Think Azadpur Mandi, one of the biggest wholesale markets in India dealing in fruits and vegetables, and one can easily imagine huge gunny bags filled to capacity and a long row of pickup vehicles patiently waiting outside to deliver bulk orders.

Ask ‘cargo owners’ if fast and efficient transportation is a huge challenge and they will agree en masse. Things are so chaotic that business owners seek the services of brokers/agents (read intermediaries) to arrange deliveries. Worse still, owners of small fleets have to wait long and negotiate the fares, often making losses due to delayed load availability, payments and random deductions.

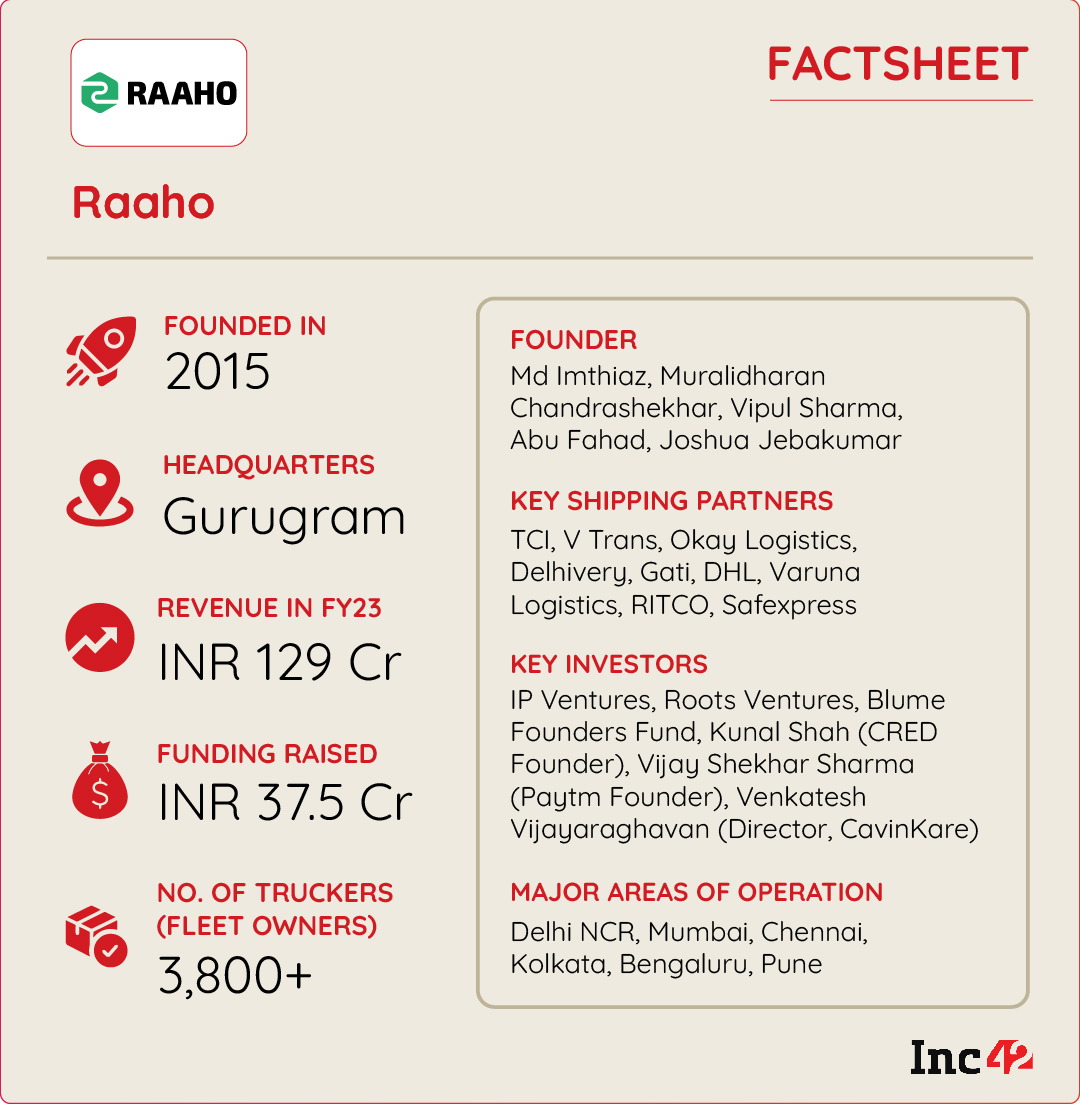

But the scenario has changed to a large extent after Gurugram-based Raaho started operating as the ‘Uber for trucks’ in India. It connects shippers (third-party logistics/3PL players) with truck/fleet owners in about 15-20 minutes, focussing on efficiency and operational transparency in a largely unorganised inter-city trucking sector.

Raaho was founded in 2015 by serial entrepreneur Md Imthiaz, Muralidharan Chandrashekhar, Vipul Sharma, Abu Fahad and Joshua Jebakumar. Operational since 2017, it is an online truck aggregator and on-demand inter-city truck-hailing platform that eliminates the need for intermediaries. The startup uses machine learning and data science for freight matching and route optimisation, thus slashing extra miles and emissions and guaranteeing higher incomes for the trucking community.

In 2014, Imthiaz exited hyperlocal reward and discovery platform. The serial entrepreneur began searching for his next project and wanted to venture into the grocery space.

But before starting up, the founders frequently visited Azadpur Mandi for a deeper understanding of the supply chain dynamics. During these visits, they witnessed for the first time the difficulties faced by truckers.

“They depend on brokers for the freight,” recalled Imthiaz. Moreover, the freight matching is done completely manually using a register that contains all essential data such as the driver’s name, licence number of the vehicle and vehicle type with information on the origin & destination (called ODVT in the industry parlance). This manual method was time-consuming and quite inefficient. Truck owners used to report to those brokers early in the day and waited until the evening/ next day for their freight.

