What happened when tech giant Google flexed its muscles and delisted 10+ popular Indian apps from its world-leading app store, citing the long pendency of billing compliance? Well, homegrown Internet companies got angry; #EvilGoogle started trending and government intervention was sought to redeem the situation.

A temporary truce is in place, but Indian developers are now actively seeking a robust alternative. And that’s where fintech giant’s PhonePe

Much of this narrative is familiar. Once again, Google is up in arms, trying to ensure that all Play Store apps, annually earning $1 Mn or more, use its billing system so that it can collect 30% commission on every in-app purchase — more on the current fee structure later.

Google has been at it since 2020, allowing a year’s grace period for non-compliant apps to integrate the technology. After that, the tech giant faced roller-coaster legal battles in India regarding its alleged market dominance and anti-competitive practices on Play Store. Petitions have also been filed before the NCLAT against Play Store’s billing policy.

Unsurprisingly, Google lost its initial lawsuits and was fined a little over INR 1,337 Cr and INR 936 Cr in two separate cases by the Competition Commission of India (CCI). After all, the tech behemoth owns the Android operating system, and Google Play Store, a leviathan of an app marketplace, comes preloaded on almost all Android smartphones. The reach and the convenience typically make the Play Store the go-to choice. Hence, it might have hit Google harder when Walmart-owned PhonePe launched the Indus Appstore in February this year to challenge Google’s dominance.

No doubt Google restored the apps after MeitY’s (ministry of electronics and information technology) intervention. But it is merely an extension of the payment deadline, and the tech giant will continue to send invoices to ‘non-compliant’ apps. Unless developers from all categories are ready to shell out the 30% ‘Google tax’ and want to abide by the company’s aggressive approach (the outright ban slapped on the Indian apps is proof enough).

The timing of Indus’ launch could not have been better. Indus went live on February 21, just ten days before Google made its delisting announcement on March 1, and nearly throttled a host of major apps such as Matrimony.com, Jeevansaathi, Shaadi, Naukri, 99acres, KukuFM and STAGE, among others. In essence, the all-new app store had a fortuitous entry amid a growing clamour for fair industry practices, while developers started looking for an India-focussed robust alternative.

In contrast, the Indus Appstore offers a hyper-localised and affordable pp marketplace, aligning better with Indian customers through multilingual solutions.

