Circle Internet Financial, the issuer of the major stablecoin USDC, has announced the release of a new technology called the Cross-Chain Transfer Protocol (CCTP) that allows for faster, safer, and cheaper movement of USDC between blockchains.

This new method aims to replace the widely used “bridges” in decentralized finance (DeFi), which created a derivative token called a wrapped asset to solve the problem of fragmented market cap across different blockchains.

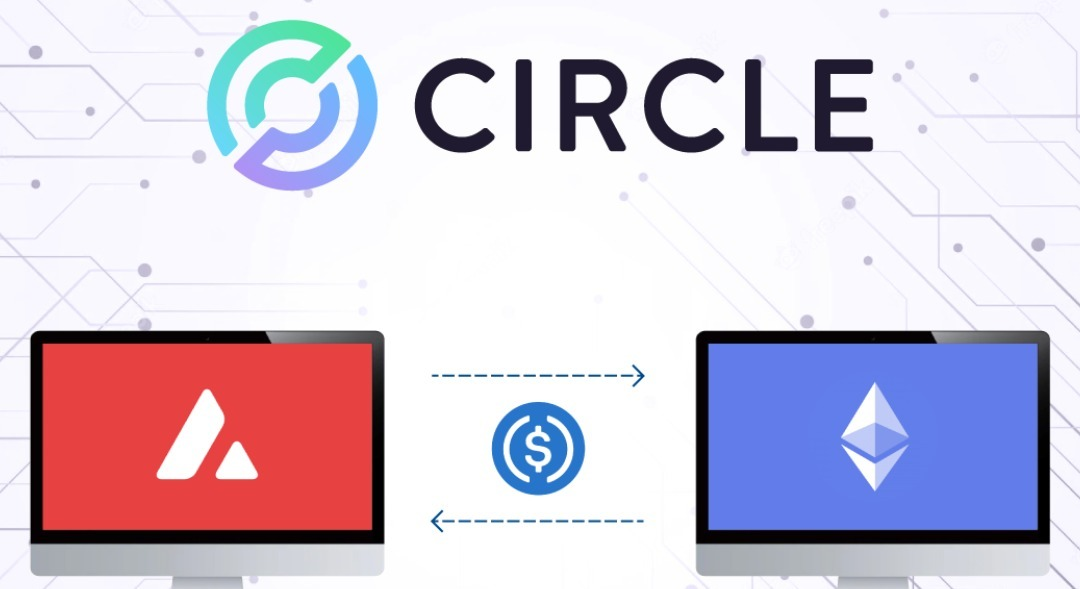

Initially, the CCTP technology will be used for USDC transfers between the Ethereum and Avalanche blockchains, with more chains to come in the second half of 2023. DeFi apps can integrate relevant smart contracts to make it easy for users to move their stablecoins.

The process works by destroying USDC on the source chain and recreating it on the destination chain, effectively eliminating the need for bridges and wrapped assets. This could have a significant impact on asset swaps, making it easier to move cross-chain and cross-token transfers behind the scenes.

Circle’s new technology also seeks to simplify the user experience for developers and users, providing a highly liquid, safe, and fungible asset in native USDC. This milestone makes USDC a natively multi-chain digital dollar.

Several infrastructure providers, including wallet company MetaMask, bridge operator Wormhole, and bridge aggregator LI.FI, will have CCTP coverage at launch, further expanding its reach and impact.

The release of CCTP marks a significant step towards a more integrated and efficient DeFi ecosystem, breaking down the barriers currently fragmenting USDC’s $30 billion market cap across many different blockchains. With more chains to come in the future, this technology has the potential to transform the way stablecoins and other assets are moved between blockchains, making it faster, safer, and cheaper than ever before.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)