India FinTech Forum’s IFTA has announced its 8th edition where it will showcase 24 high-potential startups and 6 scaleups, leading innovations in the financial technology sector.

According to a statement, The startups, shortlisted from over 1250 applications from various countries, will be meticulously evaluated by a distinguished jury. It will announce the winners at IFTA 2023 on 1st November in Mumbai, with the event featuring online sessions on 30th and 31st October.

Sougata Basu, Founder, CashRich and Executive Committee Member, IFF, says, “At IFTA, this year’s shortlisted startups shine with enormous potential. Past winners at IFTA include Razorpay, Open, Simpl, and Pismo (acquired by Visa for $1 billion in 2023), and they exemplify the transformative power of business innovation. With a member base of over 4,000 fintech companies and over 35,000 individuals, India FinTech Forum continues to promote purpose- driven innovation.”

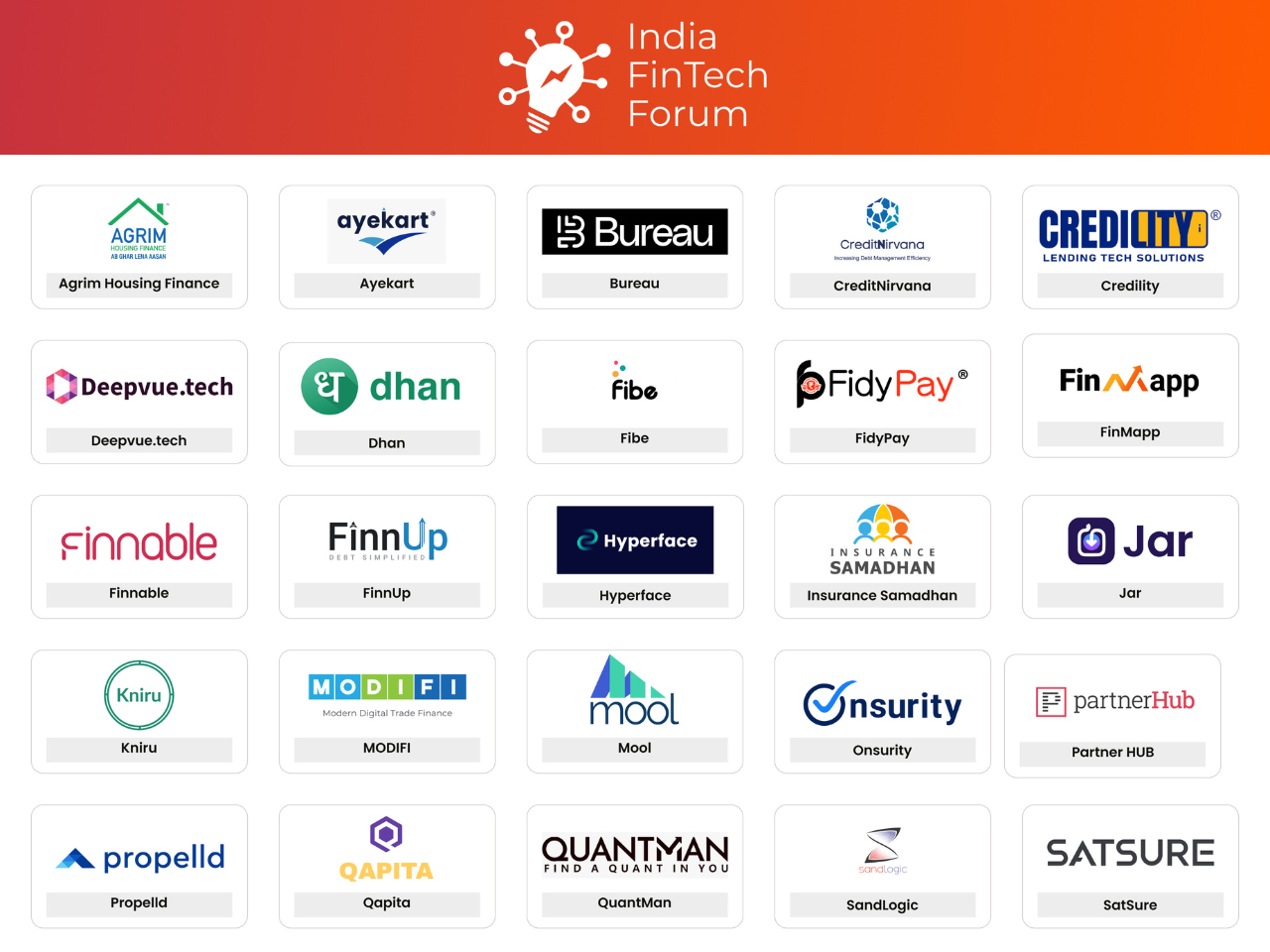

Meet the India FinTech Forum listed high-potential startups:

Agrim Housing Finance is working to empower underserved communities by providing digital home loans through advanced technology and innovative algorithms.

