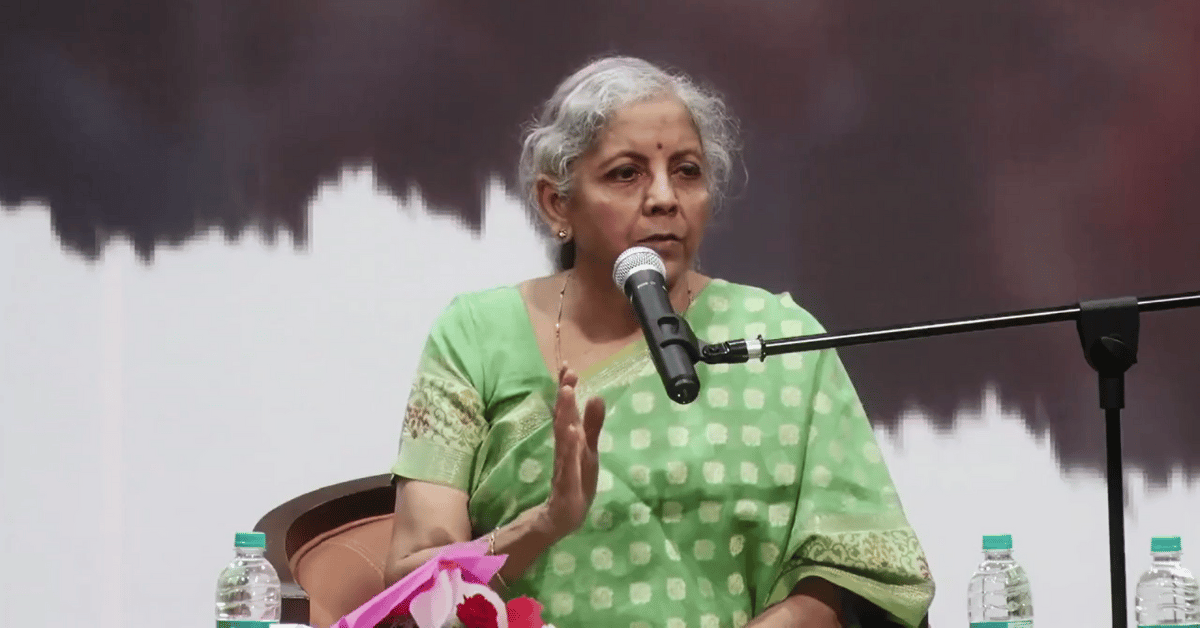

Addressing the press conference after the GST Council meet, finance minister Nirmala Sitharaman said that GST on online gaming was not on the Council’s agenda

The GST Council’s decision to levy 28% GST on real-money gaming was implemented from October 1 2023

The finance minister earlier said that the decision will be reviewed six months after it comes into effect

Online gaming companies, which are awaiting a review of the 28% tax regime for them, failed to get any relief from the Goods and Services Tax (GST) Council as the issue was not discussed during the Council’s meeting on Saturday (June 22).

Addressing a press conference after the meeting of the GST Council, finance minister Nirmala Sitharaman said that GST on online gaming was not on the Council’s agenda, and hence there was no discussion on it.

The GST Council’s decision to levy 28% GST on real-money gaming was implemented from October 1 2023. The finance minister earlier said that the decision will be reviewed six months after it comes into effect.

While there were speculations that the GST Council might review the decision in its meeting today, the subject didn’t find a place on the agenda. It is pertinent to note that it has been over eight months since the 28% GST regime for online gaming came into effect on October 1, 2023.

(The story will be updated soon.)

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)