Tesla’s now-on, now-off India entry is uncertain as usual, with the latest media report suggesting it may not happen until the end of 2023. However, India has seen a remarkable surge in electric vehicle (EV) sales this year, with more than 100K EVs sold per month. It is worth noting that these sales figures don’t include the low-speed electric vehicles that do not need registration.

According to the Ministry of Road Transport and Highways, more than 1.1 Mn have been registered as EVs in the current calender year 2023. Out of these, 500K+ are two-wheelers (2Ws) and 350K+ are three-wheelers (3Ws).

lockquote>

As EV sales continue to rise despite a global semiconductor shortage and a general scarcity of raw materials, ‘green mobility’ enthusiasts remain only too vocal about the simplified mechanics of these vehicles and their ultimate advantage. An EV has around 200 moving parts, as opposed to more than 1,000+ moving parts found in conventional petrol or diesel cars with internal combustion engines (ICE).

Therefore, electric vehicles might require fewer repairs than their ICE counterparts, and repairing/servicing could be less expensive for EV users.

Setting up charging stations at showrooms and service centres will enable dealers to transform their service areas and cater to EV requirements. Plus, it will earn them incentives as EV manufacturers and all related service providers get subsidies under FAME II (Faster Adoption and Manufacturing of Electric and Hybrid Vehicles in India, Phase II) and various state policies.

Also, the widespread adoption of electric models may reduce India’s overdependence on imported crude and its derivatives, currently catering to more than 85% of the country’s total energy consumption. This has raised severe economic concerns as India’s trade deficit continues to widen due to pricier oil, influenced by international market dynamics and policies of oil-exporting nations.

Consider this. The country spent a staggering $145 Bn+ on crude imports in FY22, equivalent to 4% of its GDP for that year. And the export-import gap reached $24.16 Bn in August 2023, the biggest ever since a $26.9 Bn deficit in October last year.

In contrast, power tariffs in India are relatively stable, unlike the drastic fluctuations in petrol and diesel prices. Hence, the additional power usage tends to impact EV users less instead of compounding the financial burden on average citizens. However, there are challenges associated with equitable power distribution across the country, which may increase the overall costs of EV ownership.

Moreover, ICE vehicles are notorious for their low power efficiency. Their energy usage is around 20%, while the rest is wasted as heat. On the other hand, EVs have high energy efficiency levels, ranging from 87% to 95%, meaning they convert a high percentage of the energy into useful propulsion. This explains why EVs are the ubiquitous choice as a green and affordable mobility option, even though they own just a tiny slice of the global auto market (15% of total sales, according to Statista).

But here lies the catch.

The Indian government has already announced its EV 2030 goals, intending to replace 30% of private cars, 70% of commercial vehicles and 80% of two- and three-wheelers with EV options. But how many Indians will be able to own one even when tax incentives and fuel savings are factored in?

Even in a high-income and credit-powered society like the US, Musk has recently drawn flak for slashing the prices of two Tesla models. Those who protested were aggrieved customers who had to pay in full before price drops came to boost Tesla sales.

No doubt, a price-conscious Indian market requires a thorough analysis to understand if buying an EV is more affordable now – whether loan rates and insurance costs are competitive or remain out of bounds for most people keen to make an EV purchase. In this article, we will do a detailed cost analysis to answer the following:

- Is EV ownership still costlier compared to ICE vehicles?

- Are interest rates on EV financing higher than what is charged for conventional vehicle loans?

- Is the insurance cost for EVs higher?

Electric Or ICE Vehicle: What’s Going To Cost Users More?

