Equitas Small Finance Bank Limited, one of the leading SFBs, has announced a new tenure for Fixed Deposits in Domestic and NRE/ NRO Interest Rates Accounts. The revised interest rates will be effective from 05th June 2023.

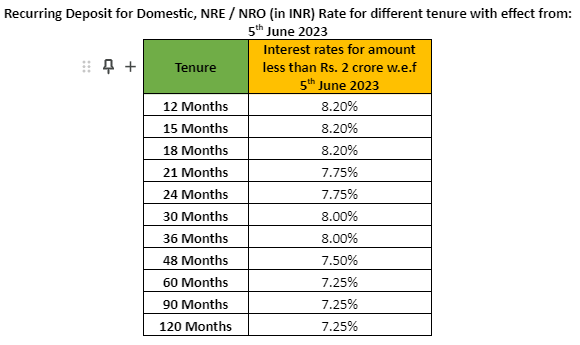

The bank has introduced a new slab of 444 days tenure that offers an interest rate of 8.5% for deposits less than INR 2 crore. The bank also continues to offer interest rates on RD investments for tenures ranging from 12 months to 120 months. Both domestic and NRE/ NRO account holders will be eligible to benefit from this new slab. Furthermore, domestic senior citizens will receive 0.50% extra on the FD and RD rates. The interest payouts will continue to be quarterly across all account types.

Murali Vaidyanathan, Senior President and Country Head, Equitas Small Finance Bank, said, “Equitas Small Finance Bank is happy to announce the new 444 days tenure for the savers’ community. This is an important deposit allocation for customers’ needs as it fits in goal-based planning for short-term and long-term vision with the best-in-class rate of return. We want to continue to promote a savings culture among our customers and provide them with maximum benefits, ultimately helping their money to grow. Now you can also book best-in-class rates FD through our online digital channels as it scores over the regular FD process in terms of convenience and ease of operation. A quick and convenient way to save money and maximise profits on maturity.”

For further information or any questions, please contact equitaspr@adfactorspr.com;

About Equitas Small Finance Bank Limited [ESFB]

Equitas Small Finance Bank is one of the largest small finance banks in India. As a new-age bank, we offer a bouquet of products and services tailored to meet the needs of our customers – individuals with limited access to formal financing channels, as well as affluent and mass-affluent, Small & Medium Enterprises (SMEs) and corporates. Our firmly-entrenched strategy focuses on providing credit to the unbanked and underbanked micro and small entrepreneurs, developing products to address the growing aspirations at the ‘bottom of the pyramid’, fueled by granular deposits and ‘value for money’.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)