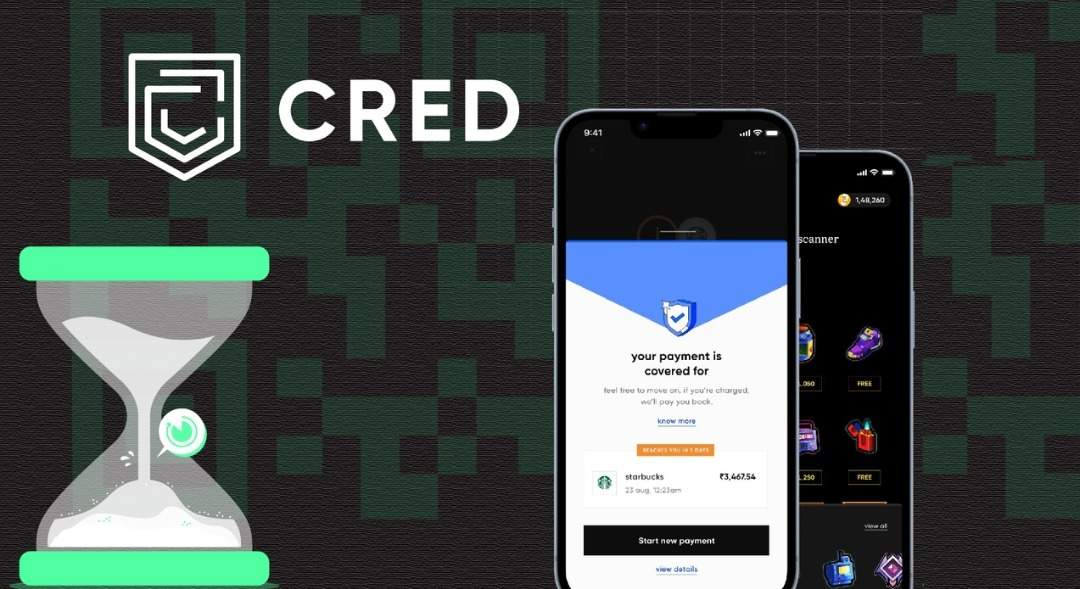

Fintech platform CRED has launched its peer-to-peer (P2P) payments system, powered by the Unified Payments Interface (UPI), its fourth major product launch in just four months. The new service aims to offer its users a seamless and secure payment experience, with features such as custom virtual payment addresses and payment reminders for recurring transactions. CRED’s payment system will also include proactive nudges for high-value payment scenarios and potentially risky transactions.

The company is also introducing a new cashback feature called WIN-WIN, where both the payer and the recipient receive cashbacks in their CRED balances for payments made to ‘special contacts’. The balance can be redeemed for bill payments or store transactions on the CRED app.

CRED Protect is another key feature of the new payments system. It actively nudges members to protect their identity by masking their personal details like mobile numbers and ensuring privacy. Once custom virtual payment addresses are activated, payments will be made via alias UPI IDs by default.

This new launch comes after CRED’s foray into the luxury travel space with CRED Escapes and its buy-now-pay-later product, CRED Flash. It also launched a tap-to-pay offering for retail payments using credit cards and a Scan & Pay feature for payments directly through bank accounts.

The company’s renewed focus on scaling up revenue and adding more customers to its user base is evident in its recent spate of product launches. CRED’s goal is to become a one-stop solution for its users’ financial needs, including credit card bill payments, reward points redemption, and now, P2P payments.

The Indian fintech industry is rapidly evolving, and CRED’s latest launch is another indication of the sector’s potential. The convenience of P2P payments and the security offered by UPI are likely to make CRED’s latest offering a popular choice among its users.