multipl, the pioneer of Spendvesting in India, has released its “Spendvesting Report,” which highlights an innovative personal finance strategy enabling Indians to save a significant 20% on all their lifestyle spends. This approach, developed by multipl, merges lifestyle goals with prudent investing, offering a way for consumers to live their dream lifestyle while building a secure financial future. The report identifies travel as the preferred category for spendvesting enthusiasts, with gadgets and shopping also being significant, pointing to the popular lifestyle goals that drive financial decisions. It also notes that 50% of Indian spendvestors are in the 26-34 age group, showcasing the strategy’s resonance with Millennials and Gen Z.

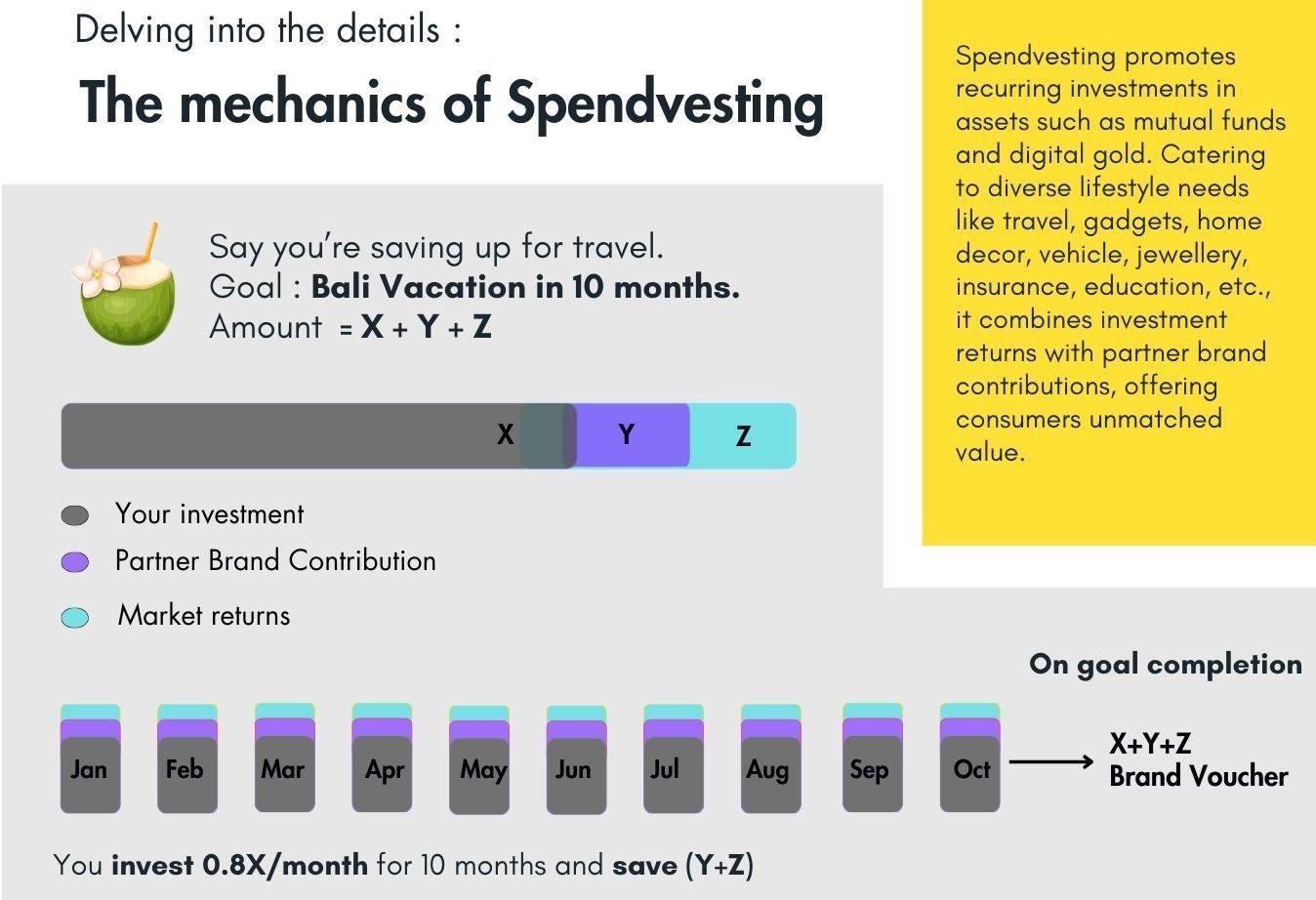

Presented in collaboration with Blume Ventures, Augmont – Gold for All, DSP Mutual Funds, and EaseMyTrip, this comprehensive report tracks the evolution in Indian spending habits, moving away from traditional banking and credit usage towards a more balanced spendvesting approach endorsing a positive habit for a stable financial future. It tackles the growing issue of credit card defaults and debt accumulation among younger generations, emphasising the need for financial discipline. By integrating investments in short-term debt/hybrid mutual funds and digital gold with daily lifestyle spends like travel, gadgets, and insurance, spendvesting seeks to simplify modern financial literacy demands and facilitate healthy and rewarding spending habits through the gains from investments and contributions from partner brands.

Highlighting the investment tendencies of younger demographics, the report demonstrates Millennials and Gen Z’s preference for fintech startups for customised investment advice. It illustrates that an average software engineer earning between ₹12L-₹14L annually could save around ₹1.2L per annum simply by adopting spendvesting.

Paddy Raghavan, co-founder of multipl, states, “Spendvesting is not merely a financial strategy; it represents a shift towards mindful and gainful consumer behavior.” He adds, “Our collaboration with Blume Ventures, Augmont, and DSP Mutual Funds, has enabled us to offer a report that is intended to inform and equip consumers to meet their financial objectives while pursuing the lifestyle they aspire for.” As interest and participation in spendvesting grows, it is set to capture a wide ranging audience, capitalising on India’s expected digital economy boom to $1 trillion by 2030.

About multipl:

Founded in 2020 by Paddy Raghavan, Jags Raghavan, and Vikas Jain, multipl is the world’s first and largest platform dedicated to Spendvesting. As a SEBI-registered investment advisor, multipl serves over 500,000 users, integrating financial planning and investment to help achieve personal goals. With partnerships with 70+ leading Indian brands, multipl offers unique advantages and rewards, solidifying its position as a leader in redefining personal finance through Spendvesting.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)