It’s looking like the year of startup IPOs and unicorns chasing profitability, and Swiggy is all set to join the parade.

The food delivery and quick commerce decacorn is on track to report close to INR 10K Cr in revenue for FY24, riding on the surge in Instamart orders, platform fees related to food delivery and growing traction for its dining out business.

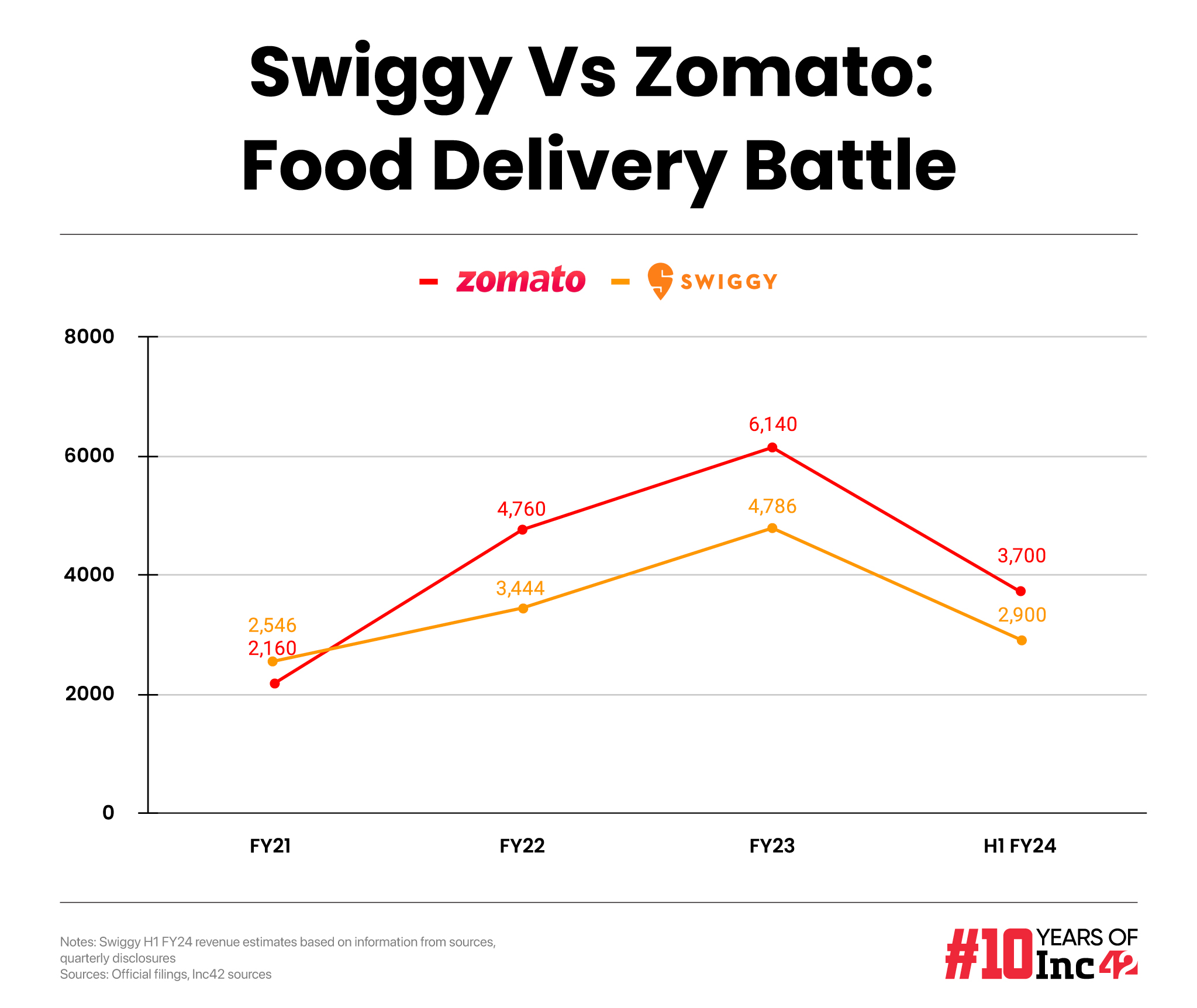

As per sources, who have seen Swiggy’s disclosures for H1FY24 as of September 2023, the company has touched INR 4,735 Cr in revenue only from food delivery and quick commerce vertical Instamart.

