The Indian fintech ecosystem has undergone significant transformation since the revolution in digital payments infrastructure with the introduction of the unified payments interface (UPI). The digital shift has also ushered in concepts like Buy Now Pay Later (BNPL), neobanking as well as digital banking, and now, generative AI (GenAI) is poised to be the next big disruption for Indian

The increasing adoption of GenAI is expected to push this growth forward in the fintech ecosystem as cost is reduced and user experience is enhanced.

Inc42’s conversations with several GenAI investors in the country revealed that the GenAI-based applications and models for specific sectors are one of the key areas of interest for the VCs currently. In that, most investors are expecting a breakthrough in GenAI usage in enterprise SaaS and fintech.

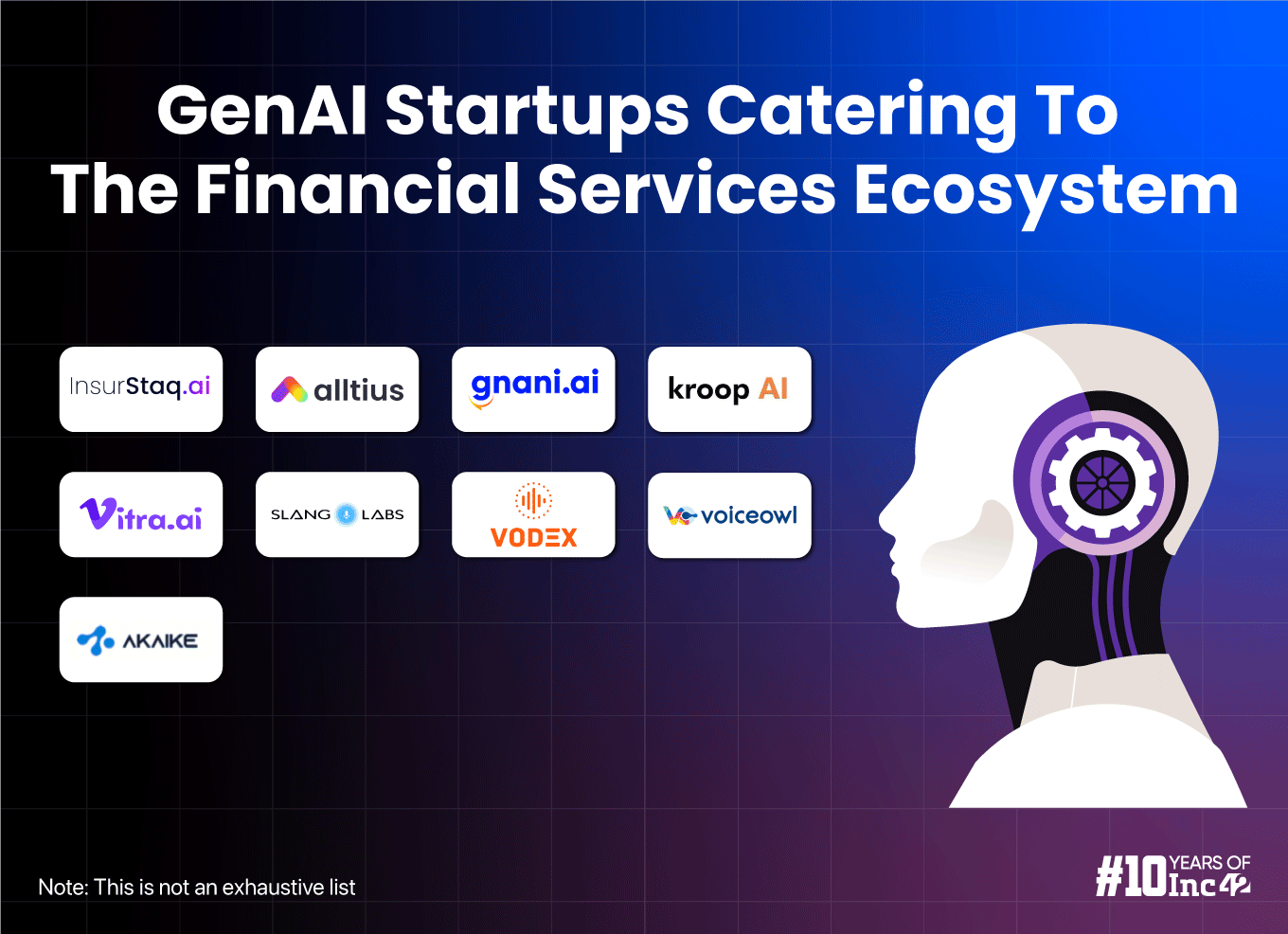

In further interaction with multiple fintech industry expects, GenAI startups building models and applications for the fintech ecosystem, and their investors, Inc42 found that while the adoption could be slow in certain pockets, there is significant demand already created in areas such as the usage of AI-based chatbots and voice bots for simplifying customer support processes by banks and other financial institutions.

