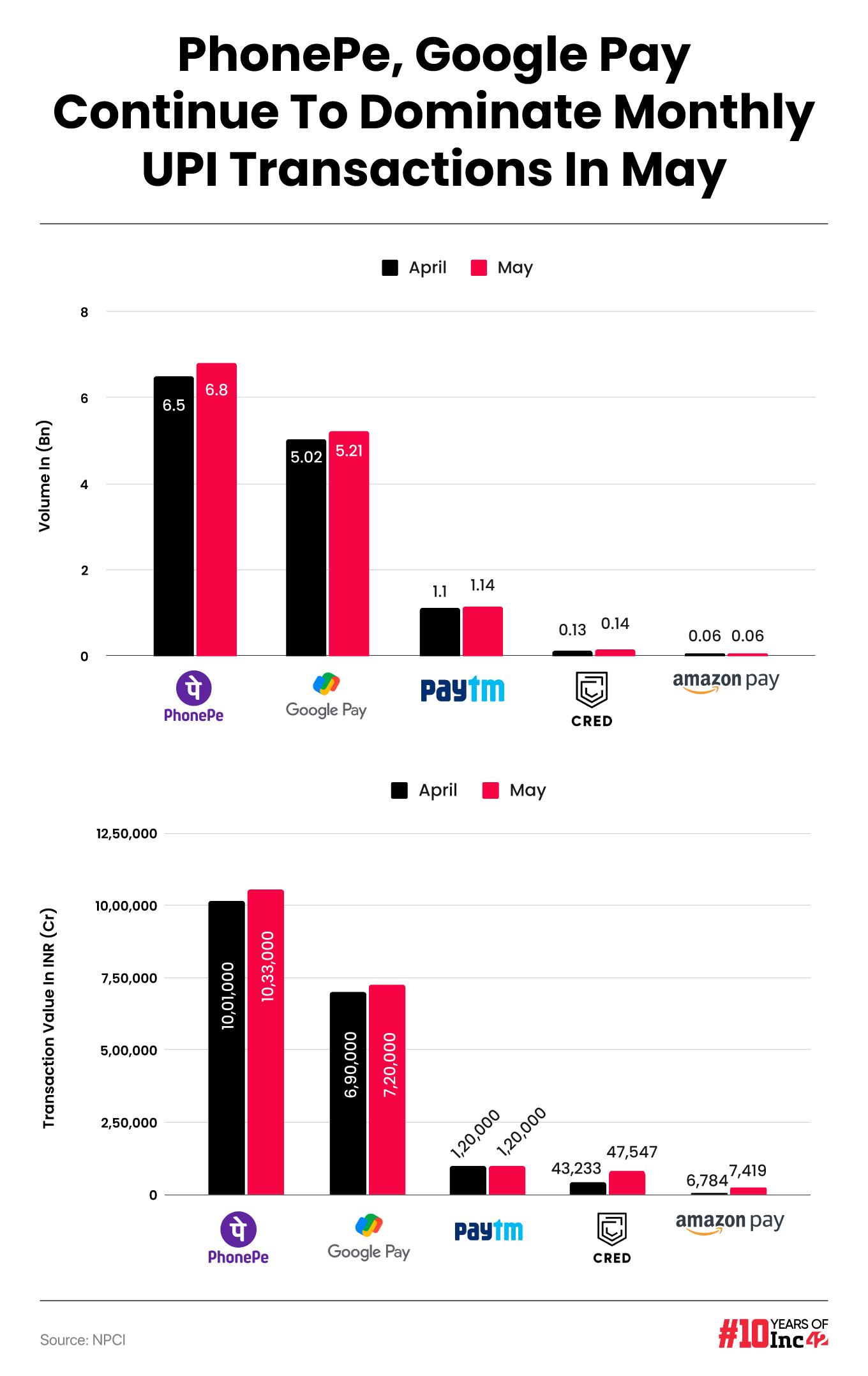

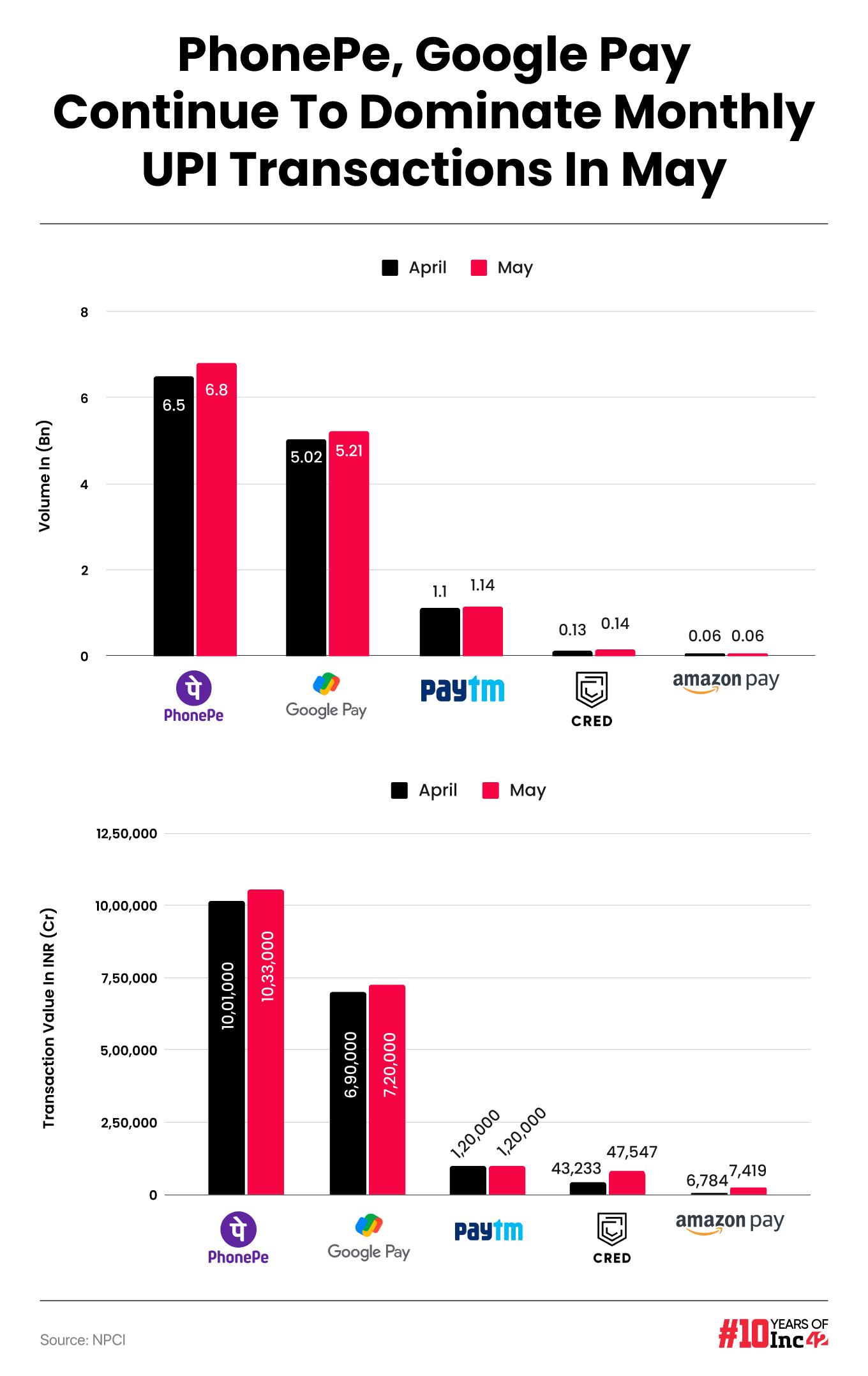

PhonePe, with 683.19 Cr transactions, accounted for 48.6% of the total UPI transactions in May, while the share for Google Pay stood at 37%

After seeing a nearly 8% month-on-month decline in UPI transactions in April, Paytm saw its transactions grow 2% last month to 114 Cr

UPI transactions processed by Navi almost doubled to 2.97 Cr in May from 1.5 Cr in April

The Unified Payments Interface (UPI) ecosystem continued to be dominated by Walmart-owned PhonePe and Google Pay in the month of May, with the two apps cumulatively commanding over 85% share in the total transactions.

The month of May saw 1,403.58 Cr UPI transactions worth INR 20.44 Lakh Cr.

As per the National Payments Corporation of India’s (NPCI) data, PhonePe, with 683.19 Cr transactions, accounted for 48.6% of the total UPI transactions in May. The value of these transactions stood at INR 10.33 Lakh Cr.

GooglePay saw 521.95 Cr transactions in May, translating to 37% of the total volume. In terms of value, GooglePe clocked transactions worth over INR 7.2 Lakh Cr. Trailing them were Paytm and Cred, which processed 114 Cr and 1.40 Lakh transactions, respectively.

After seeing a 7.7% month-on-month decline in UPI transactions in April, Paytm saw its transactions grow 2% last month.

Interestingly, UPI transactions processed by Navi almost doubled to 2.97 Cr in May from 1.5 Cr in April.

Besides, other startups Mobikwik, Groww, Slice, and Flipkart also saw marginal growths in their UPI transactions on a month-on-month basis.

It is pertinent to note that PhonePe and Google Pay have been dominating the UPI market for many years now. In fact, NPCI-owned Bharat Interface for Money (BHIM) has also struggled to grab a meaningful market share. Its transaction volume dropped about 8% MoM to 2.34 Cr in May from last month’s 2.54 Cr.

In a bid to pull itself out of the rut, BHIM is now eyeing a partnership with the Open Network for Digital Commerce (ONDC). The entities began talks of a potential tie up last month.

Meanwhile, the dominance of PhonePe and Google Pay, which are owned by foreign entities, was also flagged by a parliamentary panel. The panel underlined the need to promote indigenous players in the fintech sector to challenge these entities.

Amid all these, the NPCI is said to be mulling extending the timeline for the implementation of a 30% cap on the UPI market share of digital payments platforms by two years.