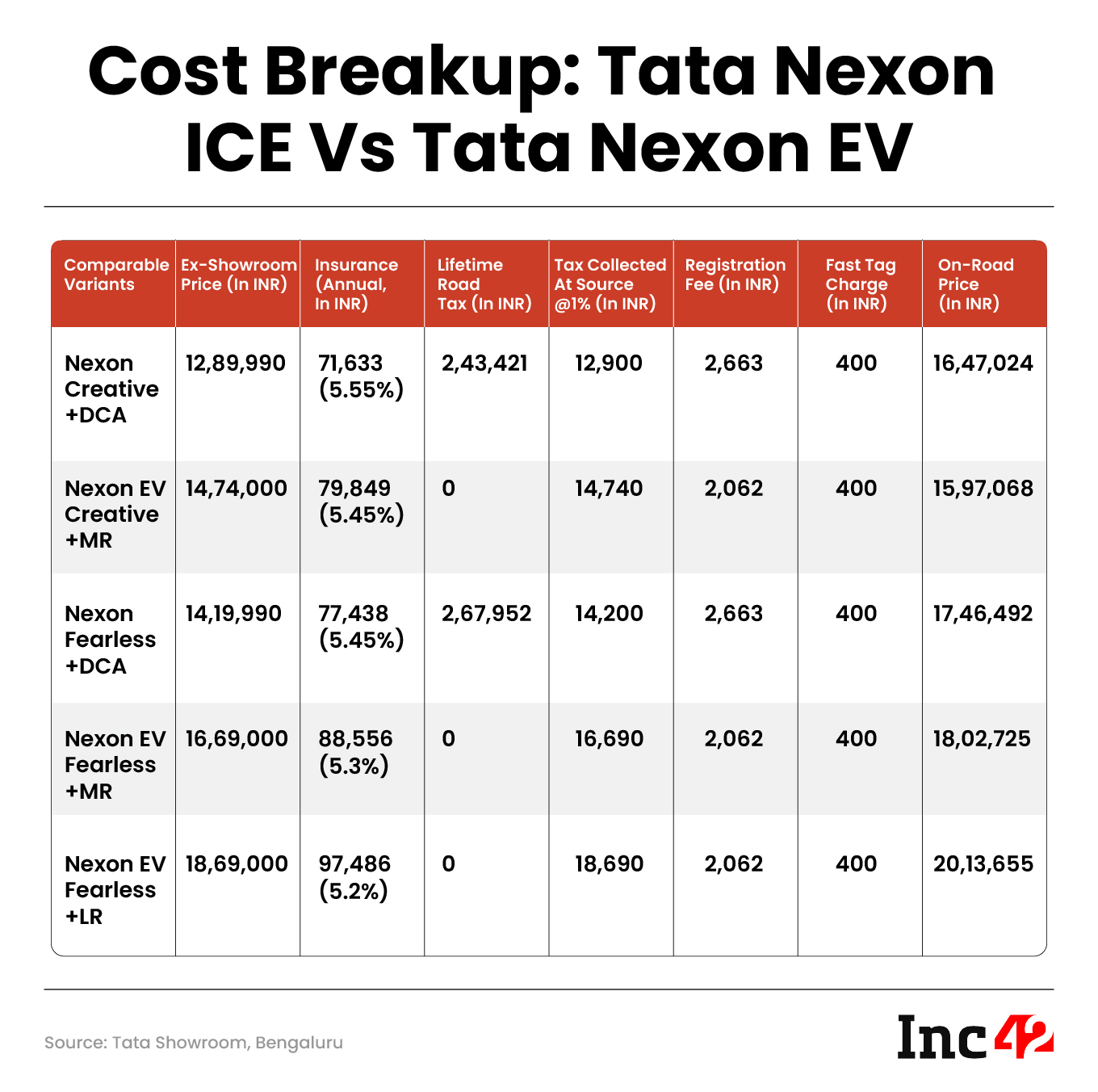

To assess the cost of owning an EV versus an ICE vehicle, we have compared the ex-showroom and on-road prices of Tata Nexon and Tata Nexon EVs at a Bengaluru dealership. A direct comparison of the similar models reveals a relatively modest price disparity ranging from (-) INR 50K to (+) INR 56K.

But when we compared a long-range variant with a larger battery, the price gap stretched to INR 2.6 Lakh.

It is worth noting that people often compare EVs with manual/standard-transmission ICE vehicles. MTs, where drivers manually do gear changes with the help of a gear stick, are cheaper than their automatic counterparts.

On the other hand, EVs are linear and thus automatic systems, as these do not require gearboxes or clutches for movement. EVs are quiet, ensure quick and smooth response and provide superior driving comfort, thus justifying their premium pricing, according to analysts.

