SUMMARY

The homegrown fashion ecommerce space is poised to grow at a CAGR of 25% to surpass the $112 Bn threshold by the decade’s end

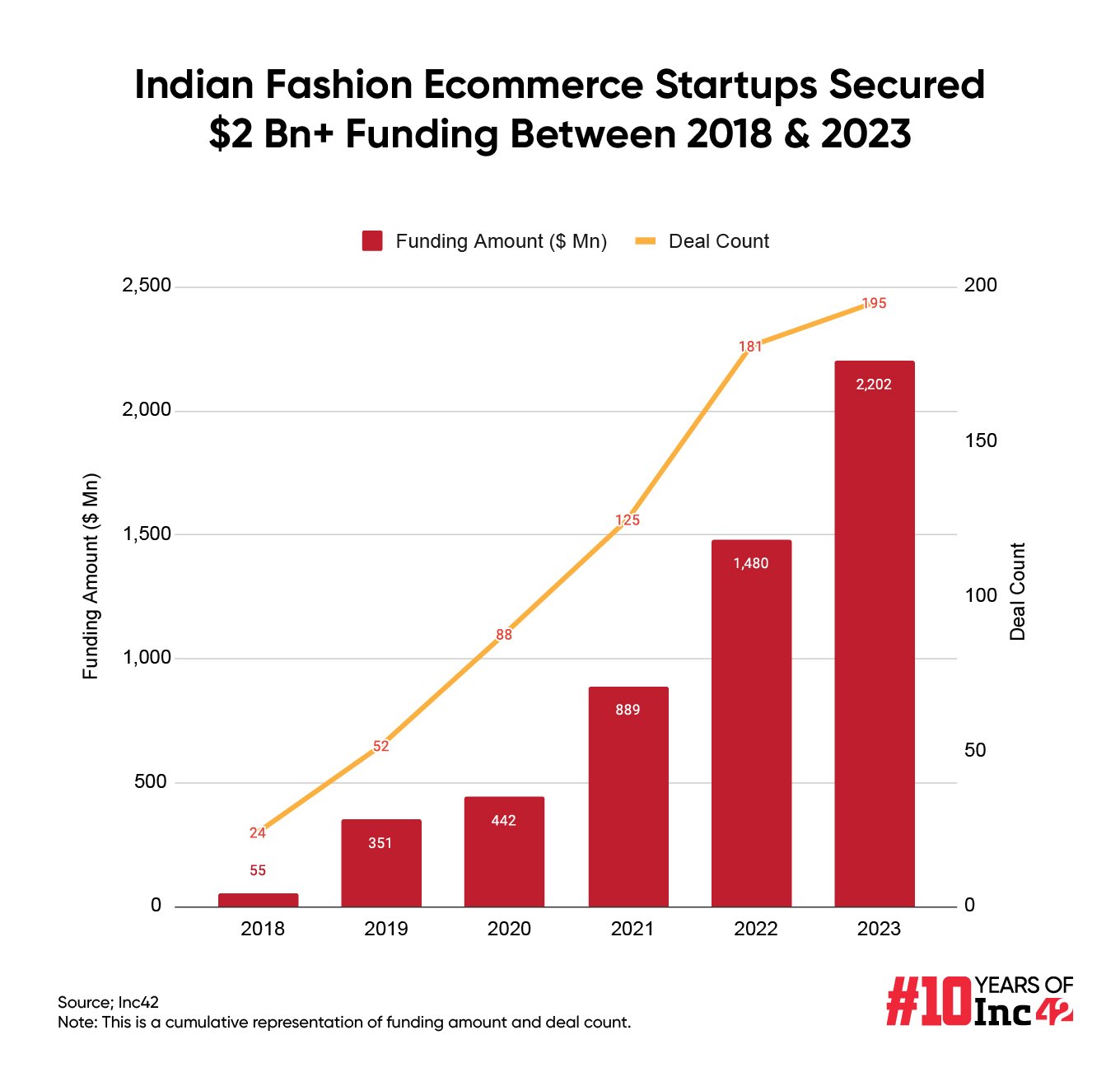

More than 200 fashion ecommerce startups in the country have collectively raised over $2.2 Bn+ from 2018 to 2023

The report identifies Delhi NCR as the fashion capital of the country. Having raised more than $1.4 Bn in 60+ deals, the region surpasses Mumbai and Bengaluru at $300 Mn+ and $237 Mn+, respectively

Indians are projected to upgrade their wardrobes more frequently than expected. Well, this is what Inc42’s latest “State Of Indian Ecommerce Report, Q1 2024” seems to be pointing out.

