SUMMARY

There was no clarity on whether these charges have been introduced for all users

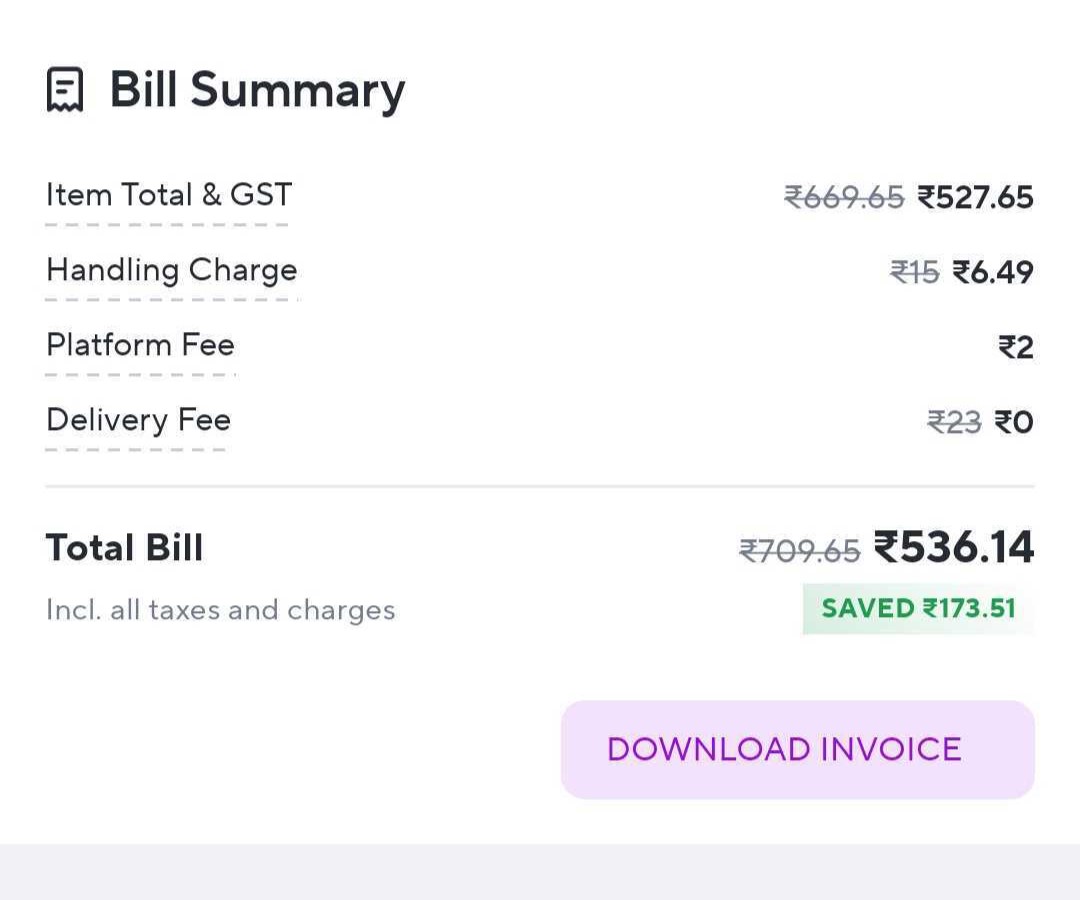

This is on top of separate handling charges that the platform levies on the orders, which ranges anywhere between INR 5 to INR 20 depending on various factors

With this, Zepto could be looking at creating alternate revenue streams and shoring up profitable numbers, taking a leaf out of the playbooks of Swiggy and Zomato

In a bid to bolster profitability, quick commerce startup Zepto has started rolling out a platform fee of INR 2 per order for its users.

This is on top of separate handling charges that it levies on orders, which ranges anywhere between INR 5 to INR 20 depending on the order size, location and time of the day. Additionally, Zepto also charges a surge fee and a separate “cart fee” for orders below INR 100.

“We don’t believe in being over dependent on delivery fees to be profitable. We believe in core operating efficiency and cost reduction to be profitable. We are on track to achieve the EBITDA positive milestone even with much lower delivery fees,” a Zepto spokesperson told ET.

There was no clarity on whether these charges have been introduced for all users.

With this, the company could be looking at creating alternate revenue streams and shoring up profitable numbers, emulating similar charges levied by food delivery verticals of Swiggy and Zomato.

However, unlike Zomato-owned Blinkit and Swiggy Instamart which only charge a handling fees, Zepto has now also begun experimenting with the platform fees.

The development comes close on the heels of Zepto unveiling a new membership programme Zepto Pass, starting at INR 99 a month, for select users that offers unlimited free deliveries on orders above INR 99. For this too, Zepto had taken a leaf out of the playbooks of Swiggy and Zomato which offer a similar service under the Swiggy One and Zomato Gold respectively.

Meanwhile, Zepto continues to report losses. It more than tripled its losses year-on-year (YoY) to INR 1,272.4 Cr in FY23, while shoring up its operating revenues 14.3X YoY to INR 2,024.3 Cr.

Meanwhile, the quick commerce startup has set its eyes on meeting its EBITDA profitability targets in 2024. Alongside, Zepto has also sped up plans to move its base back to the country and list on the Indian bourses by as soon as 2026.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)