Besides, there is also an increasing application of GenAI for underwriting insurance, as well as building customised investment portfolios, loan options, and insurance plans.

Are India’s Fintech Startups Ready For GenAI?

A recent EY report suggests that a large number of financial services players in India have either already started the process of harnessing the power of AI in at least one use case or have plans to pilot it over the next 12 months. These financial services majors’ core target right now is to use GenAI to improve customer service, improve efficiency, and reduce costs.

Speaking to Inc42, Vatsal Kanakiya, CTO at 100X.VC said that fintech seems to be the domain where GenAI adoption is taking off the most because financial services have a lot of redundant manual business processes, which can be automated. Besides, the industry also tends to be generally one of the earliest adopters of any technical innovations across the world, he said.

In fact, he believes that startups building GenAI applications should first target the BFSI and fintech industry given the large scope for automation in it.

Echoing a similar sentiment, a PhonePe spokesperson said, “India’s fintech ecosystem has always embraced innovation and we believe that the ecosystem recognises the revolution of GenAI.”

“Traditional models are already getting disrupted by fintech startups leveraging cutting-edge technologies like data analytics, machine learning, and AI to personalise financial experiences… We also believe the expanding use of GenAI will play a big role in boosting efficiency across teams in companies while enabling further financial inclusion in India,” the spokesperson added.

lockquote>

While the inclination of the financial services companies right now is more towards partnerships and external assistance given the huge cost and data feeding required for building LLMs from scratch, some are also building their in-house LLMs.

Currently, GenAI has found its prominence in fintech by enhancing the biggest challenge of customer support.

GenAI-Powered Chatbots Automating Fintech Processes

Conversational AI has gained widespread popularity across domains over the last few years. The emergence of GenAI has brought about a significant improvement in the efficiency of chatbots and voice bots. While this advancement poses a threat to millions of jobs, the benefits it brings to companies are substantial.

The PhonePe spokesperson said that tools like AI-powered chatbots are becoming increasingly popular given that they act as virtual financial advisors, readily available 24/7 to offer customised guidance.

“These conversational interfaces analyse user data and financial behaviour, generating tailored recommendations…Hyperpersonalised insurance and wealth products with AI-powered chatbots acting as advisor are obvious use cases of GenAI in fintech,” the spokesperson said.

In fact, most Indian financial organisations – from large enterprises such as HDFC Bank, IDFC First Bank to the likes of Policybazaar, Plum, and Fibe are using AI-based chatbots to solve multiple bottlenecks.

Speaking to Inc42, Shrini Viswanath, cofounder of online wealth management platform Upstox said that in October 2023, the company upgraded its chatbot to use GenAI. Now, when customers ask questions, they get more relevant content due to semantic search being more effective at document retrieval.

“Since October, we have seen both a growth in new customers and active customers leading to a growth in customer contacts. Our chatbot is handling this increase in customer contacts more effectively as we are observing only 22% of chatbot conversations directed to a chat agent versus 30-35% before using GenAI,” said Viswanath.

lockquote>

Viswanath explained that unlike delivery or ecommerce platforms, where the problems chatbots need to solve are limited to refund or return, in wealth management, it could be as small as ‘how to open a Demat account’ to ‘what should I invest in’. Hence, there is no one-size-fits-all solution and everything is tailored. Besides, there are language gaps.

“By using OpenAI’s and Haptik’s stack, we are leveraging GenAI to give better answers to user queries, which are not wizard,” Viswanath said. “We are also providing customers with a summary of the article using natural language generation rather than the previous response that only included a list of one-three articles.”

Meanwhile, in fintech particularly, virtual bots have a wide range of use cases beyond customer support. With GenAI models making chatbots more intelligent, their use cases can span from account management and providing customers with customised insights on investments to enabling fraud detection.

