B2B fintech solutions provider Zaggle has successfully secured INR 98 crore in two tranches as part of its pre-initial public offering (IPO) round, according to a tweet by the company. The funds raised will contribute to the company’s growth strategies as it moves towards its upcoming IPO.

Two Tranches of Pre-IPO Funding

In the first tranche, Zaggle secured INR 73 crore from a group of investors, including Vikasa India EIF I Fund and Acintyo Investment Fund PCC – Cell 1, as stated in a public notice shared by Zaggle. The second tranche involved the allotment of 15.24 lakh equity shares amounting to INR 25 crore to Value Quest SCALE Fund.

Board and Shareholder Approval

The pre-IPO funding round was carried out following the approval of the company’s board and shareholders during their meetings held on August 10 and 11, 2023, respectively. This strategic move reflects Zaggle’s commitment to enhancing its financial standing and positioning itself favorably for its impending IPO.

Zaggle Background and Growth Trajectory

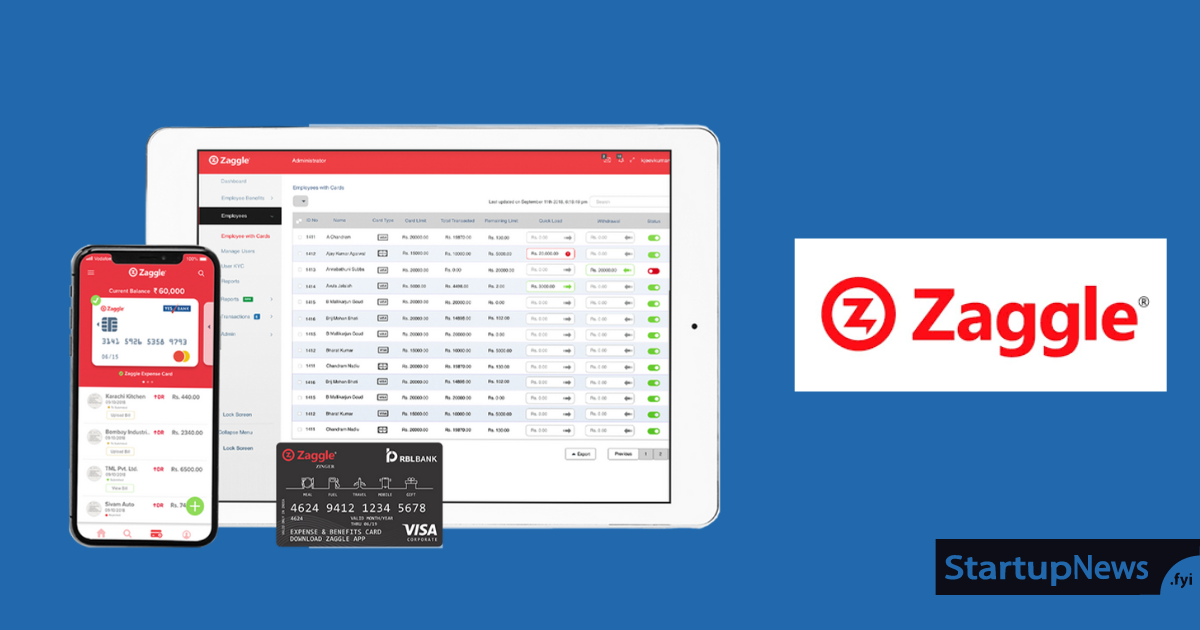

Zaggle, established in 2011, functions as a spend management and corporate employee benefits platform. The company helps businesses streamline financial operations. It offers automated accounts management. Zaggle issues prepaid cards through banking partners. It facilitates employee incentives and rewards.

Zaggle Positive Financial Performance and Future Prospects

Zaggle’s financial performance showcases remarkable growth. In FY22, the company’s after-tax profit (PAT) increased by 2.2 times to INR 41.92 crore from INR 19.33 crore in FY21. The revenue from operations went up from INR 239.97 crore in FY21 to INR 371.25 crore in FY22. According to its draft red herring prospectus (DRHP), Zaggle’s IPO plans comprise a fresh issue of equity shares amounting to INR 490 crore, along with an offer for sale component of up to 1.05 crore equity shares.

The IPO market for tech startups is picking up pace after a quiet period. Zaggle’s funding achievement matches this positive trend. Other startups are also experiencing prosperous listings and strong debuts on stock exchanges. Analysts anticipate a market turnaround in the latter half of the year. This provides optimism for startups aiming to expand and grow through IPOs.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)