“Acquisitions are not plain maths where you simply add the revenue and user base numbers; it’s a merger of two different cultures and it needs chemistry, which takes time. Unfortunately, BYJU’S was in a rush to combine the numbers.” — a founder who sold his startup to BYJU’S in 2021.

lockquote>

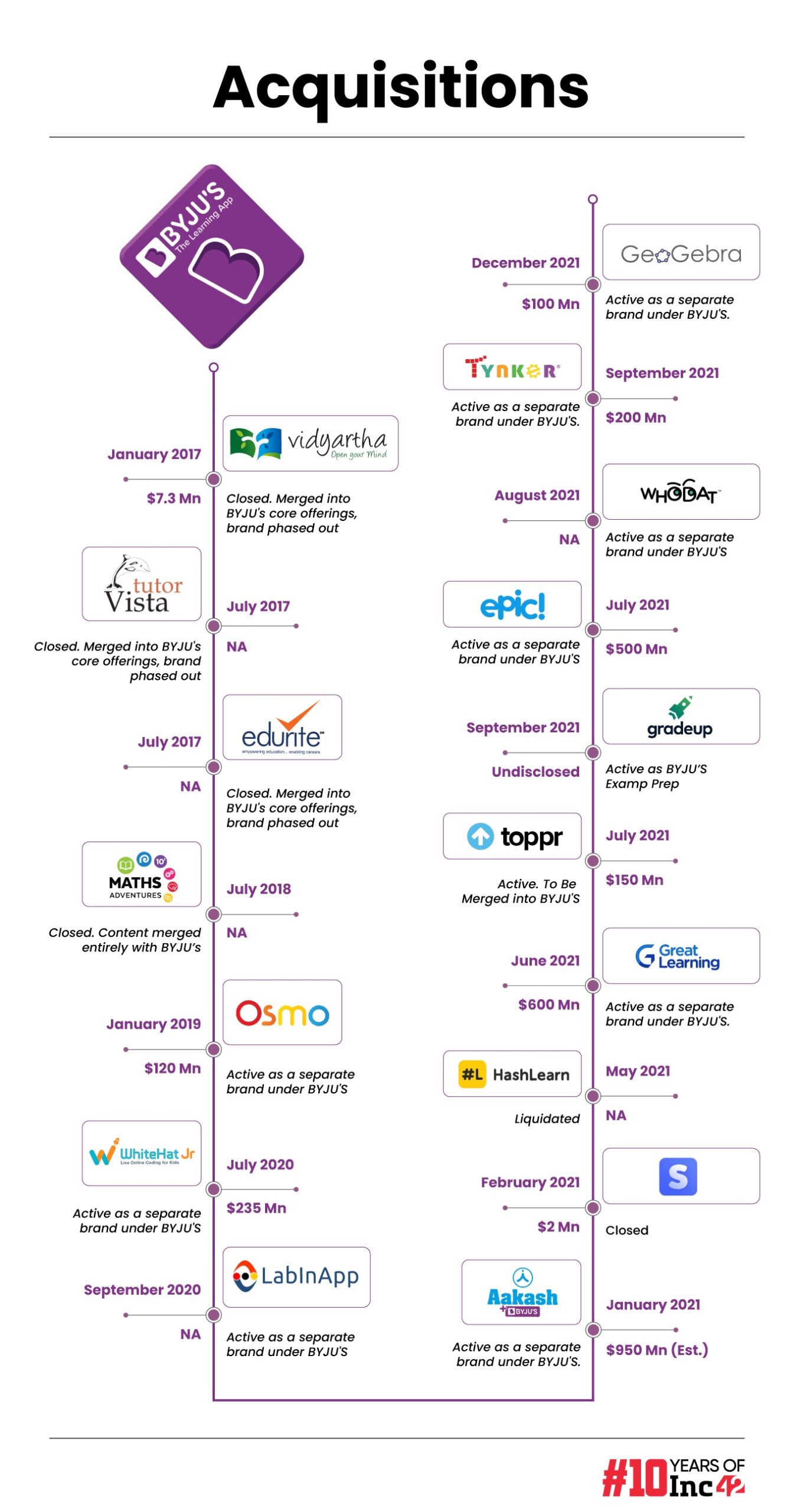

Between 2017 and 2021, BYJU’S went on a shopping spree and acquired 17 startups. That’s unprecedented in the Indian startup ecosystem.

