In a landscape dominated by digital transactions, fintech startups are redefining traditional banking by extending financial services to a broader swath of the Indian population — many of whom were previously underserved. Given this massive opportunity, India’s fintech market is poised for significant growth, with projections showing a potential to reach $2.1 Tn in market size, expanding at an 18% CAGR.

Nonetheless, incumbent banks remain indispensable due to their longstanding trust and reliability. Embracing the agility, technological innovation and customer-centric approaches of fintechs, these established players are actively adapting to the digital landscape to ensure their continued relevance and growth. Rather than a competitive landscape, it’s an ecosystem of collaboration where fintechs can leverage the banks’ extensive customer base, regulatory know-how and financial muscle.

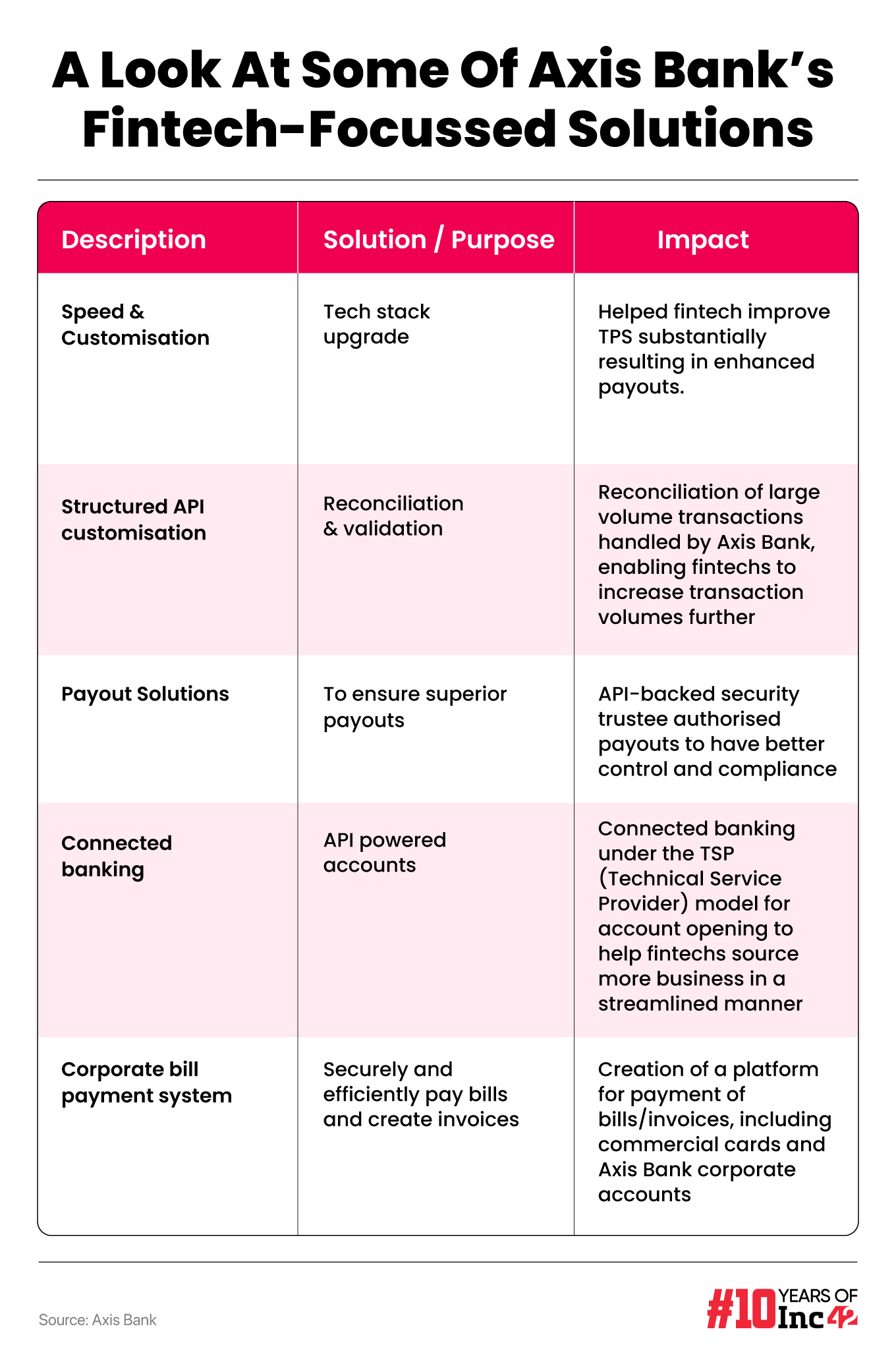

Axis Bank, one of the largest private banks in India’s banking sector has notably embraced such collaborations. From cash management and core banking solutions to structured API customisation and Bharat Bill Payment System (BBPS) — Axis Bank equips new-age players with a variety of capabilities. This fosters a mutually beneficial alliance between the parties.

Its partnership with full-stack digital payments platform Cashfree Payments serves as a relevant example to showcase how such synergies come into play. The Bengaluru-based fintech startup, which specialises in critical areas like collection, disbursal/payout, verification and more, partnered with Axis Bank in 2021 to strengthen its payout and other solutions.

The partnership encompasses three major areas: Payments through API, connected banking and escrow services. Presently, Axis Bank serves as the primary escrow bank for the startup, offering settlement solutions for 360 days a year in India. Additionally, it facilitates direct rails with international payment gateways like CyberSource and Mastercard Payment Gateway Services (MPGS), enabling Cashfree’s Payments’ merchants to accept global payments.

