For generations, local stone mills have been the heart of Indian households to produce flour (atta). Yet, in the last two decades or more, this age-old practice has been replaced by the rise of branded packaged atta.

Notably, the expansion of the packaged atta industry has been unprecedented ever since names like Aashirvaad, Fortune and the ilk took the onus of grinding grains to make that perfectly round Indian bread (Chapati). Not to mention, this growth knows no bars, with the industry projected to swell at a CAGR of 13.71% to become an INR 24,000 Cr+ opportunity by 2032.

However, post the pandemic, as the country shows its commitment to adopting a healthier lifestyle and moving away from everything refined and processed, including atta, a number of D2C brands are ready to seize this opportunity.

Chakkizza, TWF Flour, Namma Chakki, and Natraj Attachakki are some names reshaping the market paradigm that is being ruled with an iron fist by the aforementioned legacy players.

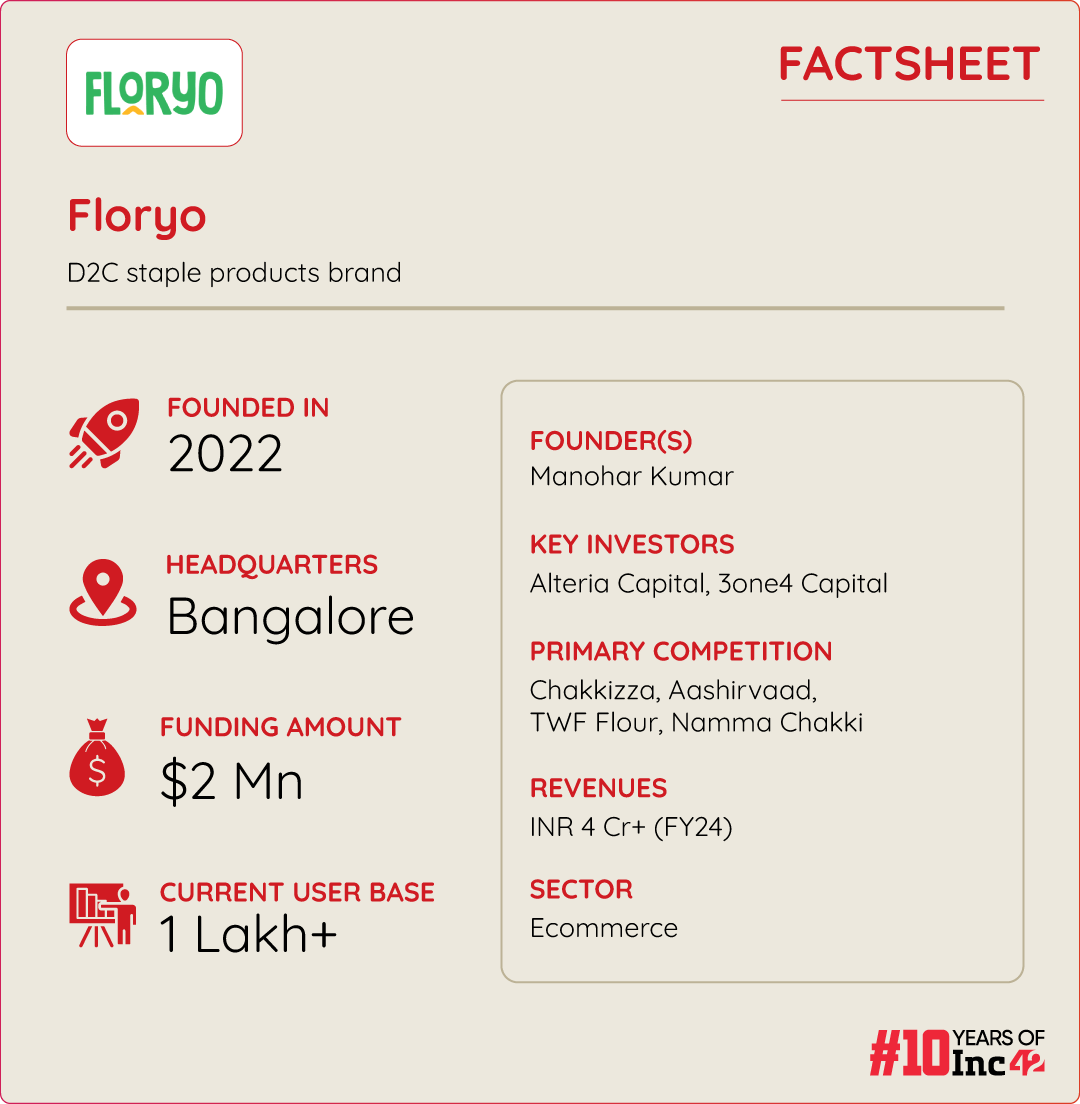

Amid this transition, Floryo, founded in 2022 by Manohar Kumar, aspires to keep the traditional stone mill culture alive, serving flour that has all its nutritional value intact, unlike ultra-refined packaged products in the market.

All in all, with a sharp focus on eating into the market share of established brands, Floryo currently sells freshly produced and made-to-order wheat flour via its platform — although it aims to rule the entire staples category, including rice, millet, processed oil and ground masala, in the not-so-distant future.

Currently, it offers different types of whole grain flours such as functional multigrain flours, single grain flour, customised multigrain flours, and gluten-free multigrain flours.

According to the founder, the startup’s made-to-order lineup of flour is “far superior in taste and texture compared to packaged flour”.

lockquote>

“This is because traditional legacy players adhere to a conventional, internal, and manufacturer-driven approach focussed on cost and margins rather than quality and consumer needs. In contrast, we have adopted an outside-in approach, prioritising the consumer’s perspective and needs first,” Kumar said.