Indeed, very few companies in the world have this kind of appetite. Apple acquired some record 100 companies between 2014 to 2021, but this was following a period of consistent profitability. Anyway, a comparison of BYJU’S and Apple’s acquisition strategies is warranted.

Except for Beats (a $3 Bn acquisition), most of these deals by Apple were simply small acqui-hires or technology acquisitions. They didn’t impact the culture of the company or the chemistry between teams. The fact that Apple remains the largest company in the world by market cap today indicates that it managed to integrate these acquisitions successfully to a large extent.

As we will see, that’s not the case with BYJU’S, where the acquisitions didn’t exactly align with the company’s culture and business models.

With immediate interjections from the top management and changes from top to down level, many of these acquisitions soon became a burden for the parent company and are now ready to be re-sold at much-reduced prices.

The inorganic growth strategy saw an unprecedented exponential decline of the parent company and the acquired companies, barring a few.

Before diving into the specifics, let’s establish some context by starting from the very beginning.

The Making Of An Edtech Empire

Even though the company was incorporated in 2011, Byju Raveendran, along with the founding team, started working on building an online learning product in 2009. The BYJU’S learning app was brought to market in 2015, and the company took its first steps into the world of edtech.

By 2016 onwards, BYJU’S was well into its journey but its culture was still evolving. The company tried to set a benchmark in terms of rigorous training for its sales and content teams, and hefty salary packages.

However, soon, grievances regarding a toxic and aggressive work environment at BYJU’S began to accumulate.

Videos, audio clips, and message screenshots started circulating on social media, which seemed to back the concerns of toxic work culture and the pressure faced by employees as the company looked to achieve big numbers at any cost.At the same time, instead of fixing these internal issues, the company had started to look out for acquisitions to expand the product line and user base.

BYJU’S went on to acquire 17 companies over the next four years and spent around $3 Bn on these acquisitions.

In 2017, the idea behind these acquisitions was basically to expand the product line such as getting into online tuition, personalised evaluation programmes and so on. However, by 2021, the focus had shifted entirely to acquisitions. A former core team member even went on to say that some of these acquisitions were primarily aimed at diverting attention from deteriorating financials, including concerns from investors.

Diving Into BYJU’S M&A Strategy

“In the early days, we hardly had any funding from major investors except Aarin Capital. It was a conscious decision then. Once we had the products, the funding started coming in, and with it came the pressure to expand as fast as possible,” according to a former core team member who is no longer associated with the company.

Soon after launching its first product, the company raised a Series C round in 2016 and then started its scaling-up journey. With big investors such as Lightspeed and Sequoia (Now Peak XV Partners) having infused almost $160 Mn, it was time to step on the accelerator.

Employees who saw the company in those early days, before the unicorn and decacorn hype, say the investor expectations aligned with what Raveendran would promise. For instance, investors wanted big exits and returns on their investments, and Raveendran committed to growing at a fast pace to help give them the returns.

Rarely does a startup turn profitable in the early years. Another key parameter that helped Raveendran to lure investors.

“Raveendran was always the most ambitious person in the boardroom. A person who does not shy away from taking bold moves,” said the former core team member quoted earlier, adding that this was a quality that investors liked about him.

In fact, having seen that BYJU’S was willing to splurge on acquisitions, investors encouraged edtech founders in their portfolio to adopt the acquisition route, two former employees, who did not wish to be named, seconded.

lockquote>

Trouble In The Acquisition Land

While BYJU’S seemed poised to dominate edtech in 2020, many things went wrong with these acquisitions. For one, the company needed an extra long runway to integrate these companies meaningfully.

“Imagine you have raised some funding and invested all of it into acquiring new companies. And this is when you’re not breaking even but rather making huge losses. You don’t even have the runaway to run these acquired companies. You have to raise debt to keep them running. And then you have to lay off 80% of the employees to sustain the acquisition,” said the former core team member.

lockquote>

The inorganic approach coupled with inadequate disclosures to investors and financial reporting failures likely obscured the true extent of losses and potentially blocked efforts to secure additional funding, as we were informed.

It’s no secret that acquiring companies often come with unforeseen challenges and liabilities. The promised synergies may not materialise quickly enough to have a positive impact on the business, leading to prolonged financial strain. The company’s loss of close to INR 8,500 Cr or $1 Bn in FY22 illustrates the depth of the pitfalls of such unchecked expansion.

