The Asia-Pacific (APAC) region is increasingly becoming a primary growth catalyst in the global assets under management (AuM) market. According to a KPMG report released in December 2023, despite volatile market conditions, the total AuM in this region surged to $27.2 Tn in 2022. Additionally, the report highlighted that APAC experienced the highest ten-year CAGR of 11% from 2011 to 2022, surpassing the global average of 9%.

In essence, the growing population of high-net-worth individuals (HNWIs), their diverse requirements for accumulation and decumulation and a host of investor-friendly regulations are rapidly transforming how financial advisors work and are throwing open never-before opportunities.

But it is only the tip of the iceberg.

According to a recent report by McKinsey, the asset and wealth management industry across APAC is still nascent, as 40-45% of personal financial assets are trapped in cash and deposits. More number crunching reveals a hugely untapped/underserved market, with onshore personal financial assets hitting an estimated $81 Tn by 2027. In contrast, wealth management penetration currently stands at a meagre 15-20%.

Shilpi Chowdhary, former managing director at Credit Suisse Singapore and the CEO of Lighthouse Canton, a global investment institution headquartered in Singapore, identified this critical gap nearly a decade ago. Shilpi spent a significant portion of his private wealth career with global investment banks, managing portfolios for the ultra-rich. This experience provided valuable insights into the dynamic yet fragmented world of the asset and wealth management industry.

Under his leadership, Lighthouse Canton has quickly grown to manage over $3 Bn Asset & Wealth Management (AuM) for its clients in the Asia-Pacific and Middle Eastern regions, including Singapore, Dubai and India.

It caters to a diverse client base of family offices, institutional investors, UHNWI and their families, as well as founders of startups.

According to Chowdhary, Lighthouse Canton’s investment philosophy centres around creating long-term opportunities for wealth creation through a dynamic and adaptive approach.

Its investment team focusses on structuring portfolios so as to reduce their dependencies on the market directions and achieve enhanced risk-adjusted returns.

“In lieu of the usual 60/40 equity and bonds allocation, Lighthouse Canton leverages strategies such as trade finance, macro, commodities, insurance and long/short managers to help clients build resilient portfolios in sync with their preferences and goals and remains keen on capital preservation,” explained Chowdhary.

lockquote>

In its commitment to help investors make informed and legally compliant decisions, the firm also collaborates with prominent global financial service entities. For example, it has partnered with global financial services firms such as the US-based B2B wealth advisory BNY Mellon Pershing and LexisNexis, a global consulting firm specialising in legal, regulatory and compliance information.

Shining A New Light On Asset & Wealth Management

“We are committed to being the lighthouse — a financial vantage point and guiding light, for our investors and clients across asset management, wealth management and founder ecosystems,” – Shilpi Chowdhary, founder, and group CEO of Lighthouse Canton.

lockquote>

Despite being just a decade old player in the investment management domain, Lighthouse Canton has distinguished itself through innovative investment solutions which are backed by its robust institutional investment framework.

Lighthouse Canton operates two main business verticals – asset management and wealth management – each with its own set of differentiated product offerings and unique revenue model.

Its wealth management business manages all facets of its clients’ wealth over the long term. This includes providing tailored portfolios, alternative investments, multi-jurisdictional wealth and legacy planning services, lending solutions, along with advisory services on property investments and global residency through investments.The primary source of revenue in this vertical is through management fees.

The investment institution competes with global giants like Asia Partners, UBS Asset Management and Dymon Asia, to name a few.