Ayekart Fintech is digitizing the food & agri value chain, empowering traditional business networks with embedded finance and services.

Bureau offers a no-code, identity decisioning platform, providing a range of risk, compliance, and fraud monitoring solutions, innovated with AI.

CreditNirvana is pioneering a digital-first, end-to-end Debt Management Platform driven by ML Analytics.

Deepvue.tech provides APIs to help businesses perform automated KYC, enhanced due diligence checks, and risk-based underwriting.

Dhan is an online stock trading and investing platform aiming to provide best-in-class features at industry-standard pricing.

FidyPay simplifies payment processes for businesses by automating transaction mapping and centralizing reconciliation.

FinMapp offers a mobile app solution for those lacking financial literacy, providing financial health gap assessment, tax planning, and a comprehensive suite of financial products.

FinnUp is building a world-class B2B enterprise debt platform serving all types of debt requirements to SMEs, Large Corporates, and Financial Services.

Hyperface is a pioneering Credit Cards as a Service (CCaaS) platform, enabling banks and fintechs to launch and manage their card program quickly within regulatory guidelines.

Insurance Samadhan offers Polifyx, a mobile application revolutionizing the insurance industry by resolving policyholder grievances through a tech-enabled platform.

Jar is built on the idea of helping people make investing a habit, providing a unique solution to save money daily and invest automatically in digital gold.

Kniru is an AI-driven financial advisor who manages finances with minimal human involvement, providing precise, personalized, actionable insights.

MODIFI (Netherlands) is a global business payments company that helps exporters and importers finance and manage their international trades.

Mool is an AI-powered system that maximizes the employee’s benefits from their salary package, tailored as per their preferences while remaining compliant with tax rules and regulations.

Onsurity is a healthtech company providing comprehensive employee healthcare to SMEs, MSMEs, Startups, and growing businesses.

Propelld provides student-friendly private study loans for learners in partner institutions with customized loan products through a fully digital loan process.

Qapita (Singapore) automates equity management for private companies from inception to IPO & beyond.

QuantMan provides robust backtesting features with 5 years of options data, where years of testing process is done in less than 90 seconds, and live order execution is fully automated.

SandLogic is a full-stack enterprise AI company that provides LCNC platforms to develop Deep Learning applications to run on Edge devices.

SatSure leverages satellite imagery and offers accurate risk assessment, customer sourcing, and portfolio monitoring for better lending decisions in agricultural lending.

SaveIN enables healthcare providers to offer instant, check-out finance to their patients, embedded at the point of care, thereby splitting medical expenses into 0% interest or low-cost EMIs.

Tutelar offers solutions for risk-protected onboarding, compliance, payment fraud detection, and dispute management.

Volt Money allows retail investors to avail cash loans, credit lines, and flexible EMIs against financial assets like mutual funds instantly, keeping their financial assets intact

The 6 shortlisted startups for the fintech scaleup of the year category

Additionally, The six startups have been shortlisted for the Fintech Scaleup of the Year category, including Credility (India) and Fibe (India), evaluated based on their products, services, and the traction they have built.

Credility: The startup is focused on providing lending tech solutions. It empowers loan officers to manage and qualify leads effectively and onboard potential customers swiftly.

Fibe: Fibe targets the young and tech-savvy demographic, offering instant cash loans swiftly, even to those new to credit, by utilizing innovative credit scoring systems for superior customer profiling.

Finnable: Finnable strives to provide hassle-free personal loans to all salaried professionals promptly, leveraging technology and innovation, and supported by employers.

Partner HUB (Hungary): This company offers a white-label solution for integrating e-invoicing and financial services, allowing banks to participate in open finance and open data ecosystems by utilizing the value in invoice data.

Think360.AI: A leading AI technology firm, Think360.AI is dedicated to serving the BFSI sector with alternate data, analytics, and a modern technology stack to revolutionize credit decisioning, fraud detection, risk assessment, and customer onboarding.

Trustt: Trustt provides an AI-powered SaaS-based Core Banking Platform to banks, NBFCs, and fintechs, offering a range of products including digital lending, digital distribution, digital identity, and payments, all customized to meet the specific needs of each client.

What is IFTA?

IFTA has a rich history of spotlighting startups that have achieved remarkable success, with past winners having raised over $6.3 billion in investor funding to date. IFTA 2023 will feature participation from top industry leaders, including representatives from the State Bank of India, the Bill & Melinda Gates Foundation, Reliance Jio Payments Bank, and YES Bank, among others.

The India FinTech Forum, a non-profit initiative, serves as a collaborative platform for more than 4000 fintech companies and over 35,000 individuals, dedicated to enhancing the fintech ecosystem and ensuring that India leads the global fintech innovation wave.

Also Read:

MyMandi catering to cart-pushers raises Rs 10 crore from Real Time Angel Fund

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)