.2 Bn by 2033.

Interestingly, several new-age entrepreneurs, too, have emerged to capture the glitter of the growing demand for this eco-friendly luxury. Chahat Shah, the founder of Svaraa Jewels, is one of the many diamantaires riding the wave. Founded in 2019, Svaraa Jewels provides IGI and GIA-certified lab-grown diamonds.

However, unlike other Indian founders, Shah’s journey has been direct, to the point and a natural progression. Shah comes from a legacy diamond business family, aka Kalamandir Jewellers.

According to the Surat-based founder, Svaraa Jewels is the result of his exposure to the natural diamond industry. Speaking with Inc42, the diamantaire said that while keenly observing global trends and local opportunities in the industry, he noticed a significant rise in the popularity and sales of lab-grown diamonds in the West.

“Concurrently, we recognised that Surat was emerging as the largest manufacturer and exporter of lab-grown diamonds. This unique convergence of demand and supply inspired us to create the brand,” Shah said.

Shah added that he identified several gaps in the traditional diamond market and vowed to resolve them. For starters, the industry was plagued with a dearth of modern, unique, and trendy designs. “Traditional designs often felt monotonous and failed to capture the evolving tastes of younger, more discerning customers,” Shah said. He added that the second issue was the high cost of natural diamonds that made luxury jewellery inaccessible to a broader audience.

“Svaraa Jewels was thus conceived with the thought process of bringing modern, unique, and trendy designs to the market, all crafted with the highest standards of quality and craftsmanship. With affordability at the core, we stepped forth to make exquisite, sustainable diamond jewellery accessible to everyone,” Shah said.

Svaraa’s Omnichannel Setup

For Svaraa, the primary target consumers are high-income individuals seeking diamond jewellery for daily wear. In a bid to tap into the Indian daily wear jewellery market, estimated to reach $60 Bn by FY28, Svaraa has relied on the omnichannel approach since its inception.

Currently, 90% of its sales is generated through offline channels, with the remaining 10% coming from online platforms. The average order value online is INR 70,000.

Per Shah, given the high-ticket nature of these purchases, customers often prefer to browse online first but choose to make their initial purchases in physical stores. The offline experience then helps build trust and encourages conversions, which in turn boosts online sales, creating a symbiotic relationship between the two channels.

“Our physical stores provide a personalised and immersive experience, where customers can explore our collections in person, and receive expert advice. This integrated strategy ensures that we cater to a wide range of customer preferences, driving sales and revenue across both platforms,” he said.

Currently, Svaraa operates two retail outlets and delivers to over 6,000 pin codes across India. The startup opened its first retail outlet in Ahmedabad in 2022. Earlier this year, it opened its second store in Mumbai.

The founder of the bootstrapped startup claims to have registered 5X YoY revenue growth in FY24 to INR 16.5 Cr. The founder has set his eyes on garnering INR 25 Cr in revenues in FY25.

Svaraa’s Challenges & Opportunities

Looking ahead, Svaraa aims to establish 5-10 more physical stores and reach a target of 100-120 online orders a week. The jewellery startup also has plans to keep its focus intact on Tier I cities for its physical stores. In the medium term, it will expand Tier II cities and beyond. Its third phase of expansion will be exploring international markets, intending to have over 100 stores in India by 2030.

While Svaraa is backed by its parent company, Kalamandir, it faces stiff competition from VC-funded players like Fionaa Diamonds, Aukera, Giva, and Bluestone in the lab-grown diamonds space.

While competition is inevitable and could be tackled by tapping into one’s strengths and exploiting others’ weaknesses, the startup currently has bigger demons to fight. For instance, according to the Global Trade Research Initiative (GTRI), the lab-grown diamond space grapples with lacklustre interest in man-made diamonds and cheaper imports.

Amid the high tide of challenges, it will be interesting to see how Shah’s Svaraa Jewels outshines in the crowded market to become the De Beers of India someday.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)