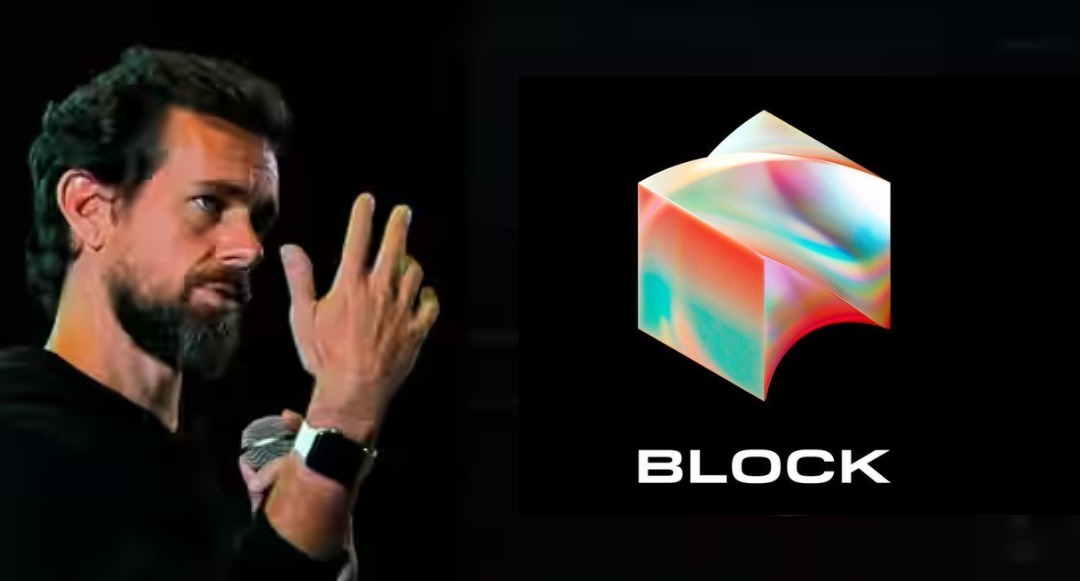

US investment group Hindenburg Research, has targeted former Twitter CEO Jack Dorsey. According to the Hindenburg report, Mr. Dorsey’s mobile payments firm Block “widely overstated” its user base.

Here are five facts about Block:

Mr. Dorsey co-founded it in 2009. Block, formerly known as Square, rose to prominence by introducing a sleek and small credit card reader that quickly became popular among vendors. According to the BBC, the company was valued at nearly $3 billion when it went public on the stock exchange in 2015.

In 2021, the company renamed itself Cash App to reflect the growing side of its business. The financial transactions handled by the tech firm range from payments to merchants to payments between individuals. The company also provides point-of-sale systems and a cryptocurrency trading app.

Hindenburg’s year-long investigation focused on Cash App, which the firm claims was used to facilitate millions in fraudulent pandemic relief payments from the US government. The company has denied all of the allegations, but the Hindenburg report sent its stock down 15%.

Cash App is a mobile application that allows users to transfer money. According to Reuters, Block said in a fourth-quarter earnings letter that it had 51 million monthly transacting actives, a 16% year-over-year increase in December 2022.

Block has been rapidly expanding and is expected to surpass $100 billion in market value by 2021. It is currently valued at $38 billion.