Indian startups cumulatively raised $227.1 Mn across 22 deals, a 34% decline from the $348 Mn raised last week via 19 deals

The week saw one mega funding round materialise when IPO-bound startup InMobi bagged a debt of $100 Mn from Mars Growth Capital

Moneyview vaulted into the coveted unicorn club this week after raising $4.6 Mn from Accel and Nexus Ventures at a valuation of $1.2 B

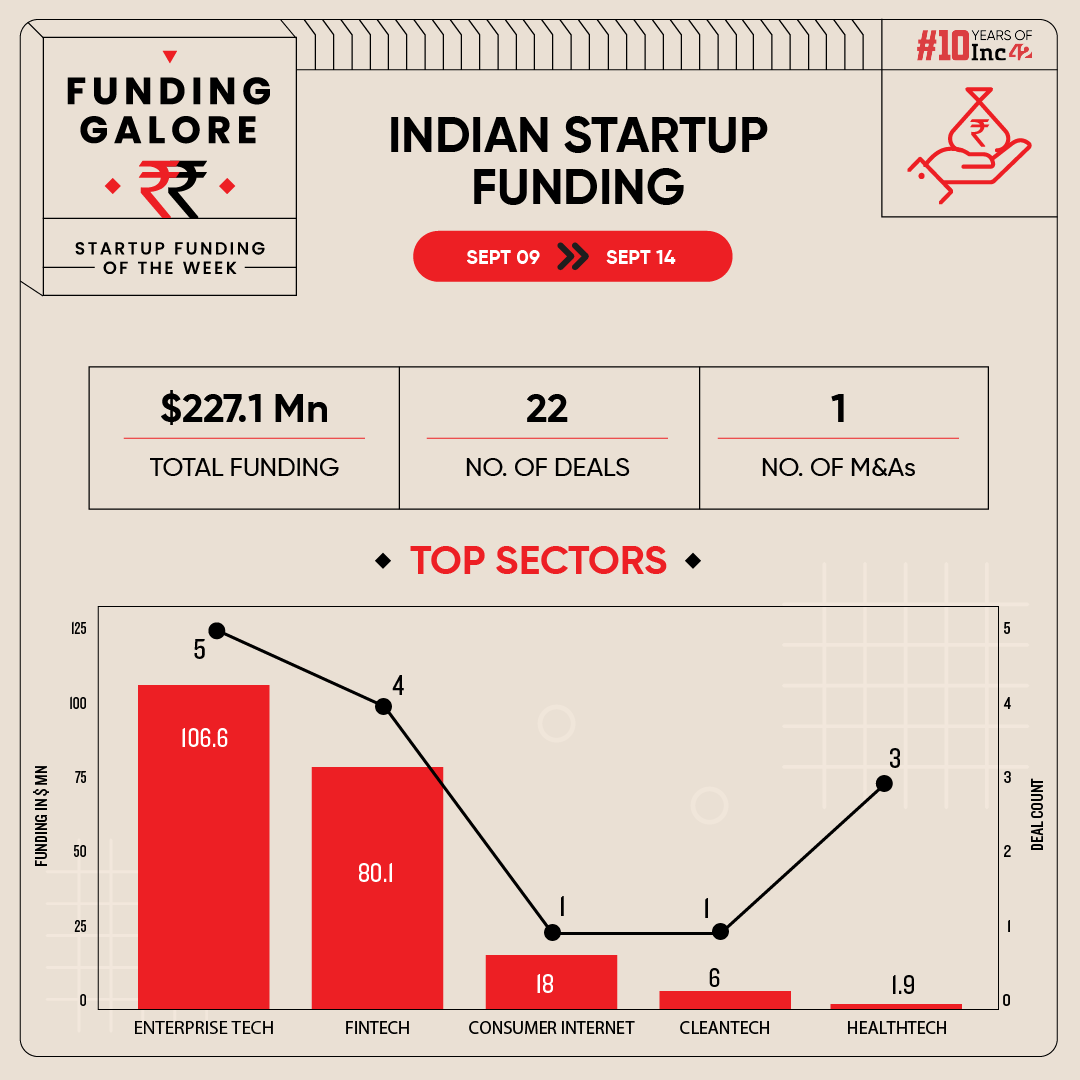

Funding across the Indian startup ecosystem entered slow lane in the mid week of September after a brief uptick in momentum. Between September 9 and 14, startups cumulatively raised $227.1 Mn across 22 deals, marking a 34% decline from the $348 Mn raised via 19 deals in the preceding week.

Despite the marginal decline, the week saw one mega funding round materialise when IPO-bound startup InMobi bagged a debt of $100 Mn from Mars Growth Capital.

Besides, the week also saw fintech startup Moneyview becoming the sixth Indian startup this year to vault into the coveted unicorn club after scooping up $4.6 Mn from Accel and Nexus Ventures at a valuation of $1.2 Bn.

Funding Galore: Indian Startup Funding Of The Week [Sept 9– Sept 14]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 11 Sep 2024 | InMobi | Enterprisetech | Horizontal SaaS | B2B | $100 Mn | Debt | Mars Growth Capital | Mars Growth Capital |

| 11 Sep 2024 | FlexiLoans | Fintech | Lending Tech | B2B | $34.5 Mn | Series C | Accion, Maj Invest, Nuveen, Fundamentum | – |

| 13 Sep 2024 | Onsurity | Fintech | Insurtech | B2B | $21 Mn | Series B | Creaegis, IFC, Quona Capital, Nexus Venture Partners | Creaegis |

| 12 Sep 2024 | Centricity | Fintech | Investment Tech | B2B | $20 Mn | Seed | Lightspeed, Paramark Ventures, Burman family office, NB Ventures family office, MS Dhoni family office, MMG group family office, Action Tesa family office, Aakash Chaudhry, Ritesh Agarwal | Lightspeed |