For context, automatic transmission in ICE vehicles is available in different tech combinations, popularly known as AMT (automated manual transmission), CVT (continuously variable transmission), DCT (dual-clutch transmission) and TC (torque converter). However, they cannot provide a completely jerk-free experience as EVs do.

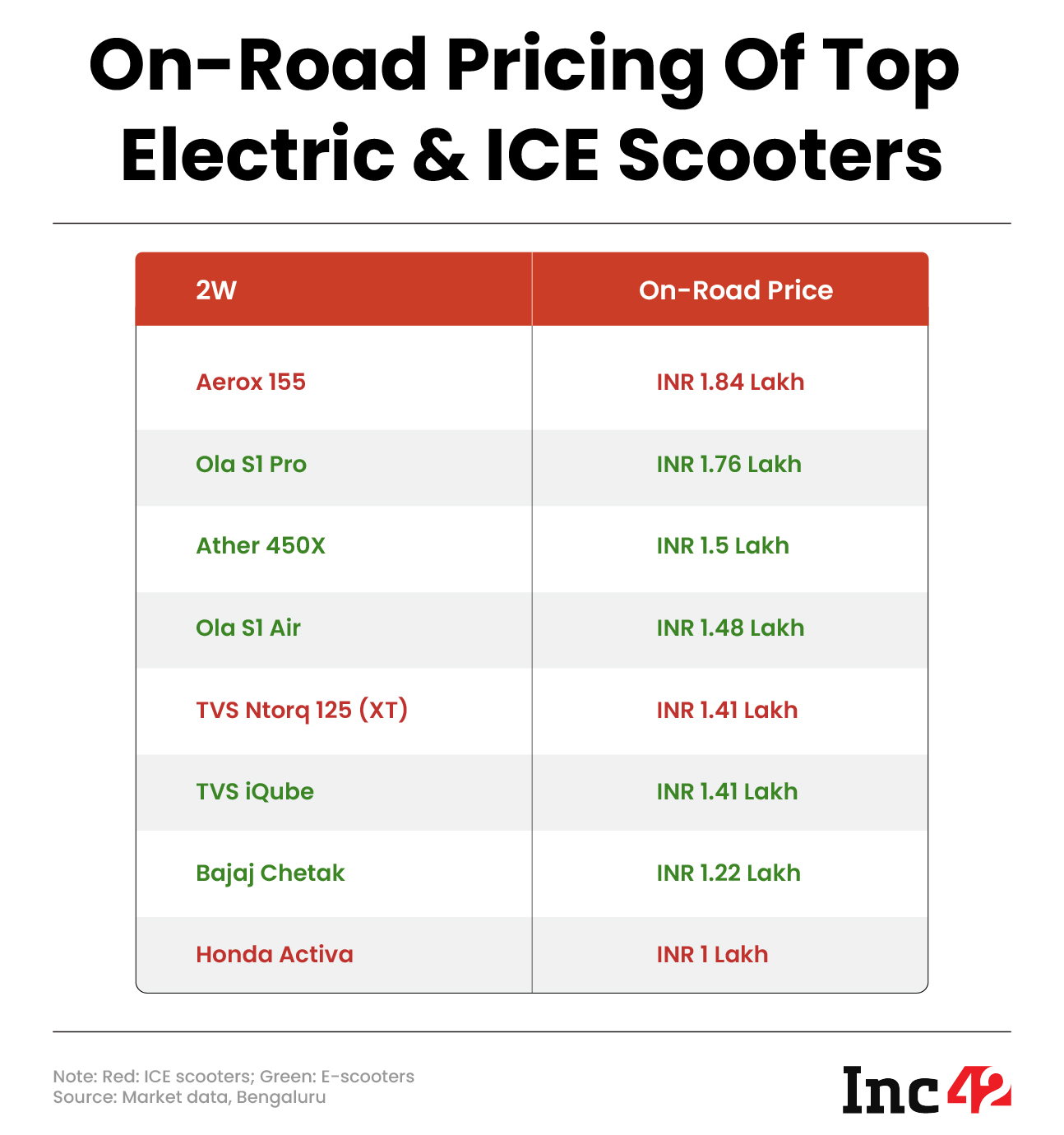

Price differentials are relatively small, especially for high-speed two-wheelers, when we include FAME incentives. As for 3Ws, the price difference amounts to INR 30K or so, which is less than 10% of the overall cost, pointed out Deb Mukherji, managing director of Anglian Omega Group, the parent company of Omega Seiki Mobility. The Delhi-based group currently operates in six countries and specialises in 3W commercial vehicles.