lockquote>

The company, which is set to celebrate its 10th anniversary this year, is on course to report over 20% uptick in revenue in FY24, from the INR 8,260 Cr it reported in FY23. Of this, more than INR 7,600 was contributed by just the food delivery and Instamart verticals, as we reported here.

Our sources did not indicate whether the company would finish FY24 with a profit, after it reported net loss of INR 4,179.3 Cr in FY23.

Besides this, the Bengaluru-based company earns revenue from restaurants for its dining out business as well as through its rapidly-growing ads network business.

Sources close to the management are uncertain about the timelines related to a public offering. Reports indicate the company is looking to file its draft red herring prospectus by March 2024, and CEO Sriharsha Majety also claimed that IPO preparations are underway.

Order Rush Drives Swiggy To Revenue Milestone

While Swiggy did not officially respond to questions or requests for clarification on these numbers, sources close to the company told Inc42 that Instamart is seeing close to 500K orders per day, up from around 400K average daily orders in March 2023.

Food delivery business is at over 1.5 Mn orders per day. Interestingly, it was in May 2023 (early FY24) that founder and CEO Majety claimed that Swiggy’s food delivery business had turned profitable (without accounting for certain costs) as of March 2023.

The growth in food delivery orders is particularly key to Swiggy’s run for profitability as the company introduced a platform fee per order of INR 1, which is now INR 3 – INR 4 per order.

The company also started charging a collection fee from restaurant partners, which is akin to the platform fee that consumers are being charged.

Inching towards profitability is critical for Swiggy, which is expected to be joining the likes of Ola Electric, MobiKwik, Digit, FirstCry, ixigo and others for a public listing by mid-2024.

Reports claimed that Swiggy is looking to raise $1 Bn (INR 8,300) through the potential offering. Interestingly, the speculated public issue’s proceeds would be in the territory of Swiggy’s FY23 revenue, and the company is comfortably on track to set a new revenue record in FY24.

Besides food delivery and quick commerce, the company also offers restaurant bookings and offers through Dineout, hyperlocal courier services through Swiggy Genie as well as Swiggy Minis, a platform for D2C brands. Further, the company has taken its first step towards a wider ecommerce marketplace business through Swiggy Mall.

Adding to these services is Swiggy’s growing ad networks business, which is said to be contributing over INR 15 per food delivery order, and which could be one of the keys towards improving the unit economics.

But the bigger question is will Swiggy be able to show a clear path towards profits on this revenue base.

Learning From Zomato’s Profitable FY24

But showing a meaningful drive towards profitability would be more important for Swiggy to woo retail investors by the time it files its prospectus for the IPO. The example of Zomato applies best to Swiggy given the parallels in their business verticals.

In FY24, Zomato has reported profitability in each of the three quarters, and its net profits have grown from INR 2 Cr in Q1 to INR 138 Cr in Q3. Zomato’s profitability has come on the back of higher order volumes and improved take rates from restaurants.

Like Swiggy, Zomato also introduced platform fees and since then the company’s food delivery business has more or less become sustainable. Swiggy’s financial performance in FY24 is all but expected to fall in line with Zomato’s improvements.

Besides the decade-old food delivery rivalry, Zomato and Swiggy are direct rivals in quick commerce, hyperlocal courier and B2C deliveries as well as restaurant bookings.

