SUMMARY

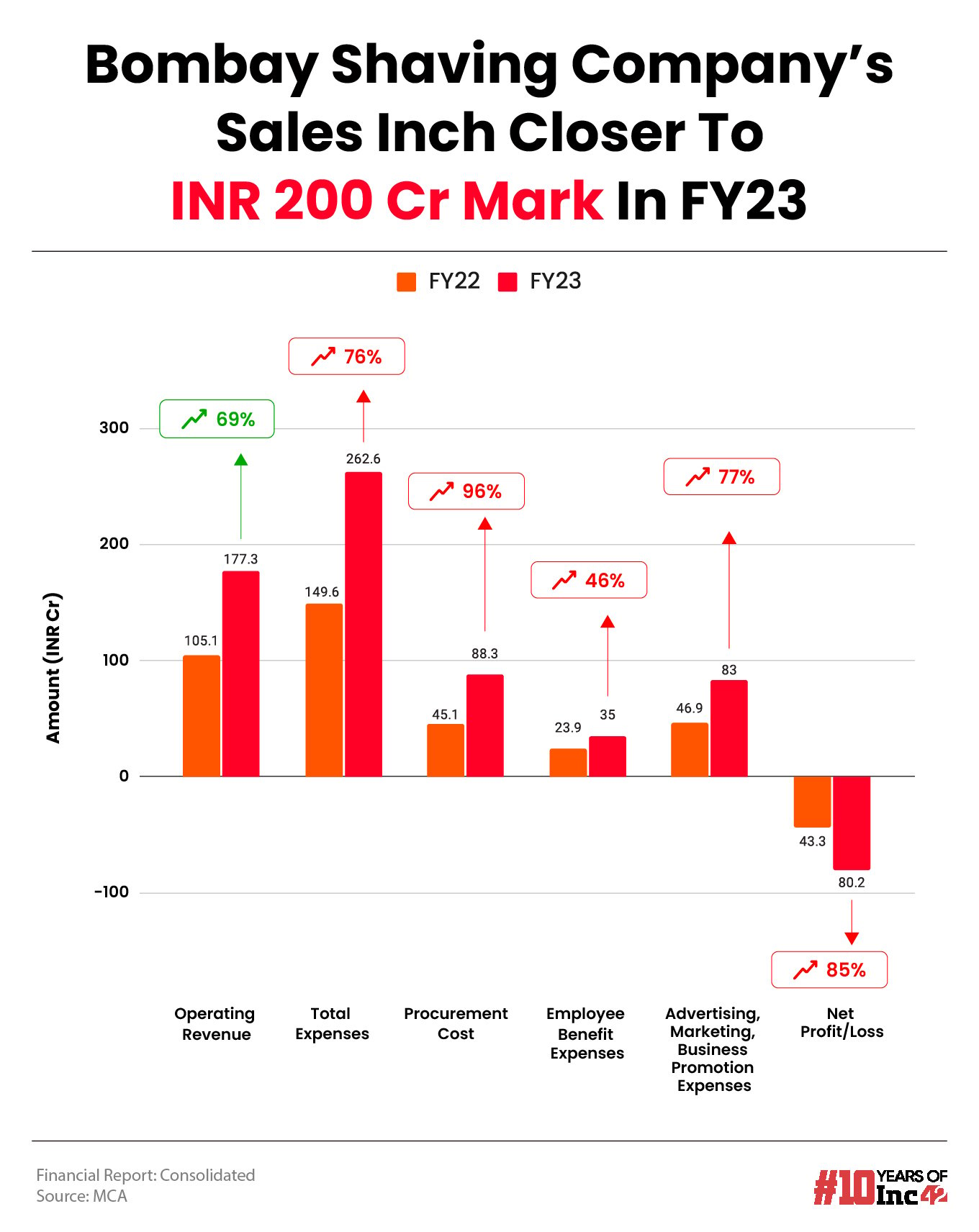

Bombay Shaving Company incurred a net loss of INR 80.2 Cr in FY23, an increase of 85% from INR 43.3 Cr in the previous fiscal year

The Shantanu Despande-led startup’s operating revenue grew 69% to INR 177.3 Cr in FY23 from INR 105 Cr in FY22

Earlier this month, Inc42 reported that Bombay Shaving Company raised INR 24 Cr debt from Alteria Capital to expand its offline presence from 12 cities to 25 cities

D2C grooming and personal care brand Bombay Shaving Company saw its net loss surge 1.8X in the financial year ended March 31, 2023. The Delhi NCR-based startup incurred a net loss of INR 80.2 Cr in the financial year 2022-23 (FY23), 85% higher than INR 43.3 Cr in the previous fiscal year.

While the loss increased, the startup’s sales inched closer to the INR 200 Cr mark. The Shantanu Despande-led startup posted an operating revenue of INR 177.3 Cr in FY23, 69% higher than INR 105 Cr in FY22.

Bombay Shaving Company primarily earns revenue through the sales of its products online as well as offline. Including other income, its total revenue rose 71.7% to INR 182.4 Cr during the year under review from INR 106.2 Cr in the previous fiscal year.

Founded in 2016, Bombay Shaving Company began as a D2C men’s shaving and grooming products brand. The startup has expanded into several other categories like fragrances and face washes since then and turned into an omnichannel brand.

Where Did Bombay Shaving Company Spend?

The startup’s total expenditure increased 76% to INR 262.6 Cr in FY23 from INR 149.6 Cr in the previous fiscal year.

Cost Of Material Consumed: The startup’s spending under the head zoomed 96% to INR 88.3 Cr during the year under review from INR 45 Cr in FY22.

Advertising, Marketing and Business Promotion Expenses: Bombay Shaving Company spent INR 83 Cr on advertising, marketing and business promotion in FY23, an increase of 77% from INR 46.9 Cr in FY22.

While it spent INR 46.2 Cr on marketing and promotion, advertising expenses stood at INR 36 Cr.

The startup’s EBITDA stood at INR -75.18 Cr during the year under review as against INR -42.97 Cr in FY22. EBITDA margin deteriorated to -42.4% from -40.88% in FY22.

Earlier this month, Inc42 reported that Bombay Shaving Company raised INR 24 Cr debt from Alteria Capital to expand its offline presence from 12 cities to 25 cities.

“We are looking at almost 35% growth in FY25. Getting the brand a lot more salient through investments in the brand campaign for our core power products will be critical right now,” Deshpande told Inc42.

The debt round came almost two years after the startup raised INR 210 Cr in its Series C funding round. The round saw participation from Gulf Islamic Investments, Malabar Investments, and Patni Advisors.

In the men’s grooming space, Bombay Shaving Company competes with the likes of The Man Company, Ustraa, and Beardo.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)