Raveendran put himself on a pedestal and stopped listening, and this should never be done, said Unacademy CEO

Gaurav Munjal said that founders should always “act” on feedback and added that all 2021 valuations of startups were “bloated”

Earlier this year, upGrad’s Ronnie Screwvala said that due to ‘one rotten apple’ (BYJU’S) the entire industry was seeing reputational damage

Amid the ongoing churn in the Indian edtech sector, Unacademy cofounder and CEO Gaurav Munjal has placed the blame of troubles at competitor BYJU’S

In a post on X, Munjal said, “Byju failed because he didn’t listen to anyone. He put himself on a pedestal and stopped listening. Don’t do that. Never do that. Don’t listen to everyone but have people who can give you blunt feedback.”

Sharing his learnings on the microblogging site, Munjal said that founders should always “act” on feedback even if they do not like it.

With this, Munjal has become the latest Indian edtech cofounder to join the debate around troubles at BYJU’S. In February, upGrad’s Ronnie Screwvala said that due to ‘one rotten apple’ the industry was witnessing reputational damage.

Responding to a tweet about shareholders of BYJU’S convening an extraordinary general meeting (EGM) to oust Raveendran and his family, Screwvala, in a post on X, had said, “Finally someone smelt the coffee!! Hope it’s not a whiff and then whimper but they will stay the course and get this done – for the whole ecosystem! For India as an investment destination! For just credibility overall of an otherwise sunrise and sunshine sector”.

However, these potshots by peers are not without reason.

Troubles Galore At BYJU’S

At the top of the funding boom in pandemic-hit 2020 and 2021, BYJU’S raised billions of dollars from marquee names in the venture capital (VC) and private equity ecosystem.

However, as the pandemic-era growth waned as schools opened, the edtech major was straddled with questions about sustainability and profitability. As funding winter made matters worse for raising capital in 2022 and 2023, the company found itself at crossroads, as the bevy of acquisitions in previous years failed to pay off.

The aftermath saw the company undertake a series of layoffs as financial reports, which were delayed multiple times, painted a bleak picture of the company’s finances. Nearly 22 months after the end of the financial year 2021-22 (FY22), the edtech giant filed its financial statements which showed that its loss ballooned 81% to INR 8,245.2 Cr during the year from INR 4,564.3 Cr in FY21.

As a result, the company has fired more than 5,000 employees since 2023. Besides, it has delayed employee salaries multiple times, seen exodus of top leadership, and restructured its business multiple times. BYJU’S is also yet to file its financial statements for FY23.

Making matters worse are a dozen-odd legal and insolvency cases filed by its investors and vendors. Earlier this year, its shareholders banded together to convene an EGM to oust Raveendran and his family from the op management.

While representatives of three major investors left the company’s board last year, shareholders such as Baron Capital and Prosus almost entirely wrote off their stake in the edtech startup this year. As if this was not enough, BYJU’S raised a rights issue at a $250 Mn post-money valuation, down 99% from its peak $22 Bn valuation in 2022.

And there seems to be no end to the company’s troubles, as the Ministry of Corporate Affairs (MCA) is probing BYJU’S for alleged financial fraud.

While BYJU’S troubles are well documented, the entire edtech sector has been affected by the ongoing funding winter and high cash burn in the last two years. Earlier this month, Inc42 reported that K-12 Techno Services was in talks to acquire Gaurav Munjal-led Unacademy.

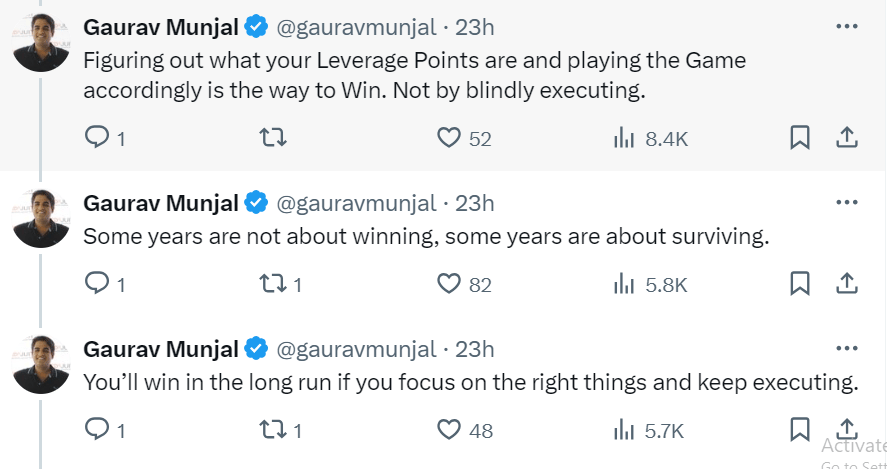

Amid all these, Munjal took to X to share his learnings from the last two years.

Munjal’s Lessons For Founders

In a series of posts on X, Munjal said that all 2021 valuations for startups were “bloated” and the current time is reality, not 2021.

Calling on all founders to be transparent, Munjal said it is important to increase transparency by 10X with investors and team members when times are tough. “When making tough decisions, don’t hide behind silent layoffs,” the Unacademy CEO added.

He also asked founders to “learn” from people who have gone through a similar journey as theirs to avoid repeating mistakes. Munjal said that “understanding unit economics on Day One” is probably the “best thing” a founder can do.

Warning entrepreneurs against holding any biases, he said it is important to focus on what customers want. He added that it is “must” to have some form of offline play while catering to Indian audiences.

Noting that “business model innovation” is more important than product innovation, Munjal said that while the best product does not always win, the best distribution does. He also said that experimentation is the key and founders should not “give up” on research and development (R&D).

Without taking names, he also said that while some investors are assets, others are “liabilities”. He added that the “trick” is to figure out the backers that are “assets” and listen to them.

He also urged entrepreneurs to look inwards and learn from how the “best Indian companies” scaled up operations. Concluding his posts, he added that winning “matters most” when a company is facing “constraints”.

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)