lockquote>

“As for 3Ws, all of which are commercial vehicles, we have considered 10.8 kWh batteries in the L5 category. Again, the price difference in comparison to their ICE counterparts is around INR 30K, less than 10% of the total cost. Thus, the price difference for EVs have dropped significantly from 30% to around 10% in the last one year, added Mukherji.

Are EV Loans More Expensive Than Conventional Automobile Loans?

Oil prices may have gone through the roof, but do Indian lenders feel as excited about EV financing as their potential customers? EV four-wheelers are still considered a luxury worldwide, and consumer incentives are often regarded as luxury-subsidising.

This is not the case in India, where 2Ws and 3Ws rule the landscape and are primarily valued as utility vehicles. But banks and other FIs feel that the segment is still nascent, and the resale/residual value of an EV may not pass muster when a loan goes bad or a non-functional vehicle turns up at their doorstep.

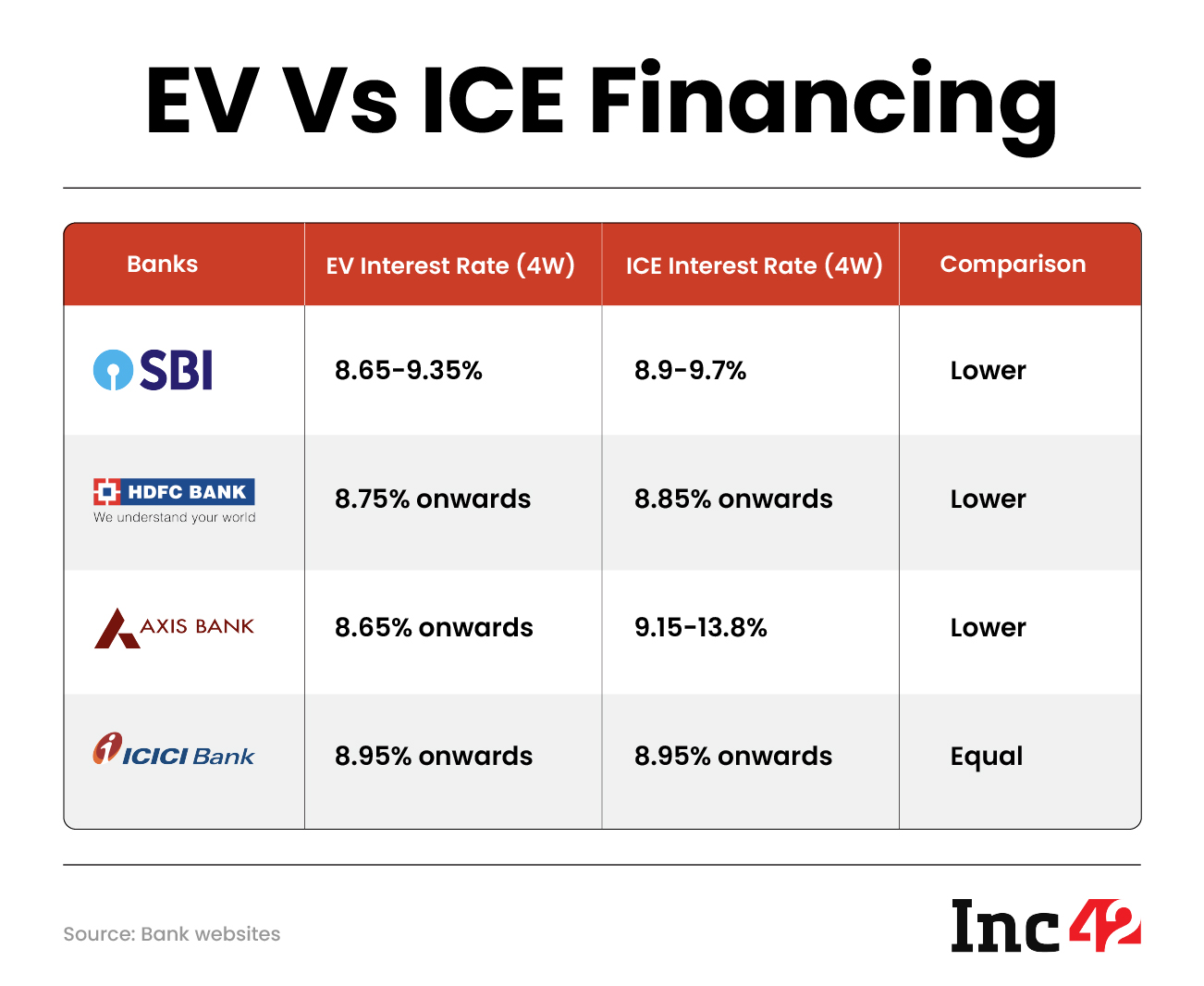

To gauge the cost of EV financing compared to ICE vehicle loans, we have analysed the interest rates charged by leading Indian banks.

The data presented above clearly shows that interest rates on EV loans are lower than ICE rates or on a par.