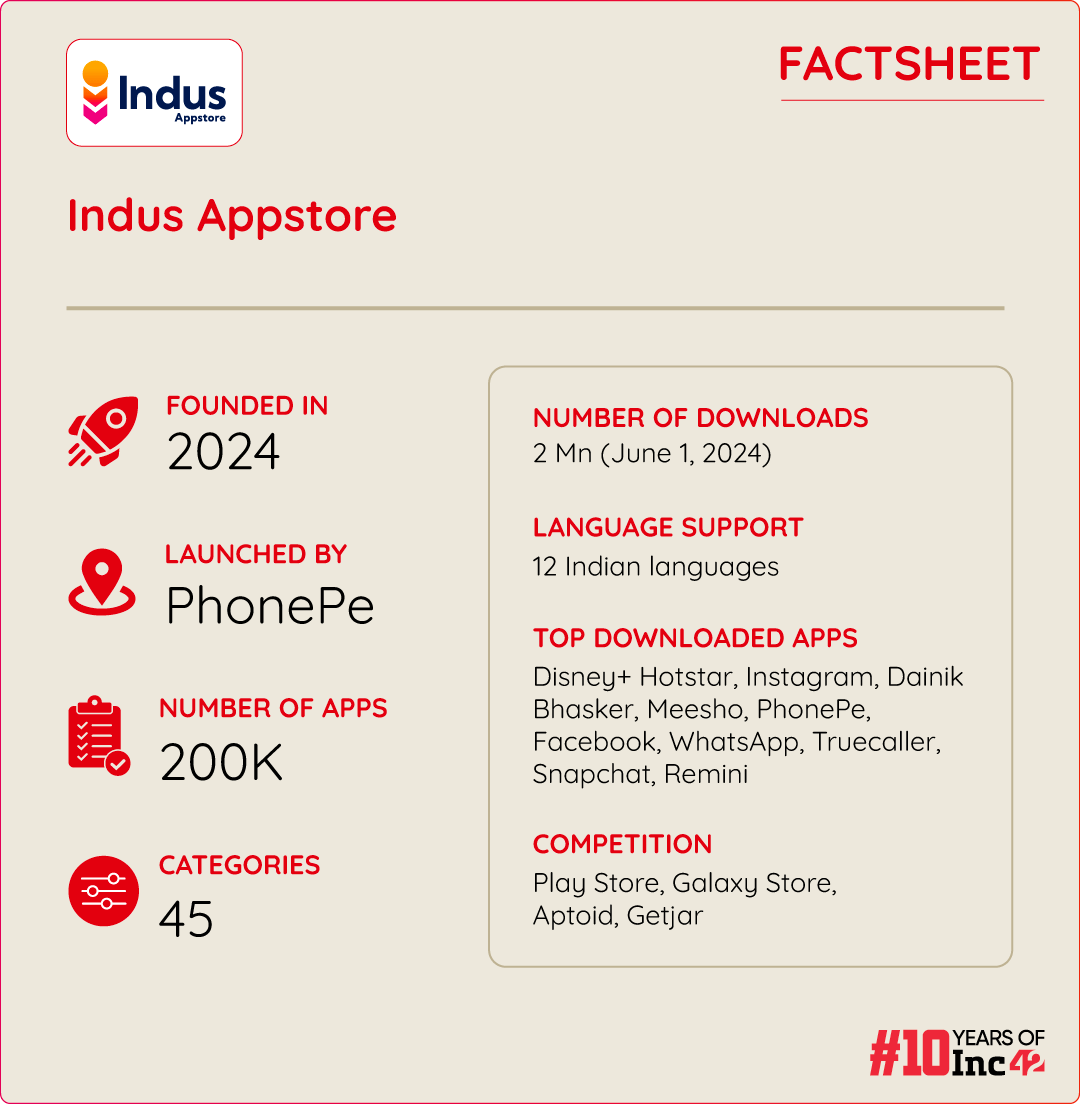

Within three months of its launch, the new app store has started to make a dent in Google’s ‘alleged’ monopoly, as it offers a developer-friendly environment, charges zero commission on in-app transactions for the first year and has zero publishing fee. (Google charges a one-time publishing fee of $25, but Apple’s App Store is more expensive as it charges $99 per year.) It lists more than 2 Lakh apps across 45 categories and has surpassed 2 Mn installs, a PhonePe spokesperson told Inc42.

Indus supports 12 Indian languages for access to localised content and has introduced a host of India-specific features such as voice search, video-led discovery, multi-format ads and more.

“We are seeing a steady increase in the number of users. The app store has gained significant traction since its launch, especially in Tier II cities, which account for 45% of the user base. Popular app categories include finance, games, social media, entertainment, tools, communication and shopping,” the Indus Appstore and PhonePe spokesperson added.

lockquote>

For context, PhonePe has moved its domicile from Singapore to India, shifting all businesses and subsidiaries to India, including the Indus Appstore. Besides this, it had also been fully hived off from Flipkart, which had acquired PhonePe, and currently Walmart is the majority owner of PhonePe.

Why Google Play Store Has Won So Far

Indus is not the first app marketplace to challenge the Play Store. Earlier, there were several app stores such as Nokia Download (SymbianOS), Download Fun, Pocket Gear, GetJar, Handango, Handmark and MiKandi. Others like Opera Mobile Store, BlackBerry World and HP App followed suit after the Play Store was launched in 2012. But challenging Google’s monopoly in the app marketplace was not possible even for pure-play tech companies like Opera, Firefox or others.

While Google fights lawsuits in various courts over industry practices and commission rates, will Indus be able to gain a strong position in the app marketplace? Before we delve into the pros and cons of the new app store’s success potential, let us look at the existing marketplaces and their fee structures.

Going by how Google Play Store stacks up compared to the competition, will it be fair to suggest that its contentious billing policy may pave the path for success for the likes of Indus? Amit Ranjan, founder of SlideShare (acquired by LinkedIn for $120 Mn) and architect of the Indian government’s project DigiLocker, said the priorities would tend to differ in this case.

“Building an app store requires deep technical expertise and a strong technical team. The business aspect comes later. You also need to maintain ‘cyber hygiene’ by tracking and filtering out fraudulent apps. This is an ongoing process, and any misstep will directly impact the store’s reputation,” Ranjan told Inc42.

lockquote>

Ranjan has a point. Consider how Opera Mobile Store was fully decommissioned last year, although it catered to 130 Mn+ monthly active users and clocked 1 Mn daily downloads of apps at one point. The reason for shuttering: Opera was allegedly involved in unfair and illegal data transactions.

Even the Google Play Store drew flak and suspended or removed around 4.7K fraudulent loan apps between April 2021 and August 2023, according to Rajya Sabha data. Therefore, nothing short of a robust tech ecosystem and stringent compliance can ensure success for independent app stores despite significant download numbers.