Besides the chaotic demand-supply scenario, the founders noticed yet another problem. “Small truckers owning fewer than 10 trucks dominate this fragmented market,” said Imthiaz. So, optimised asset utilisation is critical for these truckers for a steady revenue flow, which means they require quick and consistent freight orders.

Aware that the segment was ripe for disruption, the five set up Raaho. Its key clientele includes the prominent transporters and 3PL players such as Delhivery, Gati, RITCO, Safexpress, Om Logistics, TCI (Transport Corporation of India), V Trans, Okay Logistics among others.

The startup has onboarded 3,800+ fleet owners and now covers as many as 15 cities, including Delhi, Chennai, Mumbai, Bengaluru, Kolkata, Pune, Ahmedabad, Hyderabad, Coimbatore, Patna and more.

In March 2023, the startup raised INR 20 Cr from Inflection Point Ventures (IPV), Roots Ventures, Blume Founders Fund and marquee angels like Vijay Shekhar Sharma, Kunal Shah and more as part of its extended Pre-Series A round. It clocked INR 129 Cr in revenue in FY23, a 3x jump from the previous financial year, claimed Imthiaz.

Raaho’s Inclusive Solutions For Key Stakeholders

In a bid to change how logistics operations are carried out, Raaho has developed a B2B model, keeping in mind all three stakeholders. These include businesses/shippers needing to deliver bulk orders efficiently; fleet owners, mostly small players, offering transportation services, and drivers on the ground responsible for transporting goods within states and across state lines. Despite their codependence, there is a clear lack of convergence among these stakeholders, the critical challenge the platform aims to address.

To that end, the startup has developed three separate apps on Google Playstore for shippers, truck owners and drivers – each tailored to meet the specific requirements of respective stakeholders.

To begin with, a shipper can raise a booking request via the shipper app by specifying the pickup and delivery locations, type of freight and desired delivery date. On the trucker app, fleet owners can bid on the request by setting the price they will accept for the load. Next, Raaho uses its algorithms to list the highest bids and nearest locations matching the freight request. Raaho provides real-time shipment tracking when a job is accepted.

The platform streamlines the entire process, including easy onboarding of truck owners and drivers, document uploading and managing the same through shared access.

