U.S. Rep. French Hill (R-Ark.) did not mince words on Capitol Hill on Thursday, effectively calling out his fellow D.C. lawmakers whose “reactionary claims proved to be greatly exaggerated” when it came to blaming cryptocurrency for funding international terrorism.

It was the second part of a House Financial Services Committee titled “Crypto Crime in Context,” where testimony was elicited from financial industry experts on anti-money laundering measures and cryptocurrency analytics.

“Through hearings and confidential briefings, this committee has heard from the intelligence community, blockchain experts, and law enforcement, and we have a much better understanding of the scope and scale of crypto’s role in terror finance,” Hill said. “While the reactionary claims proved to be greatly exaggerated in the case of Hamas and Gaza, it’s still important for us to identify and close any potential gaps that can be exploited by criminals and terrorists.”

To that end, Hill emphasized the need to ensure proper oversight of the cryptocurrency industry—which may in fact be facilitated by the technology itself.

“The transparency of a public blockchain provides law enforcement with critical data about illicit actors and their networks so that they can be gone after,” he said.

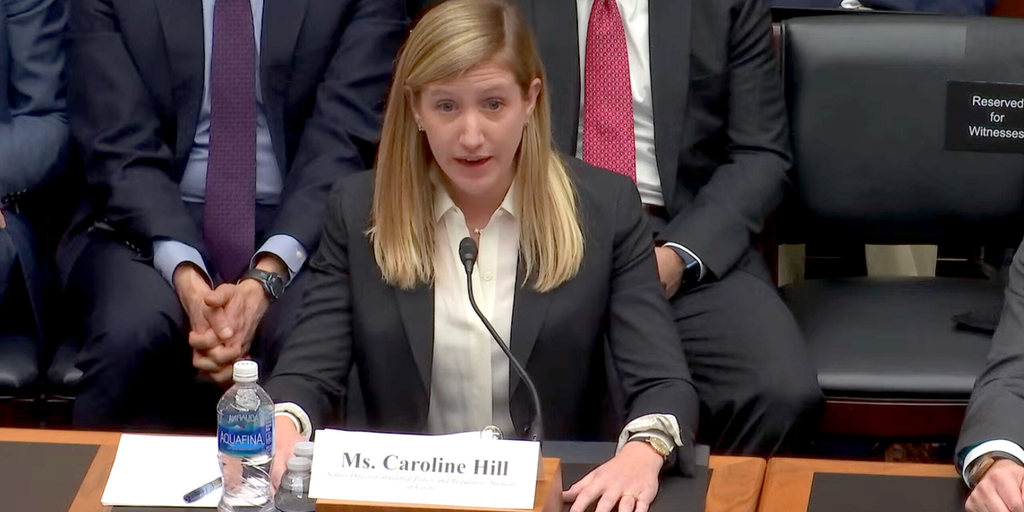

Caroline Hill, Senior Director of Global Policy and Regulatory Strategy at stablecoin platform Circle, told the committee that terrorist organizations increasingly use stablecoins to solicit donations.

“I don’t know why illicit actors turn to certain offshore stablecoins, but I believe it’s because they have publicly taken a viewpoint that they are above anti-money laundering and counter-terrorism financing standards,” Hill said. “We would encourage any U.S. dollar-pegged stablecoin to have the same regulatory obligations under OFAC and FinCEN so that they’re not used by terrorist financing groups.”

Another key challenge facing federal regulators is the concentration of illicit actors and organizations beyond U.S. borders.

“Sanctions evasion, terrorist financing, and criminal activity are concentrated with offshore platforms,” testified Grant Rabenn, director of financial crimes at cryptocurrency exchange Coinbase. He said existing legal tools should be more widely adopted to “police those offshore actors.”

He pointed out that Coinbase has identified more than 8 million crypto wallets believed to be engaged in fraud, but OFAC has sanctioned around 560 addresses in total.

“By extrapolating out from these ground truth OFAC addresses, we’re able to stop the flow of funds to bad actors in real-time,” Rabenn said, noting onshore regulated exchanges are investing heavily in compliance. “Offshore entities often play jurisdictional whack a mole, attempting to avoid tough anti-money laundering rules and expecting that regulators won’t care.”

Rabenn also warned against overregulation of the cryptocurrency industry, however, echoing Hill’s comments that the transparency of public blockchains gives more visibility into transactions than traditional finance.

“In this way, crypto is compliance on steroids,” he said. “It allows for a new dimension of compliance—public ledgers—that enable visibility into what users do on and off our platform.”

The beauty of blockchain also drew praise from Michael Mosier, former acting director of the Financial Crimes Enforcement Network (FinCEN) and now general counsel at crypto firm Espresso Systems.

“Mr. Rabenn was explaining the cases that they were prosecuting at Department of Justice, and we took on enforcement at both OFAC and FinCEN,” Mosier recalled. “The ability to have this transparent ledger, and to be operating in a digital space with structured data, made it possible to build out cases exponentially faster.”

Mosier argued that regulatory bodies like FinCEN need increased funding from Congress to take on illicit cryptocurrency activity. Ranking committee member Maxine Waters (D-Calif.) placed blame squarely on Republicans for hampering law enforcement.

“While we want to bolster the jurisdiction of U.S. enforcement agencies, allowing them to extend their reach internationally, extreme MAGA Republicans are working to cut funding for these agencies and put our national security at risk,” Waters said.

Meanwhile, Rep. Ted Budd (R-N.C.) warned against judging emerging technologies by their “worst possible uses,” arguing that would lead to “poorly conceived public policy.”

Stay on top of crypto news, get daily updates in your inbox.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)