Nevertheless, a few Android app stores like Samsung have thrived as they have built robust technology and business ecosystems. Interestingly, Google has reportedly struck a deal with the Samsung Galaxy Store to keep its Play Store as the default app marketplace on Samsung mobiles. According to media reports, Google offered Samsung exclusive gaming content, deals and events on the Play Store and YouTube and agreed to ‘white label’ its Play Store as the Galaxy Store so that Samsung could maintain its branding.

When negotiating with Samsung, Google preferred a lump sum payment model over a user-focussed payment strategy.

Will these ‘agreements’ make it difficult for developers and users to opt for alternative app stores? We have an intriguing parallel here. In an antitrust lawsuit held in the US last year, states and the federal government questioned Google’s stand regarding its search engine dominance and how it tried to squash competition by paying Apple and other tech companies to ensure that Google search remained the default option. The search giant defended itself by saying none of these agreements were ‘exclusive’ in nature and users could easily change default settings and opt for other search options.

Although Inc42 cannot independently verify whether similar ‘business deals’ are impacting the app economy in India, Google’s agreements with different OEMs cannot be ignored. And these may warrant more scrutiny from the regulators in the near future (more on these challenges later). Incidentally, a company spokesperson has confirmed that the new app store no longer caters to the Samsung Galaxy Store.

A user-friendly interface, a supply-demand match (enough engaging apps across categories are required to keep users coming back) and a robust revenue model for developers and publishers are also critical for an app marketplace to survive, according to Karan Lakhwani, India head at the app intelligence firm AppTweak. The major challenge is surpassing the Play Store’s consumer experience, validated by reviews, ratings and download numbers, he added.

How PhonePe Joined The App Store Bandwagon

Google Play Store may enjoy cutting-edge tech prowess and a better business network, but the biggest USP of Indus Appstore is its made-in-India tag, according to the PhonePe spokesperson.

“Most users are driven to download and use the app store because it is made in India, for India. On the other hand, the developer-friendly ethos of the app store makes it an ideal platform for app creators – that’s the general feedback. They also think the integrated phone login, targeted advertising and engaging features will help them reach niche audiences, driving widespread adoption and engagement,” PhonePe said.