According to the report, with the Indian ecommerce opportunity, which is projected to cross the $400 Bn+ mark by 2030 (growing at a CAGR of 19%), the homegrown fashion ecommerce space is poised to grow at a CAGR of 25% to surpass the $112 Bn threshold by the decade’s end.

Under this vertical (fashion), the women’s apparel and accessories segment is expected to emerge as the frontrunner, commanding a significant market share of 50% by 2030. This segment alone is projected to become a market opportunity of over $56 Bn by the end of this decade.

Hot on the heels would be men’s and kids’ apparel & accessories, accounting for 29% and 21% market share, respectively. Further, this growth is largely expected to emerge from Tier 2 cities and beyond.

lockquote>

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-q1-2024-infocus-fashion-ecommerce/” target=”_blank” rel=”noopener”>Download The ReportFashion Ecommerce Startups Enjoying The Investor Moat?

Meanwhile, it is imperative to highlight that more than 200 fashion ecommerce startups in the country have collectively raised over $2.2 Bn+ from 2018 to 2023.

Between 2018 and 2023, D2C fashion brands lapped up almost 93% of the total funding raised by the Indian fashion ecommerce space. At $1.3 Bn, LensKart takes the top spot on the funding podium. Other notable deals included names like Bewakoof, BlueStone, Melorra, and XYXX, to count a few.

Interestingly, the report identifies Delhi NCR as the fashion capital of the country. Having raised more than $1.4 Bn in 60+ deals, the region surpasses Mumbai and Bengaluru at $300 Mn+ and $237 Mn+, respectively.

lockquote>

Moving on, late stage startups garnered the most investor attention. Of the total funding raised in the fashion ecommerce space, 80%, or $1.7 Bn+, landed with such startups. This points to the fact that investors are making hefty capital infusions in the sector.

Overall, the nation’s fashion startups have been able to hold investor interest on the back of the Indian ecommerce growth story. The sector has proven to be a game-changer for fashion startups, which have been able to fetch cost advantages, streamline operations and cut out middlemen.

Besides, ecommerce platforms have provided fashion brands with unprecedented market reach and invaluable consumer insights, further propelling their rise in the country.

How Is AI Set To Disrupt The Indian Ecommerce Space?

