SUMMARY

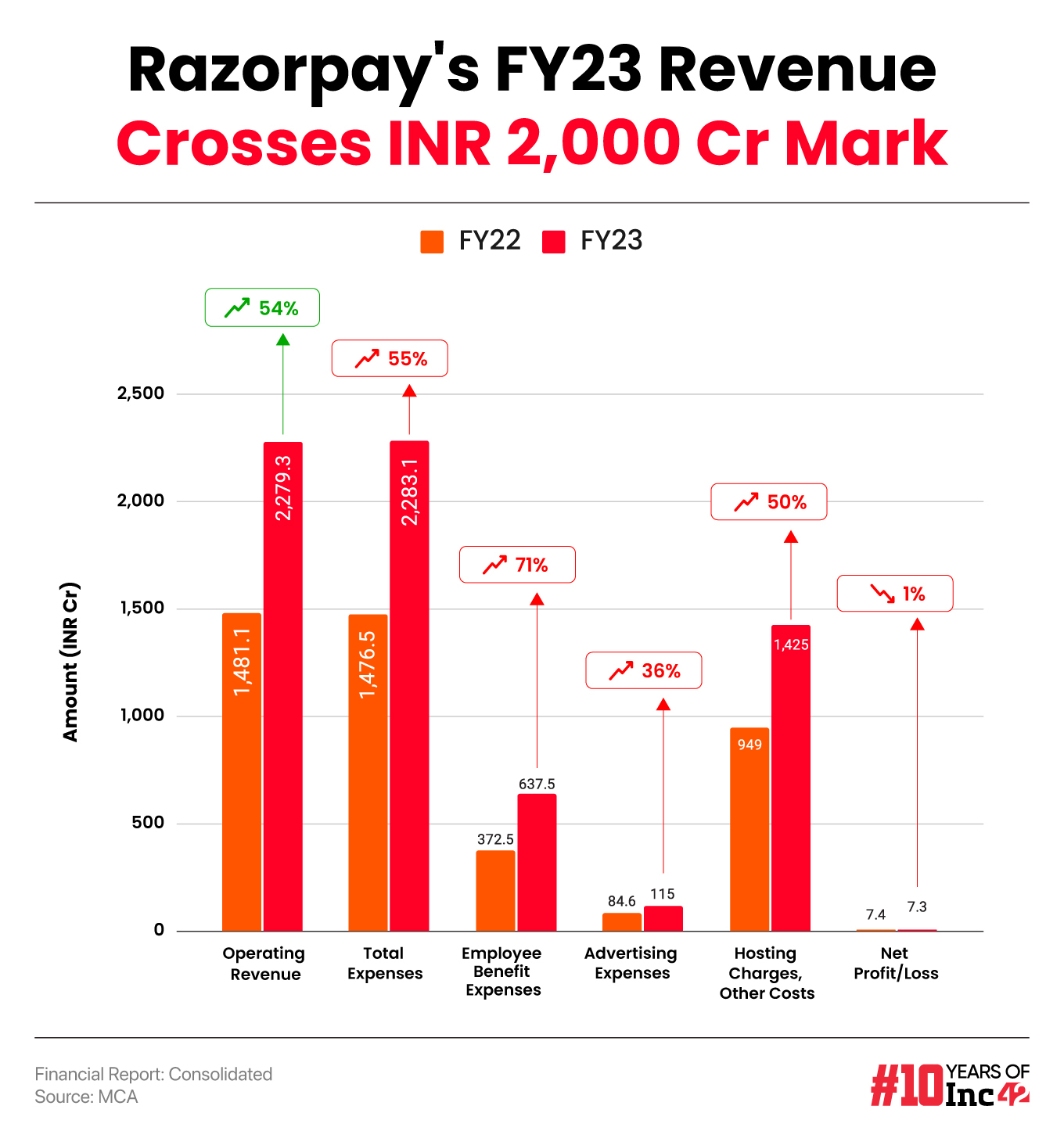

Razorpay’s net profit dipped marginally to INR 7.3 Cr in FY23 from INR 7.4 Cr in FY22

The Peak XV Partners-backed startup’s total expenditure zoomed 55% to INR 2,283.1 Cr in FY23 from INR 1,476.5 Cr in FY22

The startup is looking to shift its base to India by the end of 2024 and is eyeing an IPO in the next two years

Bengaluru-based fintech unicorn Razorpay’s revenue from operations crossed the INR 2,000 Cr mark in the financial year 2022-23. The startup, valued at above $7 Bn, reported a consolidated operating revenue of INR 2,279.3 Cr in FY23, up 54% from INR 1,481.1 Cr in the previous fiscal year.

Razorpay generates most of its revenue through payment commission fees that it earns by providing online payment services to merchants. Apart from this, the startup also generates revenue by providing software development and maintenance services.

Including other income, Razorpay’s total income stood at INR 2,293.3 Cr, a jump of 54% from INR 1,485.6 Cr it reported in FY22.

Meanwhile, net profit dipped marginally to INR 7.3 Cr in FY23 from INR 7.4 Cr in FY22.

Where Did Razorpay Spend?

The Peak XV Partners-backed startup’s total expenditure surged 55% to INR 2,283.1 Cr in FY23 from INR 1,476.5 Cr in FY22.

Employee Benefit Expenses: Employee expenses zoomed 71% to INR 637.5 Cr during the year under review from INR 372.5 Cr in the previous fiscal year, indicating an increase in the employee headcount.

Hosting Charges, Other Expenses: As per its financial statement, the startup spent INR 1,425 Cr on hosting and other expenses, an increase of 50% from INR 949 Cr in the previous fiscal year. However, it didn’t provide a breakdown of the two expenses.

Advertising Expenses: Razorpay spent INR 115 Cr on marketing and brand awareness in FY23, an increase of 36% from INR 84.6 Cr in the previous fiscal year.

Earlier, Razorpay said its point of sale devices business grew 60% in FY23 following the acquisition of Ezetap (Razorpay POS) in 2022. It said Razorpay POS witnessed a 40% growth in total payment volume (TPV) from April to October 2023 compared to the corresponding period of the previous year.

The startup also operates Razorpay Opfin, a payroll management platform, and Razorpay X, a neobanking platform.

Last week, it unveiled RAY, an AI chatbot for payments and payroll management, to enhance its offerings. It also ventured in the marketing and growth solutions space with the launch of a full-stack intelligent marketing growth suite, Engage.

Razorpay, founded by Shashank Kumar and Harshil Mathur in 2014, is now also looking to shift its base to India by the end of 2024 as it is eyeing an IPO in the next two years.

The fintech startup has raised a funding of over $740 Mn till date and counts the likes of GIC, Tiger Global, MasterCard, and Lightspeed Ventures among its backers. Its last major funding round came in December 2021 when it raised $375 Mn from Lone Pine Capital, Alkeon Capital, and others at a valuation of $7.5 Bn.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)