The startup also helps drivers working for fleet owners. On the Raaho driver app, they can easily indicate their readiness for a load and receive round-the-clock customer support They also gain by finding instant loads, optimised routes and quick payments. In contrast, offline brokers can seldom suggest shortest routes and the traditional payment cycles are usually longer. According to Imthiaz, Raaho’s partner trucks cover about 11,000 km per month, significantly higher than the industry standard of 8,000 km.

“There is a substantial boost in income for our partner truck owners and drivers due to this increased efficiency. Their earnings have seen a remarkable surge of approximately 35%,” said Imthiaz.

lockquote>

Raaho also handles payments seamlessly and ensures truckers get 90% in advance via a secure digital payment solution on the app. The remaining amount is paid within 24 hours of the submission of proof of delivery, revealed the founder.

Raaho’s revenue model is pretty straightforward. It earns a margin on every trip made through its platform. The margin is the difference between what a shipper pays and what Raaho pays to the truck owner undertaking the delivery. In the marketplace parlance, this is often called the ‘take rate’.

Will Customer Support, Tech-Managed Trucking Drive Growth?

Raaho’s inclusive business model and tech-driven capabilities have brought much-needed operational transparency to commercial trucking. The rising digital awareness across India is another boon for the platform, which plans to double the number of truck owners and drivers from 3,800+ to 8,000+ by the end of FY24. It also aims to reach every pin code in the next three to five years.

That is easier said than done, as the logistics space in India is still fraught with many challenges. Consider this. When Raaho began its operations six years ago, digital awareness was low and convincing the trucking community to switch from the age-old agent system to a fully digitalised platform was daunting. More importantly, digital payments, which form the backbone of the platform’s business model, were not widely adopted at the time. In brief, the concept of a ‘digital Bharat’ was taking shape, but early adopters were few and far between.

Still, those very challenges helped build a stellar customer support team, always ready to assist shippers, fleet owners and drivers via its digital channels. The team conducted onboarding campaigns in locations with high road freight demand. The goal was to build trust among these players, get them comfortable with digital processes and onboard them seamlessly.

Incidentally, Imthiaz and other founders had gone the extra mile to ensure they understood the trucker problem. They invested their own money, approximately INR 2 Cr, to buy 10 trucks and drove them around the country to understand the life of truck drivers and what hindered smooth operations. Their first-hand experience helped build what Raaho is today.

Even the Covid-19 pandemic proved to be a game-changer due to the surge in digital awareness and mass adoption of digital tech, including online payments. Add to that proactive policy initiatives, improved infrastructure and the focus on sustainable logistics, which amply explain why India has climbed up six places in the World Bank’s Logistics Performance Index in 2023.

This does not mean Raaho can grow exponentially without tapping into the latest technology. For starters, a handful of startups like BlackBuck and Vahak use deeptech applications to transform India’s trucking sector, as 66% of the cargo (in tonne-km) movement in the country is done via road transportation. This logistics trend has unleashed a mammoth opportunity for young logistics companies, and Raaho, too, is keen to leverage it.

“Raaho will introduce the National Digital Freight Index, showcasing daily vehicle and lane-wise pricing. This nationwide launch is set for 2024,” said Imthiaz.

Finally, trucking startups like Raaho are trying to tackle one of the toughest challenges of inter-city trucking: The deadhead miles. They refer to the extra distance that empty trucks must travel to pick up the next shipment after unloading their cargo.

But this issue is not limited to India alone. Even developed economies like the US face the same challenge. According to a report by Convoy, a trucking software company, up to 35% of U.S. truck miles may be empty. In India, the situation can be worse due to the fragmented nature of the industry.

Deadhead miles result in massive losses for truck owners because they are not paid for the time and the fuel. A report by ICICI Lombard suggests that the Indian logistics sector incurred an annual loss of $21.3 Bn in 2022 due to order delays and extra fuel consumption.

Nothing short of tech-driven load matching, smart routing and real-time monitoring and communications can do away with these hurdles and drive growth across India’s deeply fragmented logistics sector that costs between 13-14% of GDP. Can Raaho and its ilk put things right with the help of a multimodal digital infrastructure and sustainable strategies?

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)