lockquote>

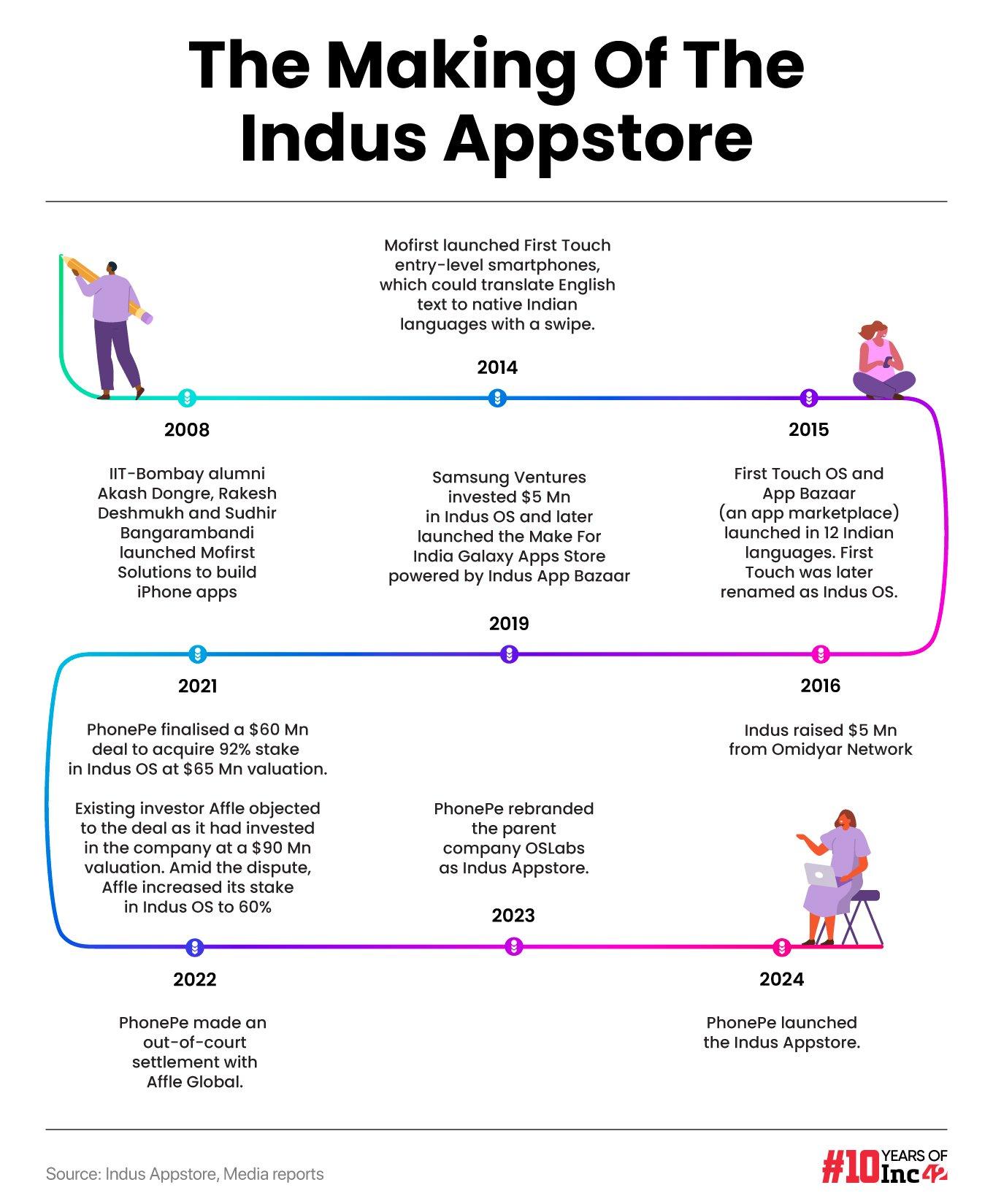

However, the Indus Appstore was not built in a day. Here is a brief look at the backstory, from the initial launch of Mofirst by three IIT-Bombay alumni to many pivots and developments – first as a smartphone maker and then as an app bazaar. Eventually, the company was acquired and rebranded by PhonePe after an intense valuation dispute with key stakeholders, including Affle.

Many think that the Indus Appstore will soon emerge as the darling of the Indian market, offering unique features to empower consumers and enhance user delight.

How Indus Appstore Is Building A Moat Against Google Play

Indus parent PhonePe is aware that no standalone app store can counter Play Store’s power of innovation and deep pockets. However, it has a long-term plan to take on Google’s ubiquitous app marketplace by leveraging its knowledge of the local market and the subsequent rise in user base.

Unlike other independent app stores that looked to take on Google, PhonePe holds an edge with more than 535 Mn registered users and 260 Mn monthly active users (MAU), which guarantees a significant number of quality users, and, hence, monetary success for developers.

However, this may not be comparable to what one earns on the Google Play Store or Apple App Store.

PhonePe aims to create a moat around its app store business by partnering with smartphone makers such as Nokia and Lava. The goal is to pre-install Indus Appstore on up to 300 Mn devices by the end of 2024.

lockquote>

“Our collaborations will ensure seamless app installations and updates. We want to make the Indus Appstore a default choice on smartphones in India, signifying a shift towards a more inclusive, autonomous and developer-friendly app ecosystem,” the company’s spokesperson said.

PhonePe has also acquired a payment aggregator licence from the RBI to enable seamless in-app transactions (payment aggregators allow clients to accept various payment methods and disburse to multiple stakeholders).

PhonePe Technology Services, a wholly owned subsidiary of the group, was also issued an account aggregator (AA) licence by the RBI. AAs typically share financial data across accounts and institutions securely so that financial information users or FIUs (like lenders or insurers) can make informed decisions. However, no data can be shared without the explicit consent of account holders.

“Some of our clients are keen to be on the Indus Appstore,” said Lakhwani of AppTweak. “I understand that its way of communication and advertising is very different from others. Google Play Store requires a different set of app metadata to succeed. So does Apple. And Indus, too, has a different strategy. Each has created a unique strategy for its app store to succeed.”

However, to attract more users, the company must target different segments uniquely, which Koo should have done when it tried to become as a Twitter killer.

“There’s always a value-seeking user, a discount-seeking user and a luxury or premium user seeking a high-quality experience. Indus should target different types by tailoring its communications to highlight discounts, user experience or specific apps,” said Lakhwani.

lockquote>

Can Indus Become The Atmanirbhar App Store?

For a long time, Indian entrepreneurs and app developers have demanded that a truly Indian app store be built to look after their interests and counter the Play Store. Paytm founder and CEO Vijay Shekhar Sharma was particularly vocal, saying Google’s charges were costlier than the business taxes the internet businesses paid in India. Paytm also launched a mini app store, and a few more popped up, thinking it was an opportune moment. One such entity was Mitron, a short video app that hurriedly launched an app discovery platform. However, none of these lasted for long after the initial euphoria died.