Started primarily through its own website, the startup then moved to Amazon in February 2023, joined the ONDC network in June 2023, and very recently, in January 2024, expanded to BigBasket Daily and other quick commerce platforms.

According to Kumar, the startup has grown its top line almost 4X from INR 1 Cr in FY23 to INR 4 Cr in FY24. He aims to hit an ARR of INR 36 Cr by March 2025. The startup is currently operating in Bengaluru and Hyderabad with a hyperlocal approach.

Floryo’s Journey So Far

Before founding Floryo, Kumar spent nearly four years at Licious as the business head of the packaged foods business. His mandate was to build their packaged food business, specifically the value-added segment.

Prior to that, Kumar headed marketing for brands like ARROW, IZOD, and HANES at Arvind Brands. He was also one of the first employees at Hershey’s India and played a crucial role in launching its syrup, spreads, cocoa, and milk.

However, Kumar always had an urge to start something of his own.

“Be it helping set up Hershey’s in India, managing large portfolios for marquee brands like ARROW and US Polo Assn at Arvind Brands, or joining Licious early in its journey — this consistent urge to build and grow businesses has been a significant part of my career.”

lockquote>

What motivated him to launch Floryo was his deep understanding of the food category and consumers. The trigger came during his time at Licious, where he closely followed consumer trends and discovered that India faces over 1 Bn incidences of lifestyle diseases, making it the capital for obesity, hypertension, and other ailments.

After eight months of research and conversations with over 1K consumers, Kumar found a significant shift in dietary habits from the freshly processed or minimally processed foods consumed by previous generations to today’s additive-laden processed foods. This realisation motivated him to address the issue by founding Floryo to offer freshly made, minimally processed foods.

Kumar said that the initial months after the launch were overwhelmingly positive as people were coming out of the pandemic period and were increasingly aware and conscious about choosing healthier, wholesome food options.

“Our proposition resonated well with consumers seeking such alternatives. Since then, we’ve acquired over 1 Lakh consumers, exclusively in Bengaluru and Hyderabad, with approximately 30,000 active monthly users.”