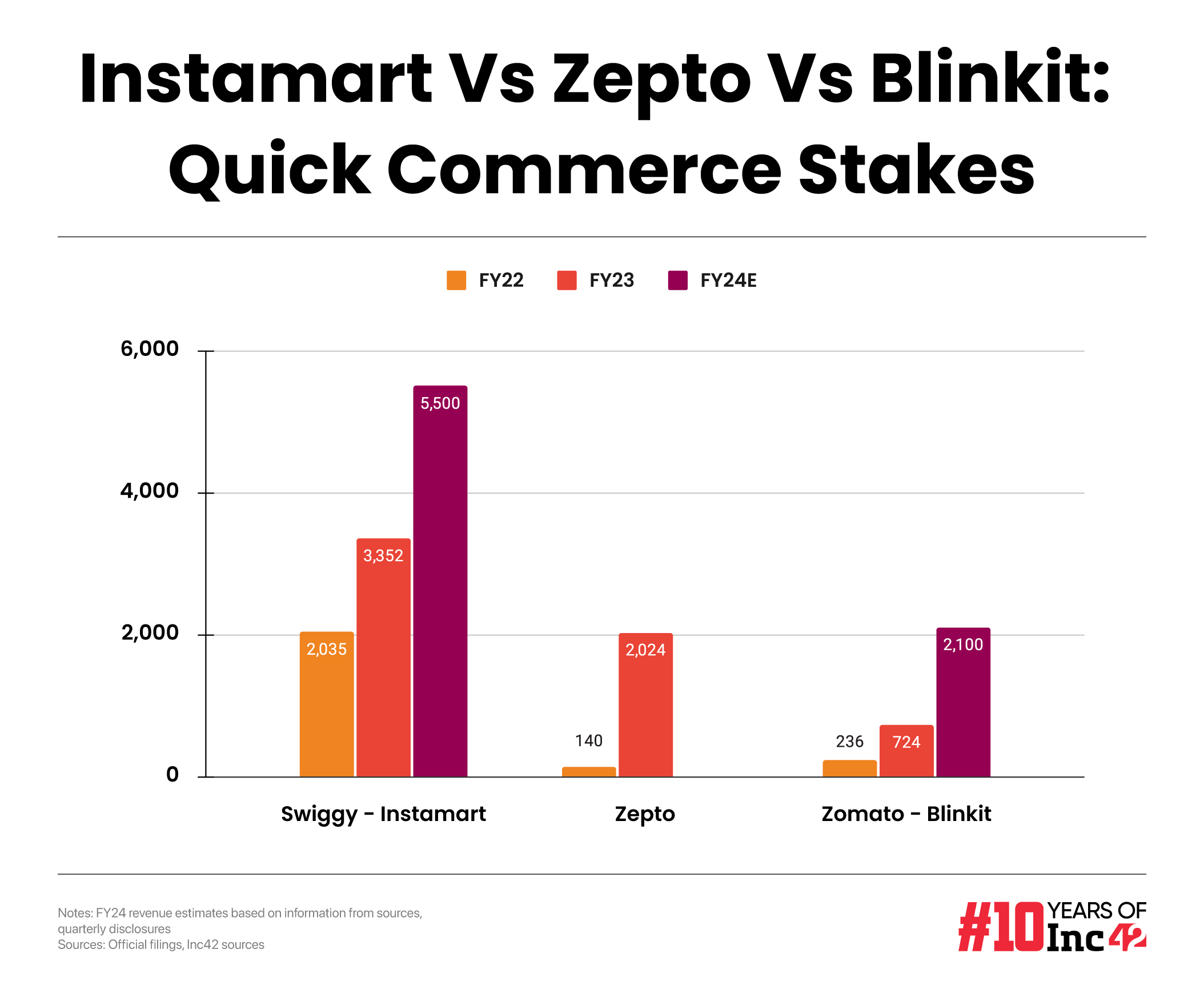

Given that it’s a publicly listed company, Zomato has to disclose quarterly results for quick commerce business Blinkit, which helps us get a gauge on whether Swiggy is on the right track. Blinkit’s revenue scale is dwarfed by Swiggy Instamart, but even on that base the Zomato-owned platform has taken strides towards positive unit economics.

