Companies in a subscription economy rely on recurring revenue streams, primarily measured through MRR and ARR

Beyond the sheer volume of revenue, investors and stakeholders must assess the quality of recurring revenue

Once recurring revenues are measured, ARR multiples are used to determine a company’s valuation

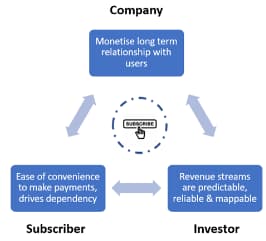

With the rise of the subscription economy across various business models and industries, several startups now have their valuations based on subscription charges.

This shift marks a departure from traditional pay-per-product models to those that generate recurring revenue through subscriptions, a concept eloquently encapsulated by Aswath Damodaran’s insight on the complexities of modern valuation.

Here, we explore how businesses and investors navigate this landscape, focussing on key metrics like Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR).

The Foundation Of Subscription-Based Models

Companies in a subscription economy rely on recurring revenue streams, primarily measured through MRR and ARR. These metrics provide a steady income flow and a clearer picture of a company’s financial health and potential for growth.

Understanding these metrics is crucial for the founders and the investors, as they offer insights into revenue stability, customer retention, and long-term profitability.

Monthly Recurring Revenue (MRR)

MRR represents the total monthly income from subscriptions. It’s a snapshot of a company’s recurring revenue, providing a straightforward metric to track growth on a month-to-month basis. However, MRR can fluctuate due to seasonal changes or promotional spikes, potentially leading to overestimated revenue if used in isolation.

Annual Recurring Revenue (ARR)

ARR is derived by annualising the MRR, giving a broader view of expected yearly revenue. This metric is useful for assessing long-term financial health and making strategic decisions. ARR incorporates several components:

-

- ARR from New Customers: Revenue generated from new subscriptions.

- ARR from Renewals: Revenue from existing customers who renew their subscriptions.

- Incremental ARR: Revenue from upgrades or add-ons.

- ARR Losses: Revenue lost from downgrades or churn.

Key Considerations For Choosing Metrics

When deciding between MRR and ARR, businesses should consider:

- Subscription Length: ARR is ideal for businesses with long-term contracts (one year or more), whereas MRR suits models with shorter, more flexible terms.

- Business Model Complexity: ARR offers a comprehensive view, useful for complex models and long-term planning. MRR provides more immediate, granular insights.

- Investor Preferences: Investors often favour ARR for its predictability and reliability over longer periods, aiding in assessing a company’s growth potential and market positioning.

Evaluating Recurring Revenue Quality

Beyond the sheer volume of revenue, investors and stakeholders must assess the quality of recurring revenue. This involves examining gross margins, revenue costs, and growth rates.

Revenue Quality: High gross margins indicate efficient operations and potential profitability. For instance, a company with 90% gross margins is generally more attractive than one with lower margins, as it retains more revenue after covering the cost of goods sold.

Revenue Cost: This metric evaluates how much a company have to spend to generate each unit of revenue. A lower cost-to-sales ratio signifies a more efficient business. For example, spending $1 to generate $1 in ARR is better than spending $2 for the same return, with the ideal scenario being even lower acquisition costs.

Revenue Growth: Rapid revenue growth suggests a strong market position and potential for future expansion. Investors often pay willingly a premium for companies that demonstrate consistent and significant revenue growth. This indicates a higher likelihood of achieving desired valuations.

ARR Multiples In Valuation

Once recurring revenues are measured, ARR multiples are used to determine a company’s valuation. This simple yet effective approach involves dividing the company’s valuation by its ARR. For instance, a company worth $100 Mn with an ARR of $10 Mn has an ARR multiple of 10.

Balancing The Metrics

It’s important to recognise the interplay between these factors. Companies may sometimes prioritise revenue growth at the expense of revenue quality or incur higher costs to drive growth. A balanced approach, considering gross margins, acquisition costs, and growth rates, is essential for sustainable valuation.

The subscription economy offers a dynamic and profitable model for startups and established companies alike. By focussing on key metrics like MRR and ARR, and evaluating the quality and cost of revenue, businesses can achieve robust valuations.

Investors, in turn, gain a clearer, more reliable perspective on a company’s long-term potential, making the subscription model a win-win for all stakeholders. Also, remember that ARR is only one of the methods to look at valuation.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)