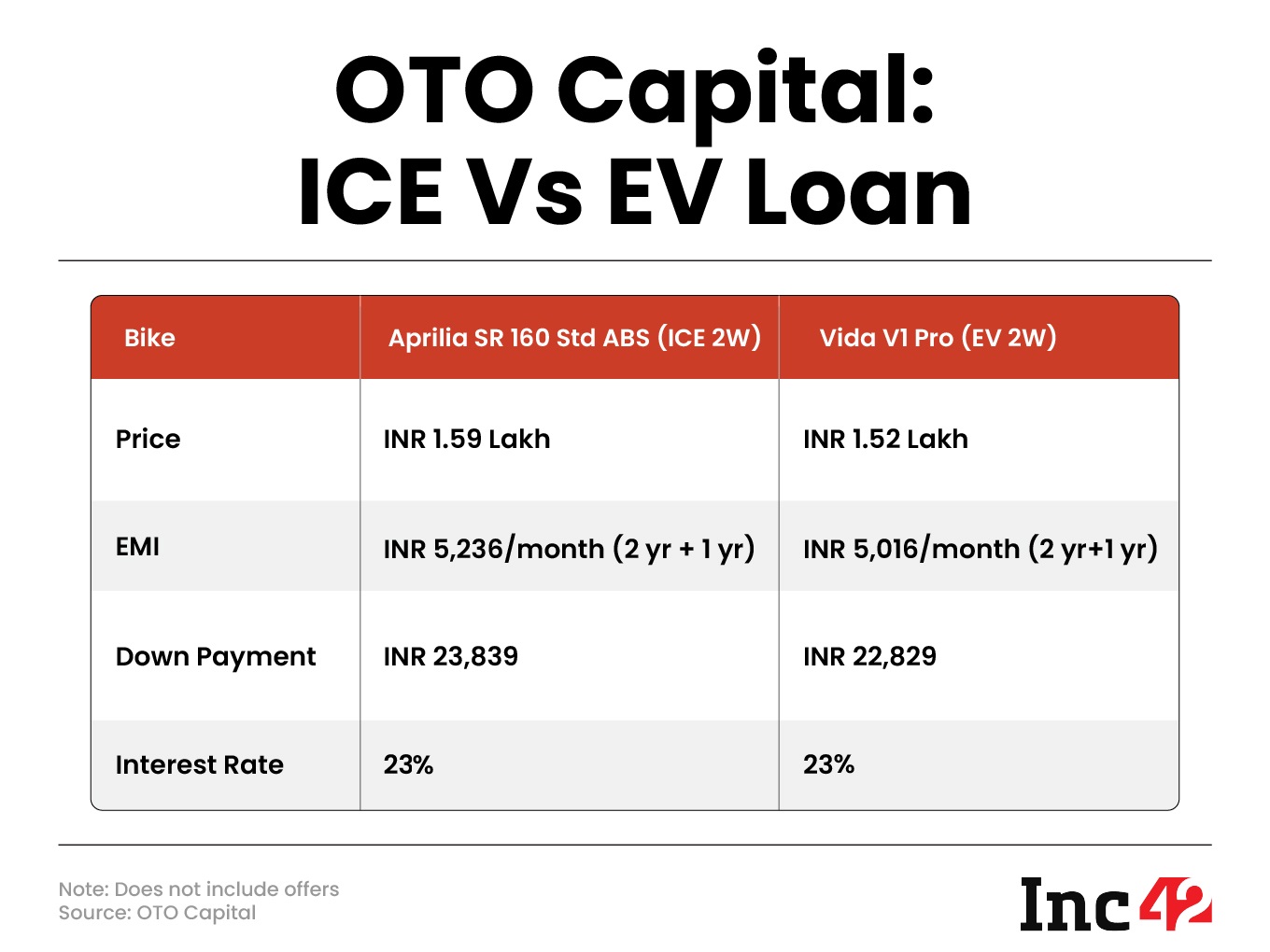

However, Sumit Chhazed, founder and CEO of Bengaluru-based bike-lending platform OTO Capital, has differentiated lending models. “There are top-selling EV 2W models from companies like Ola, Ather, TVS and Vida. You can get interest rates similar to ICE vehicles when you buy those. However, loans for not-so-popular EV 2Ws are either unavailable or incur higher interest rates,” he said.

lockquote>

Interestingly, most of the top e-bike buyers have better CIBIL scores than ICE customers, Chhazed added.

Seconding Chhazed, Sumeru Shah, business head, EV(2W), Ecofy said that the availability of electric vehicle (EV) financing solutions has now become more comparable to traditional internal combustion engine (ICE) vehicle financing. Many financiers from the ICE category have transitioned to provide financing options for EVs.

However, a significant challenge facing these financiers is the lack of a complete loan cycle history for EVs in their current state. This makes it difficult to assess the residual value and determine the vehicle’s worth at the end of the loan term, which in turn affects collection and repositioning strategies in case of customer defaults.

In terms of availability, financing options for EVs are now widespread, with many financiers offering solutions for both EVs and ICE vehicles. Some parameters, such as Loan-to-Value (LTV) ratios, maybe slightly lower for EVs, typically around 5% less than for ICE vehicles, Shah added.

The loan dynamics are different for commercial 3Ws and commercial 2Ws, primarily used for goods delivery. In these cases, EV interest rates tend to be 4-5% higher than the ICE segment due to asset and business risks.

lockquote>

Asset risk stems from concerns over loan defaults as banks and other lenders often worry about the resale value of repossessed EVs. To deal with this challenge, companies like Omega Seiki offer buyback guarantees to banks, promising to repurchase a vehicle if the borrower defaults, said Mukherji.

