SUMMARY

The plans are not finalised yet and may change ahead of the official announcement, expected on February 28

The deal has been in the works for months and will see Reliance owning 51%-54% stake in the merged entity

The development comes days after reports said that a deal had been struck between the two parties, which pegged Disney’s India operations at $3.5 Bn

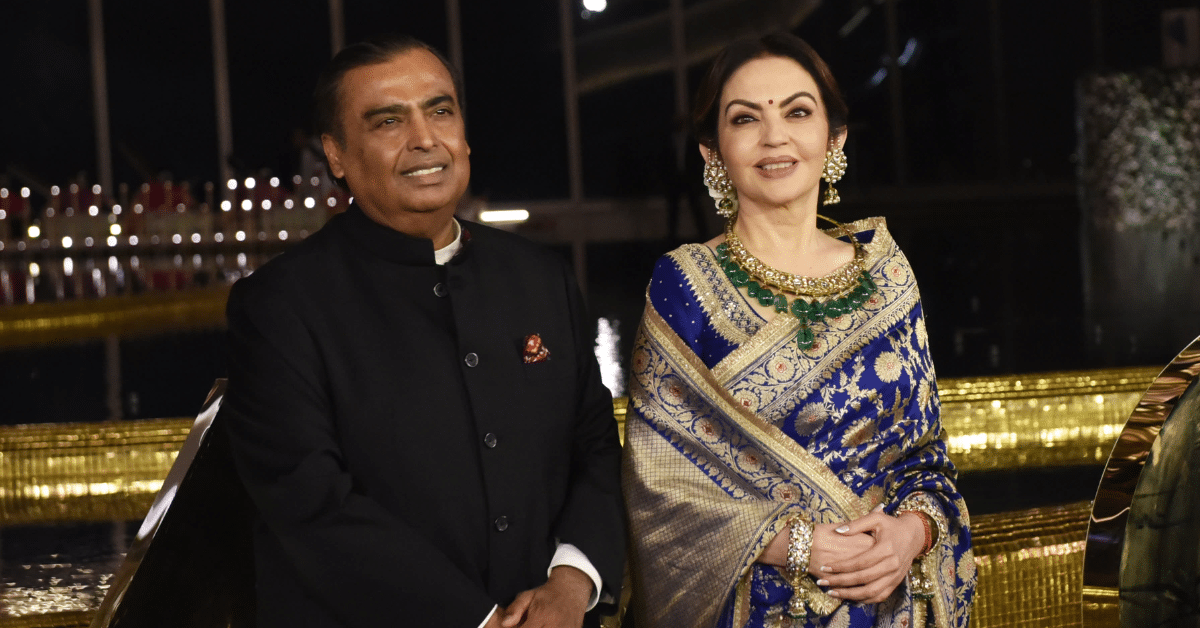

A day after Reliance and Disney reportedly signed a pact to merge their India media businesses, it has now emerged that Mukesh Ambani’s wife Nita Ambani will likely helm the board of the consolidated entity.

Reuters, citing sources, reported that Nita Ambani is expected to be appointed the chair of the board when the two companies merge their India media assets.

However, the plans are not finalised yet and may change ahead of the official announcement which, as per Reuters, is slated for Wednesday (February 28).

The development comes close on the heels of Nita Ambani quitting the board of Reliance Industries to reportedly “focus more on charity work”. She currently serves as the founder and chair of the Reliance Foundation, the conglomerate’s non-profit arm.

As per the report, the deal has been in the works for months and will see Reliance owning 51%-54% stake in the merged entity. Of the remaining, Disney will hold around 40% while the remaining 9% will be owned by Bodhi Tree, a joint venture between James Murdoch and former top Disney executive Uday Shankar.

The transaction reportedly pegs Disney’s Indian operations at $3.5 Bn, a far cry from $15-$16 Bn estimated back in 2019.

If it goes through, the deal will spawn the rise of the country’s largest media empire, covering TV broadcasting and streaming. The consolidated entity will boast of more than 120 TV channels such as Star Plus, Colors, and Star Sports.

Alongside, the combined entity will also operate two streaming platforms – JioCinema and Disney+ Hotstar, which together account for a substantive share of the Indian subscription and ad-based video-on-demand segments.

Not just this, the two players together will also hold the rights for all major sports tournaments in the country, including the Indian Premier League, ISL, English Premier League, NBA, and Olympics.

However, after the announcement, the deal will have to be cleared by the Competition Commission of India. The watchdog will review the merger deal as the two entities together corner more than 40% market share in both TV and streaming segments.

At stake is India’s $28-Bn media and entertainment market. The deal comes as Disney has been struggling to keep up with the onslaught of Reliance, especially in the streaming space.

From clinching digital rights of all major tournaments to poaching streaming rights of all premier English shows in the past two years, JioCinema has triggered an exodus of subscribers from Disney+ Hotstar. With user numbers dwindling, the latter appears to have partnered with the Indian conglomerate to streamline operations and pare losses.

The deal will see the emergence of a massive media empire and could foreshadow other players in the space.

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘862840770475518’);