Sectors That Are Likely To Lead GenAI Adoption

While it’s evident that GenAI adoption is still in its early stages, pinpointing the leading subsectors in fintech remains challenging. However, insights from various GenAI players suggest that insurance firms, aggregators, and banks are increasingly utilising the technology. The are employing it for tasks such as content generation for marketing, underwriting insurance, assessing credit risks, and improving customer support.

Insurance: Santosh Bhat, head of data science at insurtech startup Policybazaar told Inc42 that it’s been about eight months since the company started implementing solutions using GenAI to solve multiple challenges. Having largely leveraged OpenAI’s models so far, Policybazaar is also building its in-house LLMs to support its platforms.

“With GenAI, we can understand customer requirements, customer sentiment, and their intent. We are also able to get insights into if there is any fraud or potential fraud,” Bhat said.

lockquote>

Mayan Kansal, cofounder and CEO, InsurStaq.ai, said the insurance industry has historically been slow in terms of the adoption of technologies but with LLMs, the sector has acted in a more balanced way.

“Insurance professionals look at massive data. Whether it’s a request for quotation, they are trying to underwrite something, they have to look at lots of data and make sense of it. Luckily, LLMs are also good at looking at massive data,” Kansal said, adding that this is the reason LLMs are becoming popular in this sector.

InsurStaq.ai is building a search engine for insurance, which involves building end-to-end GenAI infra, including the foundational models, specific to the insurance industry.

Payments & Banking: Interestingly, traditional banks are nowhere left behind. HDFC Bank is reportedly set to roll out a private LLM-powered website in 2024. The bank is also planning to leverage a private LLM to write credit assessment models and business requirement documents.

Axis Bank has also been working on leveraging private LLMs to improve customer support and automate its existing solutions.

Dr. Dinesh Singh, cofounder and director of FAAD Network, believes that besides insurance, payments is also at the cusp leading the GenAI adoption in fintech with use cases being in chatbots for customer support, AI-powered fraud detection, and personalised investment advice.

FAAD Network is an investor in InsurStaq.ai.

Meanwhile, PhonePe said that it uses machine learning-based predictive logic to predict particular transactions succeeding based on various historical and live performance parameters. Based on this, the payments giant is able to communicate to users the possibility of a transaction failure, while also ensuring that the app will inform them when they can try again.

“This has enabled us to provide greater reliability to users and improve success rates,” the PhonePe spokesperson added.

Although lending and wealth management sectors are gradually incorporating GenAI to address diverse challenges, the overall adoption has been relatively slow, except for AI-based customer support processes.

Fraud Detection For The Fintechs: Fintech has traditionally been susceptible to fraudulent activities, but the introduction of GenAI has clearly sparked optimism within the ecosystem that these frauds can be minimised.

Today, GenAI applications have also given rise to deepfakes. In fintech, where a large amount of KYC processes are involved, a person’s voice and also face can be morphed with someone else’s. This is major hurdle GenAI applications building fraud detection capabilities can solve.

lockquote>

Kroop AI, which has built a GenAI-based deepfake detection platform, recently told Inc42 that it is experiencing a surge in inquiries from the banks, globally, for the platform because, most of the time, there is no deepfake detection layer before biometric verifications that pose a significant risk.

In fact, PhonePe also said that efficient use of AI could further improve trust and safety of payment and finance platforms by identifying and preventing frauds, which will, in turn, enable further financial inclusion across the country.

The Challenges To Overcome

While GenAI adoption is expected to transform the fintech ecosystem further, there are also near-term hurdles that can potentially slow the adoption. This includes hallucination, biased decision-making, data-privacy-related risks, as well as high regulatory scrutiny in fintech.

The recent EY report pointed out that leading risk practitioners have highlighted that the use of commercial models may increase the risk of cybersecurity given these external models have access to material and non-public data that financial organisations hold.

While these risks are eminent when using third-party LLMs, financial organisations may encounter comparable regulatory inquiries when using internal models, the report said. It also suggests that even when an LLM is built internally, organisations need to carefully consider the issues related to data lineage and architecture, reliability of model training, accuracy of the outputs, and security checks and balances.

Though challenges remain, industry experts believe that a few years down the line, the inherent issues with GenAI will be largely solved, hence opening a huge scope for its adoption and utilisation in solving the major challenges in fintech.

[Edited by Nikhil Subramaniam]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)