Floryo’s Tech-Enabled Approach

Starting with just 21 SKUs and now offering a total of 45 SKUs of freshly processed flours, the D2C brand continues to expand its product portfolio every six months. The founder claims to deliver products to the customer’s doorstep within 24 hours, which is also its key USP.

Its product lineup includes single grain atta such as wheat and millets, as well as speciality atta like oats and barley. It also sells multi-grain varieties, including functional types like diabetic care, cholesterol care, keto, gluten-free, and high protein atta. Per Kumar, customers can customise their multi-grain atta based on their specific nutritional needs directly on its platform.

“Floryo is built on four pillars — freshness in processing and packaging, customisation through technology, quality and transparency, and innovation in the staples category,” Kumar said.

The startup uses traditional stone mills (chakki) for milling grains against high-speed steel rollers used by several other players. This method minimises heat production, preserving the nutritional integrity of the grains.

lockquote>

“There are a few players who use or claim to use stone mills, but those are few and far between. But, we are tech-enabled in terms of responsive manufacturing and are exploring ways to leverage IoT devices for our made-to-order model, including leveraging AI to fine-tune our responsive manufacturing capabilities,” Kumar said.

He added that the startup’s tech-enabled “responsive manufacturing” leverages advanced technologies to enhance flexibility, agility, and efficiency. Key elements include real-time data and analytics with IoT sensors on equipment to monitor production, performance, and conditions.

With the help of this milling method and tech-enabled practices, the startup aims to deliver freshly processed, high-quality flours while retaining the nutritional benefits.

Apart from using traditional stone mills, the startup works with zero finished goods inventory, ensuring that all its products are made to order and freshly milled upon customer request.

“When a customer places an order on the website, then only we start processing the batch, ensuring each product is prepared freshly,” Kumar said.

lockquote>

What’s Ahead For Floryo

While the founder sees substantial market potential and is optimistic about competing with players like Aashirvaad, he also sees several challenges ahead.

One major challenge is distribution in India, given the nation’s vastness. “Despite the rise of ecommerce and quick commerce, the market remains predominantly offline, with over 90% of sales occurring through traditional channels. Scaling our operations requires effectively navigating this offline landscape,” Kumar said.

The second major challenge is persuading value-conscious Indian consumers about the health benefits and value of its products, which cost 7-10% more than the range the market leaders offer.

“Additionally, creating awareness and educating people about the benefits of food and their choices remain a major challenge,” he said.

To overcome these challenges and achieve its goals, the founder plans to foray into the offline space, targeting large modern trade stores and general trade outlets.

By December, it aims to be in 200 stores in Bangalore, scaling to 500 stores by March 2025 across Bangalore and Hyderabad.

lockquote>

As per the founder, the startup will initially target large format stores, modern trade outlets, and supermarkets. Once established, Floryo will expand to standalone supermarkets, followed by its entry into big grocery and kirana stores. Its ultimate aim is to leverage shop-in-shop arrangements across various retail formats.

Looking ahead to March 2025, the founder aims to reach an ARR of INR 36 Cr. In the short term (8-10 months), the startup has plans to enter multiple South Indian cities, including Chennai, Coimbatore, and Mysore.

[Edited by Shishir Parasher]

Disclaimer

We strive to uphold the highest ethical standards in all of our reporting and coverage. We StartupNews.fyi want to be transparent with our readers about any potential conflicts of interest that may arise in our work. It’s possible that some of the investors we feature may have connections to other businesses, including competitors or companies we write about. However, we want to assure our readers that this will not have any impact on the integrity or impartiality of our reporting. We are committed to delivering accurate, unbiased news and information to our audience, and we will continue to uphold our ethics and principles in all of our work. Thank you for your trust and support.

![[CITYPNG.COM]White Google Play PlayStore Logo – 1500×1500](https://startupnews.fyi/wp-content/uploads/2025/08/CITYPNG.COMWhite-Google-Play-PlayStore-Logo-1500x1500-1-630x630.png)