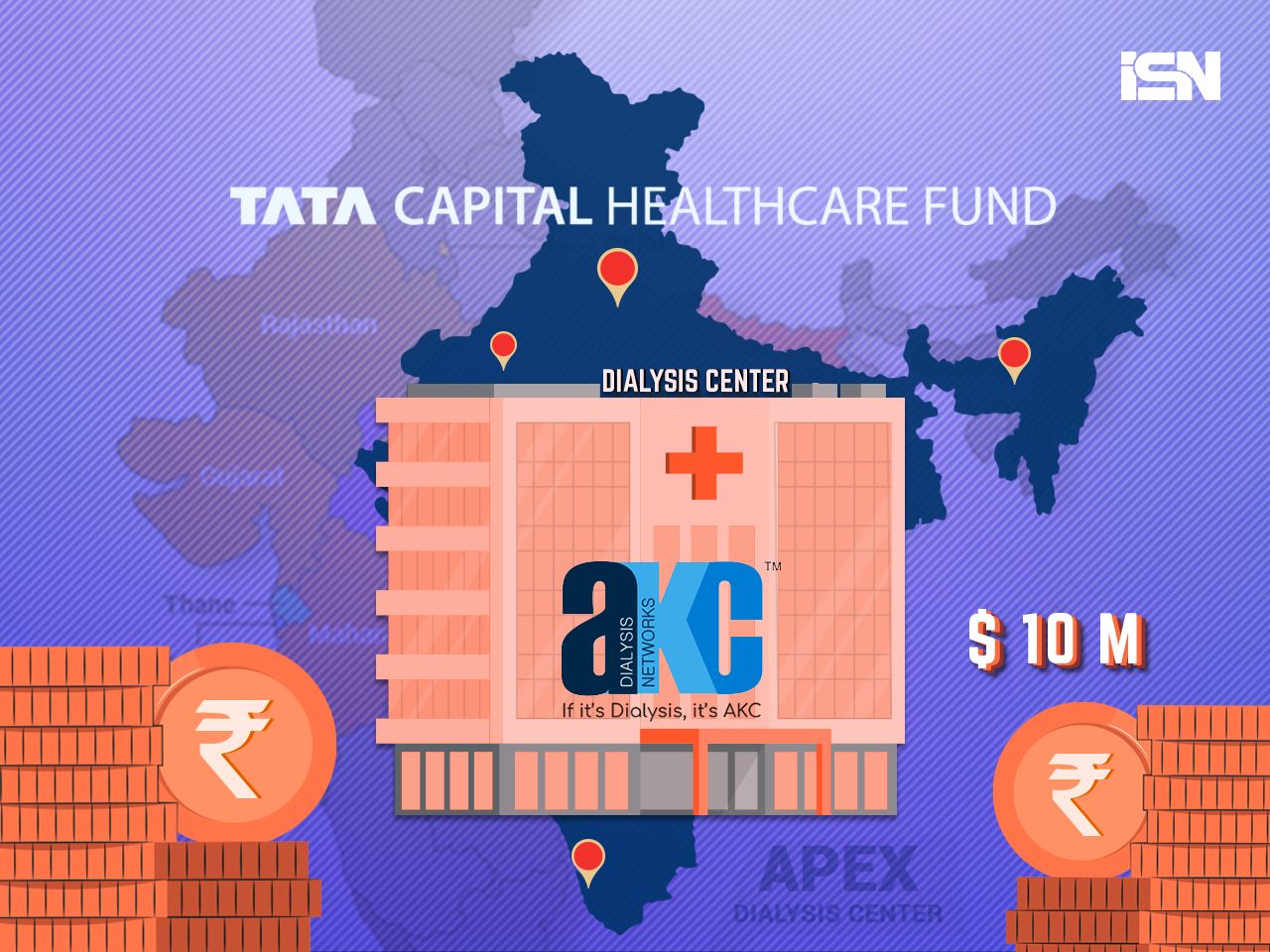

Tata Capital Healthcare Fund II (TCHF II), a private equity fund from the Tata Group that focuses on growth-stage healthcare companies, has invested $10 million in Apex Kidney Care (AKC), a Mumbai-based dialysis chain.

The development comes at a crucial time when India is grappling with a significant gap in its healthcare sector, particularly in the realm of dialysis services.

India, with an estimated 2 million Chronic Kidney Disease (CKD) Stage-5 patients and an additional 0.2mn to 0.22mn new CKD-5 patients annually, conducts approximately 21 million dialysis sessions each year, satisfying a mere 11% of the country’s overall annual requirement.

How will AKC utilize the investment?

AKC intends to utilize the fresh capital to expand its dialysis operations across India, addressing the stark need gap caused by challenges in accessibility, affordability, and compliance in the healthcare sector.

Indranil Roy Choudhury, CEO of Apex Kidney Care, said the funding will boost and enhance their service capabilities and play a pivotal role in realizing their mission of establishing a compassionate and transparent kidney care ecosystem, focused on achieving desired treatment outcomes for patients.

The medium-term capital expenditure is anticipated to be around Rs 150 crore, primarily funnelled towards scaling up private sector businesses, including standalone centres, in-hospital centres, and home dialysis services.

What does the funding mean for the dialysis sector in India?

The investment and subsequent expansion come as a beacon of hope for the dialysis sector in India. AKC, which currently operates 6 standalone centres, aims to escalate this number to over 60 in the medium term.

The company claims that it manages 61 centres with hospitals and nursing homes and operates 84 centres under the Public-Private Partnership (PPP) model in collaboration with government and municipal bodies.

The company said that the expansion is particularly crucial considering the substantial annual addition of CKD-5 patients and the palpable deficiency in available healthcare services to cater to them.

How does the investment align with TCHF II’s investment philosophy?

Vamesh Chovatia, Partner at TCHF II, highlighted the fund’s holistic investment approach, underscoring their commitment to supporting companies like AKC that strive to bridge glaring gaps in healthcare.

TCHF II, which has invested nearly US$ 200 million across two funds and has engaged in investments with 16 companies, aligns its investment strategy with backing entities that address evident healthcare shortfalls and demonstrate a robust and scalable operational model.

The fund, which has successfully exited 6 companies so far, continues to channel its investments towards the healthcare and life sciences sectors in India, fostering growth, innovation, and enhanced service delivery in these critical domains.

Also Read:

AI-powered IT management SaaS platform SuperOps.ai raises $12.4M in a Series B round

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)