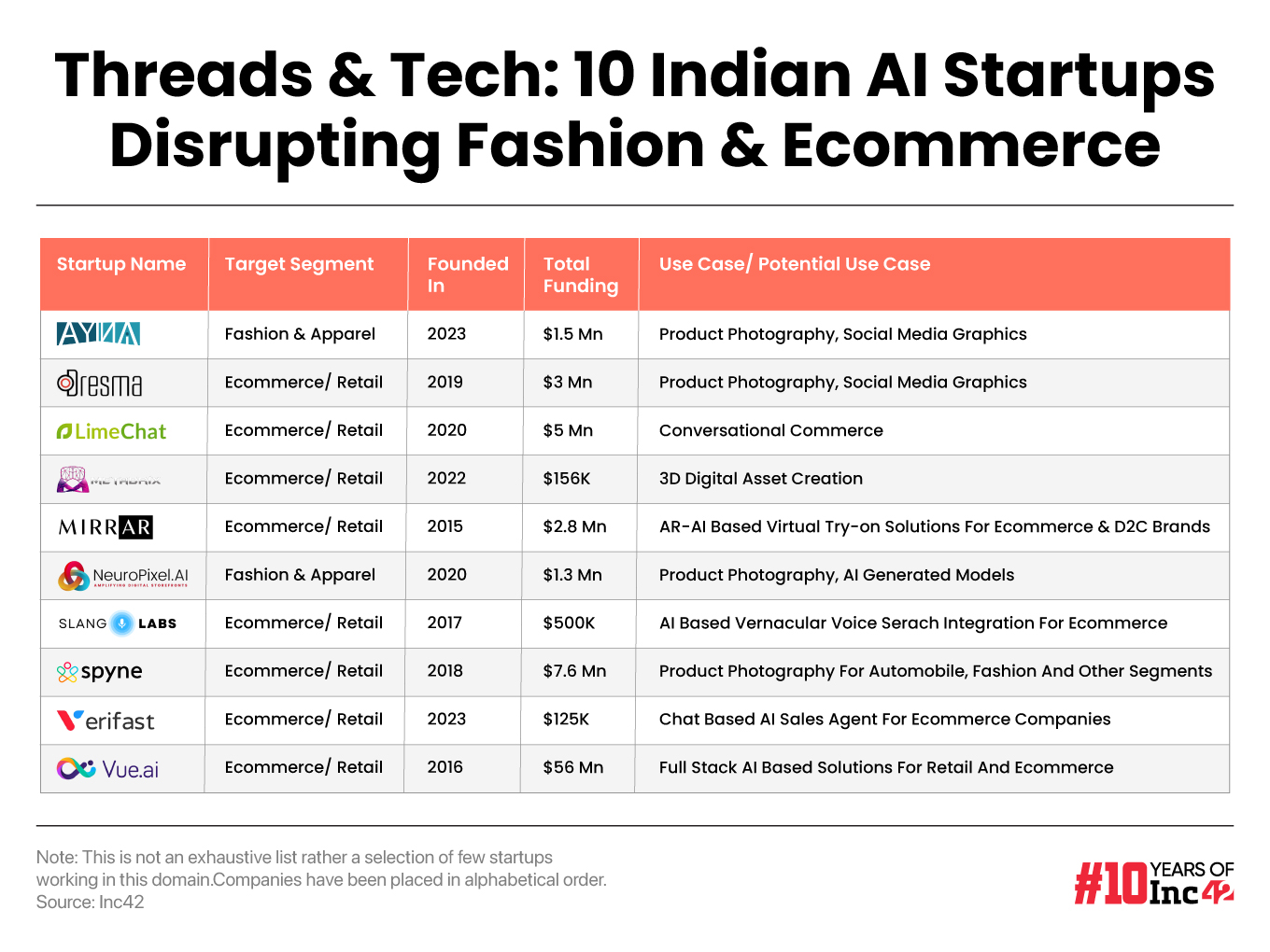

With GenAI seeping into sectors and industries, Indian ecommerce startups, too, are witnessing a surge in the integration of AI into their operations.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-q1-2024-infocus-fashion-ecommerce/” target=”_blank” rel=”noopener”>Download The Report

Many Indian ecommerce startups can be seen leveraging AI for real-time personalised recommendations and employing ML algorithms within their platforms.

A case in point is Meesho, which has increased its reliance on AI-powered chatbots to manage a substantial volume of chat-based inquiries. This transition has empowered ecommerce platforms to enhance their responsiveness, resulting in tangible enhancements in crucial customer experience metrics.

Similarly, ecommerce giant Myntra’s AI-driven personal style guide, ‘My Stylist’, aims to revolutionise fashion and lifestyle shopping experiences. This digital style assistant recommends suitable outfits to ensure a seamless and personalised shopping experience on the platform.

Overall, the ecommerce sector in India has witnessed remarkable growth and evolution, transcending geographical boundaries and driving substantial market opportunities.

Despite being bitten by a long and cumbersome funding winter, the sector continues to thrive unabated, fuelled by the rise of D2C startups and the adoption of innovative technologies like generative AI.

With women’s apparel & accessories leading the fashion segment and startups challenging traditional players, the industry is poised for further expansion and transformation. Amid this, embracing technologies like generative AI will go a long way in making this space a $400 Bn+ opportunity by 2030.

class=”pixcode pixcode–btn button btn–small aligncenter” href=”https://inc42.com/reports/state-of-indian-ecommerce-report-q1-2024-infocus-fashion-ecommerce/” target=”_blank” rel=”noopener”>Download The Report

[Edited by Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)