Call it the year of a prolonged funding winter or the year of corrections, the fact is that investors have not forgotten how their funding was burnt ruthlessly in the name of the rapid expansion of half-done business models and whatnot.

As a result, funding dry spell remained a norm throughout the year, and the world’s third-largest startup ecosystem couldn’t help but mint only one unicorn in 2023 versus 21 in 2022 and 44 unicorns in 2021.

Towards the end of last year, positive anticipations had held their heads high as industry experts saw a funding revival on the cards. However, much to everyone’s dismay, the funding winter seeped into 2023, and the Indian startup ecosystem saw a 75% year-on-year decline in funding in the first quarter (Q1) of 2023.

Besides, the number of deals, too, nosedived 58% YoY to 213 during the quarter under review from 506 in the year-ago quarter.

What triggered this was the inability of a majority of Indian startups to turn a profit, particularly at the late stage.

Corrections continued unabated and the funding winter stretched well into Q3 CY23, marking its 18-month-long journey.

According to Inc42’s latest “Indian Startup Funding Report Q3 2023”, startup funding stood at a mere $1.7 Bn in Q3 2023, the lowest in the past three quarters. On the year-on-year (YoY) basis, it fell 43.8%, while the number of deals declined 38.6% to 205 from 334 deals in Q3 2022.

However, something was different this time. Industry experts saw the country’s startup ecosystem heading towards a renaissance, with founders taking lessons from the likes of Broker Network, BYJU’S, Mojocare, Zilingo, ZestMoney, GoMechanic, just to name a few bad apples.

Interestingly, a keen focus on positive unit economics and effective corporate governance practices was seen returning to the system. Not just this, but away from the gloom and doom, many startups turned profitable this year.