The company is yet to file its financial statements for FY23, but as we reported exclusively this week, the company’s revenue has grown to INR 6,500 Cr in FY23 from INR 5,300 Cr in FY22.

Anirudh Damani, managing partner at Artha Venture Fund, believes that BYJU’S ultimately-doomed strategy is a critical lesson for startups in dealing with the complexities of inorganic growth.

“The rapid pace and volume of acquisitions was aimed at arbitrage i.e. the company tried to acquire at lower multiples and raise funds at higher valuations based on these acquisitions. This was a critical flaw. While initially, the acquisitions boosted consolidated revenue, the strategy failed to translate into profitability. This has led to the disbandment of acquired teams and dilution of any value from the acquisitions,” Damani added.

lockquote>

BYJU’S raised nearly $3.5 Bn till 2021 and used a bulk of this amount for acquisitions. In 2022, it also raised $1.2 Bn from US lenders as a Term Loan B and got another infusion of $800 Mn from founder and group CEO Raveendran. (But it remains unclear if he has indeed invested the said amount.)

Meanwhile, besides acquisitions, the company splurged on marketing and advertisements, including sponsoring the Indian cricket team’s jersey, signing agreements with Lionel Messi and bringing on board film stars as ambassadors.

Even as it had failed to account for the nuances of acquisitions, the company also failed to retain the brand equity of the acquired companies, according to a founder whose startup was acquired by BYJU’S.

Adding to this friction, acquisitions became an additional burden on the day-to-day operations. Employees also said that the centralised management approach made it worse. “Most of the brands, including Aakash, were merged with the central leadership,” he added.

Several employees were fired from across the acquired companies.

It was also hit by lawsuits — as we will see — pertaining to misselling and misleading advertisements, which added to the problems of integrating the acquired companies and aligning new employees with the work culture.

A former director at the company added that had the acquired brands such as TutorVista, Toppr, WhiteHat Jr and others operated independently, BYJU’S could have avoided the current situation where it is struggling to manage the standalone heavy losses.

Most of these were ailing companies. Instead of adding these as separate brands under BYJU’S, the need of the hour was to fix them separately. This way, the risk could have been minimised without focusing too much on creating new wings under BYJU’S such as Future School, Disney products etc, he added.

There’s a reason behind it, he argued. BYJU’S was still an emerging brand while TutorVista, Edurite, Aakash and a few others were much more established brands. It was easier for the brand to reconnect than starting afresh.

But this is just one of the reasons for the failed acquisitions — as we will see next, in many cases, BYJU’S did not need to acquire the companies it did, but went ahead because of the pressure of meeting growth targets that come along with VC funding.

Partly, this was also due to Raveendran’s inclination to present himself as a champion entrepreneur unafraid of making bold moves and taking significant risks, as noted by the former employee.

With the exception of Aakash, most of these companies including TutorVista, WhiteHat Jr, Toppr GradeUp etc were facing issues even before the acquisitions. Despite this, they had an established business model that required reaching breakeven before the full merger could be realized.

In some cases, even though the brands were not merged directly, the change in management after the acquisition adversely impacted the growth trajectory, we were told.

Experts reckon that instead of putting one brand name behind every category, it’s always better and easier to market specialised platforms independently. This would have allowed the acquired brands to stay focussed on their niches within edtech, instead of getting lost in BYJU’S large machinery.

Case in point: Acquired startups and companies that remained independent such as Aakash or Great Learning have profits and continue to be a bright spot in an otherwise gloomy time for BYJU’S.

As a result of the current controversy, even the likes of Aakash and Great Learning are suffering from the negative perception around BYJU’S as a whole.

Great Learning for instance had nearly achieved breakeven registering INR 7 Cr of loss at INR 227 Cr in FY20, however, after acquisition in 2021, net losses mounted to INR 307 Cr and INR 357 Cr in FY22 and FY23, respectively.

Aakash, which made profits worth INR 166 Cr in FY20 is yet to repeat the same pre-Covid financials.

Further, several startups that BYJU’S acquired were overpriced and ailing. For instance, TutorVista despite being a reputed startup had reduced to a distress sale by the time BYJU’S acquired, thanks to Pearson’s overthinking on profitability.

