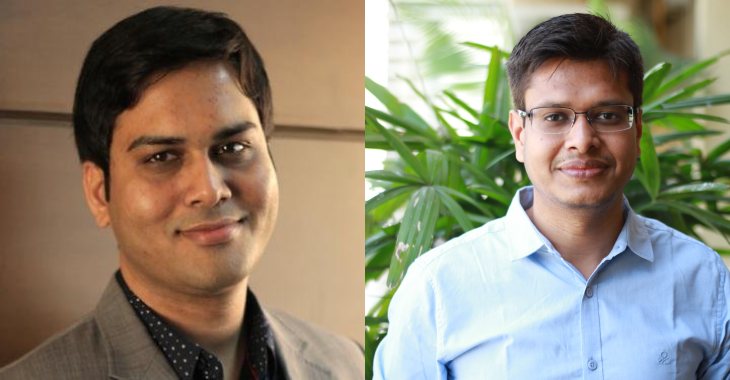

Harshvardhan Lunia, Co-founder and CEO of Lendingkart, and Jitendra Gupta, Founder and CEO of Jupiter, have assumed leadership roles as the new Chairman and Co-Chair of the Fintech Convergence Council (FCC) within the Internet and Mobile Association of India (IAMAI). This transition follows an election and sees them taking over from Naveen Surya and Srinivas Jain.

Established in 2018, the FCC serves as an advocate for the fintech sector, with a specific focus on digital lending, P2P lending, insurance, investments, and regtech. As part of IAMAI, it represents members and fosters collaboration and convergence among diverse stakeholders in the financial services landscape through a self-regulatory mechanism.

Harshvardhan Lunia, a chartered accountant and graduate of the Indian School of Business, brings over 10 years of experience, having commenced his career with leading private sector and multinational banks like HDFC Bank and Standard Chartered Bank.

Expressing enthusiasm about his new role, Lunia stated, “I am thrilled to join the Fintech Convergence Council (FCC) as its new Chair. The FCC is a leading voice for the fintech industry, and I am committed to working with the Council’s members to shape the future of finance. I am positive that my experience will be useful while collaborating with leading lights of the industry.”

Jitendra Gupta, with more than 16 years of experience and a founder portfolio that includes Jupiter, Lazypay, and Citrus Pay, has also served as MD of PayU and Chief Manager of Investment Banking at ICICI Bank.

Expressing gratitude for the opportunity, Gupta commented, “I am thankful to the industry for providing the opportunity to serve as Co-Chair of the Fintech Convergence Council… We will continue to progress on the FCC’s work in the areas of digital lending, DFSP, Insurtech, investment, Regtech, and P2P lending. We will work with respective regulators to drive independent SROs in areas of lending or fintech in general.”

In addition to these appointments, the FCC announced the selection of new chairs and co-chairs for its six other committees, covering aspects such as digital lending and investment. These developments are significant in light of recent regulatory measures by the Reserve Bank of India, impacting the fintech sector. The RBI’s decision to increase the risk weight for unsecured consumer credit exposure is expected to influence the cost of capital for fintechs. The evolving fintech landscape in India, marked by a surge in startups and the digitization of financial services, underscores the relevance of leadership roles within industry associations like the FCC.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)