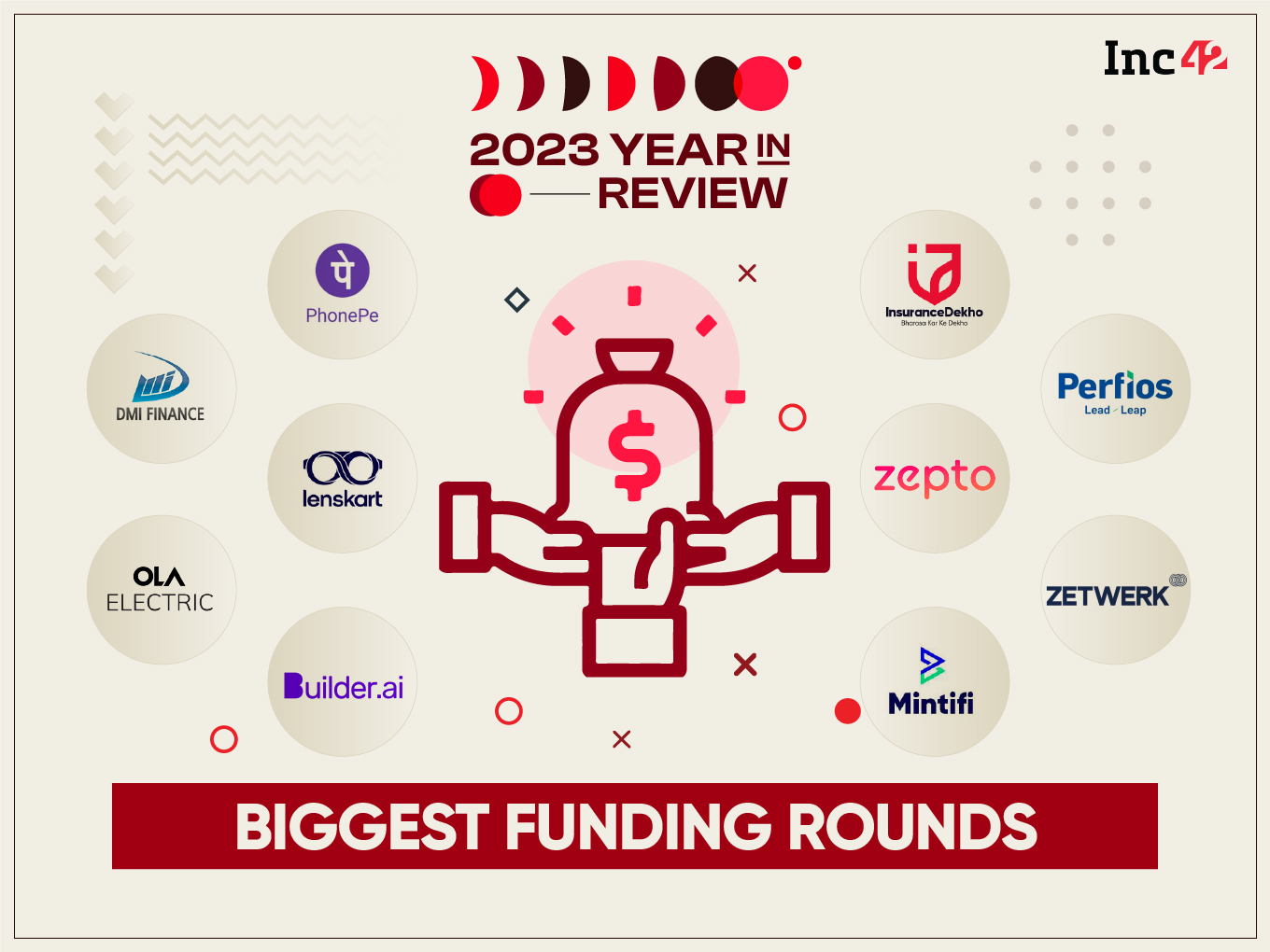

Nevertheless, while the year 2023 had its own set of challenges in terms of investors further tightening their purse strings despite sitting on billions of dollars of dry powder, silver linings did exist. And amid all this, some of the most noteworthy funding deals were inked.

As we stand at the precipice of 2024, we have compiled a list of some of the biggest startup funding deals of the year.

Here Are 2023’s Highest Funded Startups

PhonePe Tops The Charts With A Mammoth $850 Mn Raised In 2023

Even as the entire Indian startup ecosystem was struggling to raise capital and was gripped by funding winter in 2023, investors continued to flock to invest in Walmart-owned fintech startup PhonePe.

This was evident by the fact that the finch decacorn secured a mammoth $850 Mn (INR 7,021 Cr) in funding during the year, at a valuation of $12 Bn.

In what was touted as the largest equity fundraise by an Indian startup, the cash infusion saw participation from big names including Walmart, Ribbit Capital, Tiger Global, TVS Capital Funds, and General Atlantic, among others.

Of its stated intention to raise $1 Bn in 2023, PhonePe achieved 85% of its target while many other unicorn peers were mired in valuation markdowns and paucity of funds.

The move to raise big-ticket funding rounds was likely attributed to the INR 8,000 Cr tax liability on account of shifting headquarters to India and to fuel its growth ambitions ahead of the planned IPO.

Since securing the capital, the company has undertaken a blitzscaling approach – introducing a slew of new products and foraying into new categories such as income tax payment and health insurance.

PhonePe also plans to introduce a range of consumer credit products in the coming six to seven months to bolster its lending play.

Founded in December 2015 by Sameer Nigam, Rahul Chari, and Burzin Engineer, PhonePe is a digital payments and financial services company. It claims to have more than 400 Mn registered users that use its products across the country.

The Bengaluru-based startup recorded a revenue of INR 2,914 Cr in the financial year 2022-23 (FY23), up almost 77% from INR 1,646 Cr in FY22. The startup didn’t disclose its net loss for the financial year ending March 2023.

The fintech platform competes against the likes of Paytm, Google Pay, and CRED in UPI transactions.