Similarly, buying WhiteHat Jr at $235 Mn did not help either. Before the acquisition, WhiteHat Jr had reported merely INR 16 Cr revenue at a loss of INR 71 Cr. Post-acquisition, it only widened with losses mounting 30X to INR 1,690 Cr at the operating revenue of INR 484 Cr in FY21. In FY22, WhiteHat Jr.’s revenue declined to INR 295 Cr, while pre-tax losses surged nearly INR 2,358 Cr.

Overpaying To Acquire

While problems related to integrating acquired companies happen once the deal has been signed, one could say that BYJU’S was also guilty of paying high valuations and revenue multiples for many of the deals.

It must be noted that the company acquired over 10 startups in 2021, just after Covid disrupted offline learning. The pandemic gave new wings to edtech startups and new models emerged to cater to students and educators. While BYJU’S had the right idea of entering new verticals that were growing, this was a short-sighted move, particularly from the point of view of pricing, according to multiple angel investors who have invested in edtech platforms.

Take WhiteHat Jr for instance. It was not a good company to buy at the time as the startup was being accused of misselling and misleading ads (Remember Wolf Gupta?).

At the time of its acquisition, WhiteHat Jr was barely 20 months old, it had just about 120K paid users and was valued at INR 2,250 Cr. The acquisition amount was INR 400 Cr more than the combined market cap of coding market leaders NIIT and Aptech.

Days after the acquisition, WhiteHat founder Karan Bajaj even claimed that the company was on track to hit $150 Mn in ARR, a number which the company has failed to meet even four years after the deal. In fact, WhiteHat Jr reported revenue of INR 484 Cr or just over $70 Mn (as per erstwhile exchange rates) in FY21.

One could also say that BYJU’S failed to see beyond Covid when it comes to these acquisitions. The success of edtech and BYJU’S during the pandemic lockdown was a one-off.

Former employees allege that the management knew that this shine would not last long. That’s why they tried to push products and services into the market at the highest speed possible.

Burnt By The BYJU’S Experience

While complete financials for all acquired companies, including US-based Osmo and Epic Learning aren’t available, analysing available data reveals a mixed bag.

Great Learning reported higher losses in FY23, while Aakash was a ray of hope as its profits grew in FY22.

WhiteHat Jr, which was initially profitable, has faced declining user numbers, raising questions about its long-term sustainability. WhiteHat Jr’s standalone losses increased to INR 2,692 Cr in FY22, accounting for a majority of BYJU’S net loss of INR 8,450 Cr in the fiscal year.

WhiteHat Jr has been set for a rebranding to BYJU’s Future School and the acquired company is likely to be dissolved, a source told us.

Notably, Toppr was reportedly merged into BYJU’s core offerings, making its performance unclear. Among others, GradeUp which recorded profits worth INR 15 Cr in FY 23, has been rebranded as BYJU’s Exam Prep.

Despite cutting costs over the past few years, BYJU’S has not managed to show any signs of profits. Now, the company is trying to milk whatever funds it can raise by selling some of these assets.

It is said to be planning to sell the US-based Epic at around $400 Mn, and even Great Learning is said to be on the way out. The burden brought on by reckless acquisitions may not entirely be relieved by these sales.

“For startups within our portfolio, the BYJU’S experience underscores the importance of strong due diligence and measured pace in acquisitions. It’s a stark reminder that profitability and operational integration are as critical as the strategic fit of acquisitions,” Artha’s Damani said.

lockquote>

Resilient brands in BYJU’S fold, such as Aakash, may continue to thrive independently, but the future for others remains uncertain. The investors have demanded the original founders and promoters of Aakash return to the board and head the institute independently.

The potential divestiture of parts of BYJU’s empire is a cautionary tale for every startup that has over-leveraged acquisitions to raise funds or show growth.

Now, two years after its acquisition spree ended, BYJU’S is planning to raise $200 Mn at a $225 Mn valuation. Desperate times, indeed. It just goes to show that while acquisitions can bring in lots of external funding at a point in time, failure in managing these acquisitions can serve to nullify any capital advantage.

In hindsight and through the lens of these acquisitions, we can even say that this is a problem that was always going to come to bite BYJU’S.

The big question is, whether the founder Byju Raveendran has learned from the mistakes he has made. Or is BYJU’S going to remain the controversial brand, always struggling to raise the next round of funding?

By blaming the investors for hampering the latest round of funding from the rights issue, the latest emails hardly instill any confidence that Raveendran would walk the hard talk once and for all.

[Edited by Nikhil Subramaniam]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)