Business risks are closely linked with the use of commercial vehicles within distribution networks. For instance, many individuals invest in commercial two-wheelers to cater to on-demand food delivery services. But the underlying risk is rooted in possible service discontinuation in a specific area. This will leave the vehicle owner with a significantly depleted income and heighten the risk of a default.

However, media reports indicate that the regular recovery mechanisms are rarely pressed into service in such cases for fear of ‘bad’ publicity. Moreover, Chhazed observes that international funds, especially those supported by the World Bank, Asian Development Bank, the International Finance Corporation (IFC) and other international financial institutions, actively promote clean technology alternatives.

This gives lending companies access to capital at favourable rates when investing in the electric vehicle market. Understandably, nothing should go wrong in this segment, least of all lenders’ high-handedness leading to conflicts.

Given these ground realities, assessing the cost of EV financing cannot be binary – a straightforward ‘high’ or ‘low’. It varies depending on the vehicle segment. Also, more changes are anticipated when the Reserve Bank of India (RBI) puts EV financing under priority lending, potentially increasing the proportion of loans available for this sector.

How Affordable Is EV Insurance

The insurance costs observed at the Tata showroom reveal a near-parity between EVs and ICE vehicles. In fact, the insurance premium for Tata Nexon EVs is slightly lower at 5.4% compared to 5.55% for ICE Nexon models. But one should also keep in mind that insurance rates at showrooms tend to be somewhat inflated.