Lenskart Fancied A Solid At $600 Mn In 2023

Eyewear unicorn Lenskart successfully secured $600 Mn in 2023, with a significant portion of $500 Mn coming from the Abu Dhabi Investment Authority (ADIA) and an additional $100 Mn from private equity player ChrysCapital. The investments propelled Lenskart’s total capital infusion to nearly $850 Mn.

According to Inc42, Lenskart raised $879.6 Mn in funding between 2014 and November 2022. The Faridabad-based eyewear brand has raised more than $205 Mn since the beginning of 2022 alone.

Established in 2010, Lenskart stands as India’s largest omnichannel eyewear retailer, extending its reach to Singapore, the UAE, and other geographies. The company currently boasts a customer base of 20 Mn in India.

Lenskart is aggressively expanding internationally, particularly across Asia and the Middle East. In June last year, the ecommerce platform made headlines by acquiring Japan’s largest online eyewear brand, OWNDAYS, in a deal valued at $400 Mn.

With over 2,000 stores, including 1,500 in India and the remaining spread across various geographies, Lenskart is positioned for further growth.

Earlier this month, the eyewear brand announced that it was set to strengthen its presence in Southeast Asia (SEA) by launching 300-400 stores in the region over the next two years.

With approximately 70 stores currently operational in Singapore, the Delhi NCR-based unicorn plans to extend its footprint to Thailand and the Philippines.

The company’s FY23 profit stood at INR 260 Cr against a loss of INR 100 Cr in FY22, the company’s founder and CEO Peyush Bansal told ET in an interview. The startup also reportedly more than doubled its revenue to INR 3,780 Cr.

Lenskart has also ventured into the creation of a Thrasio-styled eyewear-focussed ecommerce roll-up brand, Neso Brands. To further broaden its customer base, the company is actively engaged in vertical integration through a new manufacturing facility, enabling the brand to maintain competitive pricing.

DMI Finance Lapped Up $447 Mn From Multiple Investors

In April this year, Mumbai-based DMI Finance secured $400 Mn in a funding round led by Mitsubishi UFJ Financial Group. Investor Sumitomo Mitsui Trust Bank (SuMi TRUST Bank), too, participated in the funding round, which included both primary and secondary transactions.

In January last year, the NBFC arm of the DMI Group raised $47 Mn in an equity round from Sumitomo Mitsui Trust Bank and existing investors NXC Corporation and New Investment Solutions.

With this year’s funding round, the total funding raised by the non-banking financial company (NBFC) has reached $900 Mn.

Founded in 2008 by Shivashish Chatterjee and Yuvraja C Singh, DMI Finance is a pure-play digital lender. It extends credit lines in the form of personal and MSME loans. DMI Finance sources and services customers through digital channels. It is an embedded digital finance partner for the likes of Samsung, Google Pay and Airtel.

Ola Electric’s $384 Mn Funding Buffet

In October this year, Bhavish Aggarwal-led Ola Electric secured INR 3,200 Cr ($384 Mn) in a combination of equity and debt to fuel the expansion of its EV business and establish India’s first lithium-ion cell manufacturing facility in Krishnagiri, Tamil Nadu.

Temasek spearheaded the equity portion, while the State Bank of India led the debt segment of the funding.

The company lapped up funds at a time when it was alleged of violating FAME-II subsidies norms. Besides, allegations of sub-par quality of its scooters and concerns with after-sales service have continued to shroud the EV maker for long.

Despite this, investors see a lot of potential in Ola Electric, which now plans to file its IPO papers before December 20. The startup plans to raise $700 Mn and is looking to target a market capitalisation of $10 Bn through its IPO.

Founded on May 26, 2017, under the leadership of Bhavish Aggarwal, Ola Electric is a subsidiary of Ola and operates as an Indian electric two-wheeler manufacturer. The company is headquartered in Bengaluru, Karnataka.

In October, electric two-wheeler registrations in India surpassed 70,000 units after four months. Despite facing controversies, Ola Electric’s escooter registrations continued to lead the market.

