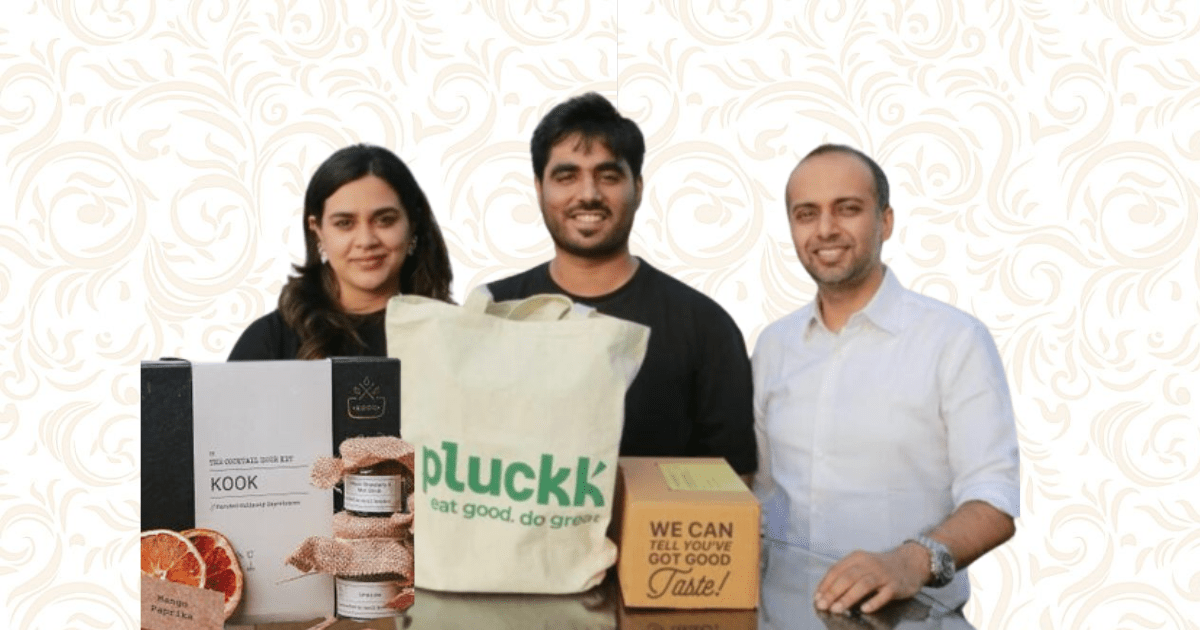

Foodtech startup Pluckk has acquired DIY meal kit platform KOOK in a cash and equity combination deal valued at $1.3 million. While Pluckk operates in Mumbai and Bengaluru, KOOK has its presence in Delhi and Mumbai.

According to Pluckk, the acquisition marks a significant step towards growth and its entry into the food kit market. The global meal kits market is projected to grow from $15.21 billion in 2021 to $31.5 billion by 2025, representing a 20% CAGR.

In a statement, Nelson D’Souza, CFO of Pluckk, said, “In the post-covid world, Ready to Cook Meal Kits have emerged as a sought after cooking trend with customers preferring to control the quality of food consumed while having more dining options which we look to leverage by offering this differentiator to our customer experience.” The acquisition of KOOK will help Pluckk accelerate its journey towards building a profitable business.

KOOK’s co-founder, Nikhil Thatai, said, “We estimate the market size of meal kits to be around $1 billion by 2025 in India and we look forward to leveraging our expertise in meal kit delivery to offer healthy and delicious meal options to cater to this booming market in our country.”

Pluckk claims that its products are ‘farm-to-fork’ and are chemical-free. The products are customised following different food trends, suitable for gut and heart health, diabetes, and include organic and exotic produce as well. Pluckk’s offerings are available on its own D2C website along with partner platforms including Blinkit, Swiggy, Zepto, Dunzo, and Amazon.

The Indian foodtech industry, especially the ecommerce sector, is seeing intense competition. While the online grocery delivery service has seen a surge since the pandemic-induced lockdowns, the cross-segment competition in a densely populated country like India has been intensifying. The battle isn’t smooth even for players such as Zomato, Swiggy Instamart.

Recently, Zomato-owned Blinkit faced a protest by delivery executives, causing it to shut down more than 100 of its dark stores. Further, over 1,000 delivery executives joined its competitors such as Swiggy Instamart, Zepto, and BB Now. Meanwhile, amid the funding crunch, food delivery app Swiggy has closed down its gourmet grocery delivery vertical Handpicked. However, users can continue to order groceries via Swiggy’s Instamart and InsanelyGood.

A MarketWatch report states that the growth of the online grocery and vegetables market is driven highly by increasing internet and smartphone penetration, and acceptance of online shopping by the population.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)