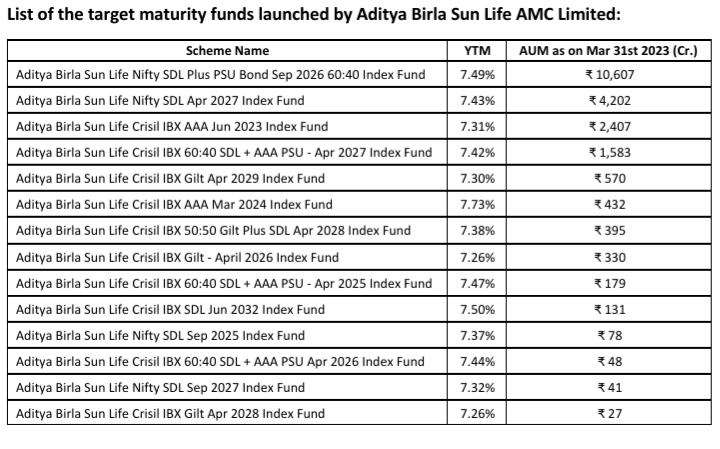

Aditya Birla Sun Life AMC Limited, a subsidiary of Aditya Birla Capital Limited and an investment manager for Aditya Birla Sun Life Mutual Fund, has further strengthened its presence in the target maturity space with its asset under management surpassing Rs 20,000 crore mark in April 2023. The company offers the widest range of target maturity funds across the industry.

The passive funds vertical also reached an important milestone with its AUM crossing Rs 25,000 crore in March 2023. Along with other ETFs, they are also the first AMC to file and launch a Silver ETF & FoF, and offer Smart Beta portfolios, such as the Nifty 50 Equal Weight, Momentum, and Quality.

Commenting on the milestone and growth of their Passive AUM, A. Balasubramanian, Managing Director and Chief Executive Officer of Aditya Birla Sun Life AMC Ltd., said, “We are happy to announce that our passive funds have achieved a significant milestone by crossing Rs. 25,000 crores of assets under management along with target maturity funds crossing Rs 20,000 crores. This accomplishment reflects the growing popularity of passive investing in India, as well as the trust our investors have placed in us. While we remain committed to providing top-quality active investment opportunities to our investors, we are equally excited about the passive investment space.”

About Aditya Birla Sun Life AMC Limited

Established in 1994, Aditya Birla Sun Life AMC Limited (ABSLAMC) is co-owned and backed by Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc.

ABSLAMC is primarily the investment manager of Aditya Birla Sun Life Mutual Fund, a registered trust under the Indian Trusts Act, 1882. ABSLAMC also operates multiple alternate strategies including Portfolio Management Services, Real Estate Investments and Alternative Investment Funds. ABSLAMC is one of the leading asset managers in India, servicing around 8.01 million investor folios with a pan India presence across 290 plus locations and a total AUM of over Rs. 2,930 billion for the quarter ending December 31, 2022 under its suite of mutual fund (excluding our domestic FoFs), portfolio management services, offshore and real estate offerings.

About Aditya Birla Capital Limited

Aditya Birla Capital Limited (ABCL) is the holding company for the financial services businesses of the Aditya Birla Group. With subsidiaries/JVs that have a strong presence across Protecting, Investing and Financing solutions, ABCL is a financial solutions group that caters to diverse needs of its customers across their life cycle. Powered with more than 34,000 employees, the businesses of ABCL have a nationwide reach with over 1200 branches, more than 2,00,000 agents/channel partners and several bank partners.

Aditya Birla Capital Limited is a part of the Aditya Birla Group, in the league of Fortune 500. Anchored by an extraordinary force of over 140,000 employees, belonging to 100 nationalities, the Aditya Birla Group operates in 36 countries across the globe.

About Sun Life

Sun Life is a leading international financial services organization providing asset management, wealth, and insurance and health solutions to individual and institutional Clients. Sun Life has operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of December 31, 2022, Sun Life had total assets under management of $1.33 trillion. For more information, please visit www.sunlife.com. Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.