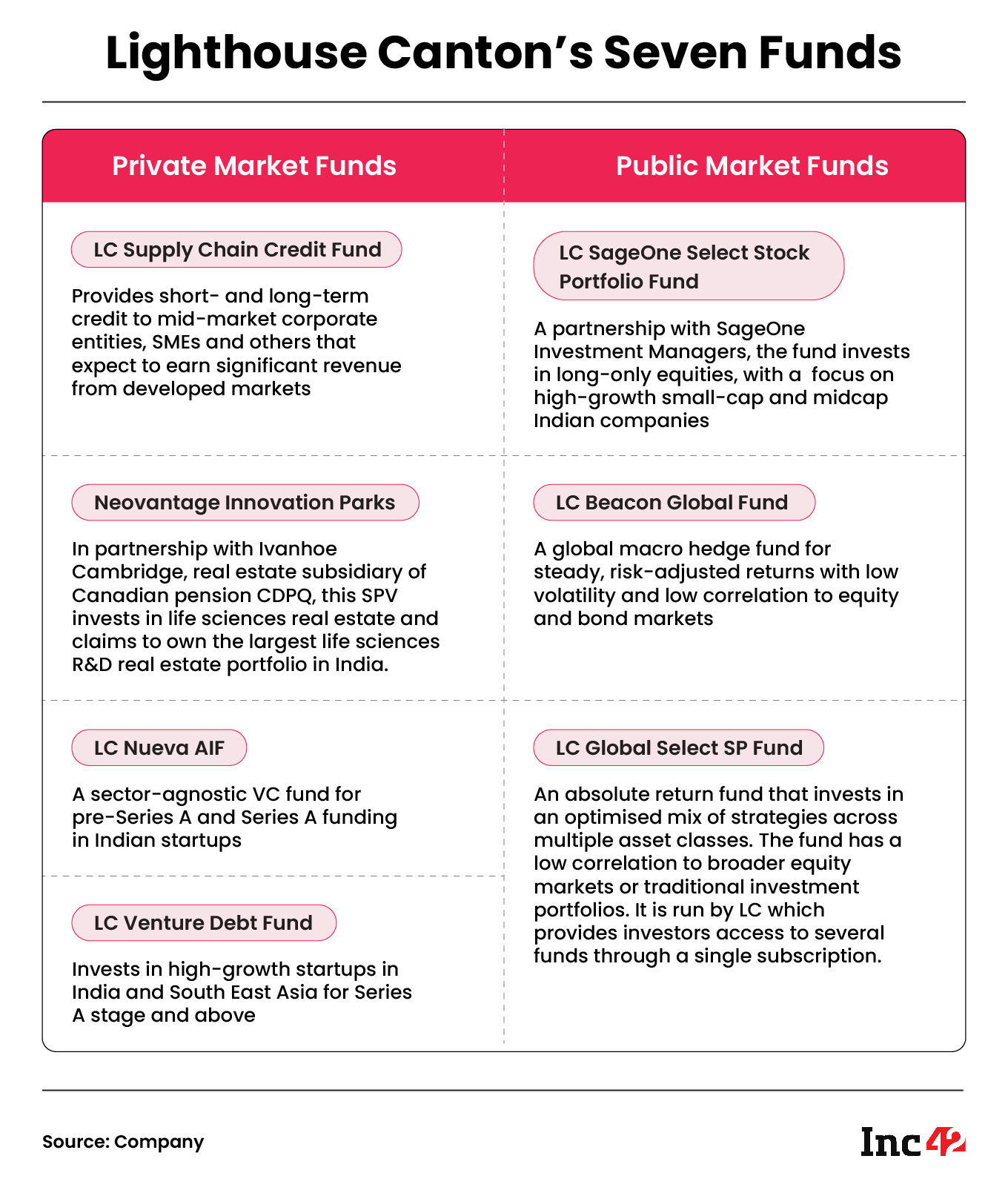

Lighthouse Canton’s Asset Management business invests on behalf of both institutional investors and accredited investors. With investments in both private and public markets, Lighthouse Canton’s strategies focus on private credit, venture debt, venture capital, life sciences real estate, Indian equities and global macro. The revenue in this vertical is primarily generated through management fees and carried interest. (See table: Lighthouse Canton’s Seven Funds)

How Lighthouse Canton Stays Ahead Of The Curve

The firm’s investment philosophy has been consistent and successful over the past decade as it blends the agility of a technology startup with the reliability of a seasoned financial institution.

Amid the Covid-19 mayhem and global lockdowns in 2021, the company identified the need for a digitally-powered platform to simplify wealth management. It pushed for digitalisation in 2021 and subsequently launched LC Vantage, an AI-powered digital platform in 2023.

The platform has many features ranging from analytics and reporting, a communications suite and intelligent trading tools.

It provides investors a portfolio consolidation feature that helps consolidate the investor’s portfolio by merging and organising various investment holdings, accounts and assets into a unified and comprehensive view. Then there is the portfolio analytics engine that analyses and comprehends portfolio data with ease and the trade automation function that enables the relationship managers to directly send trade orders to designated custodians or financial institutions responsible for executing the trades, thus eliminating the need for further manual intervention.

The platform also offers a communication suite, allowing clients to directly engage with their relationship managers as well as other investment professionals across the teams.

The company places equal emphasis on the expertise of its investment professionals in guiding clients through investment decisions, optimising returns, and managing risks effectively.