In the meantime, the startup expanded its product line, launching the Ola S1X escooter model in August shortly after delivering the Ola S1 Air model to customers.

Ola Electric’s net loss almost doubled to INR 1,472 Cr in FY23 from INR 784.1 Cr in FY22 due to a steep rise in expenses.

Its consolidated revenue during the fiscal surged 510% YoY to reach INR 2,782 Cr in FY23. The EV startup aims to garner revenue of INR 4,655 Cr in FY24.

Builder.ai Received A $250 Mn Qatar Investment Authority Boost

London-based AI startup Builder.ai raised $250 Mn in a Series D funding round led by Qatar Investment Authority (QIA). Other investors who backed the startup included Iconiq Capital, Jungle Ventures, and Insight Partners.

In a statement, the Microsoft-backed startup revealed that the funding round resulted in a valuation increase of over 1.8X.

Builder.ai had raised the funds for hiring new talent, fostering partnerships, and advancing its technology.

The company claims to have doubled its headcount since January 2022 and expanded its global presence with the opening of four new offices in the US, the UAE, Singapore and France.

With its last funding round, Builder.ai’s total funding now stands at over $450 Mn.

Founded in 2016 by Sachin Dev Duggal and Saurabh Dhoot in Gurugram, Builder.ai offers a platform for entrepreneurs to build apps without little to no coding knowledge using AI.

InsuranceDekho Lapped Up $210 Mn To Disrupt Insurtech Sector

Insurtech startup InsuranceDekho raised $210 Mn across two funding rounds in 2023 to expand its presence across the country.

In February, the startup raised $150 Mn in a Series A funding round, which was a mix of equity and debt. The equity round was led by Goldman Sachs Asset Management and TVS Capital Funds, and also saw participation from Investcorp, Avataar Ventures and LeapFrog Investments

Almost seven months after this, InsuranceDekho secured $60 Mn in a mix of equity and debt in its Series B round. It saw participation from Mitsubishi UFJ Financial Group, Inc, BNP Paribas Cardif, Beams Fintech Fund and Yogesh Mahansaria Family Office. Existing investors TVS Capital, Goldman Sachs Asset Management, and Avataar Ventures also participated in the round, which valued the startup at around $650 Mn-$700 Mn.

The insurtech soonicorn said it planned to utilise the capital to enhance marketing efforts, expand distribution in rural India, scale up its tech platform, and explore inorganic growth opportunities.

Founded by Ankit Agrawal and Ish Babbar in 2017 as the insurance arm of online car marketplace CarDekho, InsuranceDekho received $20 Mn from its parent firm Girnar Software in 2020. Later, it was hived off to function as a separate unit. The platform allows users to compare and buy insurance from top companies. The insurtech platform offers motor, life, health, pet, and travel insurance.

The startup reported a 29% decline in its net loss to INR 51.5 Cr in FY23 from INR 72.2 Cr in the previous fiscal year. Operating revenue doubled to INR 96.4 Cr from INR 47.9 Cr in FY22.

Perfios Inked $229 Mn Funding Deal With Kedaara Capital

In September, Bengaluru-based fintech SaaS startup Perfios signed an agreement with Kedaara Capital for an investment of $229 Mn in the startup’s Series D funding round through the combination of a primary and a secondary sale.

The investment had come almost 19 months after Perfios raised $70 Mn at a valuation of $400 Mn.

The funds were intended to fuel its global expansion plans, particularly into North America and Europe. Additionally, the startup had planned to invest in technology to enhance its comprehensive suite of decision analytics SaaS products.

Founded in 2008 by VR Govindarajan and Debasish Chakraborty, Perfios is a credit decisioning and analytics startup, which operates in B2B and B2C segments. Currently operating in 18 countries, it claims to be working with over 1,000 financial institutions.