According to Cashfree Payment’s founder Akash Sinha, Axis Bank has enabled the fintech startup to process substantially improved transactions per second (TPS). It also ensures seamless handling of high transaction volumes which has been instrumental in achieving a success rate of over 95% across various modes.

“The collaboration combines Cashfree Payments’ expertise in digital payments with Axis Bank’s strong banking infrastructure, providing businesses with a secure platform to streamline their financial processes,” Sinha said.

Axis Bank’s partnership with Cashfree Payments has evolved from a PAPG (Payment Aggregators and Payment Gateways) solution, providing fintechs with a more integrated banking partnership, where they are closely working together to support Cashfree Payments’ growth.

How Cashfree Payments Empowers Businesses With Digital Payments

Cashfree Payments was founded in 2015 by Akash Sinha and Reeju Datta at a time when UPI was still a year away and the boom in digital payments post-demonetisation across India was a long way off.

The founders identified complicated payment issues across ecommerce, education, fintech and more. Each required customised solutions to address unique challenges and the duo decided to build the essential blocks first. Later, these could be integrated to introduce automated solutions for BaaS or even big legacy companies.

It launched its payment gateway in 2016, followed by its Payouts service in 2017 — the major pillars of its payment solutions. And soon, its growth trajectory found its momentum as Cashfree expanded its offerings in partnership with banking players like Axis Bank.

Today, the platform claims to provide 120+ payment options on the collection front, enabling businesses to scale up fast and cater to a wide range of customers. It also claims to serve more than 6 Lakh businesses across various sectors.

Sinha added that Cashfree Payments processes 2 Lakh Cr transactions every year (1,000 per second) and has serviced 6 Lakh+ businesses across sectors and 200 Mn bank accounts. Besides, the startup also has an automated verification suite in place to help authenticate individual users and business partners (suppliers, service providers and more).

It follows a commission-based model, where it charges businesses for using its payment gateway to receive payments from its customers. However, the fee may vary depending on the cost of the product. For instance, merchants pay Cashfree Payments up to 1.9% of the transaction for using its payment gateway.

For settlements, Cashfree Payments charges companies between INR 2.5 to INR 10 for every transaction, depending on the transaction size.

For a payment centric platform like Cashfree Payments, forging a strategic partnership was imperative. At first, Sinha revealed the complexities of stakeholder mapping within various banking verticals posed a significant challenge. However, he said that Axis Bank’s dedicated team, which acted as a single point of contact, helped the startup streamline processes and expedite the integration process.

Since 2021, Cashfree Payments has leveraged Axis Bank’s comprehensive suite of banking API integrations — spanning bill collections, payments, trade and more, to deliver support to its customers across a wide spectrum of virtual accounts such as UPI, RTGS (Real Time Gross Settlement) and NEFT (National Electronic Fund Transfer). This diversity not only allows users to transact using their preferred payment method, but also enhances their banking experience.

Through its bank transfer API, Cashfree Payments also refers merchants to Axis Bank and encourages them to open accounts with it. Moreover, Sinha revealed that Axis Bank’s support in enabling APIs for collections and disbursals has streamlined the fintech’s operations and helped it offer comprehensive banking solutions.

Further, he disclosed that Axis Bank’s clear communication on compliance and product guidelines about rate updates, merchant category code rates and information on regulations has empowered the startup to make informed decisions swiftly and create a sustainable business model.

Expanding on this, Amitabh Chaudhry, MD & CEO at Axis Bank says, “Whether it is an API-powered escrow, robust and quick TPS or cutting-edge tech to handle payments, we’ve striven to build it all for our fintech clients”.

The Indian fintech landscape is experiencing rapid growth with 23 unicorns and 34 soonicorns. This surge is driven by several key factors, including increasing internet penetration, widespread smartphone adoption and government initiatives such as Digital India and Make in India.

For these new-age disruptors, partnering with Indian banks isn’t merely a strategy for expansion, it’s a catalyst for credibility. Banks generally have years of trust and reliability and by collaborating with them, these startups can gain an invaluable stamp of approval, foster trust among their customers and grow. Moreover, such collaborations speed up the process of navigating the complex regulatory landscapes, thus, enabling fintechs to comply with stringent norms and regulations efficiently.

Axis Bank, in particular, has demonstrated a strong commitment to partnering with fintech firms, highlighting the trend of mainstream financial institutions embracing fintech partnerships.

Chaudhry further revealed “Through its team of experts in products, technology and client relationships, the bank collaborates closely with fintechs to understand their specific challenges and provide tailored solutions across services with secure transactions and more”.

Today, Axis Bank works with 110 global and homegrown fintech firms including the likes of Paytm, PhonePe, PayU, Razorpay, Google Pay, CRED, PineLabs and Cashfree Payments among others.

It is also important to note that banking partnerships today extend beyond the utilisation of technological capabilities and banking infrastructure as banks and fintechs are also increasingly joining forces to co-create products like connected banking, co-branded cards that offer customers distinct benefits and rewards and more

Moreover, banks are providing customers with a broader range of financial services and opening up their APIs to fintech companies, thereby empowering the latter to innovate and create new financial products and services.

This collaborative approach signifies a profound shift in the financial services industry, as traditional players and fintech disruptors work together to meet the evolving needs of consumers in the digital age.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)