| 10 Sep 2024 | AppsForBharat | Consumer Internet | – | B2B | $18 Mn | Series B | Fundamentum, Elevation Capital, Peak XV, Mirae Asset VC | Fundamentum, Elevation Capital, Peak XV, Mirae Asset VC |

| 10 Sep 2024 | Nestasia | Ecommerce | D2C | B2C | $8.5 Mn | – | Susquehanna Asia VC, Stellaris Venture Partners | Susquehanna Asia VC, Stellaris Venture Partners |

| 10 Sep 2024 | Clean Electric | Cleantech | Electric Vehicle | B2B | $6 Mn | Series A | Info Edge Ventures, pi Ventures, Kalaari Capital, Lok Capital | Info Edge Ventures, pi Ventures, Kalaari Capital |

| 12 Sep 2024 | Moneyview | Fintech | Lending Tech | B2C | $4.6 Mn | – | Accel India, Nexus Ventures | – |

| 12 Sep 2024 | Dharaksha Ecosolutions | Agritech | Biotech | B2B | $3 Mn | Seed | Avaana Capital | Avaana Capital |

| 13 Sep 2024 | Futwork | Enterprisetech | Horizontal SaaS | B2B | $2.5 Mn | Series A | Michael & Susan Dell Foundation, Artha Ventures, Simile Capital | Michael & Susan Dell Foundation |

| 10 Sep 2024 | Crackle Technologies | Enterprisetech | Horizontal SaaS | B2B | $1.7 Mn | pre-Seed | We Founder Circle, AC Ventures, Impetus Technologies, Sunicon Ventures, Global DeVC, Misfits Capital, Ludo King | We Founder Circle, AC Ventures |

| 10 Sep 2024 | Exposome | Cleantech | – | B2B | $1.7 Mn | pre-Series A | Colossa Ventures, 3i Partners, Rahul Rathi, Bhukhanvala Holdings Private Limited, Excel Industries Limited, Spectrum Impact | Colossa Ventures |

| 13 Sep 2024 | Newmi Care | Healthtech | Fitness & Wellness | B2C | $1.5 Mn | Seed | Sprout Venture Partners, LetsVenture, Sarcha Advisors, Key Ventures Forum | Sprout Venture Partners |

| 11 Sep 2024 | Mitra | Ecommerce | D2C | B2C | $1.3 Mn | pre-Series A | Bestvantage Investments | Bestvantage Investments |

| 11 Sep 2024 | Zivy | Enterprisetech | Horizontal SaaS | B2B | $1.2 Mn | pre-Seed | Blume Ventures, Paradigm Shift Capital, iSeed, Everywhere Ventures, Indian Silicon Valley, Marsshot Ventures | Blume Ventures |

| 12 Sep 2024 | Apptile | Enterprisetech | Horizontal SaaS | B2B | $1.2 Mn | – | Singularity Early Opportunities Fund, Crown Trust, DeVC | Singularity Early Opportunities Fund |

| 12 Sep 2024 | GameEon Studios | Media & Entertainment | Gaming | B2B | $1 Mn | – | SucSEED Indovation Fund, ICE.VC, IAN, CD Equifinance, Nexus Global Opportunities Fund, Vivek Goel, Patni Family, Tal64 | – |

| 12 Sep 2024 | Wundrsight | Healthtech | IoT & Hardware | B2B-B2C | $400K | Seed | Inflection Point Ventures, Social Alpha | Inflection Point Ventures |

| 9 Sep 2024 | Transcell Biologics | Healthtech | Healthcare Services | B2B | – | – | Quantiphi, IAN Group | – |

| 12 Sep 2024 | Leezu’s | Ecommerce | D2C | B2C | – | – | – | – |

| 12 Sep 2024 | Trisu | Ecommerce | D2C | B2C | – | – | All In Capital, JK Tyres, Amaanta Group | All In Capital |

| 13 Sep 2024 | Agilitas Sports | Ecommerce | D2C | B2C | – | – | Spring Marketing Capital | Spring Marketing Capital |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- Buoyed by InMobi’s mega funding round, enterprisetech emerged as the leader in terms of funding at a sectoral level.

- Fintech trailed enterprisetech at a sectoral funding level with startups in this space securing $80.1 Mn via four deals.

- Seed funding went up tremendously this week to $24.9 Mn, zooming over 2X from last week’s $10.7Mn secured by startups at this level. The bump in the seed funding numbers came primarily due to the $20 Mn bagged wealthtech startup Centricity.

- Nandan Nilekani’s Fundamentum, Nexus Venture Partners, and IAN group emerged as the lead investors this week, backing two startups apiece.

Updates On Indian Startup IPOs

- Electric two wheeler major Ather Energy filed its DRHP with market regulator SEBI to raise more than INR 3,100 Cr via an IPO. The proposed public offer comprises a fresh issue of equity shares worth INR 3,100 Cr and an offer-for-sale (OFS) of up to 2.2 Cr equity shares.

- IPO bound foodtech major Swiggy is reportedly mulling to increase the fresh issue size of its public offer to cumulatively raise INR 5,000 Cr.

Mergers and Acquisitions This Week

Other Developments Of The Week

- Ex- Jio President Vikas Choudhary announced the launch of his new fund Playbook Partners, a SEBI-approved Category II alternative investment fund. Announcing the first close of the fund at $130 Mn, the firm looks to close the fund at $250 Mn in the near future.

- Listed lending tech startup Moneyboxx announced that it is looking to raise $20.9 Mn via issuance of equity shares on a preferential basis and warrants.

- Fintech startup Finova Capital is reported to be on the verge of raising $95.3 Mn from new and existing investors in a mix of primary capital infusion and secondary share sale.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)