According to the company, it delivers 8.2 Bn data points to banks and financial institutions every year to facilitate faster decisioning and processes 1.7 Bn transactions a year with an AUM of $36 Bn.

Fintech SaaS startup Perfios turned profitable in FY23, posting a consolidated net profit of INR 7.8 Cr on the back of a significant jump in its service income from India business.

The startup reported a net loss of INR 16.8 Cr in FY22 on an operating revenue of INR 136.5 Cr.

Zepto Turned Unicorn With $200 Mn Funding Round

Mumbai-based quick commerce unicorn Zepto successfully raised $200 Mn in its Series E funding round in August at a valuation of $1.4 Bn, becoming the first and only unicorn of 2023. Without disclosing how it planned to use the fresh capital, the startup said it plans to go public by 2025.

Later in November, Zepto raised an additional $31.25 Mn as part of the Series E funding round from Goodwater Capital and Nexus Venture Partners, along with the participation of angel investors such as Oliver and Lish Jung, and Mangum II LLC.

Founded in 2021 by Aadit Palicha and Kaivalya Vohora, Zepto seized the opportunity created by the increased demand for rapid ecommerce delivery during the Covid-19 pandemic. The startup gained attention when it secured $60 Mn in funding in November 2021 from investors like Glade Brook Capital, Nexus, and Y Combinator.

Zepto competes against the likes of Swiggy’s Instamart, Zomato-owned Blinkit, and Reliance-backed Dunzo.

Zepto’s net loss surged 3.35X to INR 1,272.4 Cr in FY23 from INR 390.3 Cr in the previous financial year. Revenue from operations zoomed 14.3X to INR 2,024.3 Cr during the year under review from INR 140.7 Cr in FY22.

B2B Manufacturing Unicorn Zetwerk Secured $120 Mn In Series F

In October, B2B ecommerce unicorn Zetwerk raised $120 Mn in its Series F funding round, which was led by Avenir Growth Capital and saw participation from existing investors Lightspeed, Greenoaks Capital, and Steadview Capital.

Additionally, the B2B unicorn secured INR 100 Cr (around $12 Mn) in debt funding in March this year.

Notably, Zetwerk raised $210 Mn at a valuation of $2.7 Bn in a round led by Greenoaks in December 2021.

Founded in 2018 by Amrit Acharya, Srinath Ramakkrushnan, Rahul Sharma and Vishal Chaudhary, Zetwerk connects manufacturing companies with vendors and suppliers for customised products, industrial machine components and other equipment.

Zetwerk has raised nearly $674 Mn in funding since its inception. The B2B unicorn competes with the likes of Infra.Market, Moglix and OfBusiness.

While the unicorn has yet to file its financials for FY23, it posted a loss of INR 59.7 Cr in FY22, up 45% from INR 41.1 Cr in FY21.

Last year, Zetwerk went on an acquisition spree, picking up four companies between July and November 2022 for a total of $50 Mn.

Mintifi Raised $110 Mn To Give Indian SMEs A Lending Push

In March, the B2B digital lending startup, Mintifi, announced that it raised $110 Mn (INR 902 Cr) in a Series D funding round led by Premji Invest.

The startup’s existing investors, Norwest Venture Partners, Elevation Capital, and International Finance Corporation (IFC), too, participated in the round.

Mintifi had raised the funds to deepen its presence in the supply chain financing domain and expand its product range. The startup also intended to deploy investments towards scaling up the B2B payments vertical and dealer management system.

A part of the funds was put aside to strengthen the tech stack and enhance engagement. The investment also enabled Mintifi to expand its capital base for credit purposes to more than $600 Mn.

The post title=”Big Money Moves: Here’s The List Of India’s 10 Highest Funded Startups Of 2023″ href=”https://inc42.com/features/big-money-moves-heres-the-list-of-indias-10-highest-funded-startups-of-2023/”>Big Money Moves: Here’s The List Of India’s 10 Highest Funded Startups Of 2023 appeared first on Inc42 Media.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)