Finally, LC Vantage offers investors’ the capability to invest in global markets across various specialised investment products. According to Chowdhary, the platform currently carries 14 asset sub classes including options, bonds, funds, shares, ETFs, private equity, loans, term deposits, FX products, commodities, warrants, and more.

The varied product offering, coupled with advanced portfolio analytics and intelligent investment advice provides investors with holistic visibility into their portfolios and allocations.long with insights into key parameters like geographic, currency and sector distribution, daily portfolio & instrument level attribution, risk analysis, volatility assessments, ESG scores and more, LC Vantage aids in enhancing transparency over investments and eliminates conflict of interest.

Nurturing India’s Startup Ecosystem With Strategic Funding

Lighthouse Canton has delved into diverse sectors and geographies but has always sought to bolster the Indian startup ecosystem. In a recent interaction with Inc42, Chowdhary underscored the potential for institutional investment in the country, driven by its rapidly expanding and dynamic startup landscape. The Indian startup ecosystem currently ranks among the top three globally.

“This thriving ecosystem has attracted substantial funding from domestic and overseas VC firms. Our seasoned venture capital team has a strong track-record and wealth of knowledge in identifying and backing promising startups at early and growth stages. Given their positive assessment of the ecosystem, we decided to support this burgeoning economy,” said Chowdhary.

In 2021, Lighthouse Canton and Delhi-based Nueva Capital formed a strategic partnership and launched LC Nueva AIF. The sector-agnostic fund, with a corpus of INR 350 Cr, is a Category II AIF (alternative investment fund) that aims to invest in 30-35 Indian startups during its eight-year tenure. It primarily focusses on Pre-Series A and Series A entities and has invested in a number of startups such as personal care brand Svish, retail tech platform Dukaan and HRtech startup Internshala.

Lighthouse Canton also launched the LC Venture Debt Fund in 2022. The SEBI-registered Category II AIF is worth INR 550 Cr and largely targets growth stage startups in India and Southeast Asia looking for Series A funding or above.

The fund invests in startups with annual revenue exceeding $5 Mn, EBITDA-level profitability and a minimum of $8-10 Mn in funding from reputed VCs. It has already backed 13 startups, such as Rentomojo and LoanTap.

The Blueprint For Global Growth

Lighthouse Canton is gearing up to enter lucrative markets with substantial wealth management opportunities. It has set its sights on China within the APAC region and aims to expand its footprint in the EU, as these markets are deemed highly promising for wealth management firms. In fact, China stands out from the rest as it was home to the second-largest population of ultra-high-net-worth individuals (UHNWIs) in 2022, trailing only behind the US.

Given the current geopolitical scenario, Lighthouse Canton’s primary focus on the APAC region may stand it in good stead. For instance, the ongoing European energy crisis, heightened by the Russia-Ukraine conflict, has escalated the inflationary strains and raised the spectre of stagflation. This has led to a considerable decline in UHNWIs’ wealth across the globe.

According to data from Knight Frank, Europe witnessed the most significant decline in wealth, with a 17% slump in 2022 On the other hand, African and Asian markets were relatively better off, with 5% and 7% declines, respectively. This presents a promising opportunity for AWMs like Lighthouse Canton that pinpoint the APAC and Middle East regions as their primary growth frontier.

Discussing Lighthouse Canton’s expansion plans, Chowdhary says that the AWM firm is well-prepared to cater to the unique financial needs of its expanding clientele. It is also committed to investing in technology-driven solutions to streamline processes, reduce documentation efforts and provide clients with valuable portfolio insights.

Lighthouse Canton is particularly bullish about Indian startups, especially those in the healthtech, consumer tech, fintech, edtech and cleantech segments. “Globally, investors are expressing interest in India’s growing pool of talented founders and entrepreneurs, especially in the early stages of their ventures. These investments are attractive due to their long-term growth prospects. Plus, there’s no immediate pressure to generate quick returns,” said Chowdhary.

In these tech-enabled times, investors increasingly prefer digital wealth management solutions and cutting-edge tools that provide insightful analytics and personalised solutions. But fulfilling these goals poses a substantial challenge i.e. scalability to facilitate smooth collaborations across systems, platforms and organisations.

However, a tech-driven, client-centric journey has already started in global AWM companies like Lighthouse Canton, thanks to their constant tech transformation and financial expertise. While they continue to develop attractive portfolios, generate returns, and create compelling opportunities for long-term wealth creation across market cycles, delivering value through a holistic approach will remain crucial for their next phase of growth.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)