As we wrote earlier this week, Blinkit’s low revenue base is a potential hurdle for long-term sustainability and profitability. At some point, Zomato has to press the accelerator on revenue for Blinkit. Quick commerce has the potential to have a larger addressable market for Zomato in comparison to food delivery particularly for high-consumption categories such as grocery.

But Blinkit has been relatively slower than rivals Zepto and Instamart in latching on to this opportunity.

Sources in Swiggy indicate that Instamart’s revenue growth has come alongside an increase in take rates from Instamart. Average order value has also grown by over 20% in the ongoing fiscal year to around INR 460 per order.

lockquote>

In comparison, on the back of festive season growth between September and December 2023, Blinkit’s operational and financial metrics saw a major spurt, and its average order value (AOV) was well above Swiggy at INR 635.

The latter is definitively a factor for Blinkit’s back-to-back contribution positive quarters. Swiggy’s Instamart may have higher revenue for now, but whether this matches Blinkit’s strides towards sustainability unit economics is unclear as of now.

While public listing speculation was also seen in 2022 when a number of companies were eyeing the public markets, this is a better time given that the company has reached a massive scale.

Zomato’s up-and-down experience would serve as the best guide for Swiggy to navigate the retail and institutional investor landscape. Interestingly, Sanjeev Bhikhchandani, the chairman of Info Edge, one of Zomato’s earliest backers, believes that Zomato’s turnaround in the stock markets over the past 6 months coincides with improvements in the company’s bottom lines.

While it may not turn profitable on a consolidated basis in FY24, the $1 Bn+ revenue is likely to be a big signal about the potential value that Swiggy can create for public investors. Given this, even a hint of profitability will be the cherry on top.

All Eyes On Swiggy IPO

The other piece of the profitability puzzle is of course cost rationalisation. Sources, who have seen the disclosures by Swiggy to its investors, indicate that revenue growth in FY24 has come alongside a significant reduction in monthly cash burn.

From around INR 330 Cr at the end of FY23, Swiggy’s monthly burn has come down to INR 180 Cr per month by H1FY24.

lockquote>

After firing 380 employees in January 2023, the company once again resorted to layoffs in January this year. As we reported, Swiggy is in the process of laying off 400 employees, or around 6% of its total workforce, across departments, with the customer support and tech teams being the hardest hit.

A former Swiggy employee told Inc42 in January that the management is focussed squarely on profitability. “As a result of this, the pressure on the employees to meet the targets had grown. Many employees, especially in the tech department, have been looking for jobs and some top senior executives have already quit.”

lockquote>

Indeed, Swiggy has seen several high-profile exits in recent months, though several of these quit the company to launch their own ventures.

For instance, former head of Swiggy Instamart Karthik Gurumurthy quit to launch a retail tech venture Convenio, while former CTO Dale Vaz has begun his entrepreneurial journey with trading platform Aaritya.

Besides this, Anuj Rathi (SVP, central revenue and growth), Sidharth Satpathy (VP, Instamart) Ashish Lingamneni (VP, marketing) and Dineout cofounder Vivek Kapoor have also stepped down in the past year.

However, the company filled any potential leadership gaps by roping in Hindustan Unilever (HUL) veteran Ashwath Swaminathan as the chief growth and marketing officer; former Amazon India exec Anirban Roy as vice president of growth, revenue and category for Swiggy Instamart as well as Dipak Krishnamani — Amazon India and Marico alumni — to head Swiggy Mall.

These appointments are key for Swiggy ahead of a potential IPO. Not only does it add a wealth of relevant industry experience to the company’s leadership, but their experience of scaling up retail and ecommerce giants would be critical for Swiggy in the long run.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)