Given these ground realities, can PhonePe’s app store topple the Google Play Store this time? Two of the five experts with whom Inc42 spoke doubted whether it would be viable in the long run due to Google’s near-monopoly across the Android ecosystem.

For instance, the entire Android market can be split into five major segments – the licensable OS market for smart mobile devices (smartphones, tablets, and more), app stores, web search services and online video hosting platforms (OVHP). Google has standardised agreements with various companies to maintain its dominance in these segments. Its crucial agreements with OEMs encompass mobile application distribution, anti-fragmentation (for seamless versioning), Android compatibility commitment, revenue sharing and mobile service distribution/placement bonus.

OEMs must adhere to these stringent agreements, which prevent them from developing Android non-compatible hardware. Moreover, they can only include Google Mobile Services (a collection of applications and APIs such as Google Search, Chrome, Gmail, Google Maps, YouTube and more that help support functionality across devices) after signing the mobile application distribution and anti-fragmentation agreements.

Also, Android prevents installations from third-party sources. When users manually download apps from a third-party app store, they receive multiple security warnings that the apps sourced from elsewhere may harm the device. These warnings often deter users, while developers have little choice but to operate through the Play Store.

Of course, such ‘trade practices’ under the guise of security have been challenged worldwide, including in India. The CCI had already fined the tech giant, but these penalties have been challenged in the Supreme Court. In a separate case, Winzo Games is also fighting a case in the apex court regarding these ‘security warnings’ and other issues.

Elsewhere, in the Epic Games versus Google case, a California jury found that the latter violated antitrust laws (laws to ensure economic competitiveness and counter monopoly) in Google Play Store’s billing practices. The presiding judge will announce the measures to be undertaken in 2024.

In May 2022, the European Commission and the Competition and Markets Authority also probed Google Play Store’s business practices. South Korean regulators are also investigating Play Store’s billing, including a formal review of Google’s compliance with new billing regulations.

Rameesh Kailasam, CEO at IndiaTech.Org, a think tank for Indian tech startups, pointed out that the Play Store makes in-app purchases prohibitively expensive and economically unviable for startups and internet economy companies.

To begin with, 15-30% commissions are an issue if transactions are done within the Google Play Billing system. Google came with an alternate billing system, where the app developers can use their payment gateways but have to pay a service fee of 11-26%, which is currently being investigated by CCI. But until now, it has not been a win-win for small developers, paying a cut to one of the world’s richest tech companies.

“Moreover, many of these apps are built outside India despite catering to the Indian market. It means the income from apps or the commission does not accrue to India. Although Google allows for some bypass routes, these are still prohibitively costly,” Kailasam added.

lockquote>

Even when developers list their apps on another app store, integrating them with Google Ads requires Google Play Store listing IDs. Therefore, anyone looking for a wider reach through Google’s pay-per-click advertising platform is compelled to list the apps on the Play Store.

But there’s more to this narrative. While developers struggle to cope with all sorts of arm-twisting, winning a business battle with an industry heavyweight could be too difficult, as the Aptoide App Store soon found out. The Portugal-based mobile app marketplace runs on the Android OS, and the store can be accessed and installed via the store’s official page. Moreover, unlike Google, developers can manage their stores on the platform.

“With Aptoide, that moment [of contention] came in 2018. We took Google to court after the tech Goliath tried by all means unnecessary to suffocate the company’s activity and kill the competition,” founders Paulo Trezentos and Álvaro Pinto shared on their website. “They told users that Aptoide was a menace to the mobile society. They made Aptoide’s app vanish from Android phones without warning. They kept circling more wagons around Google Play Store, making Android app downloads increasingly difficult outside of the platform.”

lockquote>

Google eventually lost the case. The courts and the European Commission found it guilty of abusing its dominant position and anti-competitive behaviour. The tech giant was heavily fined and ordered to backtrack.

But one thing is clear. Given its influence, capital and resources, it will always be tough to beat Google at its own game. Closer home, it will be even more difficult. After all, 95% of smartphones in India run on Android and the Google Play Store has been the default app store for most of these users.

Just like Aptoide, PhonePe or even Walmart may have to lock horns with Google sooner or later for a greater market share. However, the success of the Indus Appstore will largely depend on its ability to deliver a superior user and developer experience that can convince all stakeholders to give it a shot.

PhonePe’s founder and CEO Sameer Nigam once said that a billion people or more could not be dictated regarding app discovery or transaction if they wanted a change. Indus and PhonePe could be heralding that change.

[Edited by Sanghamitra Mandal]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)