The cost dynamics are entirely different when buyers purchase insurance from independent providers. Generally speaking, insurance premiums for EVs tend to be 25-60% higher compared to their ICE counterparts, according to an official working for Digit Insurance. The company charges approximately INR 28K for insuring a Tata Nexon ICE vehicle, but the premium escalates to INR 44K for a Tata Nexon EV.

lockquote>

Other insurers like Acko also have similar variable rates, further emphasising that EV insurance is disbursed at a premium in the current market.

Disparities in insurance costs also underscore the complex interplay of various factors. These include the availability of spare parts, the relative novelty of EV technology and the perceived risks associated with EV insurance. But as the ecosystem matures and more components are produced locally, the cost dynamics will gradually align with traditional ICE vehicles.

Our Finding: EVs Will Be Way Cheaper!

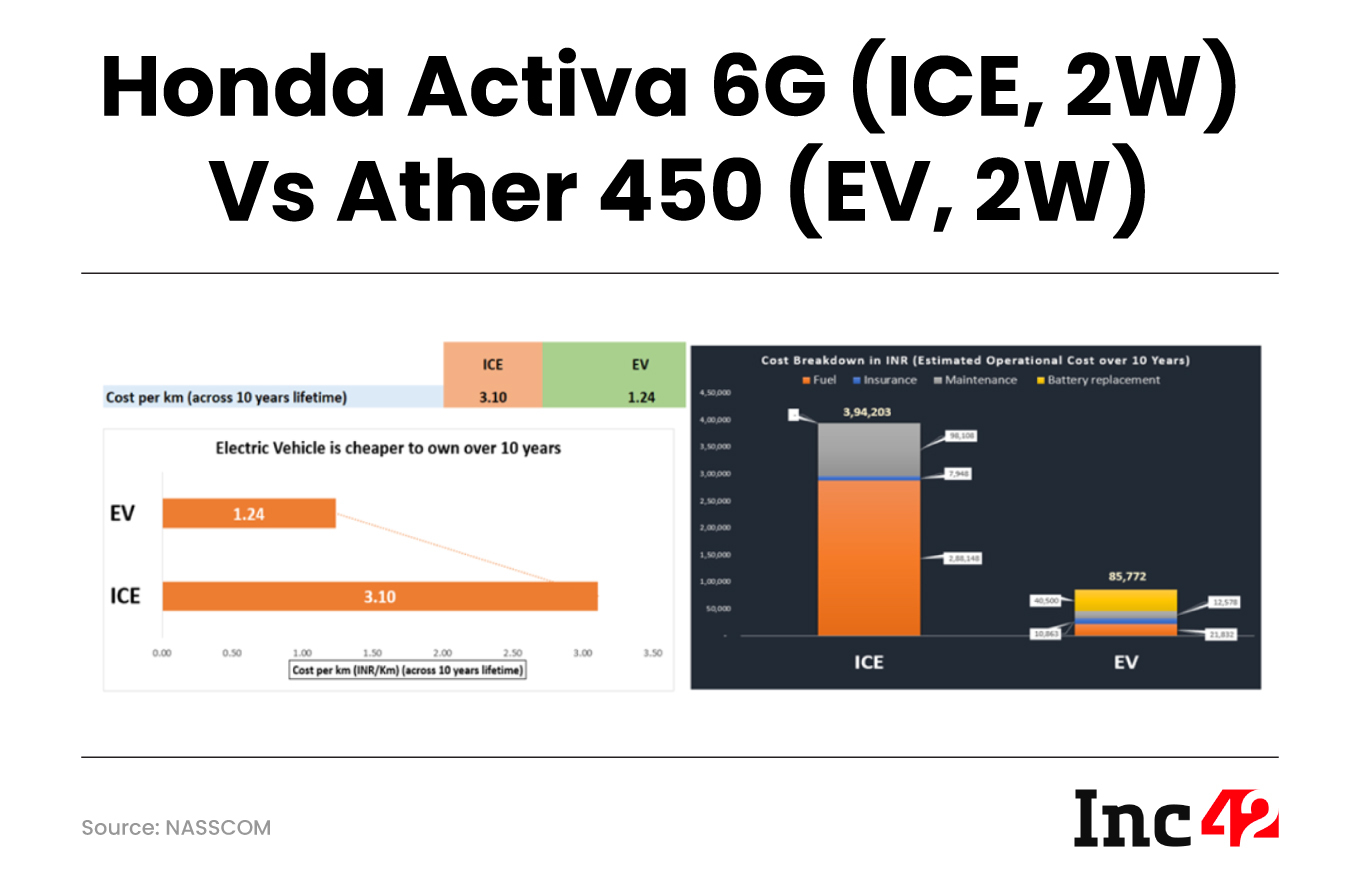

In India, the cumulative running and maintenance costs typically amount to INR 17/km for diesel-powered vehicles. Of course, the country is not ready to go off diesel yet, especially when it comes to medium and heavy commercial vehicles. But small and light commercial vehicles may find viable alternatives among EV 3Ws. Despite a marginally higher interest rate of 4-5% on EV loans, it will not pose a significant impediment due to substantially reduced operational costs.

To understand this better, let us consider an individual who drives an ICE auto-rickshaw and typically earns INR 700-800 per day. However, Mukherji of Anglian Omega said the person could easily make at least INR 1,200 a day by shifting to an e-rickshaw. This would translate to an additional daily income of INR 500 (a 50% rise) after accounting for the daily expenses. This extra earning is bound to boost the driver’s financial well-being.

The pivotal role of technology is evident in this context. Operating an EV costs roughly one-tenth of a conventional vehicle’s per-km expense, approximately INR 12 for ICEs.

On the flip side, EVs will require battery replacements within three to five years, a substantial operational cost one cannot ignore.

Currently, most 2W batteries in India can last up to 1,000 charge cycles, while 3W and 4W batteries work for up to 2,000-2,400 cycles. This is an assumption based on the changing technology around batteries. For instance, while the new Nexon EV battery life cycle is not public yet, the older Nexon EV claims to have only 1200 life cycles. It is worth noting that these estimates correspond to a lower driving range compared to international standards.

