SUMMARY

Zomato is setting up a plant for processing value-added food supplies, including, sauces, spreads and semi-finished perishable products under Hyperpure

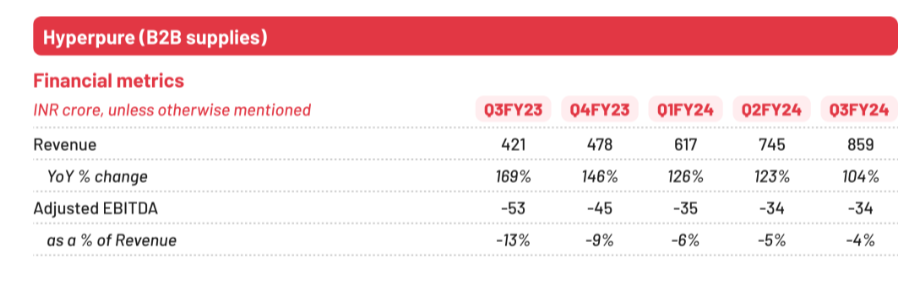

In Q3 FY24, Zomato’s Hyperpure vertical saw more than 2X YoY growth in revenue to INR 859 Cr

In 2022, Zomato claimed that Hyperpure had the potential to grow as big as or even bigger than the food delivery business

While food delivery — and quick commerce recently — has been the mainstay for Zomato over several years, there’s another vertical that the company has carried and scaled up gradually for nearly five years now: Hyperpure. Now the company is looking to push the accelerator on Hyperpure with expansion into food processing and supply of semi-finished perishables.

In Q3 FY24 (as of December 2023), Zomato’s Hyperpure vertical saw more than 2X YoY growth in revenue to INR 859 Cr. On a quarter-on-quarter basis, Hyperpure’s Q3 revenue grew 15% from INR 745 Cr reported in the quarter ending September 2023.

The B2B restaurant supplies business, which was launched in April 2019, is coming close to its fifth anniversary, and finally showing much of the promise that CEO Deepinder Goyal and other leaders in the company have spoken about in the past.

In its Q3 FY24 shareholders’ letter, Zomato said Hyperpure’s revenue growth has come thanks to a surge in the core restaurant supplies business and the relatively newer quick commerce opportunity.

“To address a growing need of our restaurant partners, we are now setting up a plant for processing value-added food supplies including, sauces, spreads, pre-cut and semi-finished perishable products, among others,” the company stated in the shareholders’ letter.

lockquote>

While Hyperpure has got some lip service from Zomato’s management in each quarter since its public listing, we haven’t heard much in the way of how the company would be looking to make this a bigger part of its business.

The Hyperpure Promise

For instance, in its first annual general meeting (AGM) after the public listing, Zomato said Hyperpure could emerge as big as or even bigger than its food delivery business.

“We think that this business has the potential of becoming as large or even larger than our food delivery business because the addressable market here is potentially larger than food delivery,” Zomato chairman Kaushik Dutta had said in 2022.

lockquote>

But there were some concrete developments on the Hyperpure front that showed Zomato was serious about building up the B2B supplies business for the long haul.

In August 2022, Hyperpure acquired Blinkit’s warehousing and ancillary services business for INR 61 Cr. In May last year, Zomato named Rishi Arora as the CEO of the Hyperpure vertical, and sharpened its focus on profitability.

Announcing the Q2 results in November 2023, Zomato said Hyperpure as a strategic back-end for restaurant partners was seeing improved success.

Currently, Zomato earns ad revenue, onboarding fees, delivery commissions and per-order commissions from restaurants. Hyperpure as a vertical was seen as a way to bring more restaurants into this revenue fold.

Now, in its Q3 report, Zomato said that adding a processing plant for food supplies has the potential to expand margins and drive higher engagement with its restaurant partners.

This is key because the company’s average monthly active food delivery restaurant partner base has grown by 21% over the past four quarters. From 209 such partners in Q3 FY23, Zomato has 254 monthly active restaurant partners for food delivery as of Q3 FY24. As this base grows, the company would want to maximise the revenue it earns from restaurant partners.

Meanwhile, Zomato’s consolidated profit after tax surged to INR 138 Cr in Q3 FY24 from INR 36 Cr in the preceding September quarter.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)