Aye Finance raised the debt funding from Dutch entrepreneurial development bank FMO

The fresh capital will be used to disburse loans to underserved micro, small and medium enterprises across India

Aye Finance claims to have disbursed loans worth more than INR 10,000 Cr to more than 8.67 Lakh customers till date

Lending tech startup Aye Finance

The fresh capital will be used to disburse loans to underserved micro, small and medium enterprises (MSMEs) across India, the startup said in a statement.

Founded in 2014 by Sanjay Sharma and Vikram Jetley, Aye Finance offers affordable business loans to micro enterprises in the country. It uses cluster-based credit assessment with AI algorithms to assess risk in the absence of traditional business documents.

It claims to have disbursed loans worth over INR 10,000 Cr to more than 8.67 Lakh borrowers till date.

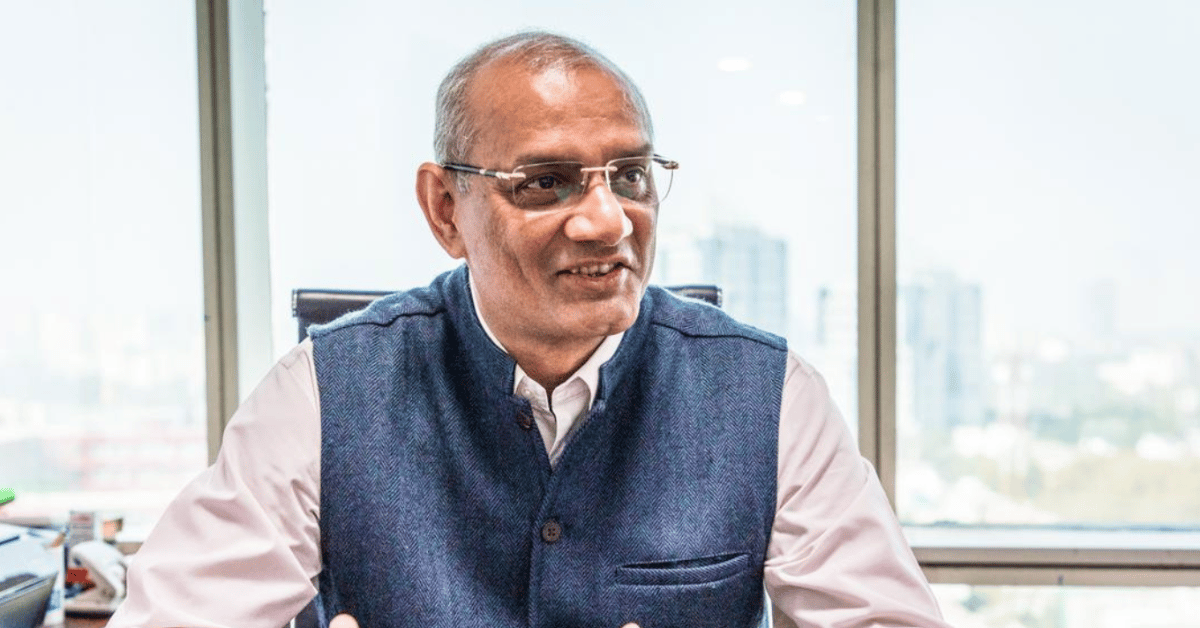

Commenting on the investment, Krishnan Gopal, chief financial officer of Aye Finance, said, “This latest funding from FMO will be instrumental in allowing us to rapidly scale our lending efforts and include the grassroots businesses that form the backbone of the Indian economy.”

The fundraise comes nearly three months after Aye Finance raised INR 137 Cr in debt funding from German impact investment and portfolio management firm Invest in Visions in March.

In December last year, the startup raised INR 310 Cr in a Series F funding round led by the UK’s British International Investment (BII).

Overall, Aye Finance has raised a total funding of over $380 Mn till date.

The startup claimed its net profit grew 3X year-on-year to INR 161 Cr in the financial year 2023-24 (FY24), while revenue from operations rose 67% to INR 1,072 Cr.

Aye Finance operates in the fast-growing Indian fintech market, which is expected to reach a size of $2.1 Tn by 2030. The lending tech market alone is expected to become a $1.3 Tn opportunity by the end of the decade, as per an Inc42 analysis.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)