For example, Chinese EV major BYD offers an impressive battery range of 4,000-22,000 life cycles and a driving distance of 500 km to 1,000 km. Tesla which offers a life cycle of 1500 also offers a range of around 640 Km.

In other words, a Nexon EV could run up to 3,60,000 km (300×1200) against Tesla’s 9,60,000 Km (640 km x 1500). Though Nexon still suffices the most Indian individual’s personal needs, this underscores the room for improvement within the Indian EV landscape, believe experts.

Further, while focusing the game of lifecycle vs range, India needs to focus on improving lifecycle as this will also keep the weight of EVs in check.

Battery prices in India saw a 30% dip in the past year, from $220 to $160. But it still exceeds the international baseline of $100, said Mukherji. Fortunately, a promising trajectory lies ahead, with industry behemoths like Tata Motors, Ola Electric, Reliance and Vedanta announcing their plans to make battery cells in India. This strategic shift is expected to yield a twofold benefit. Cost-efficient technologies will narrow the price gaps between homegrown and imported batteries and provide local manufacturers with a cutting edge.

In light of these developments, even the prospect of replacing a battery in three to five years should not pose a significant financial obstacle. The improvements expected in battery technology and affordability, coupled with the economic benefits of EV operations, will position electric vehicles as a compelling ‘green mobility’ choice.

Improvements in charging infrastructure are also important to address range anxiety. With growing investments in charging stations and a more efficient, widespread distribution, EV owners will likely have easier access to powering up. To meet its 2030 goals, India will reportedly require 46K public charging stations compared to 5.2K facilities currently operational in the country.

As most industry experts believe, electric vehicles are the future and are fast becoming a reality. But the teething problems continue to plague ‘adopting’ economies like India. By 2030, vehicles powered by fossil fuels are expected to lose momentum as big automakers gradually turn to cost-effective, environment-friendly options.

But it will require sleeker and better battery tech (EVs must be 50% lighter to reach sustainability goals, says carmaker Stellantis) and lakhs (or crores) of public fast-chargers to build a countrywide ecosystem. Once the scale is reached, prices will drop and one can break free of the ICE mould without much ado.

[Edited by Sanghamitra Mandal]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)