The Securities and Exchange Commission (SEC) filed a complaint against three of MoviePass’s former executives, alleging they lied to investors and the public ahead of the company’s official relaunch.

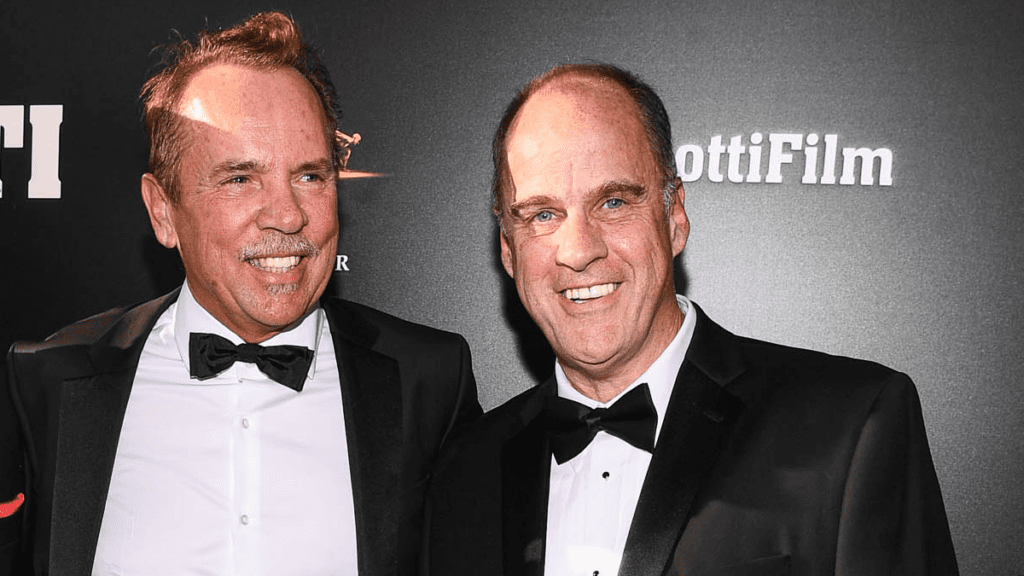

The SEC filed a complaint against former MoviePass CEO Mitch Lowe and Ted Farnsworth, the former CEO of parent company Helios and Matheson Analytics (HMNY), alleging that they lied about how the company planned to be profitable and used “fraudulent tactics to prevent MoviePass’s heavy users from using the [unlimited subscription service].” When Lowe and Farnsworth were in charge, MoviePass promised users a $9.95 per month subscription that included an unlimited number of 2D movie tickets. However, MoviePass quickly said goodbye to “unlimited,” effectively ending a service that was likely losing a lot of money. In 2020, the company declared bankruptcy.